New Horizons: Rethinking Emerging Markets and China

Emerging market (EM) equity investors have a multitude of factors to contend with as we move further into 2025. Trump-era tariffs, geopolitical tensions and China’s macro challenges require close monitoring, with spillovers and implications likely to vary significantly across different markets. A fresh look at portfolio construction may help investors disentangle a dynamic and evolving environment. By thoughtfully reassessing EM equity allocations, including China exposures, investors can better navigate a wide range of potential opportunities and risks.

Decoupling and Divergence

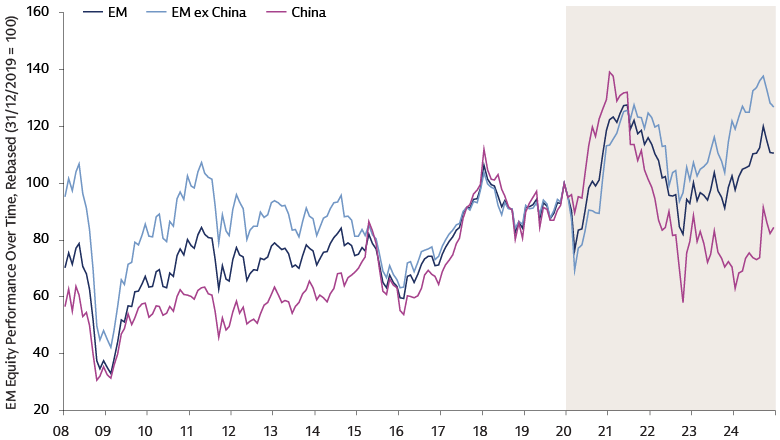

Decoupling between EMs ex-China and China has grown as a theme in recent years, particularly in terms of equity performance. The markets no longer move in tandem like they used to. While China’s equity market has matured and grown to account for a large part of the global EM universe—now with a 28% weighting in the MSCI EM Index1— it has different market drivers and diverging growth fundamentals. Since 2020, regulatory crackdowns, a property downturn, and structural debt and demographic challenges have led to market volatility and weak returns for China stocks. As such, the growth gap between EM ex-China markets and China has narrowed in the past few years as emerging markets outside of China have posted improving growth figures. Meanwhile, the Chinese economy has seen a more challenging trajectory characterized by a slowdown, though China still posts stronger growth than EM ex-China. More recently, favorable policy announcements and depressed valuations have highlighted the potential for an equity market recovery in China.

Source: Bloomberg and Goldman Sachs Asset Management. As of November 1, 2024. Total return in USD. Past performance does not guarantee future results, which may vary. For illustrative purposes only.

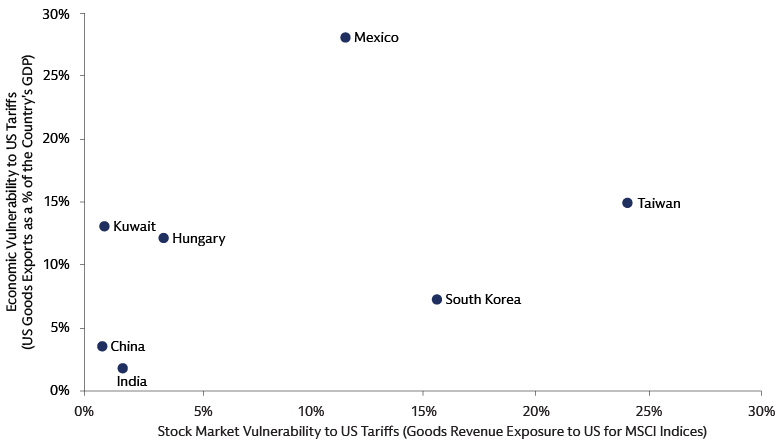

Bifurcation between EMs and China equity markets may be amplified going forward due to US trade policy shifts. Coming into 2025, macro data coming out of China surprised on the upside, but recent US tariff announcements on China (with some retaliation) have driven more volatility and uncertainty on the outlook.2 Perhaps surprisingly, China scores relatively low in terms of its tariff exposure as a percentage of its GDP. While the US is China’s largest export market, China’s exports to the US only account for a small percentage of its GDP. China-listed companies also only generate a small proportion of their revenues in the US, making them less vulnerable to US tariffs than firms from other EMs, even though the likelihood of tariffs being imposed on China is higher.

