Public Pension Quarterly 3Q 2024: Small Caps: Big Comebacks

Quarterly Snapshot

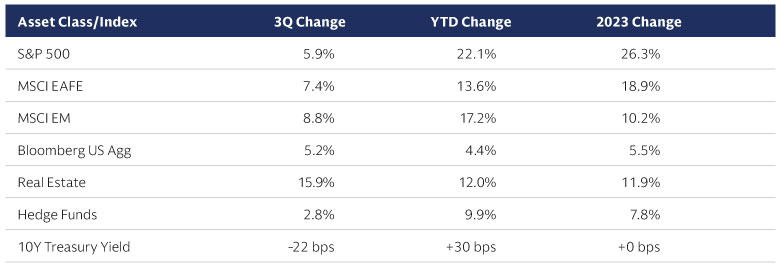

Source: MSCI, Bloomberg, and Goldman Sachs Asset Management. As of September 30, 2024.

- In the third quarter, global equity markets continued their rally, with emerging markets showing pronounced gains primarily due to the announcement of policy updates and stimulus measures in China.

- The Federal Reserve (Fed) announced a 50-bps rate cut in September on the back of cooled inflation data. The cut and expectations of faster monetary policy easing by the Fed potentially led to US Treasury yields falling substantially and real estate significantly outperforming other asset classes over the quarter.

- Global elections and geopolitical risks have continued to be topical, potentially driving more volatility in the coming months.

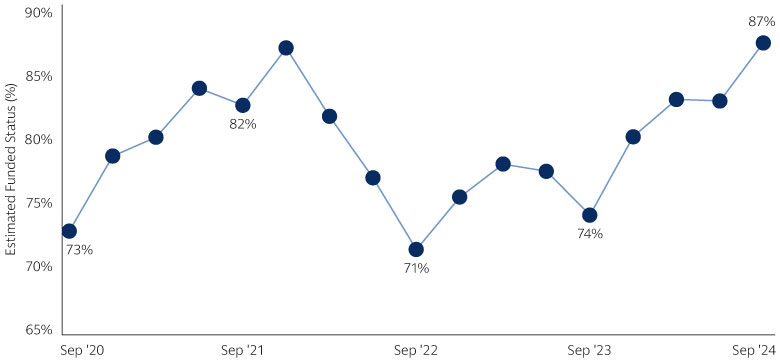

Source: Boston College Center for Retirement Research and Goldman Sachs Asset Management. As of June 30, 2024. Funded status reflects estimated asset returns and liability growth.

- We estimate that investment returns for public pension plans were 6.8% in the past quarter, which contributed to our estimated aggregate funded status rising to 87%.

- Strong asset returns over the past few quarters have driven our estimate of the public pension system funded status back to its highest mark since year-end 2021.

Source: MSCI, Goldman Sachs Global Investment Research, and Goldman Sachs Asset Management. As of September 30, 2024. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation.

In The News

Pension Industry Updates

Nasdaq Publishes Research on Public Pension Fee Savings

- In a recent report, Nasdaq eVestment presented key findings on the fees and dispersion of fees that public pension plans pay for similar strategies in the public market, broken down by mandate size and cost basis.

- For example, the report cites that the highest possible cost-savings identified in S&P 500 Index strategies came at the $250 million mandate size, as a 3.5 bps fee difference may yield $87.5k in potential savings on a single mandate.

- Factors that may contribute to the dispersion in fees paid include consultant selection, manager relationship-building, and difference in research capabilities amongst investors.

- The report further hypothesizes that many plans invested in passive index strategies several years ago have not revisited fee terms in the proceeding year. Hence, there may be opportunities for investors to renegotiate and obtain fee savings without having to switch their service providers.

Observations on the US Election Results

- The Republican party led by Donald Trump won the White House, Senate, and the House of Representatives in the latest US elections.

- The market now awaits the potential implications of legislative changes under a second Trump administration. Key focuses for the Republicans starting January of next year may include modest fiscal expansion, increased tariffs (mainly on China), and lowering net immigration levels.

- In the equity market, a pro-domestic growth environment may benefit sectors such as financials, cryptocurrency and digital assets, traditional energy, as well as small caps. However, uncertainty around fiscal policy and inflation concerns may continue to drive market volatility higher.

- For the bond market, potential impacts from the election results may include sell-offs in the near term due to fears of increased deficits and a marginally higher inflation outlook.

Notable Pension Asset Allocation Updates

- In October, New York State Teachers’ Retirement System (NYSTRS) reported an 11.4% net investment return for FY 2024. The board reported that domestic equity and real estate equity were the best and worst performing asset categories, respectively. The plan ended the year with a total of $145.8 billion in assets and an estimated funded ratio of 101% based on market value of assets.

- The board also approved the creation of an internally managed passive international equities strategy that would be funded incrementally between 2024 and 2028. The strategy was established with the goal to reduce manager concentration, provide NYSTRS with operational benefits, and further enhance staff expertise and capabilities.

