De-Dollarization: Currency Contenders

Will The US Dollar Lose Its World Reserve Status?

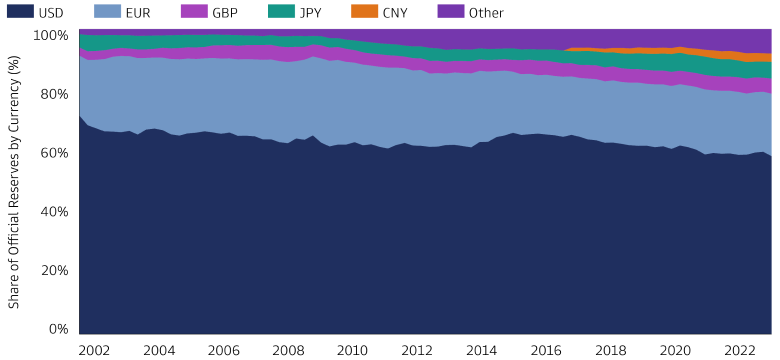

The US dollar as a share of global central bank reserves has dropped from 72% in 2002 to 58% in 2022 amid a long-standing conversation on de-dollarization.

Source: International Monetary Fund and Goldman Sachs Asset Management. As of December 31, 2022. “USD” refers to US dollar. “EUR” refers to euro. “GBP” refers to British pound. “JPY” refers to Japanese yen. “CNY” refers to Chinese yuan.

Recent headlines on de-dollarization have especially ramped up since the start of the Russia-Ukraine war:

- Saudi Arabia and China are in talks to settle Chinese oil sales with the yuan.

- Brazil and China have announced the phase-in of a yuan clearing arrangement.

- China has reported that trade with Russia is now mostly in yuan.

Still, our base case remains the same: we believe the hurdle to dethrone the US dollar is high, especially within the next decade. We explore some currency contenders and how they stack against the US dollar.

How Do The Contenders Compare To The US Dollar?

The Chinese Yuan

The Chinese yuan has become a top challenger to the US dollar as China further deepens its economic and political ties globally.

- However, key tenets of a capital market include frictionless convertibility, regulatory transparency, and trading depth. In our view, other countries would switch their primary reserves to yuan only if investing in China became more accessible and its bond market deepened materially enough to encourage holding yuan. For reference, the US bond market is approximately USD 51 tn; China’s bond market is approximately USD 20 tn.1

- Additionally, the more a country exports relative to its imports, the greater its current account and the greater its incentive to limit domestic currency appreciation. If China were to take the US dollar’s reserve status, global demand for the yuan would likely cause material appreciation in the currency. As such, until China becomes a net importer, we believe China is disincentivized from overtaking the US dollar.

The Euro

The two-decade-old euro is another popular challenger, and many countries’ currencies are pegged to the euro.

- However, fragmentation risk remains a key issue to adopting the euro as the premier reserve currency. Because the Euro area is a currency union, one member country’s government debt crisis can threaten the financial stability of the rest of the union (for example, Greece in 2015).

- Furthermore, not all 27 EU countries have adopted the euro, and the 20 countries that use the euro have independent central banks with their own mandates. The integration of member countries’ monetary and fiscal policies with those of the broader Euro area will likely continue to present challenges.

A BRIC Alternative Currency

The idea of BRIC countries creating an alternative currency has also attracted conversation.

- We acknowledge regional bloc currencies may cause further reserve fragmentation. However, a key feature of a reserve currency is that it is attached to a major economy with liberalized capital markets. A BRIC currency alternative would likely not have enough capital market clout to threaten the US dollar’s currency reserve status.

The US Dollar

The US’s deep capital markets and exchange rate arrangements solidify the US dollar’s reputation and longevity.

- The US’s deep capital markets allow other economies to reliably invest their reserves at scale in the US’s government debt, all of which enhances the US dollar’s appeal as a safe-haven currency.

- Some have argued that the US.’s high debt issuance poses a long-term concern for the dollar. We believe that would only be the case if the US.’s debt level were unsustainable. For reference, the US.’s nominal interest expense as a percent of GDP remains in-line with long-term averages at 1.9%.2

- Over 30 countries have some exchange rate agreement based on the US dollar, with 11 countries using a currency board arrangement and 13 countries (including Saudi Arabia) using a conventional peg arrangement.3 These pegged currencies create a substantial moat around the reserve status of the US dollar.

In our view, de-dollarization poses little risk of changing the global currency order in the foreseeable future, but we also acknowledge that it may be a part of a decades-long trend. If anything, we expect less that a single new contender overtakes the US dollar as the world’s reserve currency and more that multiple other currencies grow in reserve share, as has been the case for the last two decades. Until then, we believe de-dollarization will remain a popular headline but an unlikely story.

1Bank for International Settlements, as of September 30, 2022.

2Federal Reserve Economic Data, as of March 30, 2023.

3International Monetary Fund, as of July 7, 2022.