The US Inflation Reduction Act Is Driving Clean-Energy Investment One Year In

When the Biden administration marked the first anniversary of the Inflation Reduction Act (IRA) in mid-August this year, it rolled out some big numbers to demonstrate the impact of the legislation. In response to the act’s clean-energy and climate provisions, companies had announced more than $110 billion in new clean-energy manufacturing investments since the IRA became law, according to the White House. That includes over $70 billion in the electric vehicle (EV) supply chain and about $10 billion in solar manufacturing.1

The IRA has been surrounded by big claims—and intense criticism—from the start. When he signed the bill into law in 2022, President Biden hailed it as “the biggest step forward on climate ever.”2 To spur investment, the IRA relies on a package of tax incentives intended to accelerate the deployment of clean energy as well as clean vehicles, buildings and manufacturing.3 These include tax credits for investment in renewable energy projects and facilities that generate clean electricity. The law provides tax breaks for the manufacturing of components for solar and wind energy, inverters,4 battery components and critical minerals. It also sets out production tax credits for renewable and clean electricity as well as power from qualified nuclear facilities.

Republicans have leveled a wide range of criticisms at the law, which passed both houses of Congress in party-line votes.5 Senate Republican Leader Mitch McConnell, for example, has called the IRA a “reckless taxing and spending spree” that will have “no meaningful impact on the world's climate.”6 Other critics charge that the IRA benefits foreign companies in countries such as China.7 In particular, the law's incentives for the purchase of EVs have faced pushback, and not just from Republicans. Sen. Joe Manchin, a Democrat who co-sponsored the IRA but has criticized the administration's implementation of the law, said he would oppose a rush to mass adoption of EVs while China controls the supply of critical minerals required for their production.8

One year from the launch of the IRA, we drilled down into the data to understand the investment response underlying the official optimism. What we found was that—so far at least—the reality is living up to or even exceeding expectations. Analysis based on public announcements tracked by the American Clean Power Association (ACP), Climate Power and E2 show that 280 clean energy projects were announced across 44 US states in the IRA’s first year.9 These projects represent $282 billion in investment and are expected to create nearly 175,000 jobs. To find out which companies are talking about the IRA and what future projects they may be considering, we also examined earnings calls using Natural Language Processing. Solar energy was the clean-energy topic most often mentioned in combination with the IRA on these calls, followed by carbon capture and storage, and batteries and energy storage.10

The evidence of the IRA’s impact is mounting, but if the law is to achieve the goals set out by its supporters, challenges will have to be overcome. These include delays in connecting renewable energy projects to the grid and the potential for rising project costs, which could in turn push up the IRA's final price tag. Estimating the total bill for the IRA is difficult because most of the spending under the law comes in the form of uncapped tax breaks, meaning the cost will increase as more companies and households take advantage of the incentives. Initial cost estimates tended to range between $370 billion, a figure cited regularly by the White House,11 to $391 billion, calculated by the Congressional Budget Office.12

Made in America

The IRA’s potential to boost US development and production of clean-energy technology critical to the sustainable energy transition has been widely touted since its inception. The law provides the most supportive regulatory environment in clean-tech history, potentially driving results including the first large-scale deployment of green hydrogen and carbon capture, according to Goldman Sachs Global Investment Research (GIR).13 The IRA’s incentives could potentially help the US gain a larger share of the global clean-tech market, where China now dominates the manufacturing and trade of most technologies.14

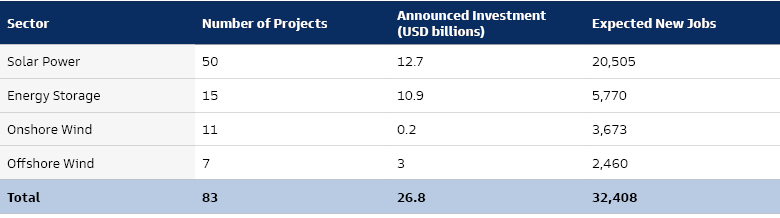

Significant progress has been made in the IRA’s first year. A recent report from ACP, for example, estimates that the clean energy projects announced through July 31, 2023, will add 184,850 megawatts of new clean energy capacity.15 The IRA’s support for manufacturing and job creation is also translating into concrete projects. Of the $282 billion of announced investment, just under $27 billion is earmarked for the construction or expansion of 83 manufacturing facilities devoted to utility-scale clean energy across four main sectors, as shown in the table below. The projects include offshore wind facilities in New York, a battery plant in Kentucky and solar development from Washington to Florida.16

ACP, Climate Power, E2, Goldman Sachs Asset Management. As of August 31, 2023.