Source: MSCI, Goldman Sachs Global Investment Research. As of January 9, 2025.

Elsewhere, Mexico, Taiwan and South Korea look vulnerable to the risk of broad-based US tariffs, both economically and from a stock market perspective. By contrast, we believe emerging equity markets with strong domestic micro fundamentals, supportive policy environments, and the potential ability to display resilience to external risks look best placed to outperform. India is one example of a primarily domestically-driven economy whose stronger-for-longer growth story remains underpinned by structural reforms. Varied levels of tariff sensitivity highlight the importance of selectivity and active management when investing across emerging markets.

Rethinking Allocations: China and EMs

We believe the strategic case for separating China allocations from the rest of EM is compelling for two key reasons. First, an EM ex-China allocation can provide diversified sources of alpha across markets with positive economic growth trajectories and stronger fundamentals than China. Second, we believe segments of China’s equity market continue to offer potential alpha opportunities. In our view, investors may want to consider a standalone allocation to enable an in-depth assessment of these opportunities and greater flexibility to implement tactical views amid market volatility.

EM Themes – Friendshoring, Demographics and Market Transformation

While we acknowledge the present risk of broad-based US tariffs on various emerging economies, a new phase of international trade has emerged in recent years, shaped by a global pandemic, Russia’s war on Ukraine, and heightening geopolitical tensions, including ongoing US-China competition. “Nearshoring” or “friend-shoring” means US manufacturing market share is shifting from China to other partners, including markets such as Mexico which may experience tariff headwinds and nearshoring tailwinds simultaneously, and reliable trade partners (friend-shoring) such as India. China is reconfiguring its own supply chains in response to increasing cost pressures and trade frictions, from which Thailand and Vietnam may benefit.

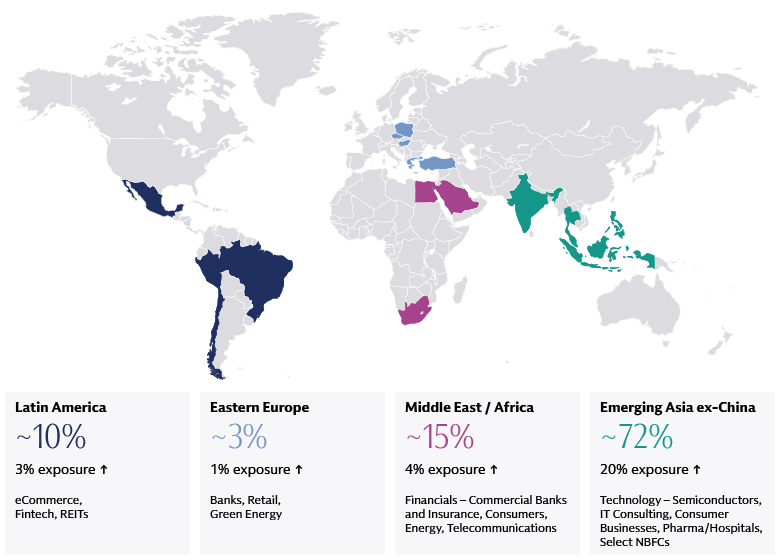

The emerging market landscape, excluding China, has its own extensive corporate universe and ample potential investment opportunities.3 Many EMs exhibit significant differences in sector and industry composition, with higher IT-related stock weights compared to China, presenting potential opportunities in allocating to EM ex-China given the growing importance of artificial intelligence (AI). Markets like Taiwan and South Korea are also leaders in the semiconductor industry. As AI continues to advance, markets that play pivotal roles in manufacturing leading-edge semiconductors may benefit from a durable demand cycle.

