From Tina to Tara: Investing in The Next Cycle

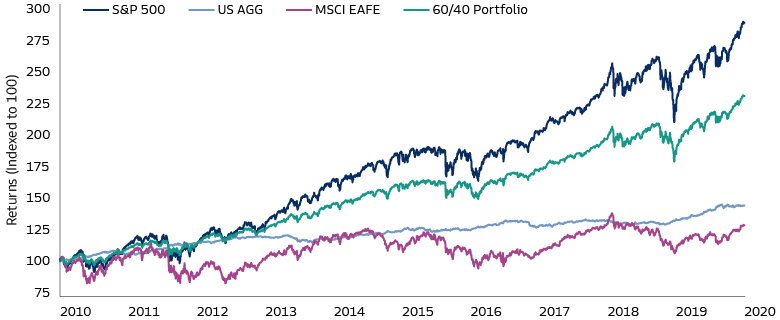

US equities have been the clear winner in many clients’ portfolios in the decade following the 2008 global financial crisis (GFC), as the asset class benefited from firm economic growth, falling interest rates, low bond yields, rising profit margins, and attractive starting valuations. Regionally, US preeminence became a dominant theme as American stock markets were home to some of the world’s most transformative technology companies. This trend underscored the growth investing bias of common US stock indices, as the growth style outperformed value investing for much of this period. The culmination of these factors gave birth to the acronym TINA (There is No Alternative) to equities, particularly US ones.

Source: Goldman Sachs Asset Management. As of March 31, 2024. Past performance does not predict future returns and does not guarantee future results, which may vary.

As we shift into the next economic cycle, marked by higher growth volatility, higher interest rates, stubborn profit margins, elevated valuations, and more episodic market volatility, TINA has made way for TARA (There are Reasonable Alternatives) to US equities. These alternatives aren’t limited to equity markets, but can be found across asset classes, including fixed income and private markets.

Entering a New Cycle

The market backdrop has fundamentally changed over the last five years; in 2019, the yield on the 10-Year Treasury and the dividend yield on the S&P 500 Index were essentially the same. From 2020-2023, that symmetry in returns disappeared. Investors experienced unique abnormalities stemming from the Covid-19 pandemic—from record low rates through the most aggressive hiking cycle on record—leading to a deeply inverted yield curve and periods of significant out- and under-performance across many asset classes. In 2021, US equities generated strong performance—as they had over the prior decade—with returns of 29% in the calendar year. In 2022, however, many investors would have likely fared better on the sideline, as a traditional 60/40 public market portfolio drew down by -16%, with both equities and fixed income contributing to losses amid a sharp global monetary tightening campaign. In 2023, cash yields between 5.00–5.50% caught investors’ attention and flows, with retail money market fund balances growing by over 40% during the year, despite strong global equity market performance.

