Sustainability Signals: Gray-to-Green, Education, Healthcare, Financial Inclusion

Momentum is building in sustainable investing. The global response to climate change is ramping up, with investment in the low-carbon transition on the rise as investors, companies and governments compete for new growth opportunities. Wider recognition that the goal of sustainable growth is unattainable unless it leads to a more inclusive economy is driving investment in key sectors such as education, financial services and healthcare.

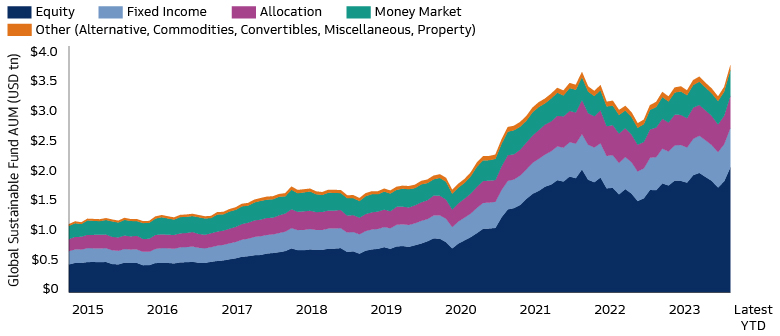

This positive progress was evident in 2023. Global investment in the energy transition surged to a record $1.8 trillion despite geopolitical tensions and macroeconomic challenges including rising interest rates and inflationary pressures.1 Sustainable investment funds saw assets under management globally reach an all-time high of nearly $3.7 trillion.2

This investment helped propel advances in areas such as renewable energy, where global generating capacity increased at the fastest pace in two decades.3 The price of lithium-ion battery packs used in electric vehicles and stationary energy storage fell to a record low.4 The rate of deforestation in Brazil’s Amazon rainforest nearly halved from a year earlier to the lowest level since 2018.5

The increase in sustainable investment has been driven by attractive economics, a widening array of opportunities and the urgent need to mobilize capital to address the climate crisis and build a more equitable economy, including helping workers prepare for new jobs created by technological advances.6 We expect the focus on sustainability to intensify in 2024, boosting investment in companies that are helping accelerate the transformation of the global economy. These include both the providers of innovative solutions and the companies that are implementing them as part of their decarbonization and inclusivity plans.

Looking ahead, we believe a focus on real-world impact, especially in heavy-emitting sectors, will expand the sustainable investment universe by bringing in companies that are leading the transition. The incentives unleashed by the Inflation Reduction Act in the US and similar initiatives around the world may spur development of solutions in clean energy and electric vehicles. The focus on inclusive growth, heightened in 2023 by the cost-of-living crisis, is driving new technology solutions and creating attractive social-impact opportunities.

The pace of the sustainable transition could slacken in the year ahead, with higher interest rates and slower growth expected in most advanced economies.7 Geopolitical tensions could impact global supply chains, and the results of the 2024 election super cycle could affect the commitment of governments to advancing environmental and social progress through policy and incentives. But in our view, the improving economics of sustainability and the opportunities it is creating will transcend potential headwinds.

Source: Morningstar, Goldman Sachs Global Investment Research. Data as of January 29, 2024.