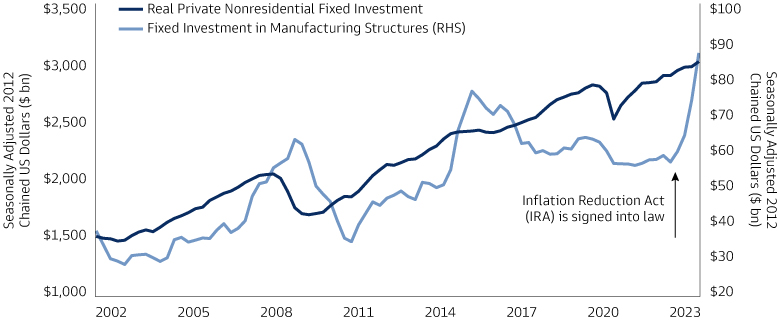

While many of these announced projects will take time to come online, and the capital expenditure to complete them will be spread over months or years, the construction of new facilities is already being reflected in US macroeconomic data. Private fixed investment in manufacturing facilities has surged since April 2022. It was propelled in part by the IRA and another piece of legislation, the CHIPS and Science Act, which provides funding and incentives to support semiconductor research and production.17

Federal Reserve Bank of St. Louis, US Bureau of Economic Analysis, Goldman Sachs Asset Management. Data as of August 30, 2023. Seasonally adjusted 2012 chained US dollars.

Next Big Thing

The IRA’s tax credits are deliberately broad to encourage investment across a range of clean-energy solutions. Its investment tax credit for energy property, for example, covers projects in the following areas: fuel cell, solar, geothermal, small wind, energy storage, biogas, microgrid controllers, and combined heat and power properties.18 The base credit amount is 6% of qualified investment, though this can be increased by meeting requirements for wages and apprenticeships and for using domestic steel, iron and manufactured products. Similar incentives are built into most of the law’s tax provisions.

The scope of the IRA’s clean-energy incentives has encouraged companies to announce a wide variety of investments in the first year, with more set to come in the years ahead. An analysis of company earnings calls in the year through August 14, 2023, shows that the law has sparked a widespread discussion of clean-energy topics, signaling the potential for future investment. Using Natural Language Processing19 to scan 27,794 calls held between July 2022 and mid-August 2023, we identified three areas of significant interest: carbon capture, utilization and sequestration (CCUS); batteries and energy storage; and hydrogen fuel and infrastructure.20 These findings are consistent with previous Goldman Sachs research, which found that the IRA would be most transformative for products including utility-scale battery storage and green hydrogen, while accelerating investment in longer-term carbon capture projects.21

Three sectors have been most vocal in discussing the IRA and clean-energy topics: energy, industrials and materials. Energy companies have led the conversation when it comes to CCUS. The IRA’s support for the decarbonization of power generation includes extending and expanding an existing CCUS tax credit to include direct air capture and lowering the threshold for some facilities to benefit.22

Materials and industrial companies are the most vocal on batteries and energy storage, which are supported by the IRA’s production tax credit for domestic manufacturing of battery components as well as clean-vehicle and clean-energy incentives. Earnings calls in all three sectors have touched on hydrogen fuel and infrastructure, an area supported by numerous provisions in the IRA, including a hydrogen production tax credit. Mentions of hydrogen in our analysis also had the highest degree of certainty regarding potential investment, with 70% including a target or project numbers, while CCUS came in at 51% and batteries and energy storage at 43%.23

Coast to Coast

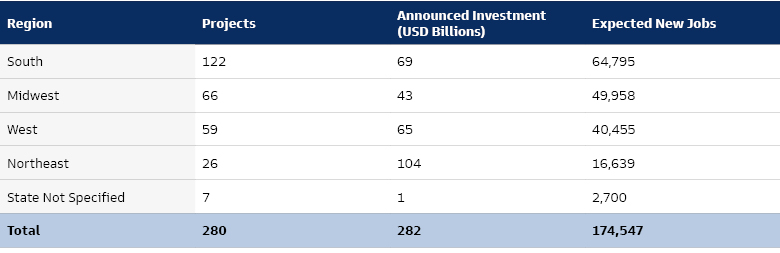

Job creation and economic expansion have been central themes of the rollout of the IRA.24 Our analysis shows that the announced investment linked to the IRA is spread broadly across the US, with the South attracting the largest number of projects and the Northeast in line for the largest investment. The following table provides a regional breakdown of announced projects and investment and the tally of jobs they are expected to create.

