Private Markets: A New Frontier for Retirement Savings

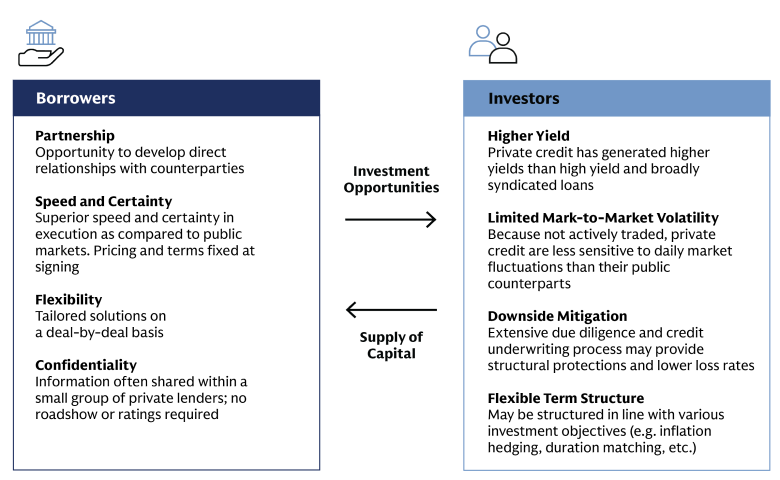

Private-market financing has significantly impacted the investment landscape over the past decade. In major markets around the world, stricter regulations in the aftermath of the global financial crisis (Volcker Rule, Basel III) have made lending activities more challenging and expensive for banks. As a result, banks have retreated from some lending, particularly to smaller and mid-sized companies. Non-bank lenders have stepped in to help meet demand, and in so doing they have profoundly altered how businesses choose to fund innovation, growth, and long-term strategies. More borrowers have been turning to private financing, drawn by the custom nature of solutions and a partnership approach between borrower and lender.

On the equity side, increased regulation of public companies has also contributed to businesses seeking out private financing. Pressure to meet quarterly earnings targets can lead to a short-term focus on immediate profitability rather than long-term growth and innovation. Scrutiny from regulators, analysts, and the media is compounded by having to contend with activist investors who may seek to influence management decisions, demand strategy changes, or even force a sale of the company.

These dynamics have made private financing choices more attractive for many companies. Private market investors across credit, equity, and real assets have expanded their offerings to provide diverse financing options tailored to the needs of companies seeking to fund growth, innovation, and other long-term goals.

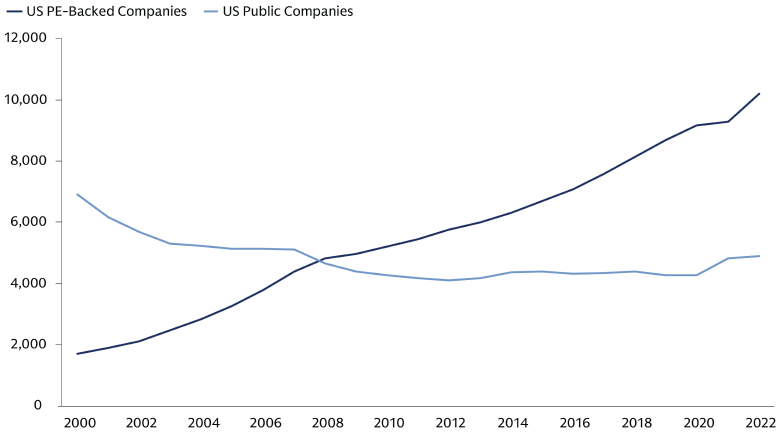

The increased depth of private markets has enabled the financing of larger companies, expanding the choice between public and private ownership to more companies. The growing number of privately financed companies reflects the trend of more companies choosing the private route, despite what may be a higher cost of capital, expanding opportunities for private capital investors. This expanding opportunity set has implications for defined-contribution pension plans.

Source: PitchBook (US PE-Backed Companies over time) as of December 31, 2022 (latest available). World Bank and McKinsey (US Public Companies over time).

