Mapping the Evolution: Hedge Funds in A New Market Regime

A new market regime characterized by higher volatility, interest rates, and inflation has emerged since 2022. This post Covid/Quantitative Easing (“QE”) environment has made hedge fund returns more viable and structurally higher, while the widening dispersion between best-in-class general partners (GPs) versus those underperforming has continued to expand. The hedge fund industry itself has also undergone significant change. Across all areas, hedge funds have become tougher to both assess and access.

The landscape has evolved to become more binary between platform hedge funds vs specialized hedge funds. It has become more expansive where skill can now be better accessed via not just funds but also separately managed accounts (SMAs) and co-investments, with lines becoming more blurred between strategies. Consequently, we believe limited partner (LP) allocators need to assess, construct, and implement their hedge fund programs differently today—largely via an expansive opportunity set and clinical selection of GPs.

Making Sense of the Market

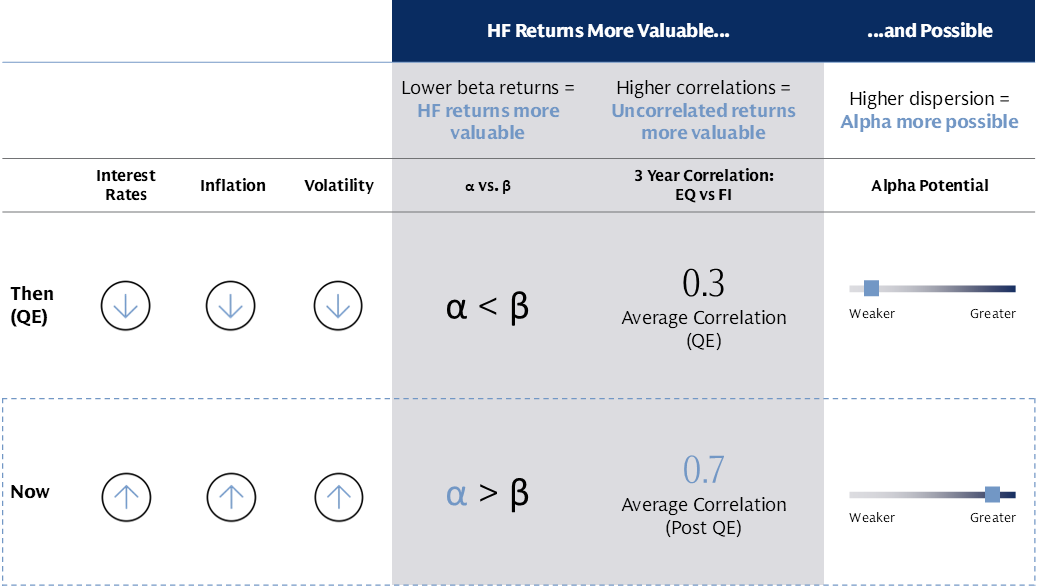

The QE era (2009 to 2021), marked by suppressed volatility, was supportive of high beta, risk assets. This made maintaining a consistent high equity beta attractive, with the equity markets returning well above long-term averages. Fixed income more often acted as a hedge to equity exposure as correlations were generally neutral or negative between the asset classes. As a result, the implication of this unusual backdrop made hedge fund returns underwhelming for GPs and less valuable for LPs.

Source: Goldman Sachs Asset Management as of June 30, 2024. “EQ”: MSCI World NR USD Index. “FI”: Bloomberg Barclays Global Agg. Index. Source: MSCI as of June 30, 2024. Source: Barclays as of June 30, 2024. “Post-QE” begins January 1, 2022. For Illustrative purposes only. Past correlations are not indicative of future correlations, which may vary. Past performance does not predict future returns and does not guarantee future results, which may vary. See glossary for additional information.