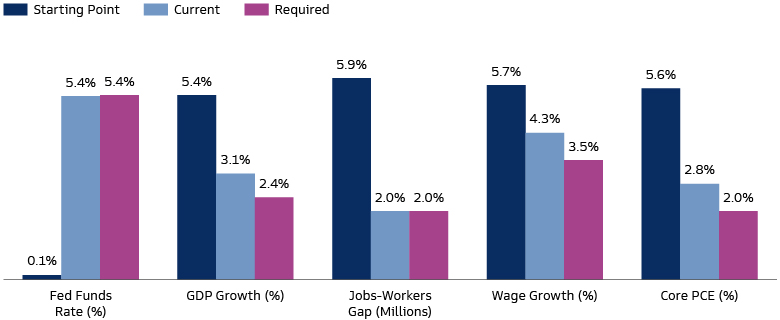

With the last few years in the rearview mirror, we believe the investment environment is settling into a “new normal”, as a higher-for-longer rate cycle creates more opportunities for return generation across asset classes. We continue to see limited recession risk with ongoing resilience in labor markets and continued progress in the fight against inflation globally. In the US, economic drags of fiscal and monetary policy have largely subsided, as reflected by the recent upturn in housing activity and moderating tightening in credit standards. The US is approaching trend-level GDP growth alongside better demand and supply balance in goods, labor and rental markets which is helping cool inflation. Our colleagues in Goldman Sachs Global Investment Research believe that several important metrics are approaching the required levels to return official inflation measures to the US Federal Reserve’s 2% target by the end of 2024.1 The Euro area and the UK have seen similar drops in core inflation levels, though their central banks will need to keep focusing on regional growth challenges. Inflation has come down across core services, durable and nondurable goods, and disinflation is widely expected in 2024.

Source: Current Population Survey, Bureau of Labor Statistics, Goldman Sachs Global Investment Research (GIR) and Goldman Sachs Asset Management. “Required” defined as the level GIR believes is necessary for 2% inflation. As of March 31, 2024, or latest available.

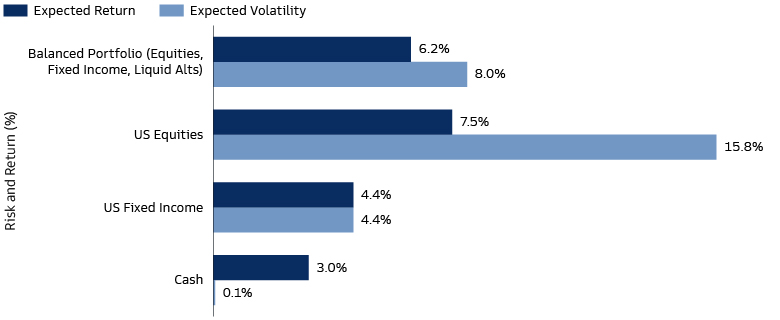

The economic environment we are entering will differ from the pandemic-related distortions in recent years. We also expect it will offer broader investment opportunities than the decade of accommodative monetary and fiscal policy that followed the GFC. We believe alongside higher rates should come a re-steepening of yield curves, providing a potential opportunity for investors with cash holdings to consider rebalancing exposures both within and across asset classes. We believe the answer to the age-old question “Is the 60/40 Dead?” is a resounding no. Instead, we believe there is room for enhancement by incorporating private market strategies into traditional 60/40 public market allocations.

Large Menu of Investable Asset Classes

We believe that investors today have more levers available to align portfolio allocations with portfolio goals, with greater potential yield opportunities in fixed income and private credit, differentiation across geographies and timeframes, and opportunities in active management as company performance in the new normal diverges. This may provide an opportunity to generate more risk-adjusted returns compared to the concentrated overweight exposures that were often a feature of past years.

Being Reasonable About Alternatives

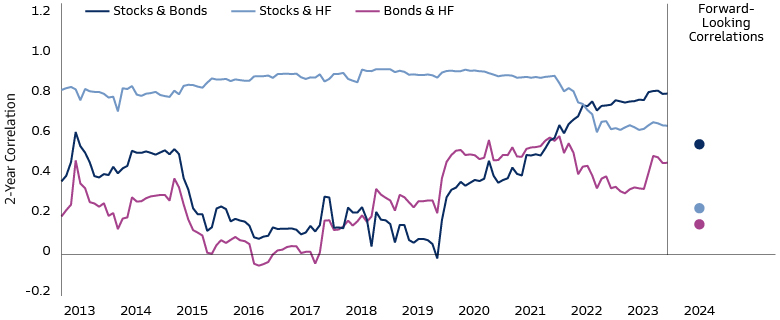

Much of the investable universe can be broadly classified as equity or fixed income, but there are certain areas that require discretion. Hedge funds and liquid alternatives, for example, vary greatly in structure and underlying exposure; as such, investors will need to determine how a specific strategy fits within a portfolio. We think it is worthwhile for investors to navigate this complexity. Hedge fund and liquid alternative strategies have seen correlations with equities decline while higher interest rates have provided a structural boost to returns, making for a more attractive portfolio diversification option for many investors.

