Sustainable Investing: A Performance-Oriented Approach

As 2025 gets under way, sustainable investors have some fundamental questions. Looking back, they want to know what drove the rise and fall in the performance of sustainable investments over the past decade, and what lessons can be learned. Looking ahead, they may want to know how to apply these lessons to help prepare their portfolios for market developments in the years ahead.

At Goldman Sachs Asset Management, we work with clients around the world who are at various stages of developing and evolving their approaches to the growth themes underlying sustainable investing. In place of a product-oriented approach focused on labels and optics, many investors are getting back to the basics of investing with a thesis-driven approach and thoughtful, disciplined implementation, seeking to capture the opportunities and manage the risks of these rapidly evolving themes. As sustainable investing enters this new phase, we asked John Goldstein and Brian Singer to share their insights on an evolving market.

What drove the ups and downs of sustainable investing performance over the past few years?

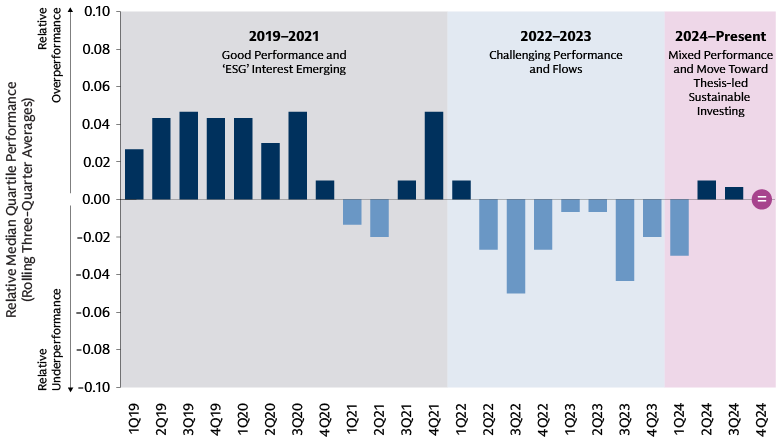

John Goldstein, Head of Sustainability, Goldman Sachs Asset and Wealth Management: In our view, the performance of sustainable funds and portfolios was often driven more by the biases built into investment strategies and products rather than by anything intrinsic to sustainability itself. Consider the years 2019 through 2021, when the market really started to take off. Sustainable funds outperformed traditional funds during most of this period. This spurred increased investor demand for sustainable funds, and the supply of funds grew quickly in response. So where did the strong performance come from? When you look under the hood, you find that most sustainable funds had style and sector tilts; many were overweight growth stocks, for example. During the period of rapid market expansion, this tilt lifted fund performance because it benefited from a market environment that supported growth stocks.1

In 2022-2023, by contrast, the growth tilt of sustainable funds weighed on performance as the market environment abruptly changed and value stocks began to dominate. During this period, sustainable funds underperformed. We believe this decline was exacerbated by another common feature of sustainable funds: portfolio exclusions or limitations on investment in traditional energy companies. When energy became the best-performing sector globally in 2022, many sustainable funds missed out on the rally. In 2024, performance and flows showed some signs of recovery, though from a relatively low level. Sustainable fund managers and many fundamental active managers nevertheless found it challenging to outperform for reasons including narrow market leadership, such as the “Magnificent Seven” stocks that drove most of the performance in the stock market.

Source: Goldman Sachs Global Investment Research, Morningstar. As of December 31, 2024. Note: Relative quartile position of median sustainable equity fund vs. traditional funds. If the median sustainable equity fund is in the top 47% of funds, for example, the relative outperformance is 3%. Past performance does not predict future returns and does not guarantee future results, which may vary. Performance is not related to any Goldman Sachs Asset Management products and are based on the respective indices. It is not possible to invest in an unmanaged index.

How has this performance history changed the thinking of sustainable investors?

