Enduring the Muni Credit Cycle

Municipal Credit Likely to Remain Stable Even as The Economy Slows

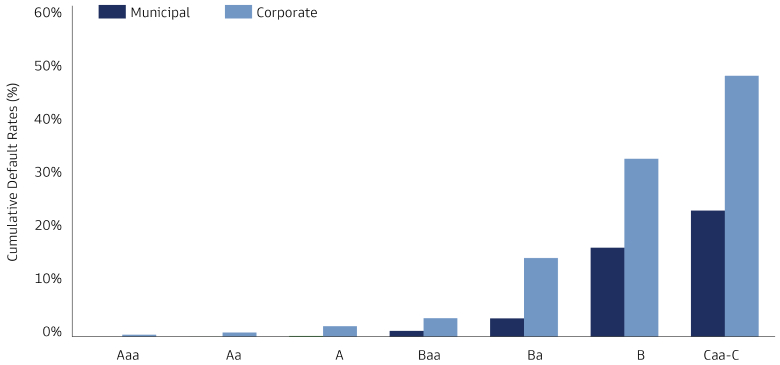

Inherent in all cycles is that the best of times do not last forever. The current muni credit cycle is no different—resembling economic cycles before, revenue expansion will likely moderate just when expenses remain elevated. Unlike corporations, municipalities are typically less nimble, or incentivized, to immediately cut spending. Often states and local governments have mandated expenses that aren’t easily slowed or reversed, and sometimes the political environment also contributes to elevated spending. Despite these challenges we believe municipal credit is far more stable than similarly rated corporate credit (Exhibit 1).

Source: Moody’s Investors Service, “US Municipal Bond Defaults and Recoveries.” As of April 2022.

Regardless of the driver, we know from the past that these cycles are consistent, and that fundamental municipal credit has remained stable through the cycle. Importantly we consider credit quality through the “life cycle” and with great revenue diversity and budgetary autonomy, municipal credit quality tends to remain in a very tight band throughout a cycle. That said, across the vastness of the muni market we do expect rating trends to change—on the margins—with a potentially weakening economy. Year-to-date upgrades have outpaced downgrades by a wide margin, and we believe this trend is starting to moderate.

Signs of Slowdown in Revenue Expansion

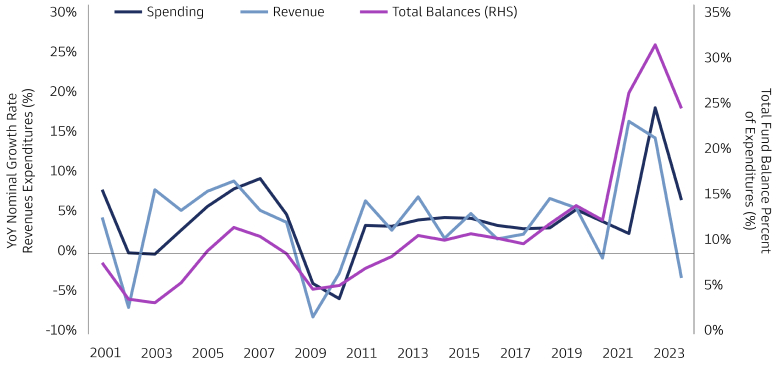

We believe that the leading edge of the change in the cycle is underway. Our Municipal Fixed Income 2023 Outlook suggested that the credit environment would start turning in the latter part of 2023. Revenue data for some major issuers are showing some signs of weakness. Most states and larger local governments are in the middle to late stages of their fiscal 2024 budgets and officials are laser-focused on current revenue performance as they forecast for the next year. The National Association of the State Budget Officers (NASBO) graph (Exhibit 2) shows the decline in revenue growth while expenses are forecast to continue to grow, albeit at a slower pace.

The good news is that, unlike leading up to the Great Recession, governments are sitting on a record war chest of liquidity, with rainy day funds hitting all-time highs in 37 states by the end of the 2022 fiscal year. Robust economic expansion in the last decade alongside enhanced federal aid during the depths of COVID-19, have resulted in reserve levels that the industry has never experienced, equal to about 30% of spending (Exhibit 2, Total Balances (RHS)).

Source: National Association of State Budget Officers (NASBO), Spring 2022. The economic and market forecasts presented herein are for informational purposes as of the date of this web page. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this web page.

Weaker Revenue Trends in California and New York Are Not Expected to Seriously Diminish Credit Quality

While state tax collections have generally recorded growth year over year, there are a few noteworthy high-profile issuers which are likely harbingers of revenue trends more broadly. California income tax receipts are now projected to come in about -8% compared with the 2024 budget while corporate taxes are weaker by about -3%. On May 18, California was placed on Negative outlook by Moody’s given its anticipated $32 billion budget gap for the 2024 fiscal year. To close the gap, the budget proposes a -5% cut in spending and depletion of a meaningful percentage of reserves. Significantly, California’s reserves heading into the 2023 year was a historic $55 billion, or 26% of total revenue. In spite of the expected large reserve drawdown, to balance the 2023 and 2024 budgets, California still budgets a healthy 18% 2024 year-end reserve.

New York’s revenues are budgeted to come in -1.3% year over year, but with a record reserve level equal to 15% of spending, closing a budget gap in the 2024 fiscal year is achievable. New Jersey is also seeing a similar -2% annual decline in revenues for the current year, but with a sizeable 16% reserve fund projected to cushion the impact. While Illinois, a state with previously the lowest investment grade credit ratings, saw multiple upgrades from the ratings agencies in 2023 is calling for a similar -2.8% reduction in revenues versus estimates. Unlike the aforementioned credits, Illinois has a slimmer reserve of 4%, however this is a meaningful improvement from near zero levels in prior years. Positively, based on the state’s 2024 proposed budget, Illinois is still anticipating surpluses in fiscal years 2024 and 2025 without use of rainy day funds.

States and Localities Will Likely Power Through this Economic Cycle

In conclusion, we recognize that a slowdown in revenue is likely upon us and that the behavior of states and localities will vary across the country. Some will endeavor to bring the expense and revenue sides into balance immediately while others will take a more gradual approach. Either way, we believe that municipal budget officers and elected officials have been through this before and will power through this part of the economic cycle as well.