Dual Dynamics: Investing in and with Artificial Intelligence

Generative artificial intelligence (AI) went mainstream in 2023. Enthusiasm over its potential impact on economies intensified. Debate grew over AI’s impact on corporate profitability. We expect AI to begin shifting from “excitement” to “deployment” in 2024 and believe investment opportunities will broaden as the technology disrupts entire industries. Investors will need clear strategies to find the next generation of AI winners and to understand and apply the technology themselves. A combination of investing in and with artificial intelligence—two distinct but interrelated approaches—may drive long-term outperformance, but the journey is likely to be complex and continuously evolving.

Still A Magnificent (7) Opportunity?

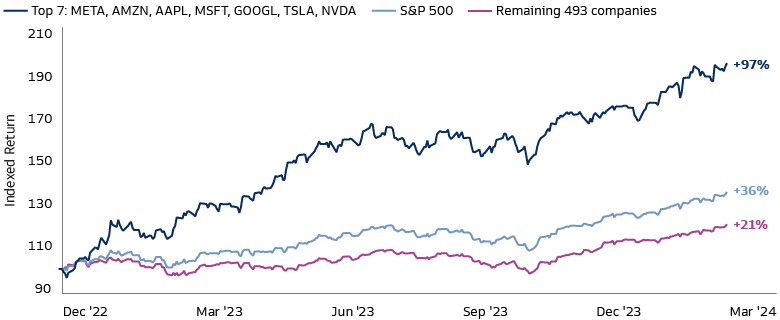

The surge of interest in AI fueled a major rally in technology stocks in 2023, with a concentrated group of large US companies leading the market higher. The so-called Magnificent 7 collectively drove 70% of the absolute performance of the Nasdaq Composite Index in 2023.1,2 The S&P 500 index returned 26% in 2023.3 Without the Magnificent 7, the index would have risen only 8%.4 The dominance of these names, primarily due to large increases in earnings driven by AI, has continued in the early part of 2024. Other quality attributes—including balance sheet strength, profit margins and size—have kept the group insulated from the impact of rising interest rates over the past two years.

Source: FactSet, Goldman Sachs Global Investment Research. As of March 1, 2024. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation. Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or its securities.

A common pushback from investors to the Magnificent 7 relates to elevated valuations. In aggregate, the Magnificent 7 stocks trade at a forward price to earnings multiple of ~30x compared with ~18x for the remaining 493 S&P 500 companies.5 However, these seven names are expected to grow sales at 4x the rate of the other 493 companies through 2025.6 It is likely that the Magnificent 7 will continue to dominate headlines in 2024. Beyond these names, finding the next set of AI winners will require investors to apply a wider lens.

Investing across the market cap spectrum—both in developed and emerging markets—may prove rewarding in 2024 as AI innovation accelerates alongside changing macroeconomic conditions. For instance, further progress on disinflation and lower interest rates could act as a tailwind for overlooked tech firms, including small cap stocks with valuations at multi-decade lows. A closer look at AI’s impact on sectors, including new tools to strengthen cybersecurity or AI-powered drug discovery in healthcare, may also uncover unique opportunities.

More broadly, a focus on nations forging their own AI paths could prove rewarding. India and Japan, for example, stand to benefit from their advantageous macroeconomic positions as we head further into an AI world. Different geographies will have unique abilities to shape AI’s development and adoption, and risk tolerance will vary from country to country. Rising geopolitical risks and global supply chains will also influence AI’s evolution, along with political events, the roll out of incentives to boost AI investment, and regulatory responses to limit perceived AI risks.

Investing in AI – Enablers, Data and Applications

As AI alters economies and industries, the range of opportunities and risks will expand and dispersion between winners and losers will widen. A helpful starting point for investors seeking exposure to AI opportunities in public equity markets may be to categorize potential beneficiaries into three broad buckets—keeping in mind that across each area, alpha generation will likely be rooted in a focus on quality, bottom-up fundamental analysis, and active management.