Source: Goldman Sachs Asset Management, MSCI, Factset financial data and analytics. As of January 31, 2025. Regions and their weights as represented in the MSCI EM ex China index, with the numbers in the smaller font underneath indicating an increase in that region’s weight compared to the MSCI EM index. The sectors highlighted is an indication of where investors may find attractive investment opportunities within a particular region, from a fundamental equity investing point of view. For illustrative purposes only.

On demographics, the number of people in China over 60 is expected to grow from 300 million in 2023 to more than 400 million by 2035.4 While the rapid aging of the Chinese population points to a potential economic slowdown in China over the coming decades, demographics in other EMs like the Middle East and India, in our view, are much more favorable. India has one of the youngest demographics in the world with a median age of ~28 years, ten years younger than in the US.5 Supportive demographic factors are a vital prerequisite for continued economic growth due to their links with the supply of labor and productivity, such that more favorable demographics may help sustain a comparably elevated pace of economic growth for longer.6

There are also transformational stories to consider. For example, we observe that countries in the Middle East are transforming their economies with reforms to diversify away from commodities by developing their financial services and telecommunications sectors. Over the medium term, estimates suggest there is scope for MENA's weight to rise to ~10% within MSCI EM Index driven by capital market reforms and new listings, with Saudi Arabia being the largest constituent from the region.7

China Themes – Innovation, Urbanization and “Old Economy” Sectors

China’s story in 2025 is likely to be shaped by policy implementation, structural transition and risks from tariffs and geopolitical tensions. Amid these forces, a closer look at sectors of China’s economy may potentially uncover pockets of opportunity.

Manufacturing capital expenditure has remained resilient in 2024, supported by strong policy initiatives such as equipment upgrades, green transition, and technology self-sufficiency which led to notable growth in sectors like non-ferrous smelting and electronics.8 The combined strength of manufacturing and infrastructure investment bodes well for the economy in 2025, which we believe helps to offset challenges from the property sector.

We believe consumer businesses, including home appliances, are poised to benefit in 2025 as policymakers focus on boosting domestic demand and given the expansion of consumer trade-in program. The automotive industry is likely to remain resilient, driven by government subsidies. China already dominates the global industrial robot market and produces over 70% of the world’s EVs,9 and we expect more market share gains despite tariffs.

Semiconductors, hardware, and software companies in China may continue to benefit given the localization focus and technology self-sufficiency amid growing AI competition globally. Urbanization, equipment upgrades and support for consumer durable goods trade-ins may improve domestic demand. Meanwhile consolidation in the “old economy” sectors, such as energy, utilities and communication services—combined with reforms aimed at increasing the competitiveness of state-owned enterprises—open potential opportunities for investors to take positions in relatively defensive companies with higher dividend yields.

How Much to Invest in China?

