Retirement Planning Works: It’s Time to Make Planning Automatic In Employer Sponsored Plans

Offering Enhanced Planning Services in DC Plans May Strengthen American Retirement

New York, NY, September 26, 2024 – American workers are paying a steep price for deficient financial planning, as life events often derail their saving for emergencies and retirement – putting their families at risk and leading to potentially delayed retirement and saving shortfalls.

This is a primary conclusion of the recently released Retirement Survey & Insights Report 2024 from Goldman Sachs Asset Management. Due to the stress of life events our survey found:

- 62% of American workers report they have less than three months of emergency savings

- 61% say they will have to delay retirement, 19% potentially for 4 years or more

- 39% of working Baby Boomers and 50% of Gen Xers report having less than $100,000 saved for retirement.

Yet as inflation falls, we believe Americans with financial grit can more capably manage through their many financial challenges and focus on longer-term planning, including increasing retirement savings.

By adding financial planning and advice to defined contribution (DC) plans, plan sponsors can substantially strengthen the retirement prospects of their workforce, our survey demonstrated. Employees must be willing to use and embrace the many effective solutions their plans offer.

“Many DC plans are not retirement plans at all,” said Chris Ceder, Senior Retirement Strategist with Goldman Sachs Asset Management. “They are retirement savings accounts that often are missing the plan – a critical tool for empowering participants to achieve retirement goals.”

Managing Life Events: The Benefits of Planning and Advice Are Vividly Clear

For too many, saving is not easy: 63% of working Americans report they are saving for multiple objectives, with 31% juggling three or more financial goals. Our survey found that workers who have conducted basic, personalized financial planning are more likely than others to have:

- Savings on track or ahead of schedule (80% with a plan vs. 39% without one)

- Increase savings each year (62% vs. 39%)

- An improved year-over-year financial situation (62% vs. 32%)

- More confidence in their ability to reach their goals (80% vs. 42%)

- More comfort managing savings (40% vs. 16%)

- Ability to navigate competing priorities (43% vs. 35%)

- Higher savings – above $200,000 (52% vs. 23%)

“Developing personalized retirement plans that help workers meet the financial challenges of predictable – and unpredictable – life events is essential to success for plan participants,” said Nancy DeRusso, Head of Financial Planning, Financial Wellness and SurvivorSupport® at Goldman Sachs Ayco “It should be considered as a potential automatic feature for all workers, just like auto enrollment and escalation, since the benefits for every plan participant are vividly clear.”

In terms of the value of advice, our survey found that working Americans who have a financial adviser are more likely to: have personalized financial plans than do-it-yourself (DIY) investors (82% vs. 43%); have confidence they will reach their retirement goals (73% vs. 59%); and have savings of over $200,000 (61% vs. 33%).

Plan Sponsors Play Pivotal Roles in Employee Retirement Planning

The Goldman Sachs Asset Management annual survey found 55% of working Americans are DIY investors who tend to be cost-sensitive and most likely to seek education and advice from family and friends. DIY plan participants expressed interest in having access to personalized planning in their DC plans: if offered, 49% said they would likely access a personalized digital retirement planner using personal data to build a personalized retirement strategy.

We believe this large, underserved cohort is a major target of opportunity for plan sponsors.

“Workers with a personalized plan – we call them retirement planners – are more likely to have higher savings, be on track, and be more engaged,” Ceder said. “They have financial grit – the ability to learn, grow, sacrifice, and persevere through financial challenges. By fostering grit, we believe individuals can better navigate uncertainties and ultimately achieve their retirement goals.”

Asked what additional resources they would seek from employers, working Americans placed greatest value on retirement planning and advice. Integrating digital solutions and human-based support through multi-channel platforms may be key to assisting those less inclined to engage with a financial adviser: DIY respondents showed greatest interest in digital and/or hybrid advice services (37%), compared to just digital (35%) or financial counseling/coaching (29%).

What’s Hurting Retirement? The Financial Vortex & Costly Life Events

Goldman Sachs Asset Management has been tracking the impact of the financial vortex – seven competing priorities that hinder Americans’ ability to save for retirement – since 2022. For the first year, Americans reported slightly less impact, likely due to easing inflation and a stronger economy at the time.

Still, the vortex’s impact on retirement saving persists, with too many monthly expenses (67% of respondents), financial hardships (61%), caring for and financially supporting family members (57%), and credit card debt (55%) having the most widespread impact, followed by paying down existing loans (53%), time out of the workforce (48%), and saving for college (42%).