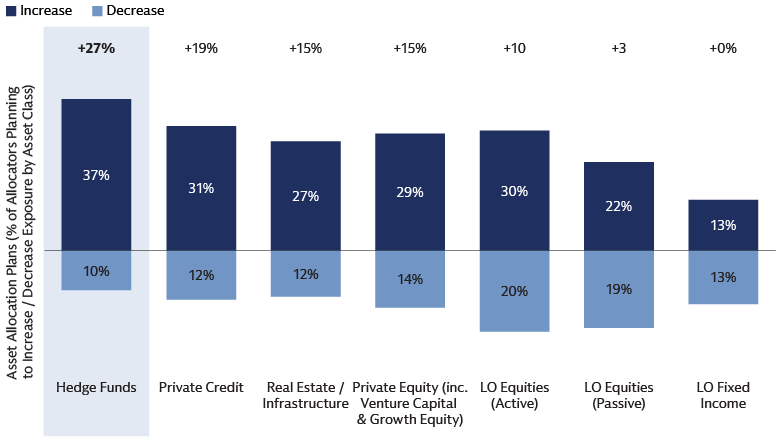

The environment has subsequently reversed since 2021, given elevated interest rates, volatility, and inflation. More muted return expectations for beta1—and higher correlations between equities and fixed income, have made hedge fund returns more valuable to allocators. Additionally, higher volatility and dispersion have created a rich security selection environment for skill-based hedge fund managers, increasing the potential for alpha. This can be evidenced as hedge funds have outperformed traditional 60/40 portfolios on a one-, three-, and five-year absolute basis, and even more so on a risk adjusted basis.2 In the period from 2020-2024, 60/40 returns fell from 6.1% to 5.5%, while hedge fund returns increased from 4.8% to 9.3%. This is even more valuable when considering the uncorrelated nature of hedge fund returns.3 Against this backdrop, there has been a resurgence of investor demand. In a recent Goldman Sachs Prime Brokerage survey of allocators, hedge funds were the most sought-after asset class in terms of forward-looking demand, compared to both traditional and alternative asset classes.4

Source: GS Prime Insights & Analytics Allocator Survey. The GS Prime Insights & Analytics team conducted an interview with multi manager firms. For the purposes of this study, they identified a group of nearly 40 managers managing a little over $300 billion. Past performance is not indicative of future results. This material is for discussion purposes only and does not purport to contain a comprehensive analysis of the risks / rewards of any idea or strategy.

There has been broad interest across the breadth of hedge fund strategies, particularly through the resurgence of both portable alpha and equity flex strategies (i.e., 130% long/30% short or 250% long/150% short). A portable alpha program combines passive exposure to an index using futures or derivatives (beta of one) via leverage with an alpha source that is typically invested in uncorrelated hedge funds (beta of zero). This alpha is then “portable” and applied to other parts of the portfolio. Flex strategies enable active long-only managers to express dynamic views in a more “flexible” way via the ability to invest both long and short, while still maintaining the desired beta of one. Despite their differences, both strategies are a means of implementation in response to muted return expectations for passive, long-only investments.

