Public and Private Credit: Capitalizing on Coexistence

The Coexistence of Public and Private Credit Markets

The revival of yield in public fixed income has sparked renewed interest in bonds, a trend underscored by inflows from pension funds looking to de-risk amid an improvement in their funded status, retail investors seeking to lock in high yields before central banks deliver adjustment rate cuts, and insurers looking to increase corporate bond allocations and extend duration, as gleaned from our 13th Annual Insurance Survey. At the same time, private credit has continued to experience significant growth, with managed assets reaching $2.1 trillion.1 The market spans a broad array of strategies in corporate, real asset, and asset-backed lending, and covers the full capital spectrum.

Public and private credit can serve as complementary elements in investment portfolios, tailored to meet specific return goals, risk tolerances, and investment horizons. Both asset classes provide income and diversification benefits. Public fixed income, known for its market depth and liquidity, is ideal for liquidity management. Private credit offers the potential for higher returns, while generally not being inherently riskier than syndicated loans and high-yield bonds—as evidenced by comparable historical credit losses. This is attributed to the customization of terms to meet the specific needs of borrowers and lenders, and the premium borrowers are willing to pay for greater certainty in execution.

Private debt markets have long been a vital source of capital for mid-sized companies, often providing funding solutions beyond the reach of traditional banking. Conversely, public debt markets are generally utilized by larger, well-established companies and governments with significant capital needs.

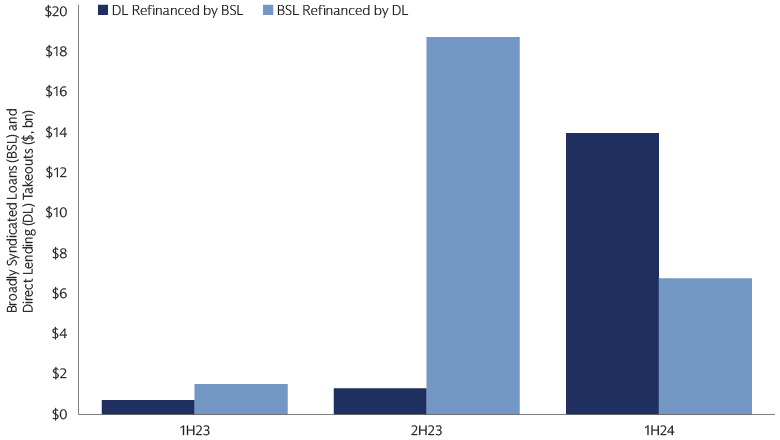

Recently, we've seen a trend of more companies strategically leveraging both public and private capital markets to secure funding. They are optimizing their capital structures through a broader range of financing options to support growth and adapt to market conditions. For example, in 2022 and 2023, many companies sought capital from private credit markets. However, in recent months, numerous companies have been refinancing in public markets. Over time, we anticipate an equilibrium where companies will choose between the lower cost of capital available in public markets versus a more tailored capital structure and financing solution in private markets; the choice may vary depending on their business phase. This evolution will allow public and private markets to coexist and expand harmoniously, offering investors a diverse array of potential investment opportunities.