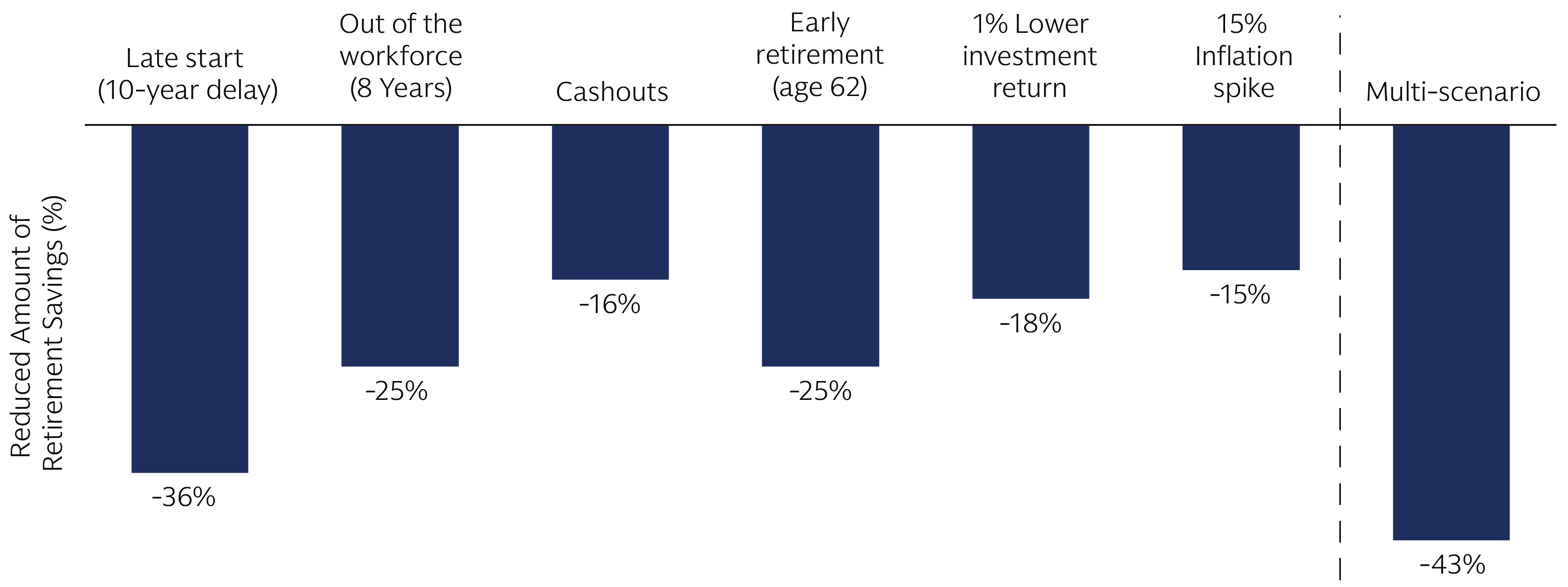

Unpredictable life events beyond the vortex can vastly reduce the funds American workers have in retirement. More specifically, the chart below shows how various events could potentially reduce retirement savings, with multiple factors depleting retirement by as much as 43%.

Source: Goldman Sachs Asset Management. As of September 2024. These examples are for illustrative purposes only and are not actual results. Portfolio Rate of Return is at 6% as this is assumed to be a conservative total return of a diversified portfolio. The chart above is for illustrative purposes only based on certain assumptions, hypothetical information, estimates, projections and statements regarding certain life events of a hypothetical retirement saver. This does not reflect results of any Goldman Sachs product. If any assumptions used do not prove to be true, results may vary substantially.

Methodology

Goldman Sachs Asset Management evaluated responses from working and retired Americans to understand the realities of preparing for and living in retirement. Our goal is to learn about the financial obstacles individuals need to overcome and the lessons they can apply. The Retirement Survey & Insights Report 2024 includes key findings that we hope will help plan advisors and plan sponsors better prepare employees for retirement. Findings are from 4,874 individuals surveyed in July 2024 and provide insights from a diverse set of perspectives, including working individuals (3,280 across generations), and retired individuals (1,594 age 45–75).

To better understand how people make retirement savings and advice decisions in the face of many competing priorities, we engaged behavioral economics firm Behave Technologies (formerly Syntoniq, Inc.). Behave Technologies developed key questions in response to our survey results to analyze four behavioral characteristics – optimism, future orientation, risk-reward focus, and financial literacy. Behave Technologies’ analysis helped provide deeper insights into retirement planning behaviors.

About Goldman Sachs

The Goldman Sachs Group, Inc. (NYSE: GS) is a leading global financial institution that delivers a broad range of financial services across investment banking, securities, investment management and consumer banking to a large and diversified client base that includes corporations, financial institutions, governments, and individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in all major financial centers around the world.

About Goldman Sachs Asset Management

Goldman Sachs Asset Management is the primary investing area within Goldman Sachs (NYSE: GS), delivering investment and advisory services across public and private markets for the world’s leading institutions, financial advisors and individuals. The business is driven by a focus on partnership and shared success with its clients, seeking to deliver long-term investment performance drawing on its global network and deep expertise across industries and markets. Goldman Sachs Asset Management is a leading investor across fixed income, liquidity, equity, alternatives and multi-asset solutions. Goldman Sachs oversees more than $2.9 trillion in assets under supervision as of June 30, 2024. Follow us on LinkedIn.