- Teacher Retirement System of Texas (TRS) recently completed an asset allocation study in October, and the board approved a new target allocation that would lower the target to private equity to 12% from 14%. In the update, the board approved a dedicated 6% target to real government bonds (including TIPS) at the expense of nominal government bonds. Other updates included structural changes in public equity and lower risk parity allocations.

- In September, Colorado Public Employees’ Retirement Association (PERA) conducted an asset-liability study and approved a change in target asset allocation. As part of the update, the plan increased targets to private equity, private debt, and real assets at the expense of public equities, hedge funds, and opportunistic investments.

Portfolio updates highlighted here represent actions taken by large public plan sponsors that we believe would be of interest to readers. 1. US equity uses Russell 3000 index. Source: Nasdaq eVestment, Goldman Sachs Asset Management, and news releases. As of November 2024. Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or its securities. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation. There is no guarantee that objectives will be met. Past performance does not predict future returns and does not guarantee future results, which may vary.

Portfolio Manager Perspectives: Greg Tuorto

Recent election outcomes and market rotation have brought small caps back in the spotlight. Greg Tuorto, a portfolio manager focused on the small and smid (small-mid) cap growth and core strategies within the Goldman Sachs Asset Management Fundamental Equity group, shares his views on the topic.

What have been some of the drivers behind increased institutional investor interest in small cap equity?

Small caps have been overlooked and under-allocated for quite a few years now. We have seen investors on the sidelines who are starting to leg in. While over the past couple of years, inflation, rising rates, and a focus on mega-cap leaders proved to be headwinds for small cap equity performance, more recently the backdrop has turned more favorable. With the economy on solid footing, decelerating inflation, and the onset of a Fed interest rate easing cycle beginning to relieve pressure on small cap balance sheets, we have started to witness a much better prospective earnings picture emerge for small caps heading into 2025. The election was another catalyst for the surge in small cap interest as many investors view small cap stocks as a potential “Trump trade,” as a way to gain exposure to domestically oriented stocks benefitting from a domestic focused administration, in an environment of solid GDP growth, stable employment, and M&A and IPOs potentially coming back.

How would a small cap equity strategy fit into a public pension plan’s portfolio?

For many public pension plans, investment returns represent their main sources of revenue. A small cap equity strategy may play a role in providing a source of liquid investment returns in the pension portfolio while offering some diversification away from a highly concentrated equity market with outsized exposure to mega-cap companies.

Public pension plans may work with their asset managers and consultants to set up an appropriate benchmark for these small cap strategies, which oftentimes are implemented in an active approach as opposed to passive in our experience.

How can an active approach in small cap investing help navigate risk and capture alpha at the same time?

The small cap asset class, in our view, is the most inefficient we’ve seen it in almost two decades, which prompts a great opportunity for an active approach. One unique aspect of small caps is the lack of analyst coverage relative to large caps. The average large cap name has over 3x the number of covering analysts than the average small cap name, so there is less published research out there surrounding small caps, placing heightened importance on proprietary research and stock selection. Furthermore, the greater return dispersion, M&A activity, and the law of small numbers play to the inefficiency of the asset class as well as the opportunity to add alpha and compound value over long periods of time. A higher quality, forward looking approach can also avoid many of the pitfalls of flawed small cap indices, including more volatile, unproven, and unprofitable companies.

What is your team’s view on small cap equity going forward?

We are excited about the set-up for small caps going forward. There have been a number of tailwinds for small caps that have been ignored over the last couple of years as we’ve waited for rate certainty and a clearer picture of whether we were going to get a soft landing. Additionally, we believe the election results and new administration’s domestic focus could be a tailwind for US equities, especially small cap stocks given the more domestic nature of the asset class. The reduction in political uncertainty is a potential risk clearing event that could promote a catchup trade for US small caps as markets could reflect further risk-taking, underpinned by increased CEO confidence. The external catalysts of M&A and a potentially busier IPO calendar could ignite small caps as they often do with animal spirits – and as the multiples in many public small cap companies are very low, this could be an exogenous multiple expansion opportunity. While we are still in the early days in terms of how policy will ultimately unfold, the prospects of regulatory changes and tax reform could provide further support. On the other hand, we are watching bond yields closely as the counterbalance. Overall, the set-up for small caps has been tipped into favor in a large way, in our view.

Source: Goldman Sachs Asset Management. As of November 2024. For discussion purposes only. The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk. Please see additional disclosures at the end of this presentation. The views and opinions expressed may differ from those of Goldman Sachs Asset Management or other departments or divisions of Goldman Sachs and its affiliates. Please see additional disclosures at the back of this report. Diversification does not protect an investor from market risk and does not ensure a profit. There is no guarantee that objectives will be met. Past performance does not predict future returns and does not guarantee future results, which may vary.

