Commercial Real Estate: Opportunities Amid Dislocation and Disruption

Commercial real estate (CRE) continues to adapt to a new paradigm. Interest rates are higher, fundamentals are softer, and the market can no longer rely on a wave of fresh capital. Shifting work and spending habits are also driving supply and demand imbalances. The US office market has been the subject of intense investor focus recently—an area we explored in Commercial Real Estate: Into the Headwinds. Outside of US office real estate, sharp divergences have emerged between asset types across regions. Opportunities are emerging due to mismatches between property prices and potential long-term value, as well as the evolution of technology, demographics, and sustainability megatrends. We think assets at this intersection stand to benefit, while those that are not will likely have a less positive fate. Not all property is created equal, and we think a one-size-fits-all investment approach loses sight of important nuances.

Caution Continues

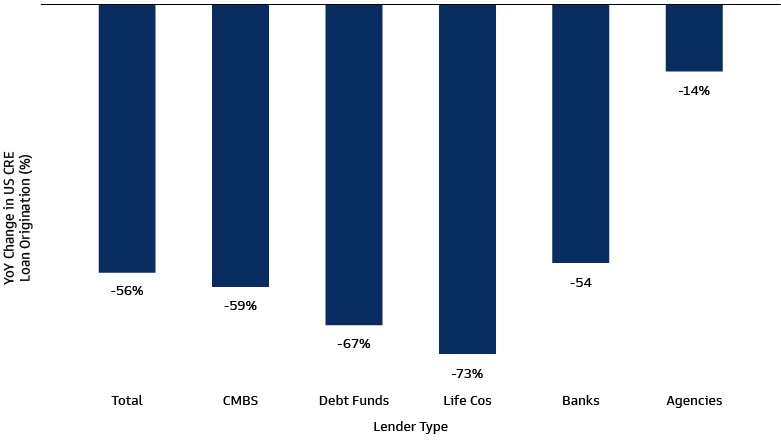

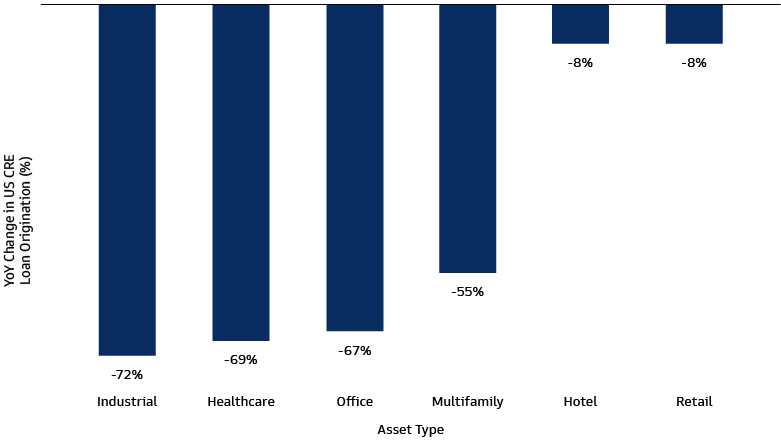

With real estate assets in the process of repricing, and with a more than $2 trillion wall of maturities over the next three years likely to force more revaluations, it’s unsurprising that some investors remain cautious about their real estate allocations. CRE deal activity—a critical metric of the sector’s overall health and liquidity—has continued to grind slower throughout 2023 due to challenged fundamentals and the higher cost and lower availability of credit. The slowdown is widespread. In 2Q 2023, not one of the top 10 largest CRE markets and none of the major sectors recorded an increase in investment activity versus the same period 12 months ago.1

Source: Mortgage Bankers Association Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations 1Q 2023. Above graphs represent percent change in volume of commercial and multifamily loan origination, 1Q23 vs. 1Q22.

The balance of distress in the US—encompassing financially troubled assets and assets taken back by lenders—rose to $71.8 billion at mid-year, marking the fourth consecutive quarterly increase. In Europe, CRE acquisitions across all sectors fell to their lowest level since 2010. Activity in Asia continues to be undermined by China’s property market, which is undergoing its own significant downward adjustment. Sentiment toward Hong Kong CRE has also suffered. Japan—much like its economy—has been an outlier; activity has held up relatively well, helped by domestic macroeconomic strength.

Any recovery in CRE market activity or capital values is likely to be uneven across regions, and we are seeing divergence in fortunes between prime versus secondary-quality assets across all areas.

