From Roads and Bridges to Renewables and 5G: An Infrastructure Evolution

Structural Forces Drive Broadening Scope

Many investors have a textbook understanding of infrastructure, with toll roads and railways, energy, electricity, and water networks quickly coming to mind. But we believe a broader view of infrastructure is warranted, comprising assets that provide essential services critical to the functioning of our societies. Indeed, the scope of infrastructure has been broadening, largely as a result of four key structural forces.

The first is climate change and a shift towards more sustainable energy consumption and penetration. In 2023, clean energy investments across renewable energy production and storage, electrified transport, and clean industrial initiatives reached $1.8 trillion – over 8x the value a decade prior.1 Investors are also focused on decarbonizing existing assets, in order to preserve their long-term value. By financing such initiatives in the infrastructure space, we believe investors can gain a compelling way to satisfy their sustainability objectives while also capturing attractive economics.

The second structural force is technology acceleration. Data center power demand has risen significantly since the COVID pandemic of 2019-2020. Goldman Sachs Global Investment Research analysts expect a 160% increase through the rest of the decade, driven by both accelerating adoption of Artificial Intelligence (AI) and non-AI technological needs.2 AI usage is not only driving significant power load requirements (for instance, a single ChatGPT search consumes 6-10x the power of a traditional Google search),3 but also increased demand for water and cooling technologies. Technology is also changing our means of communication, driving increased demand for fiber and wireless networks, as well as our consumer habits, with ongoing growth of ecommerce necessitating new logistics solutions.

The third structural change centers on changing trade flow patterns, as companies reconfigure supply chains for resiliency and evolving geopolitical realities. This impacts transport and logistics needs to support changing locations of manufacturing and storage facilities, and trade routes to deliver goods to customers.

The fourth key force is demographics. As people move and change the way they live, places with net migration require investments in traditional and digital facilities. Aging populations, alongside decreased geopolitical stability, may also drive growing demand for private infrastructure funding, by shifting public spending priorities across already-strained sovereign and local budgets.

Together, these structural forces mean that future generations will inherit a world that will be starkly different than the one today. This dynamic is driving waves of innovation as our societies and companies transform. Many investors are looking for ways to capture value in the innovation and transformation ecosystem. Infrastructure can represent a key component of a creative, multi-dimensional approach to doing so, in ways that align with individual investor goals, desired exposures and risk tolerances. Infrastructure forms a key part of the foundation of the innovation and transformation ecosystem, supporting and servicing the tools of transformation. These services have a distinct business model profile, giving the infrastructure asset class a differentiated investment profile and an important role in portfolio construction.

This segment includes both traditional and renewable power, energy storage, grid resilience, bioenergy, carbon capture and storage, and green mobility.

This segment includes traditional roads, airports, and rail assets as well as freight and aircraft leasing and specialty logistics and warehousing.

This segment includes communication towers, fiber, wireless network assets and data centers.

This segment encompasses traditional services such as recycling to more sustainable approaches to waste management, to new categories such as healthcare and education businesses that cater to evolving demographics.

Differentiated Business Model, Differentiated Returns

Infrastructure companies have a distinct business model not typically found in other asset classes. Demand is typically inelastic, due to the essential nature of services these assets provide to households and businesses. At the same time, asset supply is typically limited, with strong barriers to entry coming from regulatory and/or physical constraints (e.g., capital-intensity). Many assets feature long-term revenue contracts. Together, these factors make for sticky customer bases and steady revenue trajectories. This translates into resilient cash flows across the business cycle and offers a ballast against economic volatility.

Many infrastructure assets feature contractual revenue protections such as price escalators explicitly tied to inflation. Others can pass along price increases to their customers due to inelastic demand. This dynamic has helped the asset class deliver yield in excess of inflation, as evidenced most recently in the inflationary environment of 2021-2023, when infrastructure yields rose with, and above, inflation levels.

Source: EDHEC US infrastructure index, BLS (CPI). As of q2 2024. Past performance is not indicative of future results.