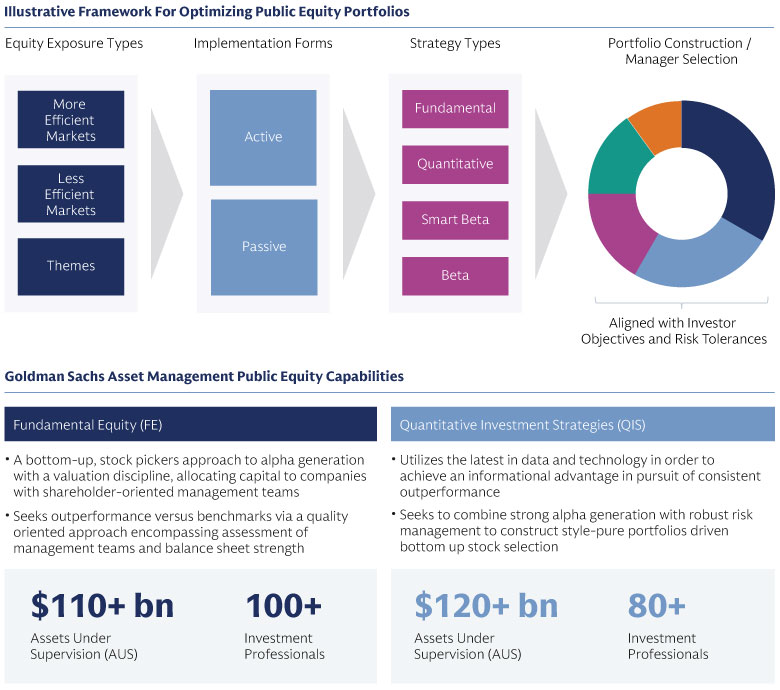

Strategy In Focus: Goldman Sachs Asset Management Equity Platform

We seek to offer a platform of fundamental and quantitative approaches to equity investing. Using strategies that span investment styles, regions, and market caps, we leverage intellectual capital across our global platform, local insights, deep expertise, and focused research.

Source: Goldman Sachs Asset Management as of September 30, 2024. Assets Under Supervision (AUS) includes assets under management and other client assets for which Goldman Sachs does not have full discretion. Note: The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk. De-risking strategies should not be construed as providing any assurance or guarantee that as a result of applying the strategy an investor will reduce and/or eliminate risk, as there are many factors that may impact end results such as interest rates, credit risk and other market risks. For Illustrative Purposes Only. There is no guarantee that these objectives will be met.

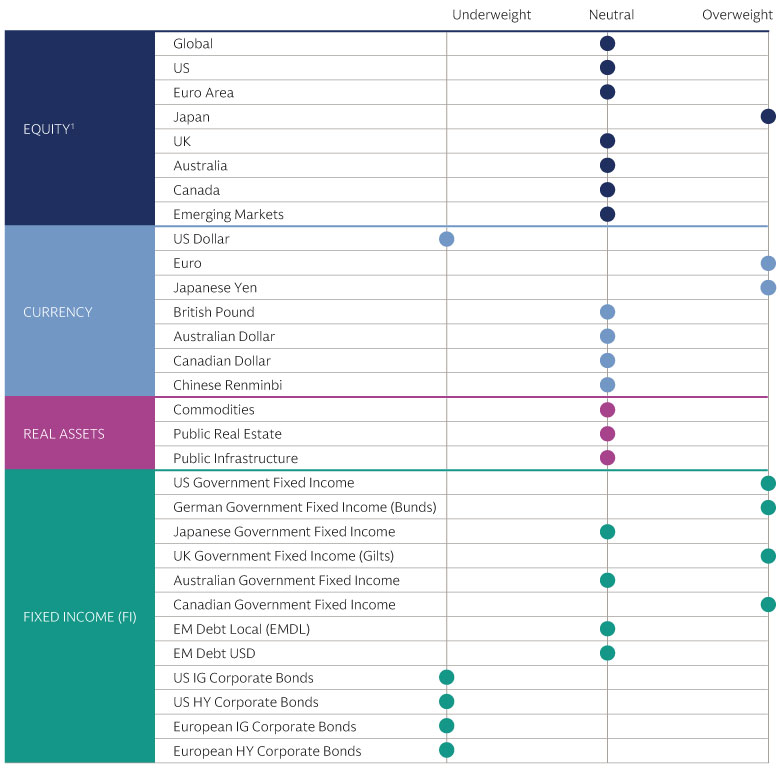

Asset Class Views

Source: Goldman Sachs Asset Management Multi-Asset Solutions. As of November 2024. Views typically reflect a six to twelve month forward investing time horizon. Views expressed are for informational purposes only and do not constitute a recommendation to buy, sell, or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change, they should not be construed as investment advice. The economic and market forecasts presented herein have been generated for informational purposes as of the date of this presentation. They are based on proprietary models and there can be no assurance that the forecasts will be achieved. Please see additional disclosures. For illustrative purposes only. 1. Views on Global Equity are absolute whereas regional / country-specific views are relative to Global Equity.