Seeking Opportunity in Perceived Risk

Offices: Flight to Quality

The office sector remains in focus given its widespread reliance on debt and bank financing, and the shift to hybrid working. Many occupiers are curbing leasing activity, downsizing staffing and delaying decision making. However, a flight-to-quality trend is boosting prime office rents as tenants seek space in the best buildings in prime locations.

In the US, only 10% of all office buildings accounted for 80% of the occupancy losses between 1Q 2020 and 4Q 2022. These were mostly older buildings in downtown submarkets with relatively high crime rates and few surrounding amenities.2 Urban hubs of Chicago and New York remain among the top office markets in terms of rent growth forecasts, while San Francisco continues to lag due to the combined impact of tech industry cuts and workers moving out of the city. While many of the headlines are concentrated on the fates of major cities with well-established real estate markets, much of the recent growth and opportunity in the US has been coming in less-developed metros and cities between the coasts.

In Europe, although fewer leases are occurring for large blocks of office space in major cities, rent growth for top-quality space in cities including London and Paris is being supported by relatively low availability.3 Return-to-office rates were generally higher in Asia than in North America and Europe in 1H 2023, which has made select markets with higher levels of office-based working, like Seoul, Singapore, and Tokyo, relatively more attractive for investors. Future growth locations for office real estate may depend on factors such as GDP growth, working age populations, and access to highly-skilled workers.

Sustainability is also creating winners and losers across regions and property types, including offices. Tenants increasingly want their spaces to represent their values and they’re willing to pay the premium for green buildings. Many corporate users of office space have committed to carbon neutrality goals; they need their real estate to be consistent with that. The extent of a “green premium” varies across different markets, with studies showing a broad trend among occupiers across regions willing to pay higher rents for space in buildings with sustainability certifications, like Leadership in Energy and Environmental Design (LEED).4 Other evidence suggests a trend for a “brown discount” on properties with relatively weaker environmental performance. While the return premium that can be earned from green buildings is an evolving science, we think the trend will be pervasive across all regions over the long-term, with Europe leading the way.

Retail: A Mixed Bag

Retail is another CRE segment enduring significant disruption, largely due to the rise of e-commerce and pandemic-related rent losses. The resumption of international tourism and resilient consumer balance sheets have provided some confidence to occupiers. Foot traffic near stores in major cities globally has also risen again but remains on average 10-20% lower across metropolitan areas than it was before the pandemic—when people come to the office less often, they shop less often. Again, trends vary by location. For instance, studies suggest online spending as a share of retail spending is lower in Japan compared to China, France, Germany, the UK, and the US.5 This may be a result of the country’s higher office attendance rates.

In the US, analysis shows many retailers have shifted their strategies and are beginning to focus their expansion plans outside of traditional urban cores. This has implications for the types of retail assets that will be desirable, as suburban areas have different needs and structures. Grocery stores as anchor tenants, for example, have become increasingly important. The potential for mixed-use has also expanded, as many suburban areas are recognizing the need for additional multifamily housing.6

Data suggests physical stores will remain at the forefront of sales strategies, but their role will continue to evolve to serve omnichannel retail (i.e., a combination of brick-and-mortar and online). More stores may also become comprehensive customer experiences hubs, rather than purely transaction venues. We believe developers of retail space should keep adaptability in mind. For investors, prime assets with high levels of foot traffic leased by tenants with sales channels that satisfy customers who want a firsthand shopping experience may emerge as long-term winners. Some assets that fall into this category may also surprise to the upside in the months ahead on rent growth and yield, given yields entered the current repricing cycle at a higher level. Therefore, cap rate expansion—the market's way of saying that the risk of purchasing CRE assets is rising—could be lower.

Rethinking the Right Side of Disruption

While the challenges for parts of the office and retail sectors are significant, certain CRE sub-sectors driven by secular growth trends may prove more resilient in an environment of elevated inflation and higher-for-longer rates. Data centers and industrial warehouses continue to attract capital, for instance. We think these new economy sectors are likely to benefit from long-term technology innovation and e-commerce trends. Other buildings on the right side of demographic changes, such as senior and student housing, may also carry pricing power and look increasingly appealing to investors in a new macroeconomic regime.