Benefits of the private ownership model

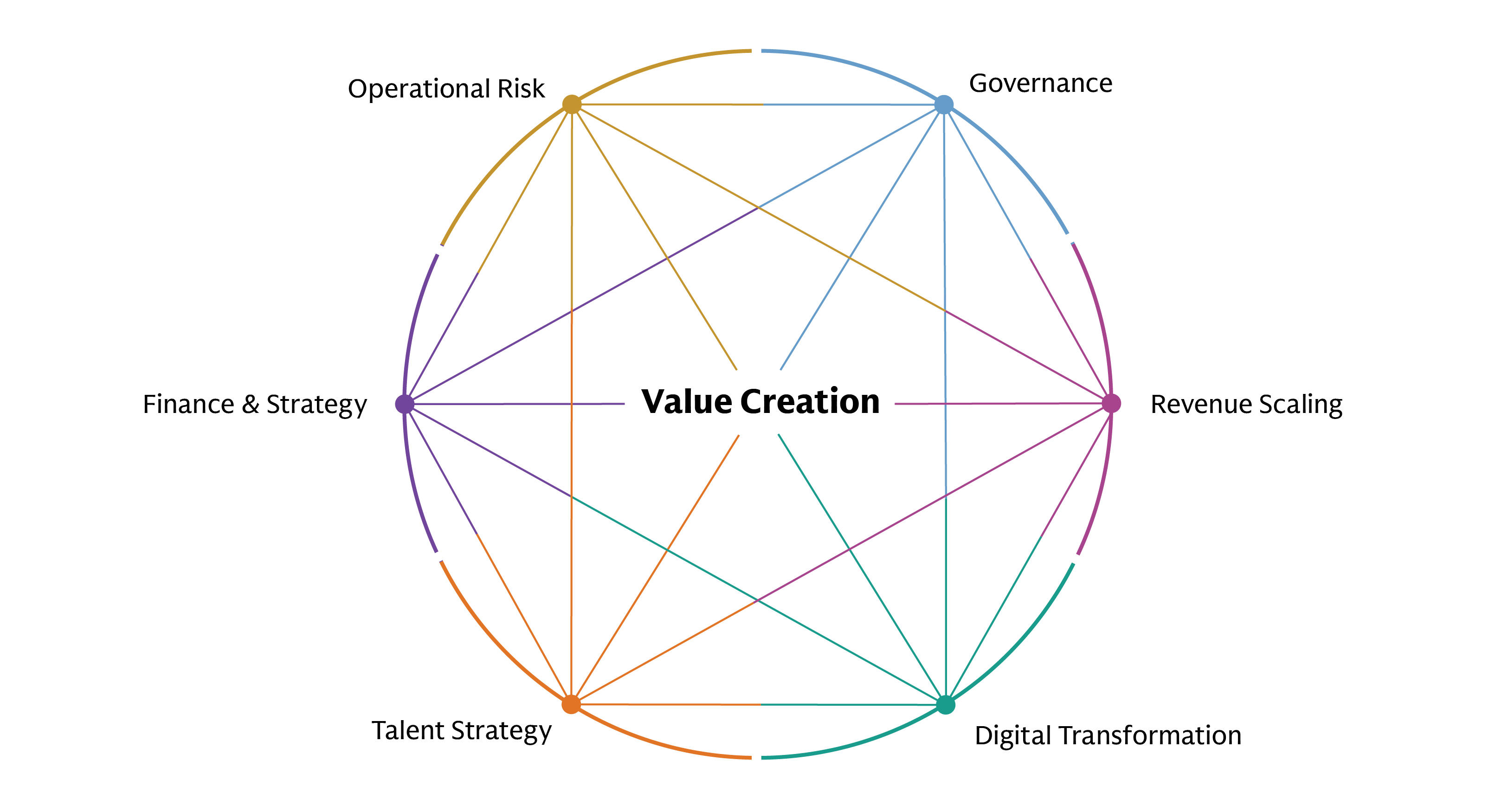

A key differentiator between private and public market financing options is that private market investors can offer a more tightly integrated partnership approach to drive value creation throughout the stages of the financing lifecycle. The challenges facing companies today are remarkably complex and span talent management, supply chain strategy, technology integration, geopolitics, and many more. Being able to navigate, develop, and execute on a business strategy that accounts for these pressures is paramount for successful growth.