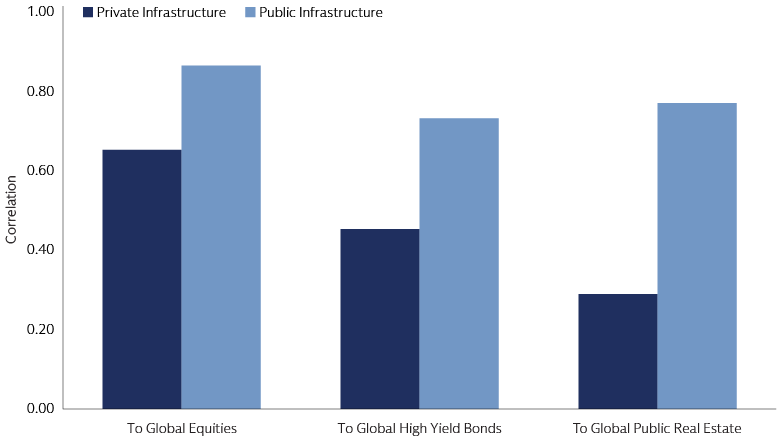

The defensive nature of revenues for many infrastructure assets makes them less sensitive not only to economic cycles but, by extension, to macro-driven equity and credit market movements. As such, the asset class has offered differentiated returns relative to traditional asset classes such as equities and fixed income. On this dimension, private infrastructure has enjoyed an advantage over public infrastructure opportunities, as evidenced by their respective correlations to traditional asset classes. Public infrastructure stocks, particularly those included in major equity indices, are subject to broad equity market dynamics. Despite the unique nature of the underlying assets, these stocks are sensitive to public market movements as passive strategies do not differentiate on fundamentals, and many active managers have to keep tracking error to the benchmark range-bound. Private infrastructure assets are not subject to this dynamic. Given these differentiated returns, adding private infrastructure to a portfolio of traditional asset classes can enhance overall returns without altering the portfolio’s risk profile. Adding private infrastructure to a portfolio that includes private equity can lower volatility and improve risk-adjusted return.4 Private infrastructure has experienced robust growth over the past decade, as investors have come to increasingly appreciate its value in a portfolio. At $1.3 trillion of AUM, it has become an accessible path for investors to gain exposure to the asset class.

Source: Cambridge Associates (infrastructure), MSCI (MSCI World, global equities), Bloomberg (Bloomberg Barclays global high yield), FTSE (FTSE EPRA NAREIT, global public real estate). Based on 15 years of quarterly data through 2023. Past performance is not indicative of future results.

A Spectrum of Investment Opportunities

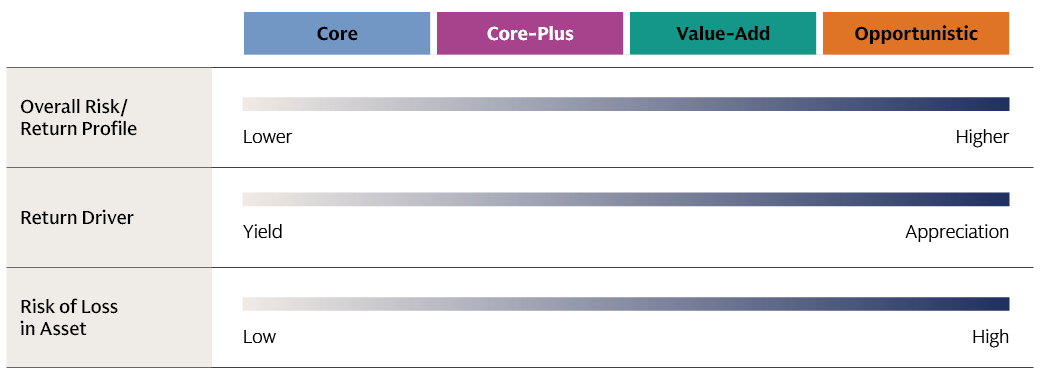

Private infrastructure encompasses a wide range of strategies that focus on assets in different stages of development, pursue different value creation strategies, and manage different types of risks. Target return levels, composition of returns, and risk profiles vary as well, enabling a wide range of approaches to incorporating private infrastructure into a portfolio.

Core strategies own and operate mature, established assets with long-term, predictable, secure income streams. They seek out established customer bases and contracted revenue streams with high visibility into future cash flows. The focus is on maintaining asset quality. These assets may be in traditional or newer infrastructure categories – for instance, operating an existing wind or solar generation facility is in scope. As technology solutions advance and asset scope expands, yesterday’s opportunistic assets may become tomorrow’s core. The key risk is commercial, specifically the danger of asset obsolescence against a backdrop of newer, technologically advanced, better located assets. Careful asset selection is key to minimizing this risk. Core strategies are the most defensive infrastructure investments, lowest on the risk/return spectrum, with returns coming primarily from yield.

Core-plus strategies also focus on mature, established assets with contracted cash flows, but they look to generate modest growth via operational enhancement or mergers and acquisitions. As a result, while much of their return comes from steady yield, they also feature some potential for upside appreciation. Asset obsolescence remains the key commercial risk, magnified relative to core strategies by the capital expenditures spent to try to enhance the asset. Operational underperformance (e.g., inability to execute the growth plan) is a key execution risk in the strategy. This risk can be mitigated via asset selection and repositioning expertise.