Technology Real Estate

The international emergence of 5G networks, blockchain, cloud computing and rapid growth of data are immense catalysts for technology real estate, including modern industrial facilities, towers that transport data and data centers to store it. Artificial intelligence—along with streaming, gaming, and self-driving cars—also has the potential to upend the market for tangible real assets as natural language processing tools work their way into businesses and society. Data centers—which accounted for 8.8% of equity market capitalization of the FTSE Nareit All Equity Index as of June 30, 2023—have shown resilience compared with other CRE sectors.7 Enormous growth in data center supply since early 2022 has been met with strong demand, particularly from large corporations finding it difficult to secure enough capacity.8 While data centers are currently viewed as broadly attractive, ongoing success is predicated on being able to meet the technology needs of the future. Many assets are ill equipped and will need to adapt and enhance power, space, and cooling requirements as AI and automation take hold.

Industrial and E-Commerce

E-commerce is driving robust industrial & logistics property demand, but economic uncertainty, labor shortages and realigned supply chains are impacting occupier sentiment and decision making. Occupiers are willing to pay a premium for modern warehouses and we expect new assets that facilitate quick movement of goods to consumers through use of automation and robotics will perform better than traditional warehouses. E-commerce retail occupiers account for between 35-40% of industrial demand and require 2-3x more space than traditional brick-and-mortar retailers. Higher demand for warehouse space can have ripple effects into other industries, including housing and office buildings supporting operations and employees. A trend towards onshoring of supply chains is—and will likely continue to be—an additional driver of demand for select industrial markets. Investors who recognize these evolutions quickly can potentially gain an early-mover advantage in a space where being first can mean building a high hurdle to competition by getting quality assets in the best locations.

Fundamentals in Focus

While specialized “new economy” assets may present compelling opportunities, they also carry different risk and return profiles. Rather than rely on CRE labels, we think investors are better served to focus on the underlying fundamentals of the assets. Conducting rigorous analysis of capital structures and cashflows to identify potential opportunities and risks is critical, especially after an era of ultra-loose policy and cheap capital that spurred a rapid run-up in property valuations during and directly after the pandemic. Many real estate companies have taken actions since the end of 2022 to preserve cash and strengthen balance sheets, but additional actions such as equity injections, or in some cases asset disposals at significant discounts, may be necessary. From a public credit perspective, we advocate for issuer selection and prefer high-quality names with lower refinancing needs. Meanwhile, as capital structures adjust, we see opportunities for private credit to fill the void left by traditional CRE lenders, particularly for high-quality assets and sectors.

We believe it is also important to recognize the geographical expansion of the listed real estate investment trust (REIT) market. This growth is creating more investment opportunities around the globe, often in property types that capture secular growth trends, like data centers, towers, and self-storage. Although the US remains the largest listed real estate market, more than 40 countries have now adopted the REIT tax structure. As of 1H 2023, there are approximately 304 listed REITs globally in developed markets, with ~60% of REITs by count sitting outside of the US (~40% by market cap). Much of the REIT expansion in recent years has been concentrated in Asia, with momentum building in markets like Singapore and Japan, presenting attractive opportunities for growth. The Middle East also has demonstrated growth in recent years with the addition of REITs in Saudi Arabia and Oman. Alongside global REIT growth, there is an expanding universe of private market real asset strategies for investors to consider. Many of these strategies allow for more efficient matching between cost of capital and risk/return appetites via a range of core, value-add and opportunistic CRE assets exposed to long-term secular themes.