ACP, Climate Power, E2, Goldman Sachs Asset Management. As of August 31, 2023.

This regional distribution of announced projects translated into $225 billion of investment planned in Republican congressional districts as of July 25, compared with $38 billion in Democratic districts.25 The jobs count so far also tilts in favor of Republican districts, which were in line for 96,216 new jobs, compared with 64,418 in Democratic districts.

Bang for the Buck

A recent study published in the Brookings Papers on Economic Activity series estimates the total budgetary effects of the IRA’s climate provisions (tax credits and direct expenditures) at $900 billion through 2031.26 It concludes that the climate measures in the IRA will remain cost-effective even with this higher price tag.

This conclusion is based on a comparison of the cost of abating carbon dioxide (CO2) emissions with the “social cost of carbon,” defined as the economic costs, or damages, of emitting one additional ton of CO2 into the atmosphere. Even at the high end of estimated budgetary effects of the IRA’s climate provisions—$1.2 trillion through 2031—the law’s tax credits enable the reduction of CO2 emissions at $83 per metric ton for the power sector, according to the study. That is far less than the damage caused by the emission of additional CO2—about $200 per ton.27 And that’s before benefits including improved air quality are taken into account.

Challenges Still Remain

For all the progress made during the IRA’s first year, challenges still remain. One of these is the potential for rising project costs. The authors of the Brookings study show that macroeconomic conditions led by higher interest rates and materials costs could hamper clean energy investment. In fact, the study cautions that “macroeconomic conditions may have larger impacts on IRA investments than IRA investments have on macroeconomic conditions.”28 A recent report from the US Department of Energy, for example, cited inflation along with supply chain constraints, geopolitical uncertainty and warranty provisions as factors hampering “the profitability of western wind turbine manufacturers across their land-based and offshore portfolios in 2022.”29

The growing backlog of renewable power projects seeking to connect to the electric grid also presents a potential hurdle for the expansion of clean energy. A recent study led by Lawrence Berkeley National Laboratory (Berkeley Lab) shows renewable power projects are spending longer in so-called interconnection queues, a term that refers to the impact studies developers must complete before a project can connect to the system.30 The study shows that nearly 2,000 gigawatts of renewable energy and storage capacity was waiting in these queues at the end of 2022, a 40% increase from a year earlier. Entering an interconnection queue is just one step in the development process, but the data nevertheless provides “a general indicator for mid-term trends in developer interest,” according to the study.

Two main issues are causing these delays, according to Berkeley Lab: grid capacity and the design of interconnection evaluation processes. Some progress has been made toward removing these obstacles. The Federal Energy Regulatory Commission has approved reforms to speed up the interconnection evaluation process, and the Infrastructure Investment and Jobs Act contains provisions to support the addition of transmissions lines to the grid.31

Reducing Carbon Emissions

The reduction of greenhouse gas (GHG) emissions is a central goal of the IRA, and recent research indicates that it could have a significant impact in this area. A study published in the journal Science, for example, found that the law’s provisions could lead to a reduction in GHG emissions of between 43% and 48% from 2005 levels by 2035.32 Without the IRA, the decline would have been in the range of 27% to 35%. The law may have its greatest effect in the power sector because its incentives “amplify trends already underway and lower decarbonization costs,” according to the study.

The US has set a target for reducing GHG emissions by between 50% and 52% below 2005 levels by 2030.33 While the IRA’s projected impact falls short of this level, the Science study shows that the law helps to narrow the “implementation gap” in reaching the official target by at least 50%.34 One unknown is the IRA’s potential to spur other federal agencies as well as state and local governments and companies to increase their own climate ambitions, which “may be key to closing the 2030 implementation gap,” according to the study.

