Last Mile Investing: Staying Balanced, Finding Opportunities

With the inflation fight seemingly moving through the last mile and growth holding up, the US economy appears increasingly likely to manage a “soft landing”. Even so, the final leg of the journey may not be straightforward. We remain alert to potential risks that may emerge from multiple angles, including both the left and right tails, as they may cause various levels of volatility. Against this backdrop, we favor a balanced approach across equities, fixed income, and alternatives, which is expected to provide diversified sources of returns, as well as hedges against potential risks. Investors may also consider incorporating additional cyclical or structural themes into portfolios to benefit from a broad set of potential outcomes.

Runway in Sight, Not Without Risks

A key question for investors is whether a much-anticipated soft landing will materialize in 2024. The US economy has been resilient so far despite higher interest rates, inflation appears to be falling back towards the Federal Reserve’s (Fed) 2% target, while the labor market has moved into better balance. The macro backdrop has become more supportive of risk assets, and the prospect of a “soft-landing” has improved. That said, we are closely watching the distribution of potential outcomes and remain vigilant to risks from both sides.

Since the beginning of the year, US economic data has surprised on the upside, as visible in the pace of US GDP growth in the fourth quarter of 2023 (3.2%1) and January’s sizable nonfarm payroll gain (229K2). Consumer spending moderated after the winter period, yet consumer balance sheets remain healthy. Meanwhile, financial conditions are easy and may even be boosting growth by some measures.3 These developments suggest to us that the risk of growth re-acceleration should not be ignored. On the other hand, while the risk of recession may have moderated, it remains above historical average, and the cumulative economic impact of the most recent monetary tightening cycle remains to be seen. Furthermore, following stronger-than-expected inflation prints, Fed officials have re-iterated that further evidence on disinflation is required before policy easing may be put in place.

Putting the path of economic growth, disinflation, and interest rates aside, potential ripple effects from other areas may warrant attention. Sources of concern may include commercial real estate headwinds and China’s ongoing macroeconomic challenges. Geopolitics will also remain in focus and likely add uncertainty to the macroeconomic outlook, particularly in the run-up to November’s US election.

Maintain Balance Amid Uncertainties

How should investors navigate this highly uncertain environment? In our view, a balanced portfolio of equities, fixed income, and alternatives should be well-positioned in a baseline soft-landing scenario and provide downside mitigation if recession risks were to re-emerge.

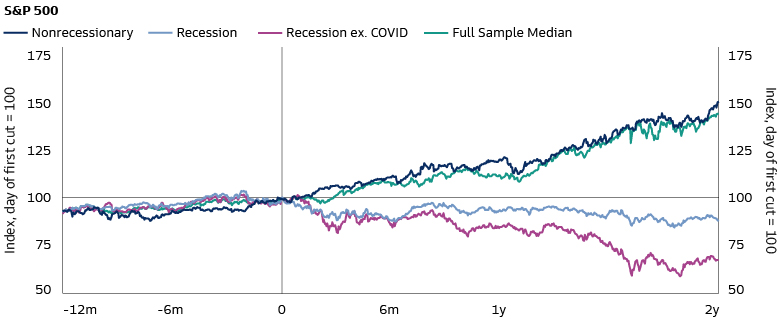

If the soft-landing scenario were to materialize, we believe it could be constructive for both equities and bonds. Historically, equities have tended to rally into and throughout non-recessionary easing cycles.4 Resilient growth and continued disinflation would also support an acceleration in earnings growth, although given persistent investor concerns about an impending recession, we favor "quality" attributes such as high profitability and strong balance sheets.

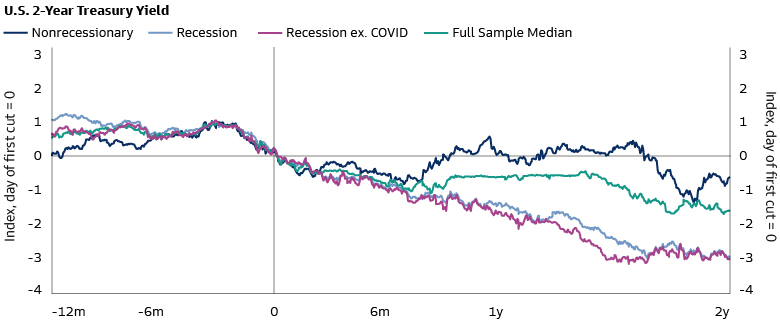

Fixed income assets, including government bonds—a key component of core fixed income securities—may also stand to benefit from the expected easing of central bank policy rates. Higher starting yields also create a buffer against adverse macroeconomic events, such as recession scenarios.

