Goldman Sachs Releases New Report: “Opening the Door to Alternatives”

Survey of 1,000 high-net-worth investors shows how wealth, risk perceptions, and generational shifts are reshaping private market participation.

NEW YORK, October 9, 2025 – Goldman Sachs Asset Management today announced the release of its latest investor survey report, “Opening the Door to Alternatives,” a survey on how wealthy individuals in the US are engaging with private markets. The report reveals rising adoption with wealth, persistent cash holdings, and a generational shift in adoption of alternatives, with Millennials showing greater familiarity and allocation to alternatives than older generations. Drawing on responses from 1,000 investors with more than $1 million in investable assets, the findings highlight both the accelerating adoption of alternatives and the barriers that remain in broadening access.

“Private markets are rapidly gaining traction well beyond institutional investors,” said Kristin Olson, Global Head of Alternatives for Wealth at Goldman Sachs. “Our survey shows that as wealth grows, alternatives become the cornerstone of portfolio construction—valued for diversification, performance, and access to innovation. The challenge and the opportunity now lie in expanding education and creating solutions that meet investors where they are.”

Key Highlights of the Survey Data

- Alternatives adoption rises with wealth: 80% of households with $10 million or more in investable assets allocate to alternatives.

- Cash balances remain high: 20% of net worth is held in cash across wealth tiers, reflecting a strong preference for wealth preservation and flexibility to cover expenses.

- Generational shift: Millennials allocate 20% to alternatives, well above Baby Boomers at 6% and Gen X at 11%, driven by performance and access to innovation and unique opportunities.

- Advice gap: only 41% of advised clients have discussed alternatives with their advisors.

Alternative allocations rise with wealth

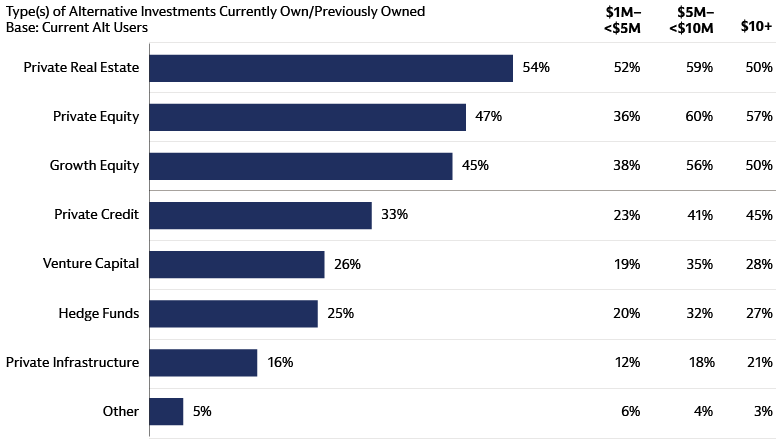

Adoption of alternatives rises sharply with higher net worth: 39% of investors with $1–5 million report using alternatives, rising to 63% for households with $5–10 million, 80% for investors with over $10 million, and 91% for those above $20 million. Private real estate is most used by individuals with under $5 million in investable assets; above $5 million usage often broadens to also include private equity, growth equity, and other alternatives. Despite more than half (56%) of individual investors generally labeling alternatives as “high risk” performance (46%) and diversification (34%) are the primary drivers for those currently invested in or considering investing in alternatives, suggesting these concerns often diminish with experience. Individuals already investing in alternatives rate them as less risky than those with no exposure (39% of those already invested in alternatives vs 73% of those reporting no investment in alternatives).

Cash holdings remain significant

Wealthy households consistently maintain high cash balances, averaging 20% of net worth across tiers. This reflects disciplined spending habits (95% of investors save monthly, averaging 18% of income) and a preference for preserving wealth (48%) and flexibility to maintain lifestyle and spending (46%). Cash provides liquidity to cover taxes and home costs, which represent the two largest annual expenses.

Generational differences

Millennials show greater familiarity and allocation to alternatives than older generations. Ninety-six percent of Millennials report familiarity, and they report high levels of interest in and allocation to alternatives, motivated by investment performance and access to innovation and unique opportunities more so than diversification. Millennials allocate 20% to alternatives, compared with 11% for Gen X and 6% for Baby Boomers, while committing just 27% to public equities compared with 43% and 48% for Gen X and Baby Boomers, respectively.

Advisor gap

Of the investors surveyed, 80% used at least one financial advisor. Despite managing on average 59% of investor wealth, financial advisors seldom address alternatives in conversations with clients. Only 41% of advised investors have discussed private markets with an advisor, compared with far higher engagement on ETFs (60%) and tax strategies (69%). Financial advisors are not the main source of information on alternatives. Millennials cite social media, while Baby Boomers rely on traditional financial media as a source of information on alternatives. Brand trust also matters: 86% of investors say they would be more comfortable using alternatives from a financial institution they know.

“Evolving product structures such as evergreen and open-end funds are lowering barriers to private markets,” said Kyle Kniffen, Global Head of Alternatives for Third Party Wealth at Goldman Sachs Asset Management. “Education is essential as these strategies take a more central role in wealth portfolios. Through Goldman Sachs Investment University, we’re equipping investors and advisors with the knowledge to make informed decisions and build resilient portfolios for the future.”

“At Goldman Sachs, we see tremendous opportunity to partner with clients and their advisors to design solutions that help unlock access to private markets,” added Kristin Olson. “This is about reshaping wealth portfolios for the next generation.”

About the Survey

Observations in this report are based on a survey of 1,000 US-based high-net-worth (+$1 million of investable assets) and UHNW investors (+$30 million of investable assets), conducted by Goldman Sachs Asset Management and 8 Acre Perspective. The data collection phase for this survey took place between July 18 and August 8, 2025. Participants were selected from a national US consumer sample, meeting specific qualifying criteria: possessing over $1 million in investable assets, serving as the primary financial decision-maker for their household, and being aged 25 or older. All exhibits in this report are based on survey responses.

About Goldman Sachs Asset Management

Goldman Sachs Asset Management is the primary investing area within Goldman Sachs, delivering investment and advisory services across public and private markets for the world’s leading institutions, financial advisors, and individuals. The business is driven by a focus on partnership and shared success with its clients, seeking to deliver long-term investment performance drawing on its global network and deep expertise across industries and markets. Goldman Sachs Asset Management is a leading investor across fixed income, liquidity, equity, alternatives, and multi-asset solutions. Goldman Sachs oversees approximately $3.3 trillion in assets under supervision as of June 30, 2025. Follow us on LinkedIn.

About Goldman Sachs Alternatives

Goldman Sachs Alternatives is one of the leading investors globally, with approximately $540 billion in assets and more than 30 years of experience. The business invests in the full spectrum of alternatives including private equity, growth equity, private credit, real estate, infrastructure, sustainability, and hedge funds. Clients access these solutions through direct strategies, customized partnerships, and open-architecture programs. The business is driven by a focus on partnership and shared success with its clients, seeking to deliver long-term investment performance drawing on its global network and deep expertise across industries and markets.