When Public Meets Private: The Strategic Role of Alternatives

Private Markets Have Historically Outperformed Public Markets

Private markets, once limited to large institutions due to high minimums and illiquidity, are now becoming more accessible to high-net-worth and retail investors. This democratization is expanding the opportunity set for individual portfolios, allowing more investors to benefit from the diversification and superior return potential of private assets.

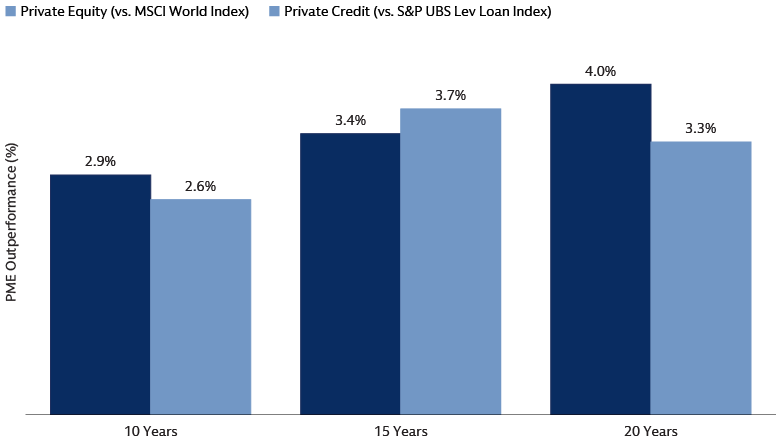

Private equity and private credit have consistently outperformed their public market counterparts, delivering annual returns that are 2.5% to 4% higher across various time periods, as shown below. This track record, measured by the Public Market Equivalent (PME) methodology, demonstrates that private markets offer higher returns while enabling investors to tap into diversified opportunities that are difficult to replicate in public markets.

Source: Cambridge Associates, as of December 31, 2024. PME is a public equivalent methodology that measures performance comparison between a private investment and a public market index. PME methodology assumes that inflows are used to purchase public shares, whose sale produces outflows, all according to the private investment’s cash flow schedule. Under PME, actual private contributions are invested in the public market index. Distributions are calculated in the same proportion as in the private investment. In essence, the public equivalent “sells” the same proportion of the dollar value of public shares contained in the calculated NAV as the private investment sells in private shares. Public returns, combined with these PME cash flows, generate a public-equivalent NAV stream. The PME outperformance is calculated from the same IRR minus the PME index IRR. This calculation does not adjust for leverage, hedging, or other risk factors that may be present in the private equity investment. Positive PME outperformance indicates outperformance compared to the index return, and negative PME outperformance indicates underperformance. For illustrative purposes only.

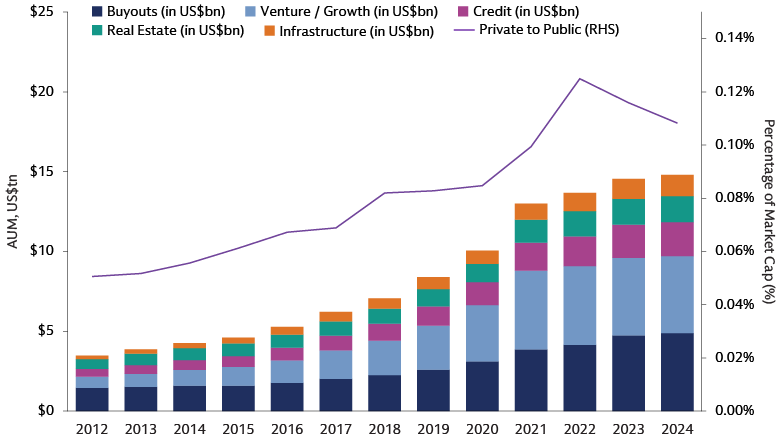

Furthermore, as companies remain private for longer—studies document that the number of publicly traded US companies has decreased by approximately 41%, from over 7,374 in November 1997 to around 4,335 as of the end of 20211—more value is generated before any public listing. This further enhances the appeal of private markets for investors seeking stronger performance and differentiated exposure.