Tracking the Trends

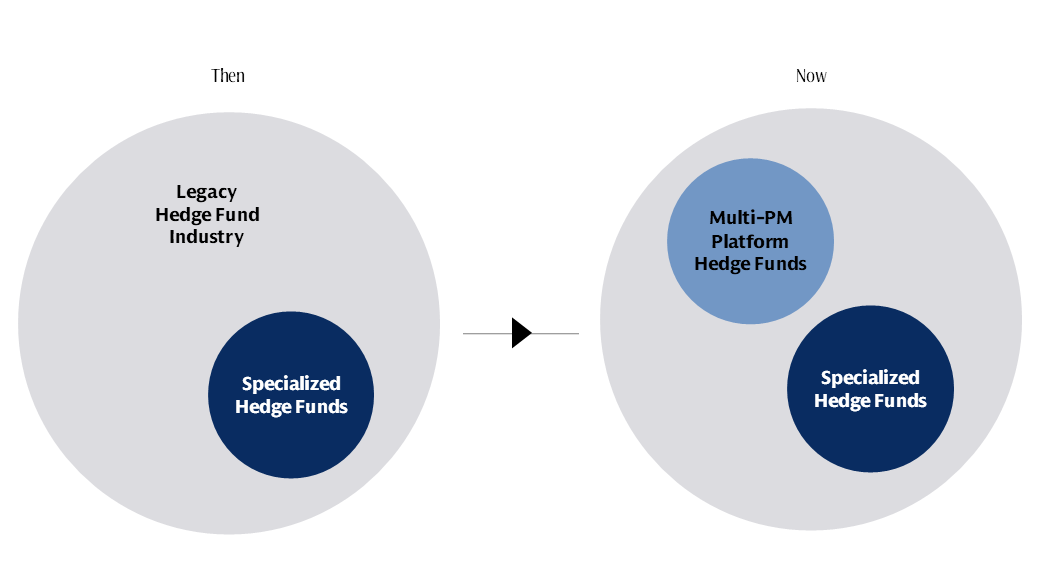

The hedge fund industry has not only evolved in size, growing total AUM from $1.4 trillion to $4.5 trillion since 2015,5 but also in complexity and anatomy. The landscape has evolved to become more binary between multi-PM, “pod” or “platform” hedge funds vs specialized, smaller hedge funds (with decision making done quite differently for each). The space today is more expansive via access points, evolving from standard commingled funds to separately managed accounts (SMAs) and co-investments. Furthermore, lines are now more blurred between platform hedge funds vs fund of hedge funds, propriety vs external, and hedge funds vs liquid alternatives. Consequently, we believe allocators need to implement their hedge fund programs differently today, taking a clinical approach to strategy and manager selection, portfolio construction, and risk management.

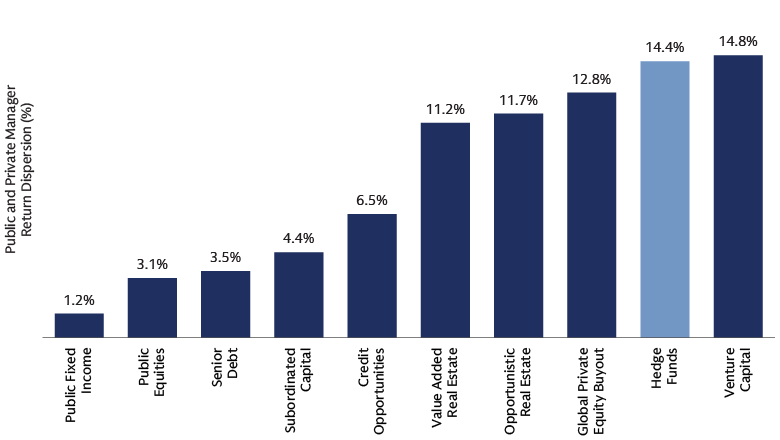

Higher return dispersion

The enhanced disparity amongst hedge fund returns relative to other asset classes has made manager selection even more important.

Source: Goldman Sachs Asset Management, Cambridge Associates, Nasdaq eVestment, Albourne as of December 31, 2023. Represents the average dispersion to the median manager across vintages 2000-2019 within each private strategy and across ten-year returns within each public strategy and hedge funds. Public equities are represented by large cap equities. Past performance is not indicative of future results. For educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

Tougher to assess, tougher to access

Hedge funds have rapidly evolved to become more multi-faceted, and in the case of the multi-PM hedge funds - less transparent, less liquid, and more expensive via pass-through fees. This has made them more difficult to assess, requiring greater emphasis on the diligence of culture, risk management, talent acquisition, data, tech and infrastructure advantages. They have also become more challenging to access with top performing GPs often being closed to new capital, with some returning existing capital.