Brian Singer, Head of GS SUSTAIN, Goldman Sachs Global Investment Research: We’ve had a lot of clients asking if the tougher period for sustainable fund performance in recent years, combined with policy uncertainty in the US and elsewhere, mean that we have reached the end of the road for sustainable investing. Have the tailwinds for themes like green capex gone for good? Our answer is no, or not necessarily.

We believe performance, not policy, will be the critical driver of market expansion. In the evolution of sustainable investing, we are entering what we call the phase of refinement. In this phase, we expect investors to focus increasingly on linkages to alpha, value creation and the fundamentals of investing – a healthy development, in our view. To find opportunities, we believe investors will increasingly focus on metrics that matter to business fundamentals. For example, we continue to find that numeric metrics that measure companies’ sustainability performance contribute more to excess returns than policies and targets. We also expect a growing emphasis on generating real-world impact, including investment and engagement across the supply chain and in transitioning sectors.

How can investors identify sustainability-related companies with positive potential performance in the years ahead?

Goldstein: Our view of the market is grounded in the belief that the underlying secular themes driving the low-carbon transition will be persistent and resilient. There will be ebbs and flows, but the direction of travel is clear. Based on this thesis, we think opportunities may be found by focusing on four factors:

- A resilient growth theme with strong underlying support

- Companies that solve a mission-critical pain point for their corporate customers or allow them to save money by operating more efficiently

- Companies that provide a critical link in a value chain, often upstream pick-and-shovel companies that supply tools or services needed to produce a product, potentially offering investors greater market share and better margins than downstream companies exposed to competition and volatility in the end market

- Being in a position to take advantage of imbalances in the supply of and demand for capital

For investors, it is important to identify how to apply these principles to capital allocation, which is largely done through specific asset classes. In private equity, venture math has been challenging. In our view, producing top-quartile return is challenging for investments that often have had longer capital intensity and time horizons and fewer unicorn-style exits. We also see a significant amount of private-equity capital chasing a relatively finite number of compelling larger-cap opportunities. The middle market has the benefit of high-quality companies with reasonable valuations and less competition for deal flow.

In real assets and infrastructure, we see significant capital pools from asset managers and owners focused on the core and core-plus segments, compressing returns. In the value-add space, by contrast, you can potentially build and grow assets to sell to those pools of capital rather than compete with them.

We believe private credit is an area that can benefit significantly from the pronounced supply-demand imbalance for capital. In the past decade, $650 billion has been raised in sustainable private equity, but only $50 billion raised for sustainable private debt.2 We think this imbalance is particularly significant given first, equity capital drives further demand for debt to grow projects and companies, and second, given the direct, bespoke nature of this market, there are significant barriers to entry for lenders lacking experience and expertise.

With these four factors in mind, where can investors seek out opportunities as the sustainable transformation of the global economy continues?

Singer: Today we are seeing key themes that are moving at different speeds and in different directions. Power demand, artificial-intelligence (AI) investment and global temperatures are rising, while support for a green premium and the exportability of critical materials are falling. Infrastructure and populations in mature economies are aging. Uncertainty surrounds inflation, interest rates, extreme weather events, policy and the pace of regulation. We think investment opportunities may be found where factors like these intersect.

For example, we think the confluence of rising power demand, higher temperatures, extreme weather events and aging infrastructure will continue to drive tailwinds for investment in reliability, primarily of power, energy and water. We see opportunity for investment in companies working in this area, which will be a priority for policymakers and corporate and residential consumers in the years ahead.

Where climate adaptation and inflation meet, we find a greater premium on solutions that may lower the intensity with which energy, resources and land are consumed without changing people’s quality of life. We think the big tech companies driving the AI revolution will remain willing to pay a premium for reliable clean energy. This, combined with broader investment in reliability and efficiency, should drive the resiliency of many green-capex infrastructure, clean-water and low-carbon technologies.

A lot has been written about the role of AI in driving increased power demand. How could DeepSeek’s AI breakthrough, which was developed using primarily earlier-generation servers, alter demand forecasts and affect investment in clean-power solutions?

