Beware of Beta: The Potential Benefits of a Multi-Sector Approach to Private Equity

As consensus has coalesced around the importance of fundamental value creation in generating attractive private equity returns, investors are naturally wondering, are sector specialists better equipped to deliver? Intuition may suggest that specialists’ advantage lies in better sector-specific knowledge and skill sets to drive value creation, and potentially better networks to source opportunities. However, data tells a more nuanced story.1

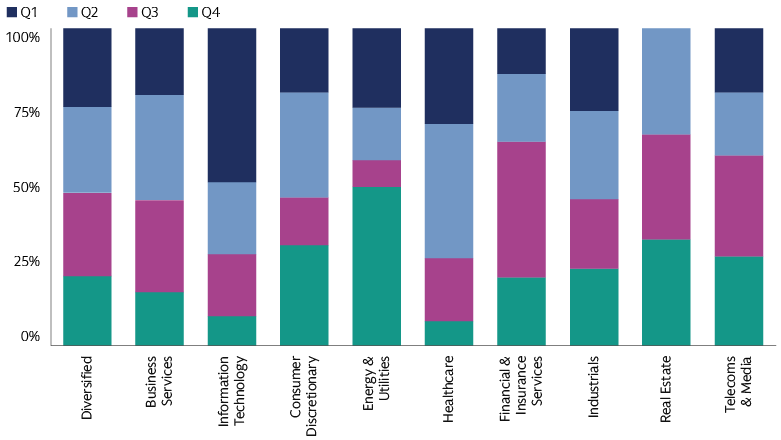

We first looked at performance quartiling of specialist and diversified funds relative to their broader buyout peers. As expected, diversified funds quartiled evenly across the four performance quartiles. Sector specialist performance was mixed. Most notable outperformance was in the Information Technology (IT) sector (where around half of funds were in the top quartile in their respective vintage years, and ~70% of funds quartiled above median). Healthcare specialists likewise showed attractive relative performance. On the other hand, financial services-sector funds seemed to fare the worst.

Source: Preqin. Buyout funds of 2005-2018 vintages. Quartiling based on the quartile rank assigned by Preqin to each fund; returns reported as of 12/31/2023.

How much of this result was manager skill (which is repeatable) and how much was sector tailwinds or headwinds (which is hard to predict)?

To examine this question, we compared sector funds’ performance to their most relevant public benchmarks (relevant sector index component of the MSCI World index), as well as to the performance of the overall public market (proxied by the MSCI World). The results showed that since 2005, IT-sector specialists, in aggregate, generated 6.3% outperformance over the broader market – but virtually no outperformance over the IT sector index2 (although some managers have generated substantial alpha3). Financial services specialists, on the other hand, generated 3.7% outperformance over the financials sector index in aggregate, three times as much as their outperformance over the broader market.4 Clearly, beta exposure was a factor in their absolute performance.

Most investors avoid trying to predict stock market cycles and timing sector allocations, and a quick look at the lack of predictability in relative performance of sectors year by year shows why.

In fact, this lack of relative sector performance predictability may be one factor behind academic findings of lack of meaningful performance persistence from a General Partner’s (GP) prior buyout fund to the next.5

Large dispersion in manager returns, both across diversified managers and across sector specialists, shows that there are skilled managers and less-skilled managers in both approaches. The onus for the LP is to go beyond the specialist/generalist label and evaluate whether the GP’s skill sets align with its value creation strategies. Intuition suggests that some amount of focus is helpful, as very disparate sectors may lend themselves to disparate value creation approaches. LPs might look for GPs who take a middle ground: a narrow enough focus to employ a systematic value creation playbook (alpha) that leverages the manager’s strengths across a few sectors, but diversified enough to limit the impact of luck (beta).

LPs who might prefer building a diversified portfolio of sector specialists should consider a few portfolio construction factors. Building such a portfolio is a more resource-intensive process, with the need to source, diligence, manage, and monitor many more GPs than investing in multi-sector managers. This approach would also spread out individual commitments across smaller tickets, which may forego the more attractive economics of fewer, larger subscriptions. Finally, the universe of sector specialists may be limited in certain sectors, making it harder to fill the allocation while maintaining appropriate selectivity. For instance, one commonly used private equity performance database shows the universe of IT-focused buyout funds as 10% the size of the diversified fund manager universe; another commonly used database shows the count of IT-focused funds at 5% of the count of multi-industry funds. Universes of specialists in other sectors are smaller still.

A core/satellite approach may combine the best of both worlds: a core of multi-sector managers combined with a satellite allocation to a small number of specialists in a couple of sectors or themes in which the LP has strong conviction and access to compelling managers. In sizing the allocations, the LP can start by estimating potential sector exposures across their multi-sector managers (for which the managers can offer some general guidance) to understand any implicit sector tilts.

1Source: Cambridge Associates and Preqin, returns reported as of 12/31/2023. Fund classifications are based on Preqin’s classification as reflected in the funds’ listed core industries. With around 300 funds overall classified as sector specialists, and the limited number of funds in certain sectors, data on sector specialists should be viewed as directional rather than definitive.

2Source: Cambridge Associates, mPME performance since 2005, as of Q1 2024.

3Source: Preqin, returns reported as of 12/31/2023. Based on the dispersion in funds’ reported IRRs and TVPIs.

4Source: Cambridge Associates, mPME performance since 2005, as of Q1 2024.

5Robert S. Harris, Tim Jenkinson, Steven N. Kaplan and Ruediger Stucke, “Has Persistence Persisted in Private Equity? Evidence from Buyout and Venture Capital Funds.” March 2022.