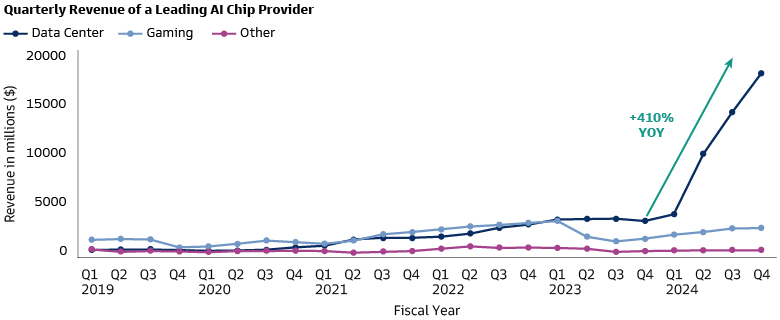

The first order beneficiaries of AI are what we call the “enablers”. This category includes companies building necessary AI infrastructure, such as semiconductor and semi-cap equipment manufacturers. The advent of commercially accessible large language models, such as ChatGPT, require significant computational power and memory. This has led to heightened demand for high-powered chips that only a handful of companies can currently design or manufacture. We believe enablers will be beneficiaries of increased investment from cloud vendors who are looking to diversify their supply of chips needed for AI as well as the buildout of data centers dedicated to AI. Active management is key when investing in this space due to the rapidly evolving opportunity set and changing risk-reward dynamics.

Source: Statista. As of February 2024. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation

As AI technologies mature and opportunities expand beyond “enablers”, tomorrow’s potential beneficiaries may be found in the “data and security” layer. The foundation of complex AI models is built upon the quality of the underlying data on which those models are trained. In addition to having a large quantity of data, the most insightful and accurate models learn from organized, accurate, and secure data. The rise of generative AI has sparked significant concerns about the impact of cybersecurity, driving demand for cutting-edge solutions. We believe companies across the tech ecosystem that can help other companies effectively protect and derive meaningful insights from their data will play an increasingly critical role. Firms that leverage data to enhance operational efficiency, better understand their customers, create more personalized experiences, and make better informed, data-driven decisions, stand to benefit.

Lastly, we believe the “applications”—software companies and firms across sectors leveraging AI to improve their products and services—will benefit in the years ahead, as AI becomes more specialized and domain-specific. With businesses seeking to embrace new technologies, software companies that provide an enhanced customer experience to help them adapt and maximize their value will be well-positioned. AI is also starting to transform other industries beyond tech, for example in healthcare, retail, and manufacturing. Many businesses have started to focus on AI integration, but we are at an early stage and there is still a long runway of growth ahead.

Investing With AI – Gaining an Edge in Equity Markets

While investors can choose to capitalize on the latest developments by deploying capital directly into AI-related opportunities, they can similarly benefit from evaluating how AI breakthroughs are helping to enhance investment management processes and investment decision-making. Using AI in systematic investing is not new, but today’s tools are far more powerful. Large language models are underpinned by “transformer technology”—the “T” in ChatGPT or in Google’s BERT. This technology introduces contextual relationships between words and documents in a way that is highly efficient and practical, allowing investors to train models using much more data than was computationally possible historically. What has resulted is really a stepwise increase in the power of these models.

Given the meaningful jump in efficacy of the latest models relative to prior techniques, we believe AI is becoming an increasingly important tool for investors to systematically extract information from the large, complex, and unstructured datasets and to inform investment decisions in public equity markets. For instance, financial news articles, earnings call transcripts, analyst research reports and regulatory filings are frequently used to complement financial metrics and market data. The exponential growth of this type of data will require new and robust techniques to extract meaningful insights and maintain an informational edge in markets. This can be particularly valuable when investing in larger, more dispersed markets, such as small caps or emerging market equities, which have persistent informational inefficiencies.

Google search queries conducted per minute7

Average users on LinkedIn per minute8

Shoppers spent on Amazon per minute9

… we believe that AI is becoming increasingly important for investors to systematically extract information from the large, complex and unstructured datasets and to inform investment decisions in public equity markets.

Any reference to a specific company or security does not constitute a recommendation to buy, sell hold or directly invest in the company or its securities. For illustrative purposes only. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation. This is a marketing communication.