Source: PitchBook, LCD. As of May 21, 2024

Status Check: One Year Post Peak Rates

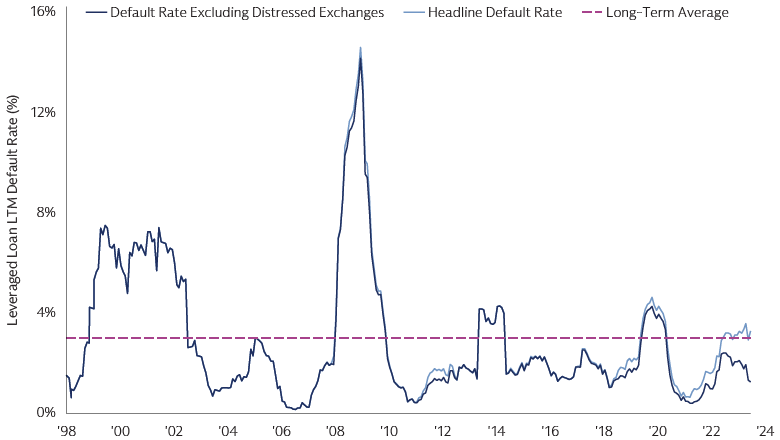

The US Federal Reserve's cycle of rate hikes concluded in July 2023. Since then, investors have been vigilant, monitoring how borrowers handle the increased cost of funding to avoid those at risk of financial distress. Despite a notable increase in interest rates, the resilience of companies, as evidenced by the limited defaults and distress, is noteworthy. The direct lending market's default rate has steadily decreased over the past year, currently at 2.7% in 1Q 2024, down from a cycle peak of 4.5%.12 Meanwhile, the leveraged loan market saw a modest uptick in its last 12-month default rate to 3.3% in May 2024, slightly above the long-term average of 3%3

This fortitude through a challenging macroeconomic climate can be credited to the sustained economic and earnings growth that has bolstered credit fundamentals, coupled with open capital markets that have facilitated debt refinancing. For instance, sponsor-backed companies, which make up a significant portion of borrowers in both the broadly syndicated loan and private credit markets, have seen median earnings before interest, tax, depreciation, and amortization (EBITDA) grow at an annualized rate of 11%.4 This growth has underpinned their ability to service debt, even as debt costs rise, and interest coverage ratios fall.

Nonetheless, it's crucial to keep an eye on the downward trend in interest coverage ratios and the quality of underwriting standards. Additionally, with central banks embarking on quantitative tightening, we believe public market debt performance is expected to be more influenced by the business cycle, policy decisions, and companies' ability to adapt to a new rate environment, as well as structural shifts such as decarbonization, aging populations, and geopolitical instability. Although rate cuts might offer some relief, they are likely to start later and be less substantial than previously thought.

Delving Deeper into the Data

While overall default rates remain low, there is a notable variation among borrowers and loans, with instances of distress in specific cases. Many distressed situations are being resolved directly between borrowers and lenders, aiming to proactively tackle issues and circumvent outright defaults. These workouts often involve strategies such as payment in kind (PIK) interest and additional equity contributions from the borrower's financial sponsors. These methods can assist companies in overcoming temporary hurdles, avoiding the costly and protracted restructuring process that could disrupt the business, while enabling sponsors to support their investments and safeguard their equity stakes. However, for borrowers facing more profound issues, these workouts may only offer a temporary reprieve, delaying an inevitable default. Even so, out-of-court resolutions can still preserve recovery values and minimize investor losses.

When assessing headline default rates, it's also important to note the rise in distressed exchanges among borrowers in both the syndicated bank loan market and private markets. For example, excluding distressed exchanges, the 12-month default rate for leveraged loans drops from 3.3% to 1.25% in May 2024.5 Distressed exchanges occur when a financially troubled company offers new debt, equity, or a mix of both to creditors, typically at a reduced value to existing debt to prevent default. While this results in losses for lenders, it's typically less costly and quicker than formal bankruptcy proceedings, and leads to more stable recovery rates and less operational disruption for the company. In some cases, the resulting capital structure proves to be sustainable; in others, it merely forestalls larger losses. As such, the impact on eventual losses from distressed exchanges remains uncertain.

Source Goldman Sachs Asset Management, J.P.Morgan. As of May 31, 2024. LTM refers to last twelve months.

Nuance Matters

In today’s dynamic financial markets, it's crucial to grasp the distinct factors that shape the investment backdrop. For instance, in the leveraged loan market, defaults tend to occur predominantly among smaller firms grappling with industry-specific changes, which does not necessarily reflect wider market turmoil. Active investors, through astute security selection, can often foresee these defaults and adeptly navigate them, mitigating potential risks.

Meanwhile, although concerns have arisen regarding loans and securitized assets connected to Commercial Real Estate (CRE) due to increased interest rates, office vacancies from remote work, and apprehensions about capital access—especially from regional banks—these issues have not led to widespread financial stress. Office CRE continues to face challenges; however, other property types exhibit robust credit and operational performance. This diversity within the CRE landscape provides investors in commercial mortgage-backed securities (CMBS) and private real estate credit with opportunities for alpha generation by leveraging the different performance profiles across various property types.