Detecting Sustainability Signals

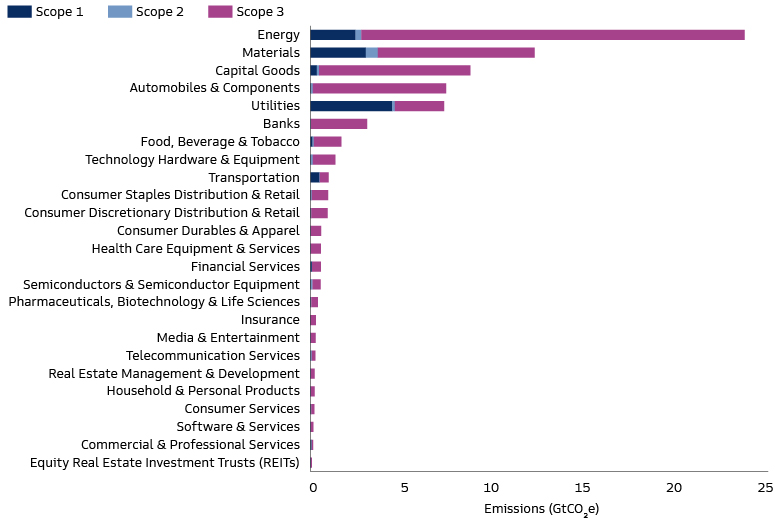

Sustainable investing has evolved. In the early days, many strategies were directed toward justifying green and social portfolio labels rather than producing real-world impact. As a result, investment flowed into carbon-light sectors viewed as more positive for the environment and steered clear of industries with higher emissions. Many investors are now realizing that if the goal is to decarbonize the real economy and make it more inclusive, this is where capital needs to go.

The sustainable transformation of the economy may require investment in companies and their value chains across all sectors, especially hard-to-abate industries such as construction, energy and transportation. For example, if producers of chemicals and cement navigate the transition successfully, they could emerge as leaders in the new sustainable economy.

To find these opportunities, investors will have to separate the signals that reveal companies’ progress in areas such as carbon efficiency from the noise of unrelated data. We believe an approach that measures progress company by company, rather than at the portfolio level, can help investors identify and track the changes they want to support. When the sources of emissions are examined in this more granular way, we find that most of the change over time results from factors including shifts in market value and portfolio changes such as divesting or adding positions. This noise can drown out the sustainability signals investors are looking for.

Integrated metrics are also needed to assess a company’s strategy and actions. A forward-looking approach that considers factors including a company’s long-term sustainability ambitions, revenue sources, capital allocation plans and actual expenditures aligned with its sustainability goals may help investors discover potential transition winners.

Opportunities in Transition

Investors seeking value uplift from the financial and impact perspectives can look for the leaders of tomorrow. Many of the companies now transitioning from gray to green may be high-emitting industrial businesses in capital-intensive sectors, and this evolution is where investors can unlock potential value.

One approach is to examine carbon-intensive sectors to understand the challenges they will face and the solutions they will need to decarbonize. The transition of the electrical grid to renewable power, for example, will require an increase in overall output and a reduction of costs. Investors could find opportunities by identifying the companies that are addressing these pain points, such as developers of energy-storage platforms and inverters, which connect power production assets to the grid.

An approach that looks across value and supply chains may complement allocations to green solution providers, because the heavy-emitting companies with the most credible decarbonization plans are often core clients of the solution providers. It can also open opportunities across public and private equity markets, including the corporations transitioning from gray to green and their suppliers, many of which are still in private hands.

Source: MSCI. As of November 2022. For illustrative purposes only. Net zero refers to a state in which the amount of GHG emissions into the environment is equal to or less than the amount removed from the environment. 22% of the market as denoted by MSCI ACWI, as of November 2022.

Note: For accounting and reporting purposes, many companies break their emissions into three "scopes" defined in the Greenhouse Gas Protocol. Scope 1 covers direct GHG emissions from sources owned ot controlled by the company. Scope 2 refers to indirect GHG emissions from the generation of purchased electricty consumed by the company. Scope 3 covers all other indirect emissions that result from the activities of a company but occur from sources that it neither owns nor controls. Examples include waste disposal and the use of sold products and services. See "The Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard," The Greenhouse Gas Protocol Initiative. As of March 2004.

Clean Energy Momentum

The clean-energy industry has been lifted by supportive policies in recent years and many national governments are competing to build capabilities of what they believe will drive future domestic economic growth. This has led to increasing competition, building investment momentum that may lead to increased choice, economies of scale and investment opportunities.