Source: Goldman Sachs Asset Management. As of December 31, 2023. Asset allocation shown reflect allocations to benchmarks and/or asset classes. Allocation metrics and characteristics are not attributed to specific investment products. Alpha and tracking error assumptions reflect Multi-Asset Solutions’ estimates for above-average active managers and are based on a historical study of the net-of-fee results of active management. Strategic long-term assumptions are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance. They are hypothetical indications of a broad range of possible returns. All numbers reflect Multi-Asset Solutions’ long-term, 10-year, strategic assumptions as of December 31, 2023. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. Indices used for US equities and US fixed income are the S&P 500 Index and Bloomberg US Aggregate Bond Index, respectively. There can be no assurance that these returns can be achieved. Actual returns are likely to vary. The returns are gross and do not reflect the deduction of investment advisory fees, which will reduce returns. For illustrative purposes only.

Equity Investing

Looking deeper at investing within asset classes, with higher rates and potentially lower economic growth compared to the last decade, a shift in focus from growth potential to robust cash flows and sensible balance sheets may be in order. The weighted average cost of capital for S&P 500 companies has surged at its fastest pace in 40 years. Higher capital costs could provide a headwind to the robust add-on acquisition activity that drove sponsor-backed M&A over the last few years, but the corollary may greater financial discipline such as an increase in divestitures as companies right-size balance sheets and reprioritize profitability over growth, creating potential buying opportunities for private equity managers.

Despite extended index valuations in some regions today, we think equities will remain a long-term return driver in portfolios but with idiosyncratic factors playing a potentially larger role. With benchmarks concentrated in a handful of companies, passive returns may not be quite as robust as in recent years, and volatility may persist in the near term, creating potential opportunities for active management. Active management in public equities generally means more deviation from a stated benchmark, while private equity provides an active ownership model as well as exposure to businesses at different stages of development. And while much of the attention in equities is focused on the corporate space, real asset categories including infrastructure can offer diversification benefits and exposure to different risk/return drivers.

We believe this approach should not only be applied to the US, but in international markets as well. Shifting geopolitical alliances, demographic evolution, and an election super-cycle are all driving divergent economic outcomes. In Asia, investors are focused on opportunities in India supported by a number of tailwinds, while a slow-moving real estate crisis in China is creating uncertainty around the medium-term economic trajectory. Diverging outlooks can complicate the picture for many investors, but they also create potential opportunities for unconstrained managers able to invest across sectors and geographies.

Fixed Income Investing

The surge in US Treasury yields has sparked a widespread shift in asset allocation. The 10-Year US Treasury yield has risen ~300 bps above its level two years ago. Even more pronounced has been the increase in shorter-maturity interest rates, which are more sensitive to monetary policy, resulting in the 2yr/10yr US yield curve being inverted for over 18 months. This yield premium appears even more attractive when looking at shorter tenors, with the 3-Month Treasury Bill currently yielding more than 5%. This has increased the relative attractiveness of cash, with US equity valuations appearing extended compared to the current level of rates. The equity risk premium of the S&P 500 compared to the 10-Year Treasury yield (i.e., the theoretical compensation received for investing in stocks over bonds) is now tighter than it has been for over the last 20 years.