Examples of new AI tools in action include large language models programmed to analyze tonal sentiment during earnings calls. In other words, signals detecting not just “what management is saying” but “how management is saying it”. Management that speaks with characteristics of confidence in their tone, for example, can implicitly be expressing a positive outlook for their company. Evasiveness of speech may correlate with the intent to avoid drawing attention to poor firm prospects. Deciphering a large amount of existing unstructured data can also help discover underappreciated thematic trends and economic relationships between companies that other investors may not see.

To effectively deploy AI and machine learning tools, practitioners should consider the use cases such that the underlying datasets justify the need for more robust data analysis techniques. Crucially, leveraging AI effectively requires the intellectual capital to not simply use technology, but an ability to understand the data, why to use it, and how. Finally, we expect investors who have access to resources and the infrastructure in place to harness data—including the compute power and processing capabilities to train large language models—will have a competitive advantage in the years ahead.

Navigating an AI Future

Beyond factors that fall directly within the control of corporate and investment management teams, unforeseen twists in AI development may shape macroeconomic and geopolitical dynamics. From a macroeconomic perspective, while AI has significant potential to boost economic growth and productivity, it may create labor displacement, rising inequality and structural unemployment. The timing and magnitude of such macro effects remain very uncertain and notoriously hard to predict.

On the geopolitical front, AI has the potential to revolutionize supply chain operations by improving efficiency, but it could also exacerbate mistrust between nations and accelerate economic fragmentation, including technology ecosystems between the US and China. As countries compete to secure the economic and geopolitical advantages of AI, we believe companies that successfully align themselves with corporate and government efforts to boost the security of supply chains and resources, as well as national security, may emerge as long-term winners.

A critical supply chain issue is that most of the world’s semiconductor manufacturing capacity is based in Asia. Taiwan dominates the manufacturing of high-end chips key for the next generation of AI technologies. Efforts by developed markets, including the US, EU, and Japan, to onshore, reshore, or nearshore semiconductor development and manufacturing—made possible by AI reducing labor costs—will create investment opportunities. In cybersecurity, while generative AI tools can help us predict, identify, and respond to security risks faster, they can also make cyberattacks easier to carry out and much more damaging. We expect significant investment in robust defense technologies and cybersecurity solutions in the years ahead.

The potential impact of AI in disrupting elections is another area for investors to watch out for. As a record number of countries go to the polls in 2024, misinformation and misuse of generative AI text, audio, and video content may influence outcomes of key policy votes by swaying public opinion or exacerbating societal divisions. And with democracies facing challenges on multiple fronts—including ongoing wars in Ukraine and the Middle East—this year is likely to provide a clearer picture of how AI can change the character of war and how democracies defend themselves.

Looking Ahead

The rapid rise and transformative potential of generative AI and machine learning puts the technology on a course to become the hallmark of the modern economy and financial markets. Predicting winners and losers and making the best use of AI is far from straightforward, particularly at this early stage in a new technology’s life cycle. There are also a myriad of unknowns, including geopolitical risks and potential for misuse of models, complicated regulatory issues, uncertain timelines for AI adoption and nascent monetization models yet to be proven. We expect the links between AI and investing to become even more intertwined as society and economies become more familiar with the technology. Investors who find ways to successfully balance the dual dynamics of investing in and with AI, while navigating an unpredictable AI future, are likely to be among the long-term winners.

1Magnificent 7 refers to Nvidia, Microsoft, Google, Meta, Tesla, Apple, and Amazon

2FactSet, Goldman Sachs Asset Management. As of December 31, 2023.

3FactSet. As of December 31, 2023.

4Bloomberg, FactSet. As of December 31, 2023.

5FactSet, Goldman Sachs Global Investment Research. As of February 29, 2024.

6Source: FactSet, Goldman Sachs Global Investment Research. As of February 29, 2024. Bottom-up consensus 2023-25E sales compound annual growth rate (CAGR).

7LocaliQ. As of December 4, 2023.

8LocaliQ. As of December 4, 2023.

9Domo. As of December 14, 2023.