Evolving access points

We believe the landscape has become more barbelled between overcapitalized, difficult to access multi-PM hedge funds vs undercapitalized, and easier to access “specialized” hedge funds, with the latter more willing to offer SMAs and co-investments allowing LPs to invest alongside their best individual trade ideas. This dynamic has created new ways to access a multi-PM hedge fund return stream in a differentiated way with enhanced liquidity and improved fees.

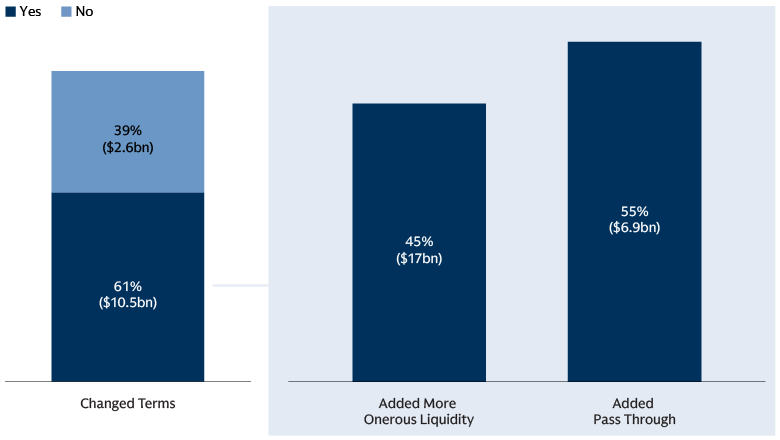

Source: GS Prime Insights & Analytics Allocator Survey. The GS Prime Insights & Analytics team conducted an interview with multi manager firms. For the purposes of this study, they identified a group of nearly 40 managers managing a little over $300 billion. Past performance is not indicative of future results. This material is for discussion purposes only and does not purport to contain a comprehensive analysis of the risks / rewards of any idea or strategy.

Evolving multi-manager hedge fund dynamics

The multi-manager hedge fund space, which encompasses a variety of subsets like Multi-PM/Pod-Shops, has experienced outpaced AUM growth relative to the rest of the industry, growing at a staggering 18.3% compound annual growth rate (CAGR) over the past six years compared to 2.3% for the remainder of the industry.6 This can be attributed to their success in delivering uncorrelated skill-based returns coupled with steady demand from allocators.

Source: GS Prime Insights & Analytics Allocator Survey. The GS Prime Insights & Analytics team conducted an interview with multi manager firms. For the purposes of this study, they identified a group of nearly 40 managers managing a little over $300 billion. The $ amount represents the average AUM of managers that responded to indicated term changes. Past performance is not indicative of future results. This material is for discussion purposes only and does not purport to contain a comprehensive analysis of the risks / rewards of any idea or strategy.

Multi-PM hedge funds are characterized by their strategy of allocating capital across a number of underlying portfolio managers (PMs). They seek to “industrialize” skill with their ability to attract, develop, and retain talent. To fight the war for talent and resources, multi-PM hedge funds have increased fees (mainly via pass-through structures), reduced liquidity, expanded into new asset classes/strategies, and even began to allocate more money externally (commonly to former portfolio managers starting their own fund).7 Consequently, not only have these pod-shops become one of the most fee intensive, illiquid, and hardest to access sub-sets of hedge funds, but they have further blurred the lines of differentiation between direct vs fund of hedge funds.

As this segment of the industry grows, the primary risks today are associated with higher deleveraging risks, continuously elevated fees, growing competition, and increased liquidity lockups. These firms have grown in size and seemingly morphed into each other as they have added new strategies to accommodate expansion. While many have autonomous decision makers via the pod structure, their usage of similar quantitative-based risk management tools has translated to growing deleveraging risk via potential crowding. As fees consistently grow higher year over year, especially through the growing implementation of pass-through fees,8 they may weigh on future net returns.

