Utilizing Realized Capital Losses to Optimize Portfolio Gains

An investor seeking strategies to mitigate tax drag while still participating in the market.

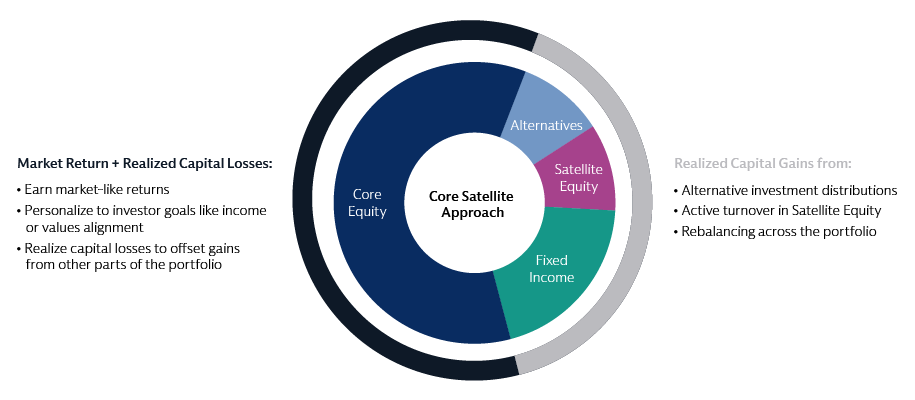

Seek a market return and also use realized capital losses to offset gains from other parts of the investor’s portfolios?

- Earn market-like returns

- Create tax efficiency across investor’s total portfolio

- Reduce reliance on ‘picking winners’ or chasing returns

We implemented a tax advantaged core portfolio with systematic year-round loss harvesting designed to achieve a broadly diversified stock market return and also harvest capital losses to offest realized capital gains from alternative and satellite investments.

Implemented a tax advantaged core portfolio with systematic year-round loss harvesting designed to earn a broadly diversified stock market return and also harvest capital losses to offset realized capital gains from alternative and satellite investments.

Created tax efficiency across investor’s total portfolio, as realized losses from core offset realized gains from satellites and created more tax efficiency upon asset allocation changes.

Reduced reliance on ‘picking winners’ or chasing returns. Provided greater portfolio diversificatiion and potentially improve after-tax returns by minimizing capital gains.

The cited case studies represent examples of how we have partnered with various institutional clients on a broad range of services and offerings. The experiences outlined in the case studies may not be representative of the experience of other clients. The case studies have not been selected based on portfolio performance and are not indicative of future performance or success. This is not a testimonial for Goldman Sachs Asset Management’s advisory services.