It's also essential to recognize that historical comparisons might not always reflect current or future market conditions. Today's high-yield (HY) credit market is of a higher quality compared to past cycles, with a greater proportion of companies rated BB—the top rating tier in the HY market—than before the 2008 global financial crisis. This is partly because weaker companies have already faced defaults during past cyclical downturns or have been impacted by structural shifts within their sectors, such as the rise of e-commerce, which has notably disrupted traditional retail businesses. Additionally, companies in the HY market are now generally larger, as smaller firms have migrated towards the private market. Larger companies often provide more stability during uncertain times, their size and reach acting as a buffer against macroeconomic challenges. The HY market has also become more secure, with many bonds now collateral-backed, lowering investor risk. Furthermore, a wider investor base has brought increased liquidity and stability, while advancements in trading technology have improved market access and transparency. Collectively, these factors collectively enhance the HY market's attractiveness to investors seeking higher yields.

In contrast, the investment-grade (IG) credit market has seen a quality decline compared to previous cycles, with the BBB-rated segment growing to be the largest due to past downgrades. However, many BBB-rated companies strive to maintain their IG status, often exhibiting stronger financial discipline and fewer unfavorable credit behaviors than some A-rated firms. This presents investors with the opportunity to leverage higher spreads supported by robust fundamentals.

Recognizing these nuances is essential to making informed investment decisions, and for understanding investment outcomes. It's the fine print and underlying trends that often hold the key to a more accurate assessment of the market's direction and financial health.

The Power of Active Management: Uncovering Structural and Cyclical Opportunities

Asset managers with a discerning approach to security selection, bolstered by deep expertise and scale, are strategically equipped to uncover distinctive structural and cyclical investment opportunities, while adeptly steering clear of potential financial distress.

This includes a renewed focus on high-quality fixed income and extends to expanding possibilities in green and social bonds issued by emerging market (EM) companies and governments. While these bonds mirror their traditional counterparts from the same issuers in their risk-return profiles, they are distinguished by their proceeds being directed towards environmental or social projects. To help meet clean energy goals, investment in EMs needs to triple from $770 billion in 2023 to an annual range of $2.2 to $2.8 trillion by the 2030s.6 Private investors play a pivotal role in providing the capital for this surge, yet currently, only a fraction of the $2.5 trillion in ESG funds is channelled into EMs, signifying a vast potential for growth. As the market matures and diversifies, it could attract a wider array of investors, including those aiming to diversify their existing EM debt portfolios or to supplement their developed market ESG investments.

In the private credit sphere, active managers have the opportunity to strategically inject capital into robust businesses undergoing temporary challenges, via more complex, structured solutions. This particularly benefits companies whose balance sheets are not ideally structured for the prevailing interest rate environment, as they may seek structured financing solutions, including hybrid capital. Private lenders are well-positioned to provide the necessary capital to unlock value, crafting bespoke capital solutions that cater to the specific needs of businesses and investors, blending both debt and equity elements.

This approach allows lenders to potentially benefit from equity appreciation, thereby enhancing overall returns, while still earning yield and maintaining a senior position in the capital structure compared to pure equity investments. Further, it demonstrates the flexibility and customization available in private market financing, offering lenders enhanced yields and protection, while providing borrowers with an avenue to reduce borrowing costs in return for an equity stake.

In conclusion, the coexistence of public and private debt markets highlights a dynamic financial ecosystem where a nuanced understanding and active management are essential. Through a strategic lens, investors can navigate new realities, and pinpoint pockets of potential opportunity and resilience within both asset classes.

1. Preqin. As of September 2023. Includes corporate, real estate and infrastructure private credit strategies, excluding funds of funds.

2. Lincoln Senior Debt Index. As of 1Q 2024.

3. Goldman Sachs Asset Management, J.P.Morgan. As of May 31, 2024.

4. Burgiss, as of Q4 2023.

5. Goldman Sachs Asset Management, J.P.Morgan. As of May 31, 2024.

6. International Energy Agency (IEA) Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies. As of June 2023.