Private Equity-like Returns with the Flexibility of an ETF

Seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the MSCI World Private Equity Return Tracker Index.

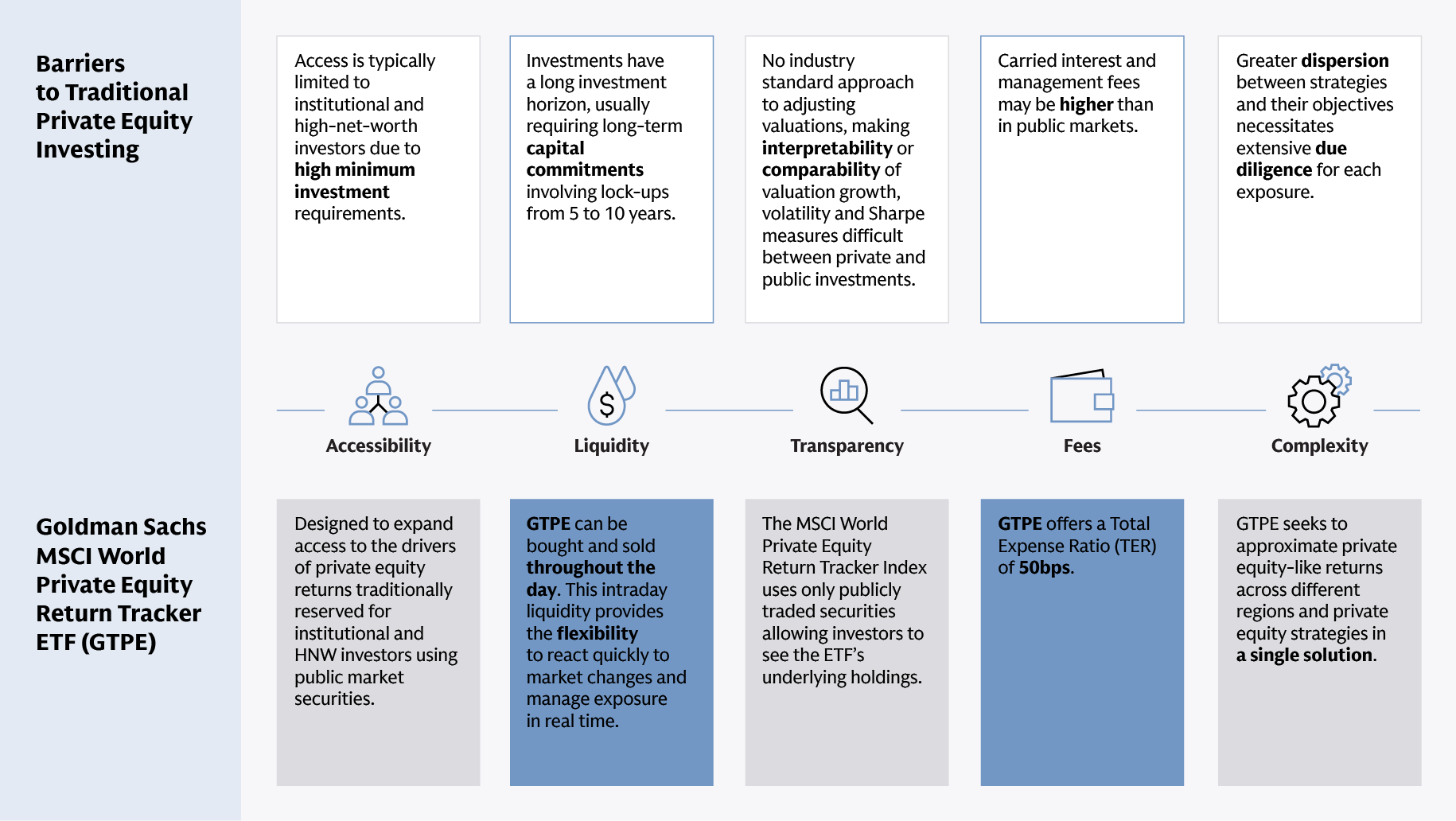

Provides a solution designed to approximate the long-term investment potential of the private equity asset class - with the liquidity, transparency and cost benefits of an ETF.

Seeks to generate private equity-like returns through a broad portfolio of public equities by tracking the MSCI World Private Equity Return Tracker Index.

The index leverages MSCI’s proprietary private company dataset – one of the world’s largest– to replicate the regional, sectoral, and stylistic exposures that represent private equity investments.

Expanding Access to Private Equity-Like Returns

Investors are looking for new ways to capture private equity return drivers with the transparency and efficiency of public markets. This new ETF bridges the gap - combining Goldman Sachs’ investment expertise with MSCI’s data driven innovation - seeking to deliver private equity-like returns in a liquid, index-based format.

For Illustrative purposes only. THE FUND DOES NOT INVEST IN PRIVATE EQUITY OR PRIVATE EQUITY VEHICLES OR FUNDS. Total Annual Fund Operating Expenses (%) Goldman Sachs MSCI World Private Equity Return Tracker ETF (GTPE) 0.50%, Please note the figure shown above is the unitary management fee. Under the management fee for Goldman Sachs MSCI World Private Equity Return Tracker ETF (GTPE), Goldman Sachs Asset Management LP., the Fund’s investment adviser, is responsible for paying substantially all the expenses of the Fund, excluding the payments under the Fund s 12b-1 plan (if any), interest expenses, taxes, acquired fund fees and expenses, brokerage fees, costs of holding shareholder meetings, litigation, indemnification and extraordinary expenses. Please refer to the Fund’s prospectus for the most recent expenses.For Illustrative purposes only. THE FUND DOES NOT INVEST IN PRIVATE EQUITY OR PRIVATE EQUITY VEHICLES OR FUNDS. Total Annual Fund Operating Expenses (%) Goldman Sachs MSCI World Private Equity Return Tracker ETF (GTPE) 0.50%, Please note the figure shown above is the unitary management fee. Under the management fee for Goldman Sachs MSCI World Private Equity Return Tracker ETF (GTPE), Goldman Sachs Asset Management LP., the Fund’s investment adviser, is responsible for paying substantially all the expenses of the Fund, excluding the payments under the Fund s 12b-1 plan (if any), interest expenses, taxes, acquired fund fees and expenses, brokerage fees, costs of holding shareholder meetings, litigation, indemnification and extraordinary expenses. Please refer to the Fund’s prospectus for the most recent expenses.

A Flexible Tool to Complement Existing Investments

GTPE seeks to provide a flexible, liquid solution for investors looking to add private equity-like exposure to their portfolios. Unlike traditional private equity, which requires long-term commitments and has limited redemption options, GTPE aims to deliver private equity-like returns with the liquidity and transparency of an ETF. This makes it an ideal bridge between illiquid private funds and liquid public market investments, offering a truly liquid component in an otherwise illiquid alternatives portfolio.

GTPE seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the MSCI World Private Equity Return Tracker Index (Net, USD, Unhedged), which seeks to approximate the returns of private equity investments by replicating region, sector and style exposures through investment in publicly listed equities. GTPE IS NOT A PRIVATE EQUITY FUND AND DOES NOT INVEST IN PRIVATE EQUIT Y OR PRIVATE EQUITY VEHICLES OR FUNDS.

Standardized Total Returns as of December 31, 2025: Since Inception (10/21/2025) at NAV: 5.18%/at Market Price: 5.14%. The returns represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our Web site at: am.gs.com to obtain the most recent month-end returns.