Boosting the Efficiency of Core Equity Allocations with an Alpha Enhanced Approach

A Little Active Can Go a Long Way

Passive equity strategies have long been a staple of investors’ core portfolio allocations. Yet index-tracking strategies are designed to trail their benchmarks after fees. They provide limited risk controls and lack the dynamism to manage volatility or incorporate investors’ specific preferences. For these reasons, we think passive exposures may not be the most efficient use of a portfolio’s risk budget, especially in the current environment of moderating forward market-return expectations,1 elevated index concentration risks, and heightened uncertainty around international trade, economic growth and inflation.

We think an Alpha Enhanced approach can complement core strategies by offering a middle ground between passive and active investing. Like passive strategies, Alpha Enhanced strategies offer cost effectiveness and limit tracking error by sticking close to a reference benchmark; like active strategies, they offer professional risk management and the potential to outperform the market, and they make it possible to integrate investors’ financial and non-financial objectives.

Historically favored by institutional investors for their low-tracking-error profiles, Alpha Enhanced strategies are increasingly accessible to a broader investor base. The growing scalability of systematic approaches along with advances in portfolio construction that enable granular levels of transparency have expanded availability across vehicles, including separately managed accounts, mutual funds and exchange-traded funds.

Alpha Enhanced: The Core Proposition

Alpha Enhanced strategies are designed to perform two key functions. Like passive strategies, they closely track a benchmark index and provide broad market exposure, known as beta. Like active strategies, they deviate from the benchmark, though these deviations are contained within pre-set tracking-error limits. This leeway allows Alpha Enhanced strategies to take active bets using a selective, risk-controlled approach.

An Alpha Enhanced strategy’s tracking-error budget is set in line with the investor’s risk appetite, but tends to fall in a range of 50 to 200 basis points. The added risk gives active managers scope to improve risk-adjusted returns by overweighting or underweighting stocks based on forward-looking views. These active positions tend to be distributed across market caps, sectors and geographies in a diversified manner to limit concentration, avoid unintended risk exposures, and maintain a composition that is close to the benchmark. The goal of this approach is to seek alpha stability, consistency and efficiency while balancing risks.

Alpha consistency

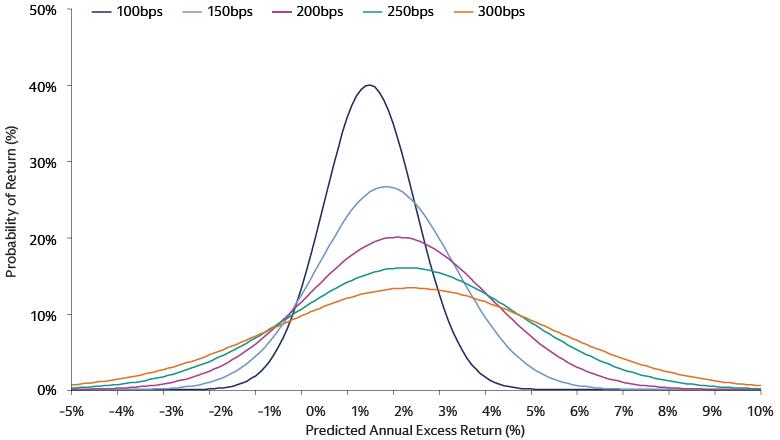

Alpha Enhanced strategies focus on the consistency, not the magnitude, of positive performance. As a result, these low-tracking-error strategies may generate positive annualized excess returns versus the benchmark more frequently than strategies with higher tracking error, though the magnitude of these returns will be smaller. In our view, this allows Alpha Enhanced strategies to outperform their passive peers, especially over the longer term thanks to the effects of compounding.

Source: Goldman Sachs Asset Management. As of October 10, 2025. For illustrative purposes only. The illustration shows the probability of a portfolio to achieve various levels of annual excess returns for various levels of tracking error. For instance, while a portfolio with 100 bps of tracking error (in dark blue) may have an average predicted annual excess return that is lower than one with 200 bps of tracking error (in green) – seen in the horizontal midpoint of each respective bell curve, the probability of achieving that return is higher for the 100 bps portfolio – seen in the vertical height of each bell curve. Withal, a lower tracking error portfolio encompasses a much higher certainty of controlled positive return. The illustration is not related to any Goldman Sachs Asset Management product or strategy.

Alpha efficiency

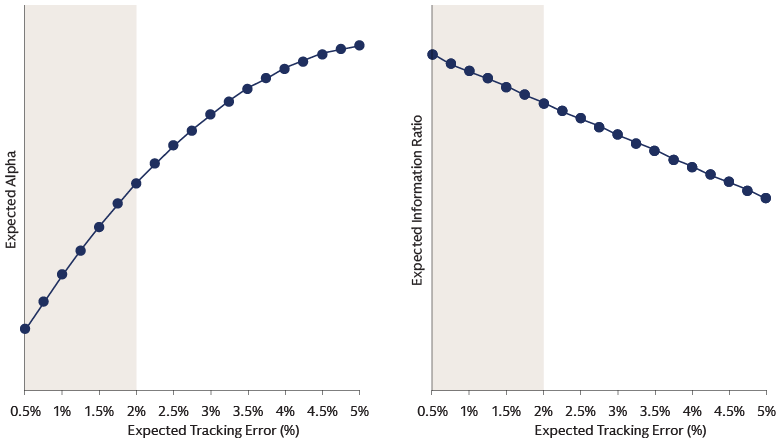

Alpha Enhanced strategies’ potential for greater alpha stability is paired with alpha efficiency. As deviation from the benchmark increases, so does the potential for excess returns. This does not happen in a linear fashion, however. As tracking error increases, we see a decreasing marginal return to alpha. In other words, the potential for risk-adjusted outperformance tends to be highest at lower levels of tracking error. This allows these enhanced strategies with limited tracking error to potentially generate more consistent alpha with a higher risk-adjusted return profile.