In the US, companies have announced $421 billion in domestic utility-scale clean energy investments since August 2022, when the Inflation Reduction Act (IRA) was signed into law.8 Goldman Sachs analysts estimate that the IRA could cost the US government $1.2 trillion through 2032 and unlock $3 trillion of infrastructure investment over that period.9 The European Union (EU) responded with its Net-Zero Industry Act and Critical Raw Materials Act.10 The EU package essentially matches the size and scope of the IRA, so taken together, the US and EU initiatives could release as much as €6 trillion in capital.11 Other countries have followed suit; India, for example, has launched a range of renewable-energy initiatives.12 All of these governments are playing catch-up with China, which dominates the manufacturing and trade of most clean-energy technologies.13

We believe this competition will accelerate global progress toward critical climate goals. The impact of the IRA, for example, is just beginning. We expect its incentives to drive innovation across asset classes in the years ahead, expanding opportunities for investors. The IRA has the potential to power breakthroughs in the US low-carbon transition, including the large-scale deployment of green hydrogen and carbon capture. Research by Goldman Sachs analysts shows that transportation, which has the highest greenhouse-gas emissions of any US economic sector, will be most affected by IRA incentives, including tax credits for electric and commercial clean vehicles.14

Companies’ capital expenditure on environmental and social objectives could slow amid policy uncertainty surrounding this year’s elections in key economies such as the US, the EU and India. We believe this uncertainty will be offset by the potential for interest rate cuts during 2024 by central banks including the US Federal Reserve, energy security concerns and the pressing need to improve energy efficiency. These factors, combined with the attractive economics of sustainability, may continue to drive the expansion of clean and renewable energy.

Driving Inclusive Growth

Many investors increasingly recognize that the goal of sustainable growth is likely unattainable unless it leads to a more inclusive economy. The challenges that must be overcome to reach this goal have been thrown into stark relief in recent years. COVID-19 drove the biggest spike in global poverty in decades, causing incomes in the poorest countries to decline sharply and creating major setbacks in health and education.15 The recovery from the pandemic has been uneven: rich economies have largely bounced back, but developing economies are struggling with debt and falling farther behind. Soaring inflation and the cost-of-living crisis have compounded these problems over the past two years, keeping poverty rates well above pre-pandemic levels in many low-income countries, particularly in Africa and western Asia.16

In response, many investors are stepping up their interest in the social side of sustainability. Increasing investor demand has spurred the emergence of products including social bonds and impact equity strategies that aim to address key challenges such as expanding affordable healthcare and reducing income inequality. The growth of markets focused on inclusive growth has been rapid: the social bond market, for example, has swelled to more than $630 billion in just nine years.17

Education is a sector in focus for 2024, driven by the need to close the sustainability skills gap amid tight labor markets in the US and Europe.18 In this space, software providers could offer exposure to themes such as digital inclusion and access to affordable education.19 Tech-driven companies are also some of the most promising enablers of access to affordable healthcare through solutions including virtual healthcare visits. These businesses can also provide greater personalization of essential services through online education platforms and tech-enabled navigation of healthcare benefits.20

Removing barriers to the financial system is another essential step in advancing the transition to a more inclusive economy.21 Access to accounts, credit and insurance helps people handle their everyday financial needs more safely, improves their resilience in emergencies and allows them to make investments that create wealth for the future. Companies across the globe are deploying digital technology to power payment and remittance platforms and open new distribution channels for financial services, improving access and affordability. This surge of innovation is creating a wide array of investment opportunities in public and private markets.

Sustainable Investing 2.0

As the sustainable transformation of the global economy gathers pace, the universe of potential investments is expanding along with the number of investors competing for the best opportunities. In this maturing market, investors may consider an approach that supports the transition of the sectors and regions with the highest, hard-to-abate carbon emissions and the greatest challenges to achieving equitable growth. To find these opportunities, investors may need to use forward-looking, granular metrics that strip away the noise and identify the signals of credible transition. We believe investments focused on unlocking value and real-world impact have potential to deliver financial performance and drive the transition to a low-carbon, inclusive economy.

1 “Energy Transition Investment Trends 2024,” BloombergNEF. As of January 30, 2024.

2 “GS SUSTAIN Tracker: Sustainable fund 2023 flows slower but positive, with improved performance in 4Q,” Goldman Sachs Global Investment Research. Data as of January 29, 2024.

