Quantifying Climate Impact on Capital Market Assumptions and Asset Allocations

At Goldman Sachs Asset Management we work to have an active, robustly resourced innovation agenda - mobilizing our people and partners to innovate in key emerging investment issues. We have a long history of such innovation in and around helping clients navigate climate and energy transition within and across asset classes, from launching Risk-Aware Low Emissions equity approaches in 2015, to our green bond franchise, to our work across alternative classes through our specialist Horizon (direct alternatives) and Imprint (allocating to external specialists) platforms.

Our Multi-Asset Solutions (MAS) team complement this asset class implementation work by researching and developing top-down tools and resources to understand and navigate prospective implications of climate change on the Capital Market Assumptions (CMAs) that drive asset allocation considerations, in partnership with S&P Global Market Intelligence over the last two years. This collaborated Climate-Aware CMAs model evaluates the possible impact of climate change on the macro economy and financial markets across various climate scenarios.

Background

Climate physical and transition risks have non-negligible impact on global economy, the broad consensus on climate impact also suggests that climate change may play a role in asset pricing and potential investment returns. On one hand, climate physical risk will likely to become significant with increasing temperature and introduces physical risk damage to global economy. On the other hand, under transitionary scenarios (e.g. Below 2 Degree, Net Zero 2050), certain technological developments, climate policy and large-scale investment are required to help drive the world to transition into a low-carbon economy and introduces climate transition risk to global economy. In fact, Goldman Sachs Global Investment Research (GIR) has estimated that $1.5-2 trillion green capex per year from now to 2070 is needed to help the world meet net-zero targets by 2070.1 Investors have a big part to play in meeting this goal.

At the same time, investors are also becoming subject to climate-linked reporting requirements, including Task Force on Climate-Related Financial Disclosures (TCFD) requirements, European Sustainable Finance Disclosure Regulation, and the EU Taxonomy. Several of these are in flux, and will be subject to upcoming legislative reviews. It’s important to quantify climate risks and prepare scenario analysis to comply with evolving regulation requirements.

Developing our climate-aware capital market assumptions

Capital Market Assumptions (CMAs) are important building blocks for asset allocation, which includes expected return, volatility and correlations across asset classes. It’s important to think through how climate will affect the macro economy and translate the impact into a robust asset class risk return profile. To this end, MAS partnered with S&P Global Market Intelligence team on Climate-Aware CMA model that can be tailored to diverse use cases in the investment process: all the way from top-down strategic asset allocation (SAA) analysis, to portfolio risk management, to regulatory reporting and monitoring.

- Climate-Aware CMAs can provide insights into the aggregate climate effects on clients’ overall portfolios. With wide coverage of asset classes (>4,000 indices) and comprehensive thinking on climate aware risk return modelling, Climate CMAs can help with climate risk mitigation for Climate-Aware SAA or climate transition solutions like Net Zero type investments.

- By incorporating climate CMAs, clients can demonstrate alignment with regulatory expectations regarding climate risk disclosure and sustainable investment. Portfolio risk management can also be enhanced with climate scenario analysis and stress testing for portfolio resilience and tail-risk exposure to climate shocks.

Methodology

Modeling the impact of climate scenarios on macroeconomic variables and financial markets involves several challenges.

- First, climate scenarios are based on projections rather than historic empirical observations, which brings in considerable uncertainties.

- Second, climate change involves the interplay of many different factors that involve feedback loops, non-linearities and tipping points. This means highly sophisticated models are required to determine the potential interconnectedness between variables.

- Third, for practical asset allocation considerations, we need to consider how to link the impacts of climate change and the transition with the financial risk and return profiles of a broad range of investable assets.

The Network for Greening the Financial System (NGFS), a network of 114 central banks and financial supervisors, has developed six climate scenarios that form the foundation of our Climate-Aware CMAs. While other bodies have also created similar climate scenarios, NGFS’s are the most widely used by central banks and other financial institutions. We have made our own enhancements to the transition and physical risk assumptions within the NGFS scenarios by applying Goldman Sachs’ proprietary bottom-up abatement cost curve2 and a proprietary physical risk damage function from S&P Global Market Intelligence.