Source: Goldman Sachs Asset Management. As of October 10, 2025. For illustrative purposes only. The illustration shows the relationship between expected tracking error and expected alpha. What is generally observed is that as tracking error increases, we see a decreasing marginal return to alpha. Changing the structure of the index involves a lot of effort and thus “costs” more for every extra change necessary, such that operating at lower levels of risk entails lower marginal costs. Therefore, at lower tracking error levels, the information ratio tends to find its maximum. Put differently, the risk adjusted outperformance tends to be highest at lower tracking error levels.

Risk balance

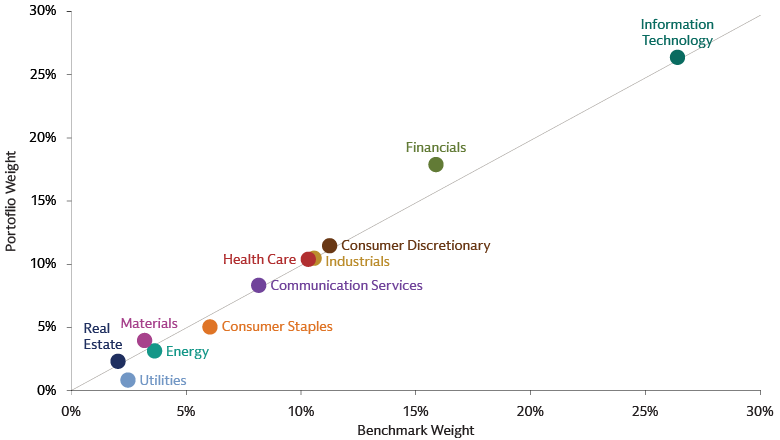

To keep tracking error within pre-set limits, Alpha Enhanced strategies tend to hold a larger number of names than strategies with higher tracking error and to track their benchmarks more closely. They also make smaller active bets across a larger number of names, which better diversifies the sources of risk because these bets are distributed along the entire benchmark. This distribution of active weights contributes to robust risk management by allowing for more effective monitoring of each bet’s impact on portfolio characteristics including risk-return profile, style and diversification. It also facilitates the adaptation of these characteristics to avoid unintended risk exposures.

As a result, we think an Alpha Enhanced approach should not cause significant deviations from the composition of the benchmark, which allows it to continue providing beta. The dynamic nature of this approach allows for firmer control of unintended biases than might be available in a non-systematic framework.

Goldman Sachs Asset Management. As of December 2024. For illustrative purposes only.

Flexibility, Transparency and Cost Efficiency

We think a data-driven, low‑alpha framework offers significant flexibility and transparency without compromising cost discipline. Its key advantages over purely passive approaches include the ability to deliver a customized portfolio aligned to specific objectives. An investor’s preferences can be integrated by defining the portfolio’s investable universe, setting the level of tracking error in line with the investor’s risk tolerance, customizing the alpha drivers to align with the investor’s return goals, and introducing value-based investing criteria such as sustainability goals.

In addition to integrating investor preferences, Alpha Enhanced strategies provide the transparency needed to monitor their impact on risks and returns across financial and non-financial components. This creates a feedback loop that can help guide the evolution of non-financial goals as internal and external policies change over time. We believe this level of granularity in attribution is best supported by a bottom‑up, systematic approach.

The costs associated with alpha enhancing also tend to be lower than those of traditional active strategies. Expense ratios are typically slightly higher than for passive funds, but this can be offset by the potential to generate alpha, which is not available to passive portfolios. For investors open to performance‑based fee structures, base fees for Alpha Enhanced strategies can be comparable to passive, with additional fees paid only on excess returns through performance participation, potentially allowing performance to pay for itself. The high alpha efficiency typical of low-tracking-error strategies translate to lower marginal costs at lower risk levels, while a scalable, systematic alpha engine helps keep operational costs contained, in our view.

Enhancing with Alpha: A Balance Between Active and Passive

An Alpha Enhanced approach strikes a balance between active and passive investing that can benefit investors, in our view. Like passive strategies, Alpha Enhanced strategies limit tracking error by sticking close to a reference benchmark; like active strategies, they offer professional risk management and the potential to outperform the market. By pursuing alpha stability, efficiency, and balancing risk, Alpha Enhanced strategies can potentially help investors achieve their goals related to risk and return, sustainability and cost.

We think a systematic, data-driven approach is essential for Alpha Enhanced strategies that seek to generate consistent outperformance while building and calibrating a portfolio within the risk limits set by the investor. This approach has the required scale and coverage to seek to smooth out the excess return profile by making a large number of small active bets along the entire benchmark, while maintaining control over any unintended biases. A robust alpha and portfolio construction engine, backed by an experienced management team, appropriate infrastructure, data, technology, and continuous research are instrumental to success, in our view.

1Goldman Sachs Global Investment Research. As of October 18, 2024. In a global strategy paper, Goldman Sachs analysts forecast that the S&P 500 would generate a 3% annualized nominal total return through 2034.