Corporate Pension Monthly

GS Retirement & Investment Solutions clients and prospects may review this monthly publication to stay up-to-date on the current investing and regulatory environment. For months that fall on quarter end, please refer to our Corporate Pension Quarterly.

Monthly Report - November 2024

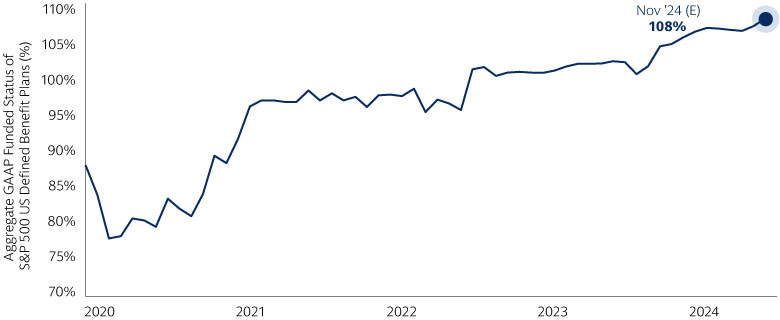

In the most recent Corporate Pension Monthly, we discuss our latest estimate of aggregate corporate defined benefit (DB) funded status, highlights from the Pension Benefit Guaranty Corporation (PBGC) annual report, and updates from Eastman Kodak.

Risk Considerations

All investing involves risk.

Investments in fixed-income securities are subject to credit and interest rate risks. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline in the bond’s price. Although Treasuries are considered free from credit risk, they are subject to interest rate risk, which may cause the underlying value of the security to fluctuate.

High-yield, lower-rated securities involve greater price volatility and present greater credit risks than higher-rated fixed income securities.

Emerging markets securities may be less liquid and more volatile and are subject to a number of additional risks, including but not limited to currency fluctuations and political instability.

Equity securities are more volatile than bonds and subject to greater risks.

Equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Different investment styles (e.g., “growth” and “value”) tend to shift in and out of favor, and, at times, the strategy may underperform other strategies that invest in similar asset classes. The market capitalization of a company may also involve greater risks (e.g. "small" or "mid" cap companies) than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements, in addition to lower liquidity.

International securities may be more volatile and less liquid and are subject to the risks of adverse economic or political developments. International securities are subject to greater risk of loss as a result of, but not limited to, the following: inadequate regulations, volatile securities markets, adverse exchange rates, and social, political, military, regulatory, economic or environmental developments, or natural disasters.

General Disclosures

This material is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. This material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon the client’s investment objectives.

THESE MATERIALS ARE PROVIDED SOLELY ON THE BASIS THAT THEY WILL NOT CONSTITUTE INVESTMENT ADVICE AND WILL NOT FORM A PRIMARY BASIS FOR ANY PERSON'S OR PLAN'S INVESTMENT DECISIONS, AND GOLDMAN SACHS IS NOT A FIDUCIARY WITH RESPECT TO ANY PERSON OR PLAN BY REASON OF PROVIDING THE MATERIAL OR CONTENT HEREIN. PLAN FIDUCIARIES SHOULD CONSIDER THEIR OWN CIRCUMSTANCES IN ASSESSING ANY POTENTIAL INVESTMENT COURSE OF ACTION.

Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur.

THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO. This material is provided for informational purposes only. It is not an offer or solicitation to buy or sell any securities.

Prospective investors should inform themselves as to any applicable legal requirements and taxation and exchange control regulations in the countries of their citizenship, residence or domicile which might be relevant.

Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or its securities. It should not be assumed that investment decisions made in the future will be profitable or will equal the performance of the securities discussed in this document.

Goldman Sachs does not provide legal, tax or accounting advice, unless explicitly agreed between you and Goldman Sachs (generally through certain services offered only to clients of Private Wealth Management). Any statement contained in this presentation concerning U.S. tax matters is not intended or written to be used and cannot be used for the purpose of avoiding penalties imposed on the relevant taxpayer. Notwithstanding anything in this document to the contrary, and except as required to enable compliance with applicable securities law, you may disclose to any person the US federal and state income tax treatment and tax structure of the transaction and all materials of any kind (including tax opinions and other tax analyses) that are provided to you relating to such tax treatment and tax structure, without Goldman Sachs imposing any limitation of any kind. Investors should be aware that a determination of the tax consequences to them should take into account their specific circumstances and that the tax law is subject to change in the future or retroactively and investors are strongly urged to consult with their own tax advisor regarding any potential strategy, investment or transaction.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Goldman Sachs Asset Management to buy, sell, or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change, they should not be construed as investment advice. Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources.

