APAC Alternatives Summit 2025: Key Takeaways

At the Goldman Sachs Asset Management APAC Alternatives Summit 2025, Marc Nachman, global head of Asset and Wealth Management highlighted that the private secondaries market could present a strong ‘secular growth opportunity’. He expects secondaries to grow at a much faster pace than the primary market and occupy a larger portion of the total alternatives universe. The pivot to secondaries is happening as investors seek to rebalance portfolios to address liquidity needs amongst other reasons.

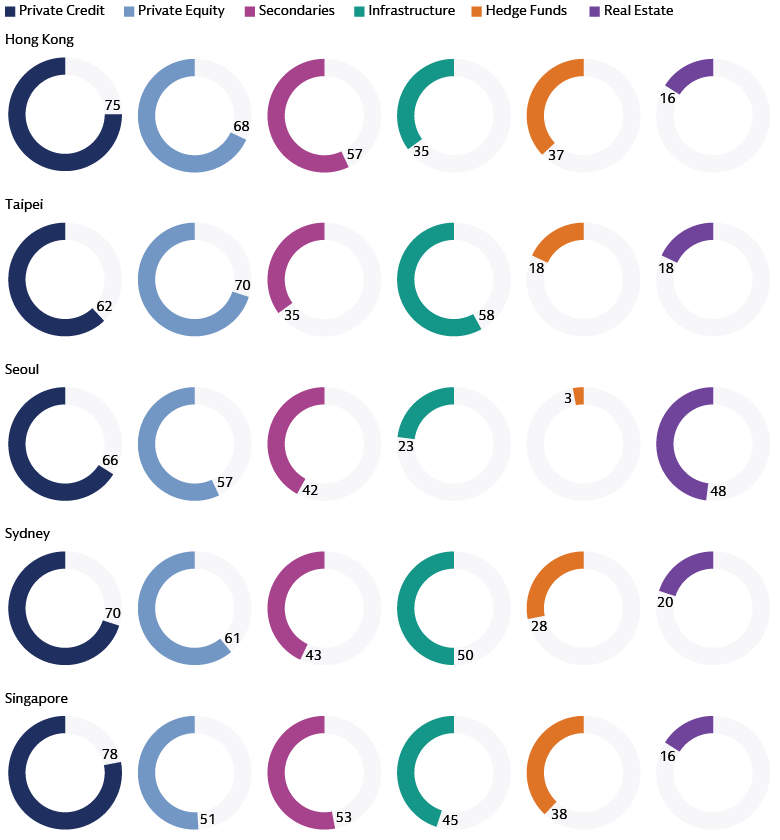

Across the Summit in Hong Kong, Taipei, Seoul, Sydney and Singapore, participants unanimously voted private credit as the top asset class to deploy capital to.

This aligns with Matt Gibson’s, global head of Client Solutions Group observation that “most client conversations start and end with private credit these days, but we still find most investors are under-allocated here”.

As the global momentum for M&A activities picks up in 2025, corporates and sponsors may continue to turn to private credit for funding. We expect opportunities across the broad spectrum of private credit strategies to benefit.

The interest in private credit is also expanding geographically, with a notable focus on Asia. Speakers at the Summit discussed the potential opportunities in the region’s maturing market, which may offer new avenues for direct lending in key growth areas. Matt also reminded investors that “irrespective of the market environment, private market investments have the potential to deliver on investment needs across the cycle, and should have a place in portfolios.”