Source: Goldman Sachs Global Investment Research. As of January 18, 2024. Based on historical asset performance around and after the first cut across Fed cutting cycles since 1984. Of the ten cutting cycles, four -were associated with recessions (1990, 2001, 2007, and 2020), six were associated with non-recessionary episodes and motivated by “normalization “ (1984, 1989, 1995) or “growth scares” (1987, 1998, 2019). Recessions (light blue); recessions excluding Covid due to its idiosyncrasies (purple); and non-recessions (dark blue).

We believe complementing core bonds with alternative exposures, such as private credit, may offer enhanced yields, help to insulate portfolios from near-term market volatility, and provide diversification benefits. The prospect of interest rate cuts in 2024 is likely a welcome development for most private credit borrowers given the floating-rate nature of their liabilities, but the effects from these cuts may be limited. Businesses with less leverage or stronger cash flows should be better able to withstand the interest rate environment, while some fully levered companies and business models will be tested by higher debt burdens.

Private equity will remain a critical part of many investors' portfolios, in our view, and an important route for accessing long-term economic growth opportunities. Leverage and multiple expansion are unlikely to add much to value creation in an era of structurally higher rates and slower growth. Instead, we believe operational value creation levers are poised to become the main determinants of success. This will have implications for how general partners (GPs) think about their competitive advantages and how limited partners (LPs) approach manager selection.

Being constructive on stocks and bonds over the medium term does not mean investors should be agnostic about risks along the way. While the year of 2024 has started with much optimism, several economic factors and geopolitical events may result in a return of volatility. As the US presidential election comes more sharply into focus, uncertainty in areas like renewable energy policy, tariffs and taxes, and financial regulation may become further priced in. Geopolitical concerns, such as any escalation of Middle East conflict or further shipping disruption in the Red Sea, could spark a resurgence of concerns on global energy supplies and global goods inflation. Considering the abundance of uncertainties ahead, investors should continue to evaluate whether expected returns are sufficient to compensate for expected risks. Valuations, market sentiment and positioning, as well as liquidity considerations, should all play a role when assessing the environment and adjusting exposures.

Get Ready to Ride the Tide

In an environment of more deviation, differentiation, and volatility, and particularly in consideration of growth re-acceleration risks, there may be opportunities to capture enhanced returns from right-tail scenarios. Profound structural forces—from digitization, decarbonization and deglobalization to destabilization in geopolitics and demographic aging—should also be incorporated into portfolio construction decisions. Meanwhile, cyclical upturns in select geographies may also provide greater diversification opportunities.

After a long run of US equity outperformance, excitement around artificial intelligence (AI) led to further gains in 2023. The beneficiaries were concentrated in the mega-caps—the Magnificent 7—which drove the performance of the S&P 500 Index.5,6 As the AI ecosystem matures in 2024 and beyond, the opportunity set may broaden. Investors will need clear strategies to identify the potential economic, technological, and investing impacts of generative AI technology.

Beyond AI, continued progress in the deflationary process and interest rate cuts from the Fed may lead to opportunities in the US small cap universe. Small caps are more cyclical, domestically exposed, and more highly levered than larger stocks. Valuations in this market segment remain low compared to history, and company fundamentals may improve further if growth were to accelerate. Some of these smaller businesses may become appealing M&A targets as capital market activity starts to rebound.

For fixed income investors, opportunities may also arise beyond government bonds. Investment grade (IG) corporate bonds, for instance, could potentially deliver attractive income and can help to preserve capital due to their high quality. A focus on sectors that can better withstand a potential growth slowdown and areas of the market aligned with underlying structural megatrends may provide more predictable income in an uncertain world, with lower volatility relative to cyclical assets like equities.