Economic and market forecasts presented herein reflect a series of assumptions and judgments as of the date of this presentation and are subject to change without notice. These forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. Goldman Sachs has no obligation to provide updates or changes to these forecasts. Case studies and examples are for illustrative purposes only.

Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources.

United Kingdom: In the United Kingdom, this material is a financial promotion and has been approved by Goldman Sachs Asset Management International, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority.

European Economic Area (EEA): This marketing communication is disseminated by Goldman Sachs Asset Management B.V., including through its branches (“GSAM BV”). GSAM BV is authorised and regulated by the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten, Vijzelgracht 50, 1017 HS Amsterdam, The Netherlands) as an alternative investment fund manager (“AIFM”) as well as a manager of undertakings for collective investment in transferable securities (“UCITS”). Under its licence as an AIFM, the Manager is authorized to provide the investment services of reception and transmission of orders in financial instruments; (ii) portfolio management; and (iii) investment advice. Under its licence as a manager of UCITS, the Manager is authorized to provide the investment services of portfolio management; and (ii) investment advice. Information about investor rights and collective redress mechanisms are available on www.gsam.com/responsible-investing (section Policies & Governance). Capital is at risk. Any claims arising out of or in connection with the terms and conditions of this disclaimer are governed by Dutch law. In the European Union, this material has been approved by either Goldman Sachs Asset Management Funds Services Limited, which is regulated by the Central Bank of Ireland or Goldman Sachs Asset Management B.V, which is regulated by The Netherlands Authority for the Financial Markets (AFM).

Switzerland: For Qualified Investor use only – Not for distribution to general public. This is marketing material. This document is provided to you by Goldman Sachs Asset Management Schweiz Gmbh. Any future contractual relationships will be entered into with affiliates of Goldman Sachs Asset Management Schweiz Gmbh, which are domiciled outside of Switzerland. We would like to remind you that foreign (Non-Swiss) legal and regulatory systems may not provide the same level of protection in relation to client confidentiality and data protection as offered to you by Swiss law.

Asia excluding Japan: Please note that neither Goldman Sachs Asset Management (Hong Kong) Limited (“GSAMHK”) or Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H ) (“GSAMS”) nor any other entities involved in the Goldman Sachs Asset Management business that provide this material and information maintain any licenses, authorizations or registrations in Asia (other than Japan), except that it conducts businesses (subject to applicable local regulations) in and from the following jurisdictions: Hong Kong, Singapore, India and China. This material has been issued for use in or from Hong Kong by Goldman Sachs Asset Management (Hong Kong) Limited and in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H).

Australia: This material is distributed by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (‘GSAMA’) and is intended for viewing only by wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth). This document may not be distributed to retail clients in Australia (as that term is defined in the Corporations Act 2001 (Cth)) or to the general public. This document may not be reproduced or distributed to any person without the prior consent of GSAMA. To the extent that this document contains any statement which may be considered to be financial product advice in Australia under the Corporations Act 2001 (Cth), that advice is intended to be given to the intended recipient of this document only, being a wholesale client for the purposes of the Corporations Act 2001 (Cth). Any advice provided in this document is provided by either of the following entities. They are exempt from the requirement to hold an Australian financial services licence under the Corporations Act of Australia and therefore do not hold any Australian Financial Services Licences, and are regulated under their respective laws applicable to their jurisdictions, which differ from Australian laws. Any financial services given to any person by these entities by distributing this document in Australia are provided to such persons pursuant to the respective ASIC Class Orders and ASIC Instrument mentioned below.

• Goldman Sachs Asset Management, LP (GSAMLP), Goldman Sachs & Co. LLC (GSCo), pursuant ASIC Class Order 03/1100; regulated by the US Securities and Exchange Commission under US laws.

