Understanding Private Credit

A company in need of debt financing—whether for ongoing operations, business expansion or corporate acquisitions—can turn to various sources of financing. One common source is a loan from a bank, which would then either hold the loan on its balance sheet or syndicate it to a group of similar investors. A large company can also issue bonds that subsequently trade in the public markets. Or the company can turn to private credit, working with a single lender to craft a tailored capital solution.

For a borrower, the advantages of private credit include certainty and speed of execution—a feature especially attractive in volatile public market conditions—as well as confidentiality in avoidance of broad dissemination of proprietary information.

What is Private Credit?

Private credit covers an array of strategies that span the capital structure and borrower type. These range from senior secured loans for blue-chip corporate borrowers, to junior unsecured credit for financing new building construction, to loans against specialized assets such as railcars and airplanes or contractual revenue streams like royalties and subscription services, to distressed situations.

Different loans carry different types and levels of risk—and can generate a range of returns commensurate to that risk. Returns also vary across yield and capital appreciation components. Senior, secured loans offer relatively stable yield and are lower on the risk and return spectrum than other private credit strategies. Unsecured subordinated and mezzanine strategies provide financing further down the capital structure, with higher yield to compensate for the additional credit risk. They may also incorporate additional securities to participate in potential equity upside. Specialty and alternative credit opportunities also typically provide cash yield and vary across the risk/return spectrum. Distressed and opportunistic strategies target firms undergoing meaningful challenges. They typically have the highest dispersion of outcomes and lack a yield component, but also have the potential for higher upside as the companies are restructured.

The variety of private credit strategies and their features means that a private credit portfolio can be structured to target a wide range of objectives and can be tailored to an investor’s individualized goals.

Why Invest in Private Credit?

Private credit can be a powerful complement to traditional fixed income strategies, offering incremental income generation, potential resilience, return enhancement, and diversification.

Income generation. Over the past decade, the asset class has generated higher yield than most other asset classes, including 3-6% over public high yield and broadly syndicated loans. Borrowers have been willing to pay a premium for the certainty of execution, agility and customization that private lenders offer.

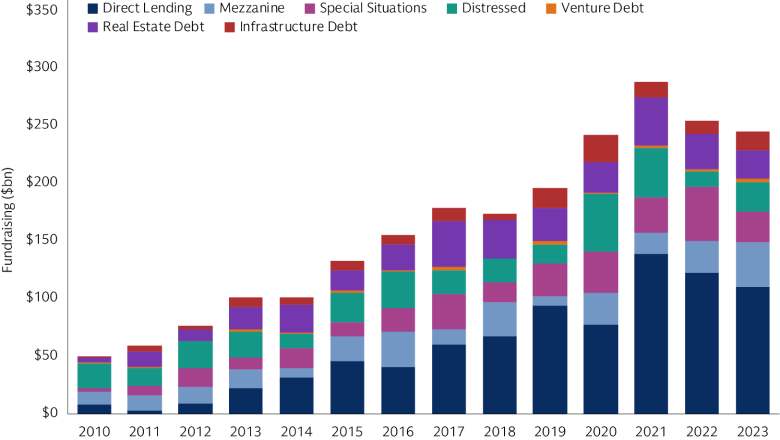

Source: Preqin. As of May 2024. Based on total AUM at year-end 2023 compared to AUM at year-end 2010.

Resilience. Private credit has historically maintained loss ratios that are lower than those of high-yield fixed income instruments. Deep access to company records received by private lenders enables stronger due diligence and documentation than may be the case in public markets. The ability to select investments without the need to manage to a benchmark can be a potential downside mitigant in an environment of increased dispersion, slowing growth, tightening monetary policy and headwinds to profitability. Furthermore, private credit typically features a single entity lending to a borrower. This can make for quicker and more efficient workouts—and potentially greater recovery—in case of default, compared to publicly syndicated debt placements that feature multiple lenders with competing priorities.