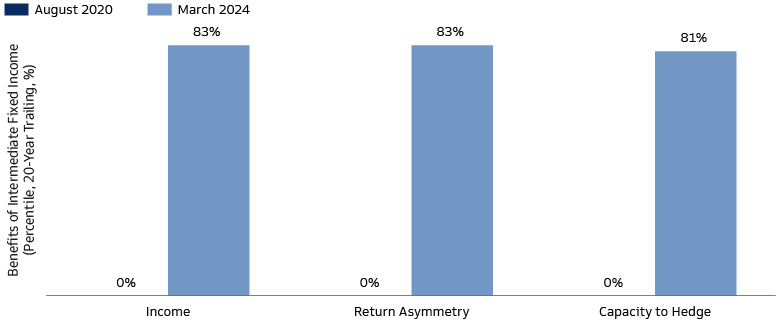

Looking forward, we expect global rates to level off as they typically have following the conclusion of previous hiking cycles. Despite intermediate rates falling from recent peaks, we still see strong value within core fixed income when looking across three key characteristics: income, return asymmetry, and the capacity to hedge an equity market drawdown. Today, we find that a US 10-Year Treasury Note provides better income (i.e., annual yield) than it has for 84% of the time over the last 20 years. Similarly, we see that it provides a more favorable return asymmetry (i.e., the difference in bond price appreciation (depreciation) experienced if rates fall (rise) by 1%) than it has for 87% of the time over the last 20 years. Finally, we see that a 10-Year Note’s ability to hedge an equity market drawdown in a recessionary scenario (i.e., bond price appreciation if rates fall to 0%) is greater than it has been for 77% of the time over the last 20 years. Timing interest rates at their peak may be ideal, but it is difficult to do. Rather than focus on what could have been, we believe investors still have a valuable opportunity to lock in attractive yields on offer across core fixed income securities such as high-quality government and corporate bonds.

Credit strategies with a higher risk/return profile also warrant attention in today’s market. Private credit strategies, which generally underwrite floating-rate loans, have also benefitted from rising rates in addition to a pullback in the traditional LBO financing sources of bank loans and the syndicated markets. With wider spreads than typically found in publicly traded securities, many private credit investors have been enjoying equity-like returns with credit-like risk. Future rate cuts will impact yields, but the higher base-rate starting point and spread premium should mitigate the impact, while the floating-rate nature of the loans can hedge against a delay in the arrival of cuts. The leveraged loan space shares many of these same characteristics, but private credit has outperformed across market cycles thanks the close nature of the borrower-lender relationship and embedded structural protections allow both sides to be proactive in addressing potential issues early in the process, leading to more selective defaults and workouts. For investors seeking fixed rates in the corporate space, the high-yield market may currently provide attractive relative opportunities after underperforming leveraged loans in recent quarters; in aggregate, high-yield borrowers are higher quality relative to past cycles, reflecting an influx of fallen angels from the investment grade market and the exit of lower quality companies during past default cycles, making them better positioned to service debt.2

In addition to simply looking at yields and default rates to construct a credit portfolio, we believe investors need to also consider the underlying assets and collateral being lent against. Most portfolios are historically oriented towards government and corporate borrowers, but other debt categories such as securitized credit, real estate and asset finance can potentially offer diversification benefits and yield enhancement. Current dynamics in the real estate market, for example, have made the risk/return profile of debt strategies relatively attractive.

Source: Source: Bloomberg and Goldman Sachs Asset Management. As of March 31, 2024. August 2020 was chosen as it was the month the 10-Year US Treasury yield hit an all-time low. Past performance does not predict future returns and does not guarantee future results, which may vary.

Source: Bloomberg, Goldman Sachs Multi-Asset Solutions, and Goldman Sachs Asset Management. As of March 31, 2024. Past and forward-looking correlations are measured between the MSCI All Country World Index, Bloomberg Global Aggregate Bond Index, and HFRI Fund of Funds Composite Index for stocks, bonds, and hedge funds, respectively. Past correlations are not indicative of future correlations, which may vary.

After a decade in which competitive alternatives to US equities were difficult to find, we believe the era of TINA has now come to an end. With fading fiscal support needed to address the fallout induced by Covid-19 and the reversal of aggressive monetary tightening necessary to tame inflation, cross-asset competition has returned, paving the way for TARA. If the last few years were characterized by outsized overweight positions to single asset classes such as equities, we believe the years ahead will be characterized by well-designed, balanced portfolios.

1 Source: Goldman Sachs Global Investment Research as of February 20, 2024.

2 LCD. "2024 US High-Yield Outlook." As of December 15, 2023.