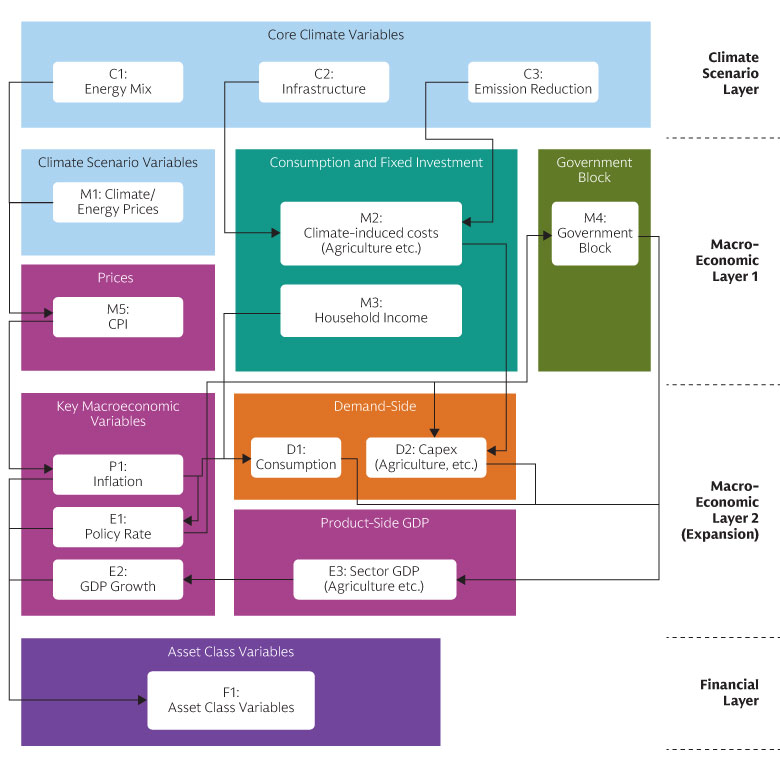

As part of the process we partnered with the S&P Global Market Intelligence team, using its probabilistic graphical model (PGM) to tackle the uncertainties associated with modeling interconnected macro variables and their embedded causal relationships. We show the PGM in Figure 1 below. It consists of three layers – a climate scenario layer at the top, followed by two macroeconomic layers, and a financial layer at the bottom.

Using this model, we start from climate scenarios and determine the potential economic and financial impacts of the transition (or the absence of a transition) to a low-carbon economy. We use the output from the PGM to generate Climate-Aware CMAs. Transparency and visualization are the key differentiators of the PGM, where the transmission mechanism is fully visible and traceable for both our own understanding and for client communication.

S&P’s probabilistic graphical model. For illustrative purposes only.

The model covers nine countries, with multiple dynamics for each country in the G7, China and India. We also aggregate these countries on a regional and global basis. The PGM directly models 26 asset classes, including equities, government bonds, credit, commodities, infrastructure and inflation-linked bonds.

The model calculates likely distributions for each macro and financial variable we consider over a 30-year time horizon. We further use an enhanced Black-Litterman approach to extend our calculation of climate-aware expected returns beyond the 26 asset classes our model directly covers to MAS’s entire investment universe, which consists of more than 4,000 indices.

In addition to expected returns, we used MAS’s proprietary conditional Value at Risk (cVaR) factor model and an enhanced GARCH model to derive climate adjusted Value at Risk measures for the MAS’s entire investment universe.

Use cases

Below we provide examples of how we can use our Climate-Aware CMAs in our investment and risk management processes.

Climate-Aware CMAs can be an important building block in helping us achieve climate-linked investment objectives, such as developing net-zero and climate-resilient investment solutions. Transitionary scenarios, – for example, Net Zero 2050, Below 2 Degrees – provides us with insight into the potential impact on the macroeconomy and asset class risk and return profiles and contribute to Net Zero type investment process.

Another important area to use this tool is a Climate-Aware SAA process, where we aim to mitigate portfolio climate risk. For example, build a climate resilient portfolio that’s less sensitive to different scenario outcomes and explore the trade-offs between Sharpe Ratio and climate resilience consideration using efficient frontier analysis.

To integrate climate risks into Asset Liability Management, it is crucial to have robust and reliable climate adjusted scenarios. Using our Climate-Aware CMAs as an input in Goldman Sachs Asset Management’s proprietary ALM Simulator Model enables us to generate stochastic simulations that take into account climate-related developments over different investment horizons. By incorporating the scenarios in the ALM balance sheet model we can assess the impact of climate-related physical and transition risks on our clients’ balance sheets based on specific risk profiles. For example, we can assess the coverage ratios of our pension fund clients and their pension distributions over time with client-specific criteria. From there, we can construct an efficient Climate-Aware ALM portfolio.

We can use our Climate-Aware CMAs to provide what-if scenario analyses to assess the potential performance of clients’ portfolios under various climate scenarios and suggest how to improve their resilience to these scenarios.

We believe the insights resulting from use of Climate-Aware CMAs can help clients assess, monitor and report on the financial impacts of the climate-related risks their portfolios are exposed to, in line with industry regulations such as TCFD reporting, California SB-261 and the EU Taxonomy.

For example, TCFD-aligned disclosures require an evaluation of climate-related risks and opportunities over short-, medium- and long-term horizons. Our Climate-Aware CMAs can accommodate different time horizons and provide insights into the impact of climate on return and value-at-risk. They can also enhance governance processes by providing a framework against which to monitor a portfolio’s climate metrics.

We believe our Climate-Aware CMAs is/are an important analysis tool within our sustainable investment framework and can play a valuable role in helping us develop climate-aware strategic asset allocations, manage portfolio risk and comply with regulatory reporting requirements.

We are currently developing an interactive user interface visualize the outcomes of our Climate-Aware CMAs and evaluate portfolio solutions and will continue to publish new insights on specific use cases.