Value creation is an important consideration for companies seeking financing and some private market investors provide their portfolio businesses with access to in-house business strategists across multiple dimensions. Experienced managers typically have extensive expertise in everything from growing and scaling businesses, to improving strategy and operations, to integrating technology for growth and efficiency. To that end, private market investors are often active owners, and given they have a more concentrated ownership of their companies compared to public equity managers, they can partner more closely and ensure their efforts are aligned with the long-term success of the business. We believe this expertise is more important than ever in today’s environment with emphasis on resiliency, agility, and innovation.

A significant portion of value appreciation now transpires within the private market before an Initial Public Offering (IPO), effectively excluding a substantial segment of the investor population from these opportunities. This phenomenon contributes to a concentration of innovation and wealth creation within the private market ecosystem, raising questions about market accessibility.

Source: Goldman Sachs Asset Management as of April 2025. For illustrative purposes only.

Academic perspective

A recent study1 views a company’s private vs. public ownership decision as value maximization: a tradeoff between more efficient governance (which favors private ownership) and the financial cost of capital (which is generally cheaper in public markets).

The authors find that all other things being equal, smaller companies tend to benefit from private ownership while larger ones tend to benefit from public ownership. However, after controlling for size, they find that private ownership is advantageous for firms with complex operating strategies and ones needing to grow and change at the expense of current profitability – for these firms, the governance efficiency outweighs the cost of capital considerations.

Firms whose strategy is clear, easily understandable, and easy to execute benefit from public ownership – for these firms, the cost of capital considerations outweigh governance considerations.

The authors anticipate that private markets ownership models are likely to continue growing as long as gains from better governance exist and private markets are a sufficiently deep provider of capital.

Changing dynamics for credit financing

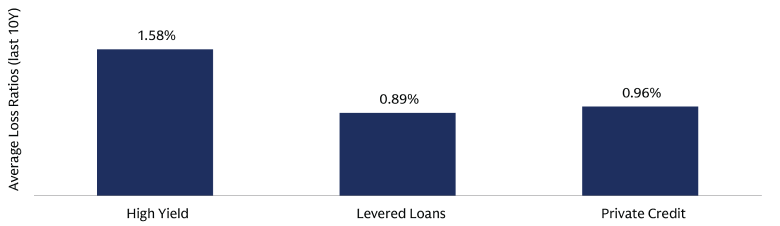

Private credit has higher historical returns than traditional public credit markets, so investors may wonder whether private credit is higher risk. A key measure of credit risk is loss ratio (i.e., the percentage of permanently lost invested capital). Private credit markets, in fact, have had loss ratios that are lower than in public credit markets. So how can returns be higher without higher losses? We believe private credit’s ability to command a higher cost of capital has been due to its general ability to provide (1) greater sophistication, flexibility, customization, speed, and certainty of execution, and (2) ability to manage complexity that may impede more traditional lenders.

Private credit lenders may offer customized debt structures, tailored to individual borrower needs, incorporating features like delayed drawdowns, bespoke covenants, and multi-currency loans

Private credit transactions can offer faster execution and avoid the uncertainty associated with the public syndication process.

The private nature of these transactions ensures confidentiality, protecting sensitive proprietary information.

At the same time, deep access to company records received by private lenders potentially enables stronger due diligence than in public markets.

Furthermore, private credit typically features a single entity or a small group lending to a borrower. This enables the use of customized protections that can mitigate losses and can make for quicker and more efficient negotiations — and potentially greater recovery — in case of default, compared to public debt that is typically more standardized and features multiple lenders with competing priorities.

Given the on average higher yield and similar, if not lower, loss ratio, investor interest in the private credit market has grown. As this market has expanded and matured, this has enabled private lenders to finance larger companies while seeking to maintain portfolio diversification parameters, and to develop innovative approaches to better meet borrower needs.

Source: Cliffwater. Private credit yield proxied by the Cliffwater direct lending index. Quarterly data as of 12/31/2023.

We believe private credit will continue to evolve in a complementary fashion to public credit markets, with larger borrowers who have more standardized needs preferring public financing options, with smaller borrowers or those with more complex needs, who can benefit more from a bespoke approach, preferring private credit.

Source: Goldman Sachs Asset Management as of April 2025. For illustrative purposes only.