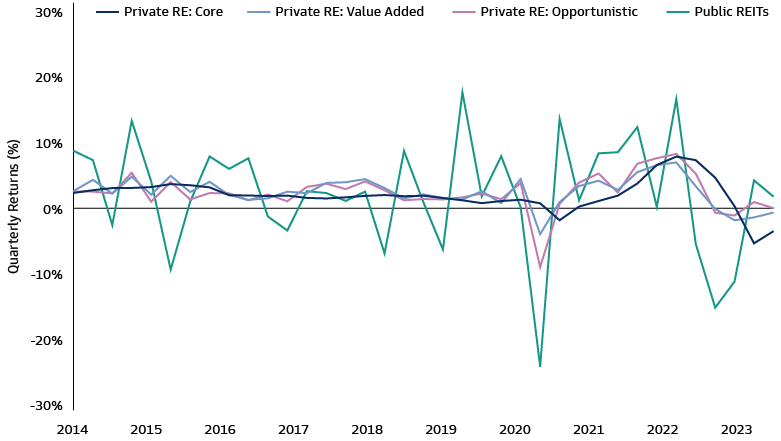

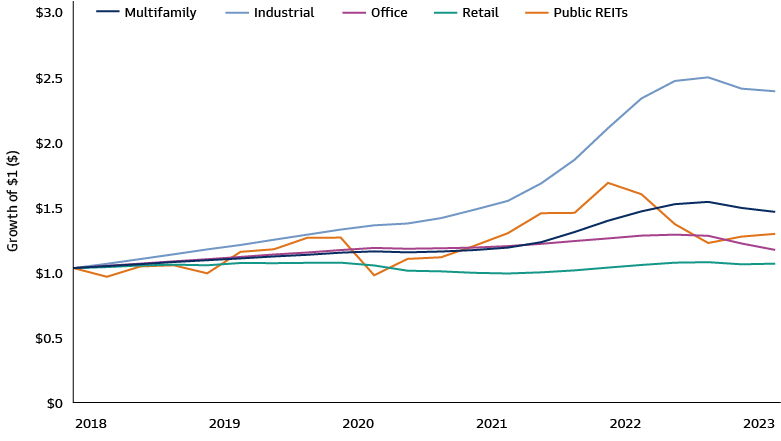

Mind the Gaps: Public vs. Private Valuations

Public REITs began to price in higher interest rates and slower growth in the spring of 2022. In the US, listed REITs valuations are down 29% from the peak, while the developed Europe index, which covers the euro area and the UK, has corrected by 42%. We believe the larger decline in Europe is justified by the CRE sector composition of fewer new economy constituents (e.g., data centers) and a weaker economic growth outlook, which implies lower net operating income (NOI) growth. Markdowns in the private space have been far more muted, although year-to-date private CRE has underperformed public markets by ~9%, with the US slightly ahead of the UK and Europe in terms of valuation adjustments. With the dearth of transactions in recent quarters, some investors are beginning to question how long the public vs. private valuation gap can be sustained. This mismatch is underscored by headlines about redemption limits being reached in semi-liquid vehicles, which has led to more scrutiny of the valuations of underlying positions in private funds.9

Source: FTSE Nareit US All Equity REITs Index, NCREIF NFI-ODCE, Cambridge Associates, as of March 31, 2023.

Source: FTSE Nareit US All Equity REITs Index, NCREIF NPI, as of June 30, 2023.

Part of the friction may be that owners of under-performing assets have few options, given current pricing and capital market dynamics. Meanwhile, those with well-performing assets do not feel compelled to realize them—both due to valuations and the advent of infinite-life funds and other means to extend their investment horizon. In the secondary market, sellers have been willing to take discounts given the market backdrop; however, like the primary market, buyers remain cautious of catching a falling knife. History suggests that private market valuations should decline to meet public prices, which typically lead private performance by six to 18 months. However, given steep corrections, public REITs could instead rise to meet private markets partway if sentiment improves. REITs also have low exposure to floating rate debt, with over 87% of the debt held by the industry at fixed rates. In contrast, almost half of all commercial property debt is floating rate. This leaves many private commercial property owners financially stressed as rates adjust upwards, creating immediate capital deployment opportunities for private credit.

What We're Watching

We expect slowing inflation, any reduction in rates and tighter credit spreads to be among the key themes that determine the fundamental health of CRE over the next few quarters. We believe interest rate stabilization, potential disposals by forced sellers and the capacity to pass on high inflation to tenants may also emerge as catalysts to spur transaction volumes and bridge buyer and seller expectations. We think more dislocation is likely to occur as the market adjusts to the new economic reality. Eventually, the CRE cycle will turn. In the meantime, investors who can navigate differences in liquidity, asset exposures, and pricing may be able to capitalize on sector and regional divergence. Actively investing in high-quality assets positioned to capitalize on technological innovation, shifting demographics and sustainability may be the optimal strategy in a market where one size does not fit all.

1 MSCI. As of July 25, 2023.

2 CBRE, Most US Office Buildings More than 90 Percent Leased. As of August 1, 2023.

3 CBRE, Global Office Rent Tracker. As of June 30, 2023.

4 MSCI. As of November 23, 2022.

5 McKinsey - Empty Spaces, Hybrid Places. As of July 2023.

6 Jones Lang LaSalle, United States Retail Outlook Q2 2023. As of June 30, 2023.

7 Nareit. As of July 5, 2023.

8 CBRE, Global Data Center Trends 2023. As of July 14, 2023.

9 Reuters. As of April 3, 2023.