2025 Private Markets Diagnostic Survey: Turning the Corner?

Across private market asset classes, and especially in real assets, most investors are feeling the same or better about investment opportunities compared to a year ago. A lack of distributions has led many investors to adjust at the margin, but GPs are increasingly optimistic about delivering liquidity across exit routes.

Main concerns differ by region: geopolitics are foremost in EMEA and APAC, while valuations are top of mind in the Americas. Valuations were cited by GPs as the main impediment to capital deployment, and the second biggest hurdle for exits.

Despite the much-discussed dearth of distributions, few investors are over their target allocations. Many LPs with mature programs continue to consolidate relationships, but investors generally continue to seek out new managers who can add value to their programs.

As LPs consolidate relationships, competition for capital has increased, with GPs expecting headwinds for flagship fundraises. When it comes to evaluating managers, LPs prioritize fees and terms, track records, and team stability; on the other hand, GPs view their differentiators primarily through an investment lens.

The Wealth market continues to be seen as one of the biggest drivers of industry evolution, but evergreen structures are not just a Wealth phenomenon.

Methodology

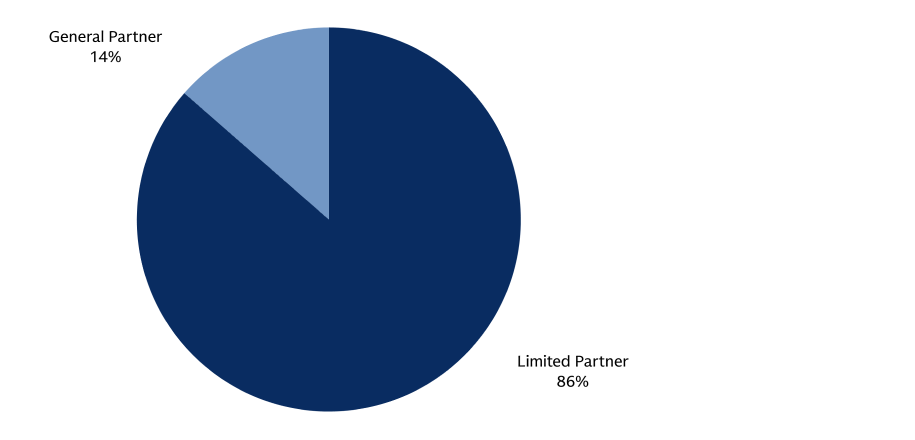

Data for the 2025 Private Markets Diagnostic Survey was collected between June 30 and August 25, 2025. The survey includes responses from 223 Limited Partner respondents and 35 General Partner respondents from around the world.

Source: Goldman Sachs Alternatives 2025 Private Markets Diagnostic Survey compiled as of August 30, 2025.