Corporate Pension Quarterly 3Q 2024: Venturing Through Volatility

Quarterly Snapshot

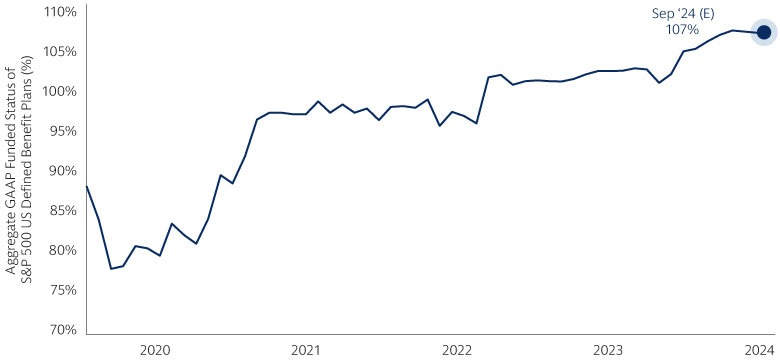

Source: Goldman Sachs Asset Management. As of September 30, 2024. Funded status reflects monthly estimates. Exceptions apply to year-end data, which are actual.

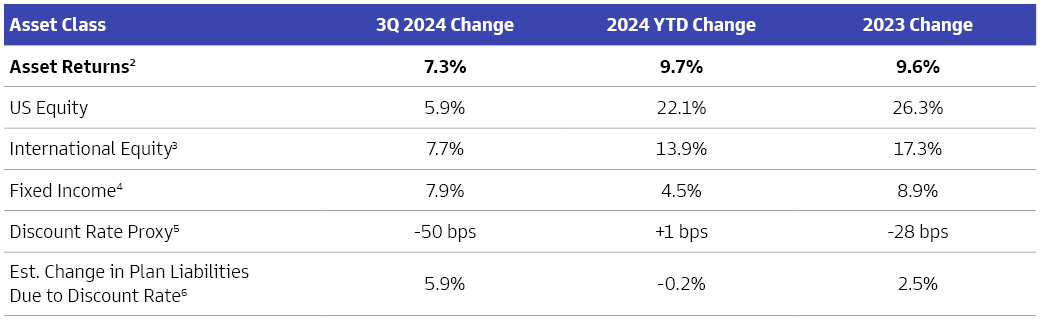

Source: Goldman Sachs Asset Management and Bloomberg. As of September 30, 2024. Percentage changes represent total returns.

- Our estimate of the funded status for the US corporate pension system decreased marginally in 3Q to 106.6% from 107.0% in the previous quarter. While asset returns were positive, our estimated discount rate steadily declined, resulting in the value of liabilities rising more than the estimated rise in assets.

- Global equity markets delivered strong performance in the quarter, driven primarily by the markets’ positive reaction to central bank actions around the world.

- Macro concerns continue to remain elevated, with US and other global elections continuing to weigh on investor sentiment.

- The Federal Reserve (Fed) announced a 50-bps rate cut in September on the back of cooled inflation data and the additional risk of labor market softening. As a result, our Goldman Sachs Global Investment Research team revised its view to now an accelerated Fed rate cut schedule, forecasting six consecutive 25-bps cuts until June 2025.

Source: MSCI, Bloomberg, Goldman Sachs Global Investment Research, and Goldman Sachs Asset Management. As of September 30, 2024. The economic and market forecasts presented herein have been generated by Goldman Sachs Asset Management and Goldman Sachs Global Investment Research for informational purposes as of the date of this document. They are based on proprietary models and there can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this document. Past performance does not guarantee future results, which may vary.

* GAAP funded status estimates are based on US plans (where specified) of defined pension plans within the S&P 500 (i.e., 238 companies with pension data per GS Asset Management analysis). 2. Average asset-weighted return of S&P 500 companies’ US defined benefit plans. For 2023, uses average asset returns based on disclosed data. When not disclosed, estimates asset returns based on actual asset returns (in dollars) and average asset value. 3. Mix of MSCI EAFE and MSCI ACWI ex-US. 4. Mix of Corporates (Bloomberg US Aggregate Bond Index), High Yield (iShares US High Yield Index), Treasuries, and Long Credit (iShares Long US Credit Index). 5. Discount rate proxy measured by 50% Moody’s AA Corporate Bond and 50% US Long Duration Corporate Bond. For 2023, uses average discount rate change for December year-end filers. 6. Estimated Change in Plan Liabilities based on increase in estimated discount rate and duration of 12. For 2023, uses average actuarial gains / losses as a percentage of starting Projected Benefit Obligation.

In The News

Recent Matters of Note

Updates on Recent Annuitization-Related Activity

- There have been several lawsuits this year surrounding pension risk transfer (PRT) transactions. In July, three former employees of General Electric Co. sued the company and its pension plan fiduciaries for an alleged violation of fiduciary duties as part of the firm’s previous PRT transaction in 2020.