Just as public markets are seeing a reduction in the number of listed companies as more businesses opt to remain private for longer, a meaningful portion of the traditional bank lending market has also shifted to private credit markets in recent years. This makes private credit a major financing opportunity and powerful complement to traditional fixed income strategies, offering incremental income generation, potential resilience, return enhancement, and diversification.

Source: Goldman Sachs Asset Management, Preqin, Bloomberg. As of December 31, 2024. For illustrative purposes only.

Easier Access, Potential for Continued Outperformance

Various structural advantages of private markets remain intact as access broadens. Private investments tap into a wider universe of companies, often at earlier stages, and benefit from active management, value creation strategies, and control or illiquidity premiums. These factors have historically driven private equity, for instance, to outperform public markets over the long term, even though short-term periods have seen some underperformance. Returns were more muted between 2021-2023, for example, due to macroeconomic headwinds, lower deal volumes and an inability for firms to exit investments and return capital to their limited partners (LPs). High performance dispersion in private markets makes manager selection and access to top managers critical.

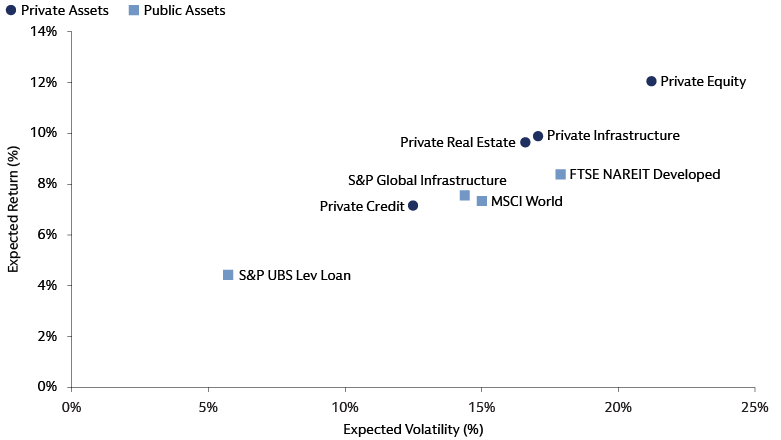

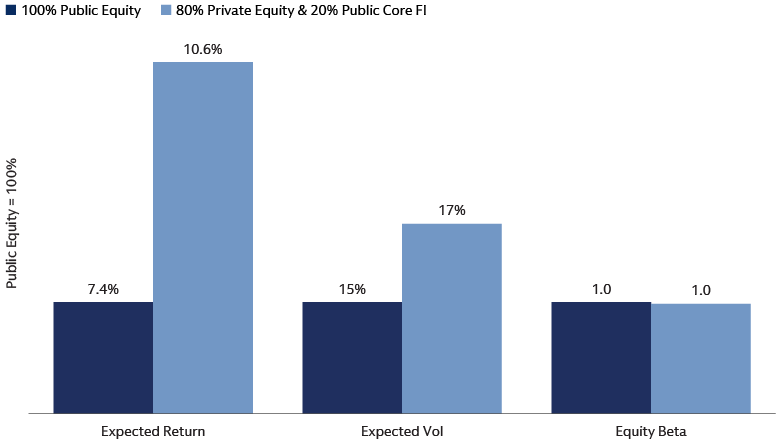

To help clients understand and manage the risks and return drivers of private investments, we use a robust framework. This starts with identifying public market proxies for each private strategy, then adjusts for factors like leverage, taxes, and fees, and finally incorporates manager-specific value-add. As you can see in the chart below, forward-looking return and risk assumptions using this approach which supports consistent, informed portfolio construction across both public and private assets.

Source: Goldman Sachs Asset Management. As of June 30, 2025. For illustrative purposes only.

Uses more leverage than public companies (average ratio 1.74 vs. 1.4), which can amplify returns and risks. Skilled managers add value through active ownership. We expect private equity to deliver about 4% higher annual risk-adjusted returns than public equities over the next decade.