Singer: DeepSeek’s announcement has raised a lot of questions. If it turns out that fewer servers are required to produce the same level of AI knowledge, how big a reduction would that be? How big a shift could we see from the latest servers to older-generation models? How would the market share of server shipments in AI’s ultimate deployment be divided between the US and the rest of the world?

Goldman Sachs Global Investment Research’s current base case calls for global power-demand growth from data centers of about 160% to 165% through 2030, with 40% of the growth fueled by renewable energy sources. To meet this demand, we expect an all-in approach to source power, including natural gas, solar, onshore wind, battery storage, and nuclear (impact more in the 2030s). For every 10% reduction in high-powered AI servers shipped, that growth assumption falls by about five percentage points. A 10 percentage-point shift away from the latest servers to those of one generation earlier would result in about a four-point decrease in the long-term overall power-demand growth rate.

Goldstein: When you’re thinking about impacts on renewable energy, it’s important to remember that AI and data centers are likely to be a major driver of demand growth, but not the only – or even the biggest – one. In a hotter world, cooling is already one of the leading drivers of rising electricity demand, along with resurgent US manufacturing and a broader electrification push.3 There are a lot of reasons to think that power-demand growth will continue. For investors, we think it comes back to the basics: finding companies with solutions that improve efficiency and reliability, and help customers do more with less.

The impacts of an aging population are an increasing concern in many economies. How is this affecting the sustainable-investing market?

Singer: We see an emerging demographic dilemma in which declining populations in mature markets have led to a shrinking productive labor pool that is tasked with supporting an aging population. This has the potential to impact multiple sustainable development goals while also driving a wider opportunity set for social investing. In terms of the potential solutions that corporates and governments may pursue to manage the impact of the demographic dilemma, we would highlight three from the investment perspective.

The first potential solution is what Goldman Sachs Global Investment Research has called womenomics: increasing the participation of women in the labor force through family-friendly benefits, childcare optionality and women's health solutions. The second would be education and reskilling. The third is the backstop, where automation and AI may improve efficiency and fill some of the gaps caused by a declining labor force. We see two other potential solutions: reform to the immigration system, which has helped in the past to maintain balance in the labor market; and relocating capital and industrial manufacturing to areas where there is a growing productive workforce. The last two are more challenged, however, and we’ll have to see where policies in the US and elsewhere land in these areas.

Looking ahead, how might investors position their portfolios in the years to 2030 and beyond?

Goldstein: Fundamentally, we believe sustainable investing is investing. That means it requires the same rigor as any other investment question. We think it is important to translate growth themes to implementable approaches that leverage the type of principles we have laid out here. Market growth does not necessarily translate into investment returns. In looking across a portfolio, it is also important to use the right tool in the right way for the right job. For example, private markets may be areas where investors can play offense in seeking to capture thematic growth opportunities. In our view, public equities may be better served by disciplined, risk-aware approaches that position portfolios for these themes, avoid unintended biases and tilts, and may add diversifying shorter-term alpha drivers to support both near-term and long-term performance.

1 Kenneth R. French, Bloomberg and Goldman Sachs Asset Management. As of March 9, 2023. Data from January 1970 to January 2023. Value investing has a long track record of outperformance, dominating the period between 1970 and early 2007 on a cumulative basis. By contrast, growth prevailed from mid-2007 until the COVID-19 pandemic, when value started to outperform again. To read more, see “Growth vs. Value: Rethink Your Investment Style,” Goldman Sachs Asset Management. As of April 20, 2023.

2 Bloomberg New Energy Finance. Sustainable strategies include Pitchbook categories: Agriculture; Air; Biodiversity & Ecosystems; Climate; Energy; Infrastructure; Land; Oceans and Coastal Zones; Pollution; Waste; Water. Private equity funds include private equity, venture capital, and infrastructure. Growth metrics compare Capital Raised from 2015-2018 vs. 2019-2022. As of December 31, 2023. To read more, see “Private Credit: Funding the Climate Transition,” Goldman Sachs Asset Management. As of October 22, 2024.

3 “World Energy Outlook,” International Energy Agency. As of October 2024.