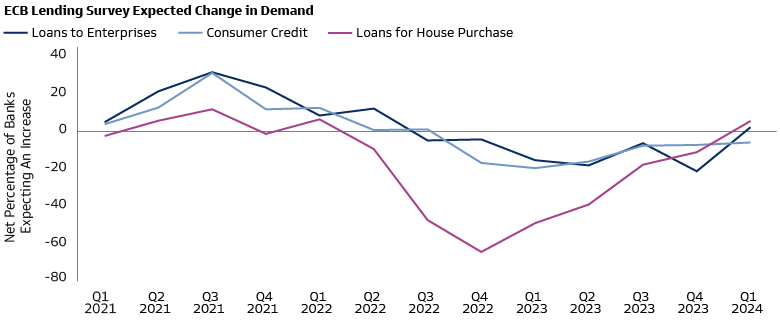

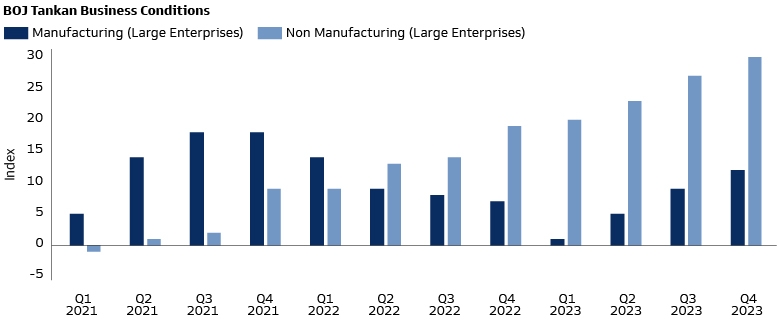

Examining regional dynamics and country nuances may also uncover bright spots across the world. In Europe, while growth momentum remains weak, there are some cyclical green shoots. Inflation expectations have started to move down and post-pandemic supply shocks, including energy prices and supply chain bottlenecks, continue to fade. The recent ECB Bank Lending Survey shows that while credit demand continues to be weak, banks are now expecting a small net increase in 2024 Q1 for loans to enterprises and loans to households for house purchases.7 Elsewhere, we expect Japan to experience an economic revival driven by the resurgence of inflation and structural corporate reforms, which likely have boosted the appeal of Japan’s equity market. As shown in the BOJ Tankan survey, business sentiment appears to be gradually improving among Japanese enterprises.8 Besides, equity valuations are also more attractive in Europe and Japan, compared to the US.9

Source: European Central Bank (ECB) Bank Lending Survey, Bank of Japan (BoJ) Tankan Survey, Bloomberg, Goldman Sachs Asset Management. As of March 20, 2024.

Looking Ahead

After a period of significant monetary tightening and global supply chain easing, the last mile of US disinflation may be within sight. While a soft-landing appears increasingly likely, uncertainties remain and there may be risks to growth on both sides. Beyond macroeconomic signals, shifts in geopolitics, and developments in global election cycles including in the US, require close monitoring in 2024. As investors, we strive to build portfolios that are robust to this wide range of outcomes. We are constructive on the return prospects of both stocks and bonds, in anticipation of the start of the Fed easing cycle; this balanced approach to portfolio construction should also be able to help insulate portfolios from recession risks if they were to re-emerge. At the same time, we remain focused on incorporating portfolio themes that may benefit from growth re-acceleration, cyclical upturns, as well as structural tailwinds. In this way, we hope to turn tail risks into tailwinds, and further enhance the risk-return prospects in portfolios

1 US Bureau of Economic Analysis. GDP 4Q 2023 (second estimate). As of February 28, 2024.

2 US Bureau of Labor Statistics. As of March 8, 2024.

3 US Federal Reserve. Financial Conditions Impulse on Growth Index (one-year lookback). As of January 31, 2024.

4 Goldman Sachs Global Investment Research (GIR). Global Markets Daily: Macro Assets After the First Cut (Chang). As of January 18, 2024.

5 Magnificent 7 refers to Nvidia, Microsoft, Google, Meta, Tesla, Apple, and Amazon.

6 FactSet. As of December 31, 2023.

7 ECB Bank Lending Survey, Bloomberg, Goldman Sachs Asset Management. As of February 26, 2024.

8 Bank of Japan Tankan Survey, Bloomberg, Goldman Sachs Asset Management. As of February 26, 2024.

9 Goldman Sachs Global Investment Research. “Global Weekly Kickstart”. As of February 26, 2024.