• Goldman Sachs Asset Management International (GSAMI), Goldman Sachs International (GSI), pursuant to ASIC Class Order 03/1099; regulated by the Financial Conduct Authority; GSI is also authorized by the Prudential Regulation Authority, and both entities are under UK laws.

• Goldman Sachs Asset Management (Singapore) Pte. Ltd. (GSAMS), pursuant to ASIC Class Order 03/1102; regulated by the Monetary Authority of Singapore under Singaporean laws

• Goldman Sachs Asset Management (Hong Kong) Limited (GSAMHK), pursuant to ASIC Class Order 03/1103 and Goldman Sachs (Asia) LLC (GSALLC), pursuant to ASIC Instrument 04/0250; regulated by the Securities and Futures Commission of Hong Kong under Hong Kong law

No offer to acquire any interest in a fund or a financial product is being made to you in this document. If the interests or financial products do become available in the future, the offer may be arranged by GSAMA in accordance with section 911A(2)(b) of the Corporations Act. GSAMA holds Australian Financial Services Licence No. 228948. Any offer will only be made in circumstances where disclosure is not required under Part 6D.2 of the Corporations Act or a product disclosure statement is not required to be given under Part 7.9 of the Corporations Act (as relevant).

Canada: This presentation has been communicated in Canada by GSAM LP, which is registered as a portfolio manager under securities legislation in all provinces of Canada and as a commodity trading manager under the commodity futures legislation of Ontario and as a derivatives adviser under the derivatives legislation of Quebec. GSAM LP is not registered to provide investment advisory or portfolio management services in respect of exchange-traded futures or options contracts in Manitoba and is not offering to provide such investment advisory or portfolio management services in Manitoba by delivery of this material.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law (“FIEL”). Also, Any description regarding investment strategies on collective investment scheme under Article 2 paragraph (2) item 5 or item 6 of FIEL has been approved only for Qualified Institutional Investors defined in Article 10 of Cabinet Office Ordinance of Definitions under Article 2 of FIEL.

Index Benchmarks

Indices are unmanaged. The figures for the index reflect the reinvestment of all income or dividends, as applicable, but do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices. The indices referenced herein have been selected because they are well known, easily recognized by investors, and reflect those indices that the Investment Manager believes, in part based on industry practice, provide a suitable benchmark against which to evaluate the investment or broader market described herein.

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by Goldman Sachs Asset Management and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR). It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. The views and opinions expressed may differ from those of Goldman Sachs Global Investment Research or other departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and Goldman Sachs Asset Management has no obligation to provide any updates or changes.

The Bloomberg US Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including US Treasuries, investment grade corporate bonds, and mortgage backed and asset-backed securities.

The Bloomberg US Corporate Investment Grade Index includes publicly issued US corporate and specified foreign debentures and secured notes.

The Constant Maturity US Treasury Index is an index published by the Federal Reserve Board that represents the average yield of a range of Treasury securities, adjusted to the equivalent maturity Treasury.

The Dow Jones Global Select Real Estate Securities Index (RESI) tracks the performance of equity real estate investment trusts (REITs) and real estate operating companies (REOCs) traded globally. The index is designed to serve as a proxy for direct real estate investment, in part by excluding companies whose performance may be driven by factors other than the value of real estate.

The iShares 10+ Year Investment Grade Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated investment-grade corporate bonds with remaining maturities greater than ten years.

The iShares 20+ Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years.

The iShares iBoxx $ High Yield Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, high yield corporate bonds.

The MSCI All Country World Index (ACWI) ex US captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries.

The MSCI EAFE Index is a market capitalization weighted composite of securities in 21 developed markets.

The ProShares Hedge Replication ETF (HDG) tracks an index that uses long and short exposure to equity, Treasury and currency indexes, and individual securities to mimic the returns of a broad hedge fund index.

The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

The S&P 500 Index is the Standard & Poor's 500 Composite Stock Prices Index of 500 stocks, an unmanaged index of common stock prices.

The US Treasury Bond is a debt obligation backed by the United States government and its interest payments are exempt from state and local taxes. However, interest payments are not exempt from federal taxes.

Confidentiality

No part of this material may, without Goldman Sachs Asset Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.