- More recently in September, two retirees from Lumen Technologies and a retiree from Bristol-Myers Squibb Co. have also separately filed lawsuits against their respective plan sponsors and independent fiduciary State Street Global Advisors.

- Six different lawsuits have been filed year-to-date by plan participants against their plan sponsors (and, in some cases, independent fiduciaries) alleging fiduciary breaches in connection with the selection of the annuity provider in PRT transactions.

Recap of the ERISA 50th Anniversary Symposium & Gala

- This year marks the 50th anniversary of the Employee Retirement Income Security Act (ERISA) since it first passed in 1974. To celebrate this landmark legislation, the ERISA 50th Anniversary Symposium & Gala was organized to provide a forum for discussing the emerging trends, current challenges, and improvement opportunities in the employee benefit space.

- Key speakers and panelists for the symposium included former government officials, legal experts, and retirement industry professionals and researchers. A recording of the symposium may be accessed here.

- The celebratory event ended with a black-tie, invitation-only gala. The event welcomed special guest speakers Senator Ron Wyden (OR) and Presidential Historian Dr. Douglas Brinkley during the evening’s program.

Source: Goldman Sachs Asset Management and news releases. As of 3Q 2024.

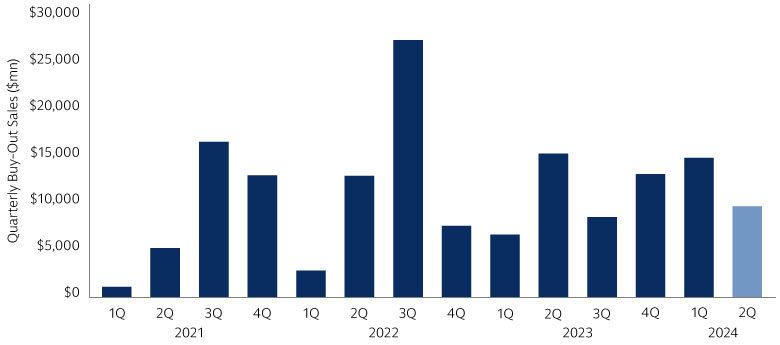

Elevated Annuitization Volume in 2Q 2024

The Life Insurance Marketing and Research Association (“LIMRA”) reported that single premium buy-out sales for 2Q 2024 were $9.2 billion, representing 183 contracts sold. With 327 buy-out contracts, the first half of 2024 set a record for the first half of a year as tracked by LIMRA.

Source: LIMRA Group Annuity Risk Transfer Survey. As of 2Q 2024, latest available as of publication.

Select Transactions Announced in 3Q

- In September, International Business Machines Corp (IBM) announced that it transferred $6 billion in pension liabilities to Prudential Insurance Co. The transaction covers about 32,000 IBM retirees and beneficiaries and is IBM’s second jumbo transaction after its $16 billion buyout two years ago.

- Crown Holdings Inc. announced the purchase of a group annuity contract from MassMutual to transfer liabilities for about 12,000 participants in the company’s primary US pension plan. The transaction would also transfer about $740 million in US pension plan assets, and the plan sponsor will contribute about $100 million as part of the deal.

- Syensqo SA announced that it will transfer about $425 million in its US and Canadian pension plan liabilities to Pacific Life Insurance Co. and RBC Insurance starting the end of this year.

Source: Company reports. As of 3Q 2024. The transactions shown above are not intended to be an exhaustive list. They are based on press releases and company reports observed during the quarter and are selected based on salience in the press.

Source: Goldman Sachs Asset Management. As of September 30, 2024. Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or its securities. Please see additional disclosures at the end of this document. Company names and logos, excluding those of Goldman Sachs and any of its affiliates, are trademarks or registered trademarks of their respective holders. Use by Goldman Sachs does not imply or suggest a sponsorship, endorsement or affiliation.

Portfolio Manager Perspectives

Many plans have seen their funded levels rise substantially over the past few years and have moved their glid paths to the “end-state” of their portfolios. As a result, we explore how plan sponsors may consider using option strategies to protect funded levels and hedge against potential equity market volatility while still maintaining exposure to equities.

In the current market environment, why does an equity risk mitigation strategy make sense for institutional investors?

The US equity market continues to move higher, and the S&P 500 index reached all-time highs around 45 times in 2024. Many valuation metrics are also at the high end of historical ranges. At the same time, geopolitical tension, concentration risk, upcoming elections, and other uncertainty continue to drive market volatility higher, with the VIX rising from around 13 at the beginning of the year to around 20 as of mid-October. Consequently, an equity risk mitigation strategy tailored to each investor’s risk and return objectives may help dampen the impact of market volatility in the portfolio.