3 “Renewables 2023,” International Energy Agency. As of January 2024.

4 “Lithium-Ion Battery Pack Prices Hit Record Low of $139/kWh,” BloombergNEF. As of November 26, 2023.

5 “Deforestation in Brazil's Amazon down by 50% to five-year low in 2023,” Reuters. As of January 12, 2024. The article cites Brazilian government data.

6 The shortfall in investment needed to achieve the United Nations’ Sustainable Development Goals (SDGs), for example, now stands at more than $4 trillion per year, with the largest gaps in energy, water and transport infrastructure. See “World Investment Report 2023,” UN Conference on Trade and Development (UNCTAD). As of June 2023. The SDGs are the core of the UN’s 2030 Agenda for Sustainable Development, adopted in 2015, which aims to protect the environment, end poverty and reduce inequality.

7 For more on the broader investment picture, see “Asset Management Outlook 2024: Embracing New Realities,” Goldman Sachs Asset Management. As of November 9, 2023.

8 “Clean Energy Investing in America,” American Clean Power Association website. As of February 16, 2024. To spur investment, the IRA relies on a package of tax incentives intended to accelerate the deployment of clean energy as well as clean vehicles, buildings and manufacturing. For more information, see: “Clean Energy Tax Provisions in the Inflation Reduction Act,” White House website. As of September 5, 2023.

9 “Carbonomics: The Third American Energy Revolution,” Goldman Sachs Global Investment Research. As of March 22, 2023.

10 These two acts are part of the EU’s Green Deal Industrial Plan, announced in February 2023. See “The Green Deal Industrial Plan,” European Commission website. As of February 23, 2024.

11 Peter C. Oppenheimer, Any Happy Returns. Chichester, West Sussex: John Wiley & Sons Ltd, 2024.

12 “Government incentivizes local development and manufacturing of renewable energy technologies,” Ministry of New and Renewable Energy press release. As of March 22, 2022. The Indian government’s initiatives to spur development of renewable-energy technology are part of its Production-Linked Incentive Scheme.

13 “Energy Technology Perspectives 2023,” International Energy Agency. As of January 2023.

14 “Carbonomics: The third American energy revolution,” Goldman Sachs Global Investment Research. As of March 22, 2023. For more information on US greenhouse gas emissions, see: “Sources of Greenhouse Gas Emissions,” US Environmental Protection Agency website. Data as of end-2021.

15 “Correcting Course: Poverty and Shared Prosperity 2022,” World Bank Group. As of October 2021.

16 “World Economic Situation and Prospects 2024,” United Nations Department of Economic and Social Affairs. As of January 2024.

17 Goldman Sachs Asset Management, Bloomberg. As of January 31, 2024. Spain’s Instituto de Crédito Oficial (ICO), a state-owned investment bank, issued the first formal social bond in early 2015.

18 On the US labor market, see: “US Economics Analyst: Is the Labor Market Weakening—or Just Returning to Normal?” Goldman Sachs Global Investment Research. As of January 22, 2024. On the euro-area labor market, see: “European Economic Forecast: Winter 2024,” European Commission. As of February 2024. For sustainability-related information on education, see: “Education for Sustainable Development: A Roadmap,” United Nations Educational, Scientific and Cultural Organization. As of November 17, 2023.

19 To read more, see our “Asset Management Outlook 2024: Embracing New Realities,” Goldman Sachs Asset Management. As of November 9, 2023.

20 “GS SUSTAIN: From Aspiration to Action – Navigating Sustainable Investing Uncertainty and Opportunity in 2024,” Goldman Sachs Global Investment Research. As of January 2, 2024.

21 The central role of financial inclusion in poverty reduction and equitable growth is highlighted by the United Nations, which cites it as a key factor in achieving seven of the Sustainable Development Goals (SDGs), including those that address hunger, health and gender equality. See: “Annual Report to the Secretary-General,” United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development. As of September 2018. The 17 SDGs, adopted in 2015, are the core of the UN’s 15-year action plan for protecting the environment, ending poverty and reducing inequality.