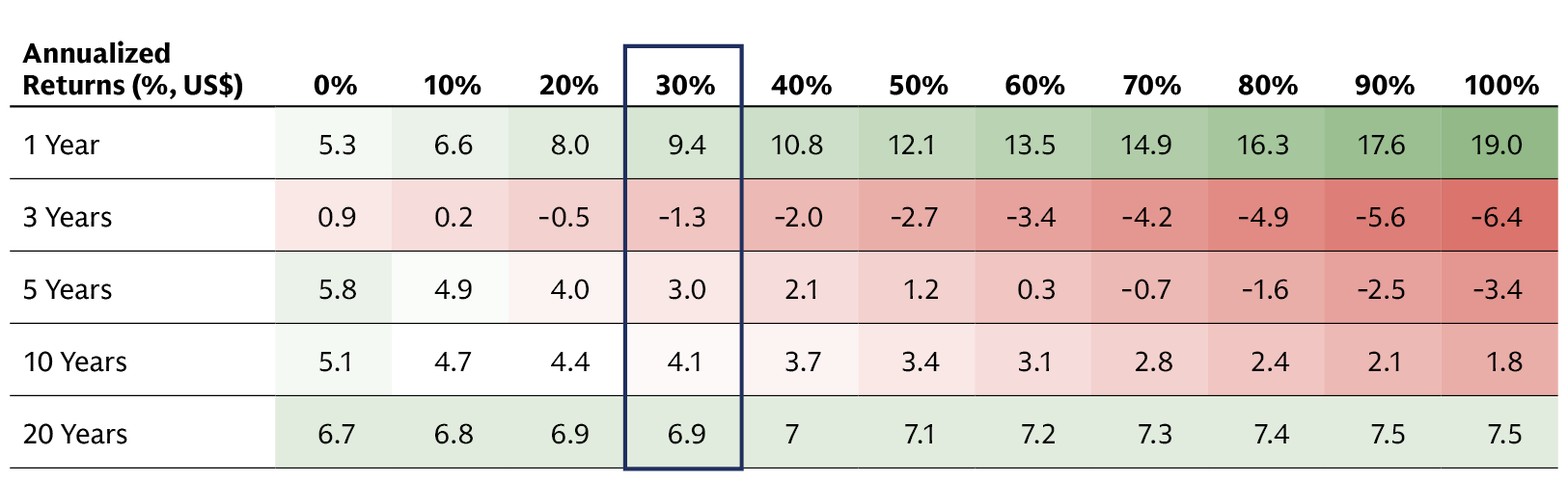

One of the biggest challenges of separating exposure to China from an EM equity allocation is determining how much to allocate to China and how much to EM ex-China. We believe there is no single answer to this question as it depends on each investor’s individual goals and preferences, including their risk appetite and capacity to manage a standalone exposure. The optimal allocation will also vary considerably over time. Over the past year, a large allocation to Chinese equities would have paid off as the asset class performed well, buoyed by government stimulus. But the same allocation would have performed relatively poorly over the past three-, five- and ten-year periods.10 In our view, it pays to be flexible and nimble when deciding the size of an allocation to Chinese equities relative to other EMs. Benchmark-aware investors may also want to consider the tracking error implications of the size of their allocation to China.

The highlighted weight of 30% for China is the average weight of the MSCI China Index in the MSCI EM Index over the past 10 years.

Source: Bloomberg, Macrobond, MSCI, and Goldman Sachs Asset Management. As of January 13, 2025. Data from December 31, 2004 to December 31, 2024. Performances are calculated using total return indices for MSCI IMI (large, mid and small cap) indices for China and EMs. EM ex China total return indices are inferred subtracting the weighted contribution of the China index from the EM index. EM equity allocations in the table are calculated assuming an equity portfolio with a 0-100% allocation to the MSCI China IMI Index and 100-0% allocation to the simulated MSCI EM ex-China IMI Index. Past performance does not guarantee future results, which may vary. These examples are for illustrative purposes only and are not actual results. If any assumptions used do not prove to be true, results may vary substantially.

New World, New Playbook

We believe investing in emerging markets, including or excluding China, requires active management to navigate market volatility and potentially take advantage of powerful themes. In our view, a complex environment of geopolitical tensions, tariffs and China’s macro headwinds strengthen the appeal of splitting China allocations from the rest of EM. This playbook may help manage active investment views in each universe more effectively. Having an informational edge across a large, diversified, and relatively under-researched EM ex-China universe may also help identify undervalued assets and potentially capitalize on mispricings. China remains a major economic force in the global economy with a rich and vibrant equity universe, but we believe idiosyncratic challenges and choppy markets require bottom-up approach focused on quality over the long term.

1 MSCI Emerging Markets Index Factsheet. As of January 31, 2025.

2 The White House (.gov), China Ministry of Commerce, China Ministry of Finance. Goldman Sachs Global Investment Research. as of February 4, 2025.

3 Goldman Sachs Asset Management, MSCI, Factset financial data and analytics. As of January 31, 2025.

4 Economist Intelligence Unit. As of January 2024.

5 Pew Research Center, United Nations. As of December 2023.

6 World Bank. As of April 2024.

7 Goldman Sachs Global Investment Research. As of February 20, 2024.

8 Ministry of Industry and Information Technology (MITT), Goldman Sachs Global Investment Research. As of February 17, 2025.

9 The China Passenger Car Association, as of October 2024.

10 Bloomberg, Macrobond, MSCI, and Goldman Sachs Asset Management. As of January 13, 2025. See EM Equity Allocation chart.