Are there any factors or features to the equity risk mitigation strategy that may be specifically applicable for corporate pension plans?

Strong equity market performance and a higher interest rate environment than most of the past decade have helped the aggregate US corporate pension system to return to its healthiest position since before the global financial crisis, with many plans now fully funded and some notably overfunded. As plans seek ways to reach or maintain their funded levels, they may consider ways to hedge against potential equity market volatility and a changing rate environment.

For plans that are fully funded or overfunded, an equity risk mitigation strategy may be structured to potentially obtain funded status protection in a cost-effective manner. The strategy is also applicable for plans that are allocated more to growth assets, with the potential to provide protection against the portfolio’s higher equity market exposure.

Many corporate pension plans have been reducing their equity allocations as part of their de-risking strategies. For those concerned about equity risk exposure, wouldn’t it be easier to just sell more equities from the portfolio?

Our work would suggest that around a third of US companies with a defined benefit pension plan still sponsor open plans. About another one-third of these plans are closed plans but still accept new benefit accruals. For the remaining third that we estimate to be frozen, there is likely still benefit to owning public equities, whether to help improve funded status or provide a potential buffer against potential mortality assumption changes. Hence, public equity remains an integral source of asset returns for many corporate DB plans.

Additionally, while selling away from public equity may help decrease direct equity risk exposure in a portfolio, other asset classes, including alternatives and real assets, may be indirectly impacted by equity market volatility. Hence, plan sponsors may benefit by considering hedging strategies from a total portfolio perspective as opposed to an asset class-only approach.

As the corporate pension universe continue to maintain healthy status, some plan sponsors aspire to shrink or terminate their plans through an annuitization. How would an equity risk mitigation strategy plan a role in that?

Many plans have moved down their glide paths and are at or close to their “end state.” Plans that look to shrink or terminate through an annuitization may be likely to seek ways to maintain their funded status in order to effectuate a risk transfer, through ways such as leaning more heavily into liability hedging fixed income or through strategies to hedge against potential funded-status volatility.

Source: Goldman Sachs Asset Management. As of October 2024. For discussion purposes only. The equity risk mitigation strategy described herein should not be relied upon as representative of actual or future information for any Goldman Sachs products and are for discussion purposes only. There is no guarantee that objectives will be met. Diversification does not protect an investor from market risk and does not ensure a profit. De-risking strategies should not be construed as providing any assurance or guarantee that as a result of applying the strategy an investor will reduce and/or eliminate risk, as there are many factors that may impact end results such as interest rates, credit risk and other market risks.

Strategy In Focus: Equity Risk Mitigation

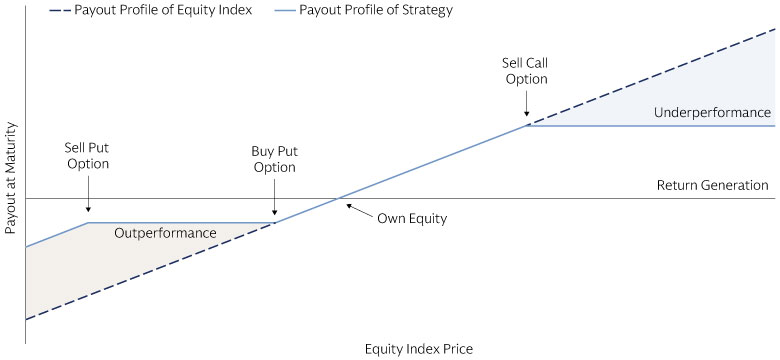

While the recent macro backdrop remains supportive, the global equity market remains volatile amidst various sources of risk. An equity risk mitigation strategy may serve as a potential way to balance the need for return-generation with that for downside risk reduction in a cost-efficient manner.

Investment Objective

An equity risk mitigation strategy may be implemented in many forms, one of which being an option overlay that aims to change the likely outcomes of the equity portfolio. These option overlay strategies balance the need for return-generation with that for downside risk reduction all in a transparent and cost-effective mandate.

Portfolio Set-up

These option overlay strategies often include equity exposure and options exposure via put spread collar (PSC). The PSC exposure buys put options to reduce impact of equity drawdowns and sells put and call options to fund the put position.

Typical Features

May be tailored to suit each investor’s specific risk and return objectives with customizable volatility targets and equity allocations

May reduce the impact of equity drawdowns on portfolios

Cost efficient implementation: may reduce both the total premium of the strategy and trading costs

Source: Goldman Sachs Asset Management. As of October 2024. There is no guarantee that objectives will be met. The option overlay strategies described herein should not be relied upon as representative of actual or future information for any Goldman Sachs products and are for illustrative purposes only. Actual results may vary for each client due to specific client guidelines and other factors.