Yield spreads over public loans have narrowed but remain attractive (150–200 basis points), thanks to illiquidity, direct origination, and stronger covenants. This can translate to 2-3% extra net returns over public syndicated loans.

Real estate and infrastructure offer diversification and inflation protection, with value-add and opportunistic strategies potentially generating 1.5–2% higher risk-adjusted returns than public REITs and listed infrastructure.

Private Assets Enhance Portfolios

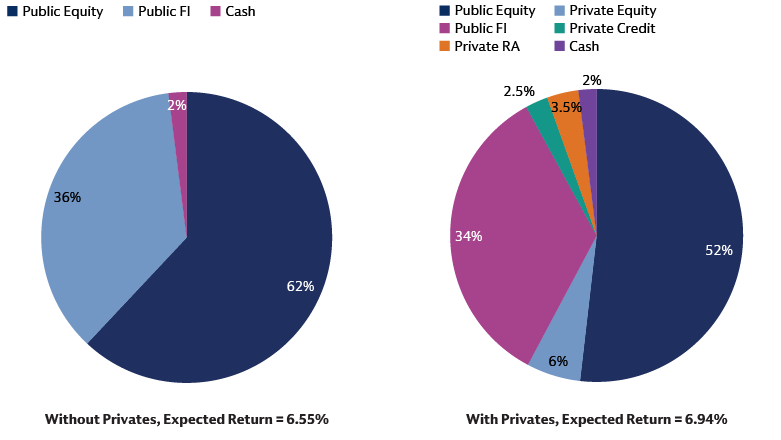

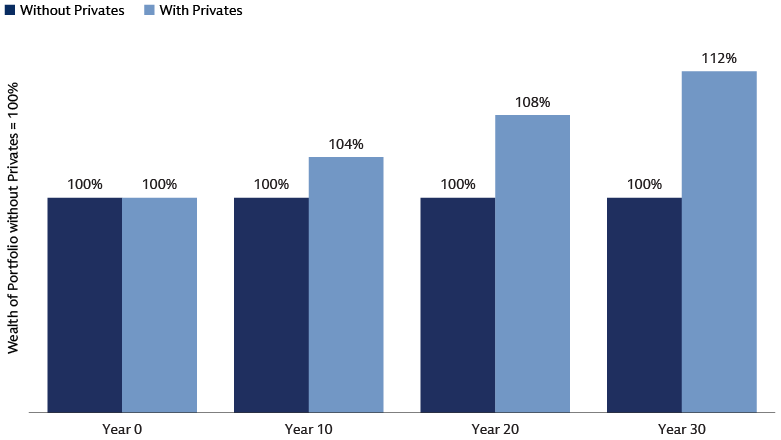

Adding private assets to traditional portfolios can significantly enhance long-term outcomes for clients. Our research shows that incorporating a 12% allocation to private investments in a standard 60/40 portfolio can boost expected returns by 40 basis points, without increasing tracking error materially compared to a public-only portfolio. Over a 30-year horizon, this incremental return could translate into a potential 12% increase in total wealth.

Beyond higher return potential, private assets also offer important diversification benefits. Their broader investment universe and lower correlation with public markets can help reduce exposure to risks such as geopolitical events and market concentration. The illiquid nature of private investments can further dampen portfolio volatility, providing clients with a more resilient investment experience through different market cycles.

Source: Goldman Sachs Asset Management. As of June 30, 2025. For illustrative purposes only.

Source: Goldman Sachs Asset Management. As of June 30, 2025. For illustrative purposes only.

A Holistic Approach to Managing Public-Private Portfolios

Adding private assets to portfolios can enhance returns and improve diversification, but it also introduces new challenges—especially related to market and liquidity risk. Private investments are influenced by broad market movements (beta) and also benefit from manager-specific strategies (alpha). Because these assets are illiquid, their reported returns tend to be smoothed and delayed, which can mask the true level of risk and make it harder to track performance accurately in real time. Private equity is also exposed to similar economic risks as public equities, for example, and the value of private equity holdings can be especially sensitive to public market conditions when it comes time to sell portfolio companies. Effective portfolio construction also demands careful attention to overlapping and correlated exposures. These exposures can be strategically managed by utilizing various funding sources, such as using small-cap allocations to partially fund private equity, or by being mindful of private credit's impact on the overall portfolio's duration profile to maintain a balanced risk exposure.