Value-add infrastructure focuses on asset growth and transformation for upside potential. Typically, these managers seek out assets with contracted revenues in attractive markets that offer stability, but also significant upside potential from operational enhancement or growth strategies such as market expansion. They may build platform assets through a combination of capital investment and acquiring smaller, complementary assets. For instance, a manager may build a platform of high-speed digital fiber networks, entering new markets and capitalizing on growing fiber demand from areas as varied as streaming services, cloud computing, and autonomous vehicles. Value creation can be predicated on driving usage and adoption in modern infrastructure categories, or implementing more tech-enabled and sustainable approaches to traditional categories to better align the assets with evolving client needs and, potentially, preventing asset obsolescence. Returns are generated through both yield and capital appreciation. Key risks relate to the inability of the asset to meet its upside potential, whether via lower-than-projected demand (commercial risk) or an inability to successfully execute on the growth and efficiency value creation plan (execution risk). Partnering with a manager that brings extensive operational experience and a track record of operational value creation can be a critical part of mitigating this risk and successful investing in value-add infrastructure.

Opportunistic infrastructure focuses on developing new infrastructure assets or extensively redeveloping existing ones. These assets are often tied to newer or evolving technologies, offering the most direct exposure to innovation. To minimize technology risk inherent in this strategy, opportunistic infrastructure managers tend to focus on proven technologies. For instance, the strategy may build renewable energy storage and distribution facilities. The key operational risk, therefore, is whether the technology can scale effectively. Other key risks include execution (e.g., cost overruns), commercial (e.g., demand for the asset or services it) and financing (e.g., evolving tax incentives). A key risk mitigant is technological expertise to evaluate scalability of the underlying technology, usage economics, constraints, and implementation timelines. Often, asset development is tied at the outset to future cash flows that the asset will generate; construction financing can depend on the usage contract (e.g., power purchase agreement) signed ahead of the build. If a long-term contract is not signed at the outset, the manager may pursue opportunities in which they have high confidence that customer bases will be sticky, minimizing churn. Once the asset is built, it can be sold to an operator with a lower risk/return target. As such, returns come primarily from capital appreciation, with little or no yield.

Source: Goldman Sachs Asset Management. For illustrative purposes only

Portfolio Construction Considerations

The expanding scope of infrastructure means that investors may find assets levered to secular megatrends in different parts of their portfolio. Notably, the line between opportunistic infrastructure and private equity (particularly growth equity) may be blurred: both can focus on building new assets and rapidly scaling newer technologies, both derive their returns primarily from capital appreciation, and both are exposed to technology risk (albeit potentially in somewhat different manner). Furthermore, opportunistic infrastructure assets are typically pre-revenue, and so lack direct exposure to the defensive nature of core, core plus and value-add assets. As such, some investments could theoretically be classified in either asset class. The line between value-add infrastructure and private equity may be similarly blurred. The line between infrastructure and real estate may also be blurred, especially in areas where a building is an integral part of the service offering (and tenancy is core to the value proposition for the client). Examples include data centers and student and senior facilities – areas where tenants have service needs.

The lines between adjacent infrastructure strategies also may be somewhat fluid. A fund manager focused on a particular strategy may consider opportunities in an adjacent one, so long as they fit with their core competencies and investment focus. Indeed, a particular opportunity may be categorized differently by different managers. For instance, a new asset build may be the purview of a value-add or an opportunistic manager, depending on the extent of the build and whether it would be a standalone greenfield asset (typically opportunistic) or a platform add-on (value-add).

This dynamic necessitates a framework for investors to determine how to classify investment opportunities, how to distinguish infrastructure assets from those that belong in other asset class categories, and how to evaluate managers in the proper context. A potential delineation between opportunistic infrastructure and private equity can be based on the amount of technology risk inherent in the company, the asset intensity of the project, and/or whether the ultimate product is a physical good (e.g., electric vehicle batteries) or a service (e.g., storing and providing energy). A delineation between value-add infrastructure and private equity can be based on the nature of revenues – are they contractual? non-cyclical? Are there physical or regulatory barriers to entry making for sticky customer bases? A delineation between different infrastructure strategies may factor in the degree of asset building, repositioning, and enhancement the manager typically undertakes.

Either way, investors should look through the asset class wrapper or fund classification to the underlying positions to understand their exposures and risks and evaluate the drivers of their managers’ performance.

Investor interest in infrastructure has been growing robustly, as investors look for differentiated sources of yield and portfolio resilience in inflationary and volatile market environments. Some investors, however, may still be referencing an old textbook on what infrastructure is and how to invest it. But as our society is evolving, so, too, is the infrastructure opportunity set. A modern approach to this modern asset class may be a key ingredient to investment success.

1 Bloomberg NEF, as of January 2024.

2 Goldman Sachs Global Investment Research. As of April 2024.

3 Goldman Sachs Global Investment Research. As of April 2024.

4 Source Goldman Sachs Asset Management. For illustrative purposes only. Reflect Multi-Asset Solutions’ strategic assumptions as of 12/31/2023, net of fee returns. Private Markets Portfolios are assumed to be actively managed. All other asset classes are passively managed. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary.