Goldman Sachs Premium Income ETFs

Differentiated access combining index exposure with an actively managed options strategy may offer lower volatility and a high level of consistent income.

Aims to generate a consistent monthly distribution rate generally from options premium and equity dividends.

Provides equity exposure to the S&P 500 Index (GPIX) and Nasdaq-100 Index (GPIQ), respectively, and dynamically sells call options, allowing for participation with rising markets and potential outperformance in negative to flat markets.

Seeks to deliver attractive income with a lower correlation to traditional income sources and their risks.

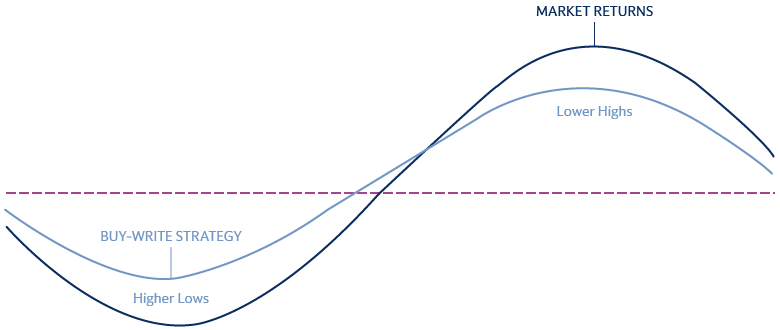

Capturing Income, Cushioning Downside

Goldman Sachs Premium Income ETFs invest in an index portfolio of stocks and write (sell) call options, seeking to generate premium income. Investors can participate in broad equity market growth but with lower highs and higher lows.

Source: Goldman Sachs Asset Management. For illustrative purposes only.

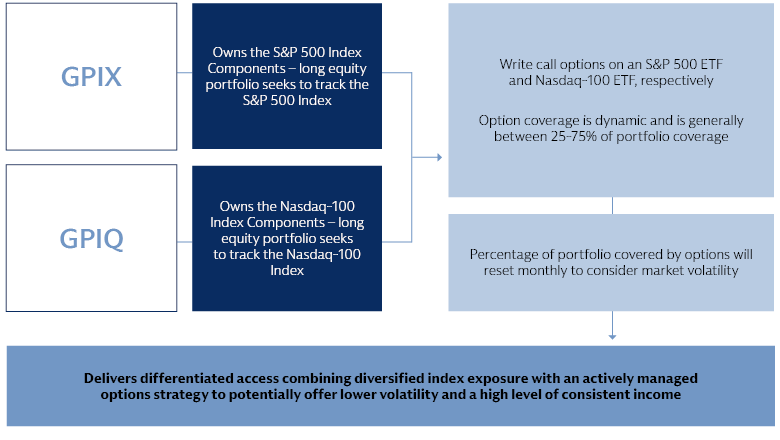

How Our Options Premium Income Strategy Works

At Goldman Sachs Asset Management, our actively managed options strategy dynamically adjusts coverage, seeking to maintain a consistent distribution rate.

Source: Goldman Sachs Asset Management. For illustrative purposes only.

There is no guarantee that objectives will be met. Your capital is at risk and you may lose some or all of the capital you invest.