To address these challenges, we use risk-based models and an optimization process that considers both market and manager-driven returns. This approach helps build resilient portfolios and supports ongoing risk management. A key part of this strategy is funding private allocations by starting with the closest public market equivalent (such as large-cap equities for buyouts). We then adjust the mix between public risk assets and core fixed income to manage the desired risk profile which would be marginally higher than a public asset portfolio considering the benefit of smoothing effect and uncorrelated manager alpha. For instance, as illustrated below, reallocating from public equities might mean allocating 80% to private buyouts and 20% to core fixed income, keeping overall equity risk in line. The below chart illustrates that adding private equity through this process can enhance the portfolio’s return with only slightly increasing overall risk.

Source: Goldman Sachs Asset Management. As of June 30, 2025. For illustrative purposes only.

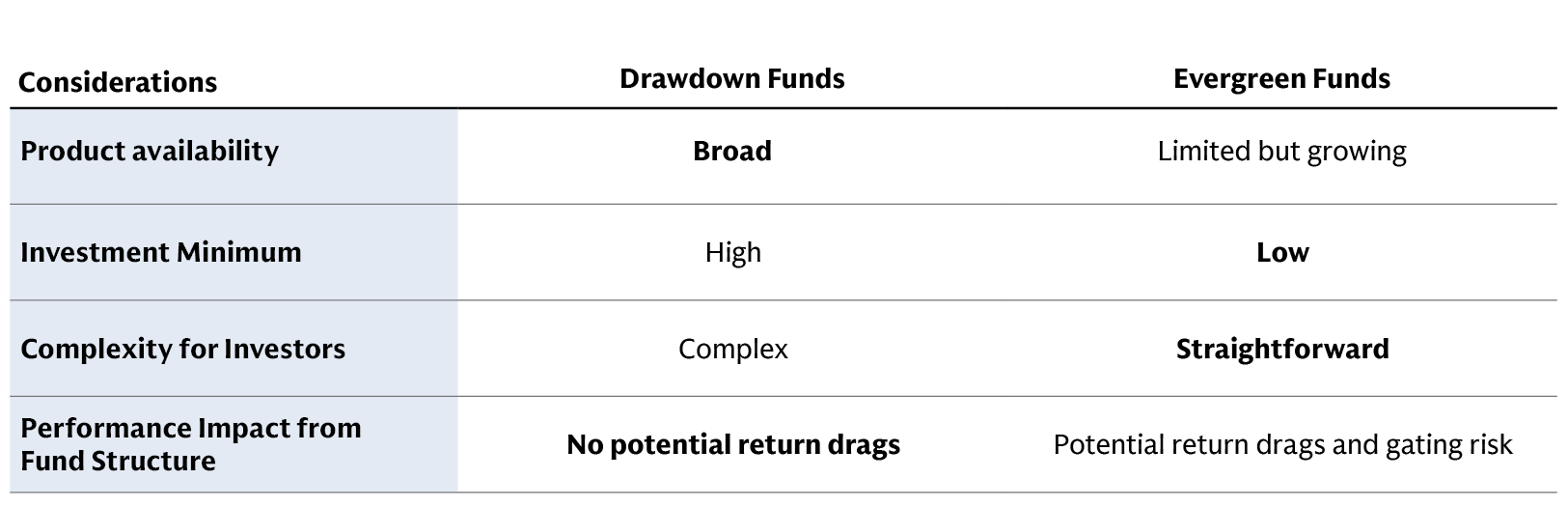

Liquidity risk is a key challenge when adding private assets to portfolios. Managing private market exposure and liquidity can be difficult, especially with traditional drawdown funds. These funds require investors to commit capital upfront, which is then called and invested over time, and returned as investments are sold—this process is often called the J-curve effect. This structure can make it hard to predict cash flows and maintain steady exposure.