Implications for investors

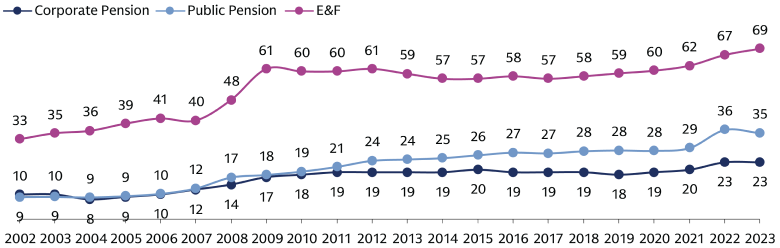

The historical strength of the private markets has long attracted institutional investors as they seek to augment investment returns and further diversify their investment portfolios. Over the last two decades, many large asset owners, such as corporate and public pension funds and endowments, have continued to increase their allocation to alternatives, seeking to capitalize on this trend.

Source: NACUBO-TIAA Study of Endowments (NTSE), Boston College Center for Retirement Research, and Goldman Sachs Asset Management. As of FY 2023. For E&F (Endowments & Foundations), the study features an analysis of the financial, investment, and governance policies and practices of the nation’s higher education endowments and affiliated foundations. The 2023 study reflects the responses of 688 institutions representing $839 billion in endowment assets and covers the fiscal year July 1, 2022, to June 30, 2023. Data reflects endowments with over $1 billion in assets prior to 2023 and endowments with over $5 billion in assets in 2023.

The increasing growth of private markets has highlighted a notable disparity in access these attractive opportunities. While private and public markets ideally function in a complementary manner, the recent shift has demonstrably limited the participation of retail investors, and those invested in defined contribution plans (such as 401(k) plans), in this growth segment of the market.

Now, product innovations are making private markets more accessible to new investor types.

Considerations for the defined contribution industry

Defined contribution plan sponsors have begun exploring how these asset classes can potentially help participants reach their retirement goals. As these markets have evolved, a key question is how this might be reflected to modernize investment portfolios. 401(k) savers are generally very long-term savers, some with a time horizon extending 30 years or more. At the same time, many savers struggle to save enough to meet their retirement goals and saving more is not always feasible. Should potentially higher-returning portfolios be considered?

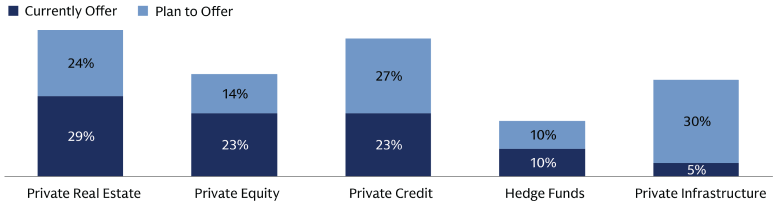

Innovations in evergreen strategies and interval funds continue to increase access to these asset classes. Additionally, collaborations and partnerships between public asset managers and private asset managers are building new solutions that can integrate public and private market strategies at the product level, rather than just at the asset allocation level.

We believe the growing interest in private market strategies and the collaborations between public and private market asset managers are major themes that will drive further change across private market asset classes.

A potential opportunity for plan sponsors is to consider how these assets may be able to be integrated into professionally-managed, multi-asset portfolios (i.e., target-date funds or managed account portfolios). With a professional manager at the helm, these strategies can broaden access to asset classes that generally are not available to individual investors, including in the growth and innovation economy, and enhance diversification.

Source: Cerulli Retirement Report as of 2024, latest available.

What’s next: Converging trends

Individuals continue to struggle to save and prepare for retirement as competing financial priorities make it difficult to balance all of life’s financial needs. The mantra to “save more” is easy to say, but hard to do for many. Enhancing investment returns may improve retirement outcomes for many who struggle. An additional 0.5% of annual return over the course of a career can reduce annual saving needs by 1.5%, illustrating the meaningful impact it can have on savings.

To that end, given the growth, maturation and comparatively strong historical performance of private market strategies, we continue to monitor the next phase of evolution to help clients position their portfolios for future market developments. In general, we believe the increasing supply of capital, the growing demand for private market financing, and the product innovation that allows these investments to be accessed by a wider range of investors will drive these trends forward.

1 Gregory Brown, Andrea Carnelli Dompé, and Sarah Kenyon, “Public or Private? Determining the Optimal Ownership Structure.” February 2020.