Implications for Investors

The IRA’s support for jobs, especially in manufacturing, should support economic growth and consumption, in turn supporting the US equity and credit markets. If four out of five projects already announced finish on time and create the expected number of jobs, this could lead to about 65,000 new jobs, mostly in manufacturing, by the end of 2024, with 50,000 coming in 2024 itself. For context, 106,000 manufacturing jobs were created overall in the US over the past 12 months.35 If job creation continues at this pace, the IRA and the CHIPS and Science Act could spur the creation of half a million manufacturing jobs over the coming decade, pushing the total to 13.5 million—a level last seen in 2008.

In our view, the materials, industrial, energy and utility sectors stand to benefit the most from this boost to manufacturing, though companies will vary widely in their exposure to the IRA. As a result, active stock-picking will be the best way to take advantage of the long-term opportunities created by the IRA in public markets. On the private side, we expect the law to open up an abundance of pure-play opportunities across the spectrum of clean-energy technology, as the law’s tax incentives make the development of new technologies more profitable.

Impact Beyond Borders

For all the investment the IRA is spurring in the US, its ultimate impact could be much greater. The law has already prompted responses around the world, including from the European Union (EU). In February 2023, EU policy makers responded to the IRA with a Green Deal Industrial Plan to increase the competitiveness of Europe’s net-zero emission industry and speed the transition to climate neutrality. The plan foresees investment in strategic net zero sectors, including through tax benefits.36 India’s government has launched a range of initiatives to spur development of renewable energy technologies under its Production-Linked Incentive Scheme.37 In the race to shape the future of clean energy, we believe this competition among countries can only accelerate global progress toward critical climate goals while expanding opportunities for investors.

1“Fact Sheet: One Year In, President Biden’s Inflation Reduction Act Is Driving Historic Climate Action and Investing in America to Create Good-Paying Jobs and Reduce Costs,” White House press release. As of August 16, 2023.

2“Remarks by President Biden at Signing of H.R. 5376, The Inflation Reduction Act of 2022,” White House press release. As of August 16, 2022.

3“Clean Energy Tax Provisions in the Inflation Reduction Act,” White House website. As of September 5, 2023.

4Inverters are key components of solar energy systems. They convert the direct current electricity generated by solar panels to the alternating current used by the electrical grid.

5For the vote in the House of Representatives, see “House Passes Inflation Reduction Act, Sending Climate and Health Bill to Biden,” The Washington Post. As of August 12, 2022. For the vote in the Senate, see “Senate Approves Inflation Reduction Act, Clinching Long-Delayed Health and Climate Bill,” The Washington Post. As of August 7, 2022.

6”One Year Later, Democrats’ Reckless Spending Spree Is Showering Cash on Foreign Companies,” Mitch McConnell Republican Leader Web Page on Senate Website. As of July 26, 2023.

7For example, Republican Congressman Jason Smith, who is chairman of the House Ways and Means Committee, has said the IRA is “paying big dividends to big business and China.” See “GOP Case for Repealing Climate Law: China and Wall Street,” E&E News by Politico. As of April 20, 2023.

8”Chairman Manchin’s Opening Remarks During a Full Committee Hearing to Examine Opportunities to Counter the People's Republic of China's Control of Critical Mineral Supply Chains,” US Senate Committee on Energy and Natural Resources Website. As of September 28, 2023.

9Goldman Sachs Asset Management. As of September 4, 2023.

10Goldman Sachs Asset Management analysis of earnings calls by companies in the MSCI ACWI Investable Market Index. Data as of August 14, 2023. NLP output reviewed by analyst.

11See for example “Building a Clean Energy Economy: A Guidebook to the Inflation Reduction Act’s Investments in Clean Energy and Climate Action,” The White House. As of January 2023.

12“CBO Scores IRA With $238 Billion of Deficit Reduction,” Committee for a Responsible Federal Budget. As of September 7, 2022. The CBO estimated the cost of the IRA’s energy and climate provisions over the period 2022-2031.

13“Carbonomics: The Third American Energy Revolution,” Goldman Sachs Global Investment Research. As of March 22, 2023.

14“Energy Technology Perspectives 2023,” International Energy Agency. As of January 2023. One of the aims of the IRA was to help make the US a leader in clean-energy technologies. See “Fact Sheet: President Biden Sets 2030 Greenhouse Gas Pollution Reduction Target Aimed at Creating Good-Paying Union Jobs and Securing US Leadership on Clean Energy Technologies,” The White House. As of April 22, 2021.