Newer private evergreen funds are designed to make things easier by allowing ongoing subscriptions and redemptions, helping to smooth out some of these liquidity issues. Beyond offering enhanced liquidity, open-ended evergreen funds provide immediate investment exposure, a significant advantage over the typical 3-4 year deployment period of closed-ended funds, which materially benefits cumulative returns over time by mitigating the J-curve effect. Furthermore, these funds help reduce the uncertainty associated with target allocations by lessening the need for overcommitment strategies often required with closed-ended funds.

However, drawdown funds are still important, especially for larger portfolios, because they offer more investment options and can access certain strategies—like value-add and opportunistic private real estate—that are not widely available in evergreen formats. Evergreen funds can also face risks like return drag and gating, which can limit withdrawals. The table below compares the main features of drawdown and evergreen fund structures.

Source: Goldman Sachs Asset Management. As of June 30, 2025. For illustrative purposes only.

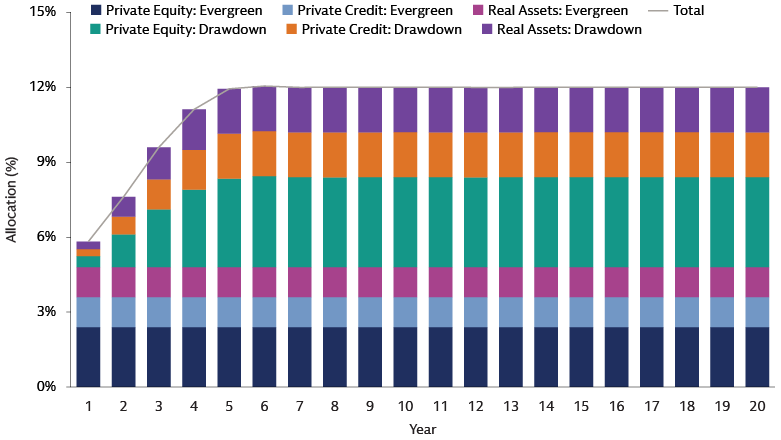

Managing a private markets program across different fund types takes careful planning and regular attention. Advisors need to make ongoing commitments to new funds, keep track of cash flows and uninvested capital, and rebalance evergreen funds as needed to keep the private allocation on target. This can be complicated, especially when using both drawdown and evergreen funds.

To make this process easier, we have developed a simulation tool that may help plan commitments, manage liquidity, and set guidelines. The tool models the cash flow patterns and market sensitivity of both drawdown and evergreen funds. By running a Monte Carlo simulation – a statistical technique to model the probability of different outcomes due to random variables – it shows a distribution of outcomes and their probabilities. This supports better management of liquidity, market, and other idiosyncratic risks. The chart below illustrates the central path projection of implementing a hybrid program using both drawdown and evergreen funds to achieve and maintain a 12% allocation to private investments. An important task of running such a program is to apply an equitization strategy for uncalled capital from commitments to closed-ended drawdown funds, where the simulation tool can help balance the trade-off between reducing cash drag and managing liquidity risks.

Source: Goldman Sachs Asset Management. As of June 30, 2025. For illustrative purposes only.

Unlocking Portfolio Potential Through Private Assets

Private assets offer compelling opportunities for portfolio enhancement through superior risk-adjusted returns and diversification. Their integration into traditional portfolios can lead to meaningful long-term wealth accumulation, even with modest allocations. However, successful implementation requires thoughtful planning, liquidity management, and a holistic approach to portfolio construction. By leveraging both drawdown and evergreen vehicles and aligning public-private exposures, investors can build resilient portfolios that reflect strategic goals and market realities.

Goldman Sachs Asset Management’s Multi-Asset Solutions (MAS) team partners with financial advisors to help them build and manage more effective public-private portfolios. Visit Goldman Sachs Investment University to learn more about Alternatives.

1Michelle Lowry. The Blurring Lines between Private and Public Ownership. 2023.