What is an ELTIF?

Background

Institutional investors have long benefited from private investments, which have the potential to provide higher returns, portfolio diversification and access to unique investment opportunities. The ELTIF, assisted by technological and operational improvements, aims to help address some of the obstacles that have made it challenging for individual investors to benefit from the same potential opportunity. The legislation imposes certain investment criteria and constraints, including limits on leverage, concentration and type of investments, with the ultimate aim of protecting end retail investors.

In 2015, the EU established the European Long Term Investment Fund (ELTIF)

The aim of the regulation is to boost long-term investments in the real economy

The legislation opens the door for MiFID Retail end-investors to access private market investment opportunities

Benefits of ELTIF Investments

Portfolio Diversification

- Access to private assets ranging from single to multi-strategy solutions

- Minimum 55% invested in private equity, private credit, loans & real estate

- Single vehicles may offer wide access across sectors and geographies

Accessible Structure

- Regulated investment vehicle

- Flexibility to invest via range of retail-friendly structures

- Maximum leverage restriction of 50% of the fund’s NAV (Net Asset Value) for MiFID Retail investors

Flexible Investment Terms

- Vehicles with generally fewer capital calls and shorter investment periods

- Increasingly competitive fee structures to invest in private markets

ELTIF Evolution

ELTIF Market

Growth in ELTIF availability from asset managers has accelerated in recent years, with the number of registered products rapidly increasing.

ELTIF Regulation

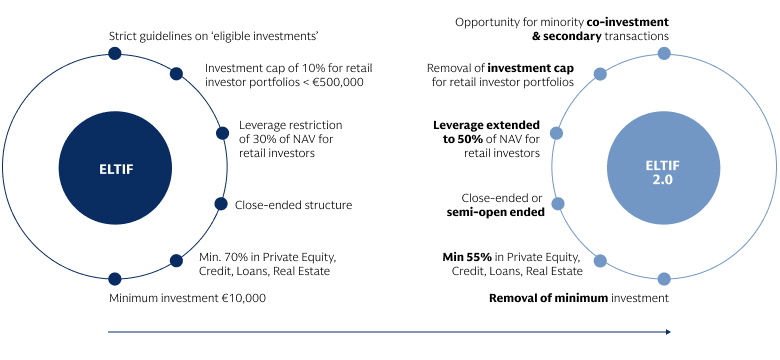

Despite the original ELTIF regulation serving as an effective catalyst for this type of investment, objections have been raised around its level of restriction & marketability.

ELTIF 2.0

The ELTIF 2.0 regulation, effective from January 10 2024, has been introduced to improve accessibility for investors with confirmed changes as follows.

Source: Regulation (EU) 2023/606