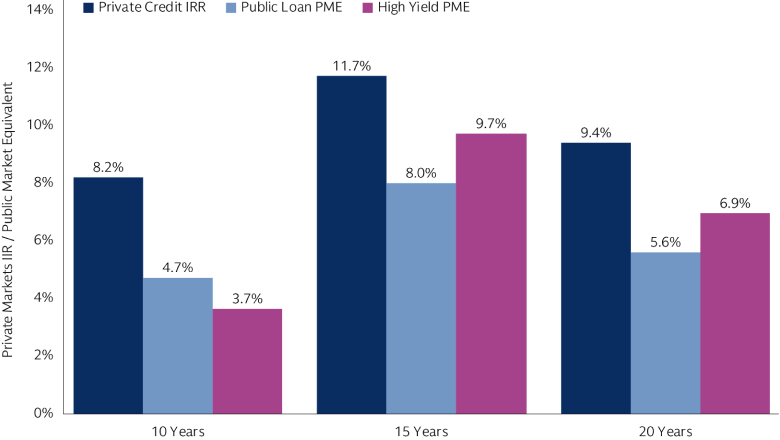

Potential return enhancement. Aided by the yield premium and resilience dynamics, private credit has outperformed public loans over the past decade, having delivered 10% annualized returns compared to an annualized 5% for public loans.1 In a rising-interest rate environment, private credit may find its floating rate nature a further advantage. Private credit instruments are typically tied to floating rates (such as SOFR). When interest rates rise, those increases are automatically reflected in the private credit coupon. This dynamic makes floating-rate debt less sensitive to interest rates compared to fixed-rate bonds, which typically lose value as interest rates rise.

Diversification. Some private credit strategies are most directly exposed to the economic health of corporate borrowers, others to the consumer, others to real assets. Some strategies, such as performing corporate and real asset credit, tend to move with the economic cycle. Others, such as distressed and opportunistic, may be more counter-cyclical, finding more attractive opportunities when the economy is challenged. Some specialty credit strategies are less sensitive to the cycles of the broader economy.

Cambridge Associates, as of December 31, 2023. Private credit returns expressed net of fees. Past performance does not guarantee future results, which may vary. Outperformance of public loans on a public market equivalent (PME) basis. PME returns reflect the performance of the S&P LSTA Leveraged Loan index (“index”) (for public loans) and the Bloomberg Global High Yield index (for High Yield) expressed in terms of an internal rate of return and takes into account the timings of the private credit strategy’s cash flows. PME returns do not represent the actual performance of the index. Indices are unmanaged and investors cannot invest in indices. The index returns are gross total return, with dividends reinvested and do not reflect the deduction of any fees or expenses, which would reduce returns. For educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

Evolution of the Asset Class

The private debt market has grown more than six-fold since the Global Financial Crisis of 2007-2008, with senior lending strategies having experienced the most robust growth. Today, the private credit market stands at $1.2 trillion.2 Part of this growth has been driven by increasing barriers to entry in certain market segments. For instance smaller companies have found it more challenging to access public markets as the average bond and syndicated loan deal sizes have grown.

Much of the growth in demand for private credit solutions, however, has been driven by the unique value proposition that private lenders can offer borrowers. Private lenders are becoming preferred financing partners due to their sophistication, flexibility, certainty of execution, and the critical support they can offer to borrowers in challenging environments, as evidenced most recently through the COVID-19 pandemic. Some strategies also focus on assets or structures too complex for typical traditional lenders to underwrite, relying on complex approaches to properly evaluate and manage risks.

The growth of the asset class, buoyed by investor interest, has also helped it expand its scope. While historically private lenders focused on middle-market companies, the recent growth in fund sizes has made it possible to also finance larger deals while maintaining prudent fund diversification parameters. It has also enabled innovative approaches to better meet borrower needs— such as the emergence of unitranche transactions, in which a lender issues a single credit instrument, rather than a more complex capital structure that would subdivide the borrowed amount into junior vs. senior tranches of debt.

Finding the Right Partner

With a variety of strategies, the dispersion of results can be wide. Even within a strategy, the range of outcomes can vary based on the skill and experience of the manager. This makes finding the right partner critical. Critical items to consider include the types of borrowers and assets each manager is lending against, their position in the capital structure, the terms and protections they negotiate, their experience and track record in investing through multiple cycles, and their expertise in managing through stressed and distressed situations.