15“Clean Energy Investing in America,” ACP. As of August 2023. This report is based on public announcements made from August 16, 2022, through July 31, 2023.

16“Clean Energy Investing in America,” ACP. As of August 2023. This report is based on public announcements made from August 16, 2022, through July 31, 2023.

17“Biden Signs Order on $52 Billion Chips Law Implementation,” Reuters. As of August 25, 2022.

18“Clean Energy Tax Provisions in the Inflation Reduction Act,” White House website. As of September 5, 2023.

19Natural Language Processing is a branch of artificial intelligence that enables computers to analyze and understand human language.

20GS Asset Management analysis of earnings calls by companies in MSCI ACWI Investable Market Index. Data as of August 14, 2023.

21“US Inflation Reduction Act: What's Transformational, What's Supportive, What's Underappreciated,” GS SUSTAIN. As of August 30, 2022.

22“Building a Clean Energy Economy: A Guidebook to the Inflation Reduction Act’s Investments in Clean Energy and Climate Action,” The White House. As of January 2023.

23GS Asset Management analysis of earnings calls by companies in the MSCI ACWI Investable Market Index. Data as of August 14, 2023.

24At a fundraiser in Utah just before the law’s first anniversary, President Biden said he regretted the name given to the legislation, “because it has less to do with reducing inflation than providing alternatives where we generate economic growth.” See “Biden Wishes His Signature Climate Law Was Called Something Else,” Bloomberg News. As of August 10, 2023.

25Based on “One Year of Our Clean Energy Boom,” a report from Climate Power, and additional analysis by Goldman Sachs Asset Management. Data as of July 25, 2023. Climate Power is an independent strategic communications and paid media operation focused on building support for climate action. It was founded by the Center for American Progress Action Fund, the League of Conservation Voters and the Sierra Club. See “Why Us” on the Climate Power website.

26John Bistline (Electric Power Research Institute), Neil Mehrotra (Federal Reserve Bank of Minneapolis) and Catherine Wolfram (Harvard University). “Economic Implications of the Climate Provisions of the Inflation Reduction Act,” Brookings Papers on Economic Activity. As of March 29, 2023.

27Another Brookings publication cites social cost estimates in the latest literature ranging from $100 to $380 per ton of CO2. See Bistline, Mehrotra and Wolfram. “The Inflation Reduction Act Could Energize the Economy,” Brookings. As of May 1, 2023.

28Bistline, Mehrotra and Wolfram. “Economic Implications of the Climate Provisions of the Inflation Reduction Act,” Brookings Papers on Economic Activity. As of March 29, 2023.

29“Offshore Wind Market Report: 2023 Edition,” Office of Energy Efficiency and Renewable Energy, US Department of Energy. As of August 2023. The report notes that the IRA “may soften the adverse impact of rising inflation, supply chain constraints, and interest rates on offshore wind project costs for early-stage offshore wind projects.”

30“Grid Connection Requests Grow by 40% in 2022 as Clean Energy Surges, Despite Backlogs and Uncertainty,” Lawrence Berkeley National Laboratory. As of April 6, 2023.

31“Grid Connection Requests Grow by 40% in 2022 as Clean Energy Surges, Despite Backlogs and Uncertainty,” Lawrence Berkeley National Laboratory. As of April 6, 2023.

32John Bistline et al. “Emissions and energy impacts of the Inflation Reduction Act,” Science. As of June 29, 2023. The researchers leveraged results from nine independent models to reach their conclusions.

33“FACT SHEET: President Biden Sets 2030 Greenhouse Gas Pollution Reduction Target Aimed at Creating Good-Paying Union Jobs and Securing U.S. Leadership on Clean Energy Technologies,” The White House. As of April 22, 2021.

34Bistline et al. “Emissions and energy impacts of the Inflation Reduction Act,” Science. As of June 29, 2023.

35“FRED Economic Data,” Federal Reserve Bank of St. Louis. Data as of September 1, 2023.

36“The Green Deal Industrial Plan: Putting Europe’s Net-Zero Industry in the Lead,” European Commission press release. As of February 1, 2023.

37“Government incentivizes local development and manufacturing of renewable energy technologies,” Ministry of New and Renewable Energy press release. As of March 22, 2022.