Evolving technological advances and quantitative dynamics

Technological advances have unlocked more ways to access hedge fund returns. They have made SMAs more accessible and easier to manage, while quantitative innovations have created new ways of harvesting alpha (mainly via AI/machine learning) and improved access to the beta (replication) of hedge fund returns.

Casting a Wider Net

In response to the transforming hedge fund industry, allocators are casting a wider net than ever across both platform and boutique hedge funds via commingled funds, SMAs, and co-investments. Through SMAs, allocators can access unique talent and alpha-oriented strategies while taping into increased transparency, liquidity, and capital/fee efficiency. On the co-investment side, there is a rich opportunity today within the mid-duration space, where inherent complexity can be exploited by investing in the best ideas across skilled managers. Despite the potential advantages associated with both SMAs and Co-Investments, it is important for allocators to be aware of the significant operational legwork and prudent risk management expertise required to run programs with strong risk-adjusted returns. Given the rise of AI and other technological trends, LPs can access more customizable and scalable solutions through quantitative strategies. Furthermore, via hedge fund of funds, allocators can access a wider range of industry top players via a combination of the highest quality multi-strategy firms and specialist firms via lower fees, higher liquidity, and greater transparency.

Source: Goldman Sachs Asset Management. For illustrative purposes only.

As the investing landscape continues to evolve from a macroeconomic, technological, and competitive standpoint, hedge funds are well poised to benefit and continue to play a key role within portfolios today, especially as elevated return dispersion and volatility potentially continue to create attractive alpha opportunities. As hedge funds grow in complexity and adapt to this changing landscape, allocators will have to cast a wider net regarding manager selection, take a nimbler approach to both investing and portfolio/risk management, and be willing to blur the lines between strategies to achieve continued alpha generation and diversification.

1 Goldman Sachs Investment Research now estimating a S&P 500 nominal return of 3% annualized over the next 10 years, compared to 13% in the past decade. As of October 18, 2024.

2 Goldman Sachs Asset Management as of December 31, 2024. Source: Pivotal Path, MSCI and Barclays as of December 31st 2024. “60-40”: 60% MSCI World NR USD + 40% Bloomberg Barclays Global Aggregate TR USD. GS Prime Services and Analystics “The Current State of the Hedge Fund Industry and the Outlook for 2025”. Hedge Fund returns net of Manager Fees.

3 Goldman Sachs Asset Management as of December 31, 2024. Source: Pivotal Path, MSCI and Barclays as of December 31st 2024. “60-40”: 60% MSCI World NR USD + 40% Bloomberg Barclays Global Aggregate TR USD. GS Prime Services and Analytics “The Current State of the Hedge Fund Industry and the Outlook for 2025”. Hedge Fund returns net of Manager Fees.

4 GS Prime Insights & Analytics Allocator Survey. The GS Prime Insights & Analytics team conducted an interview with multi manager firms. For the purposes of this study, they identified a group of nearly 40 managers managing a little over $300bn. Past performance is not indicative of future results. This material is for discussion purposes only and does not purport to contain a comprehensive analysis of the risks / rewards of any idea or strategy. Industry-wide information in this material may have been extrapolated solely from data, surveys or observations relating to hedge fund activity conducted solely in Goldman Sachs prime brokerage accounts. Information sourced exclusively from the Goldman Sachs client base or observations of the GS Capital Introduction Team may not be representative of the broader global hedge fund industry.

5 PivotalPath 2025 Global Hedge Fund Report. As of December 31, 2025.

6 Goldman Sachs Prime Brokerage, as of December 31, 2023.

7 GS Prime Insights & Analytics, September 2024: “The Multi-Manager Landscape in 2024”. Approximately 70% of multimanager hedge funds have done some form of external allocation.

8 GS Prime Insights & Analytics, September 2024: “The Multi-Manager Landscape in 2024”. Approximately 83% of multimanager hedge funds now have pass-through fees, up from 63% in 2022.