Extra Credit to Private Credit

The recent macro environment has ushered in higher base rates and wider spreads, improving the return prospects for lenders. On the other side of the coin, we believe borrowers in both public and private markets will equally need to manage financing expenses in a likely “higher for longer” interest rate environment. Strong fundamentals have kept default rates low to date, but rising levels of distress are a reflection of these challenging market dynamics for the most indebted borrowers.

Though, all distress is not created equal. Private credit can benefit from several structural advantages that well-position investor portfolios, serving as a potentially strong complement to traditional fixed income.

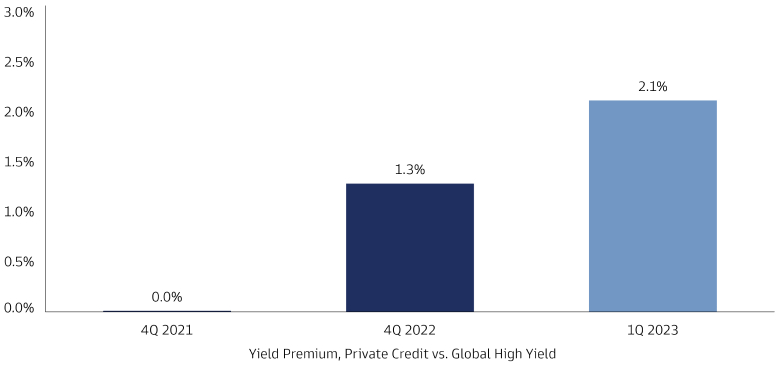

Potential Benefit #1: Premium Yields

Compared to public fixed income, private credit involves directly providing loans to companies in privately negotiated transactions.

The strategy can offer incremental income generation and greater resiliency during periods of heightened volatility.

For example, over the past decade, the asset class has generated excess yield of 3-6% over public high yield and broadly syndicated loans.

The premium is driven by borrowers willing to pay more for the certainty of execution and custom terms that private lenders offer.

Source: Goldman Sachs Asset Management/SAS. Global High Yield is represented by the Bloomberg Global High Yield Total Return Index. Private credit spreads are sourced from KBRA. Past performance does not guarantee future results, which may vary.

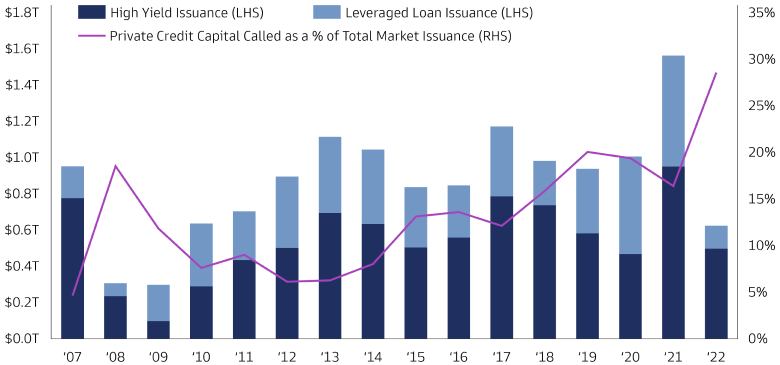

Potential Benefit #2: Accessibility

Rising rates and market volatility have led to a slowdown in high yield and leveraged loan issuance, as lenders curtail their activity.

For example, the high yield market experienced 16 consecutive trading days without issuance in March 2023, the second longest consecutive streak.1

Private credit has stepped in to fill the gap, expanding the strategy’s share of lending. As fund sizes grow, private credit is becoming a viable source of financing, with the aim to offer scale and certainty to borrowers even during market volatility.

Source: PitchBook Leveraged Commentary & Data (LCD), Preqin. As of December 2022. Past performance does not guarantee future results, which may vary.

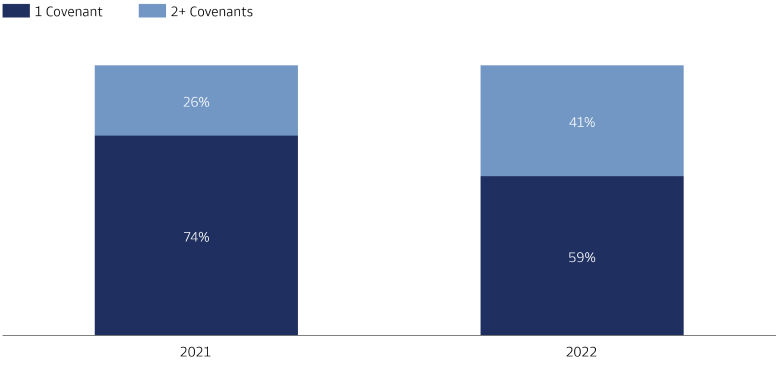

Potential Benefit #3: Proactive Monitoring

Private creditors can benefit from additional terms on lending agreements, referred to as covenants, that seek to ensure a borrower’s financial performance. These covenants are made custom to the borrower and enforce sufficient cash flow, leverage, and liquidity requirements.

These bespoke mitigants are generally not found in public credit markets, which rely on more standardized terms.

Private credit investors may also have access to deep company records, allowing them to rely on fundamentals for early warning signs. With this access and covenants in place, investors can intervene early when cash flows appear impaired and be proactive in potentially preventing default.

Source: Goldman Sachs Asset Management/SAS. Lincoln International as of June 2023. Past performance does not guarantee future results, which may vary.

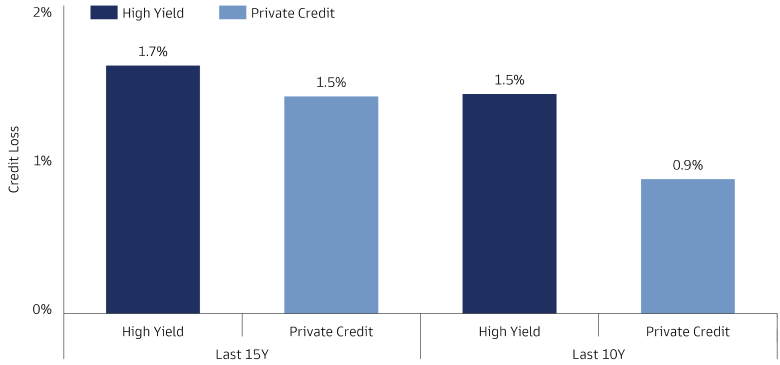

Potential Benefit #4: Proximity Drives Resilience

In public markets, the bankruptcy and reorganization process of debt can be complex as many creditors litigate and defend their claims.

Private credit typically involves a small group of lenders providing financing to a borrower. In the event of a default, this bilateral nature can often lead to a more efficient and less costly workout process.

In a workout scenario, the strategy can better preserve and recover value as a small group of like-minded investors is more likely to agree on a restructuring plan and amended terms than a disparate group of bondholders.

Source: Goldman Sachs Asset Management/SAS. Cliffwater as of March 2023. Private Credit is represented by the Cliffwater Direct Lending Index. High Yield is represented by the Bloomberg US High Yield Index. Past performance does not guarantee future results, which may vary.

We Believe Manager Selection is Key

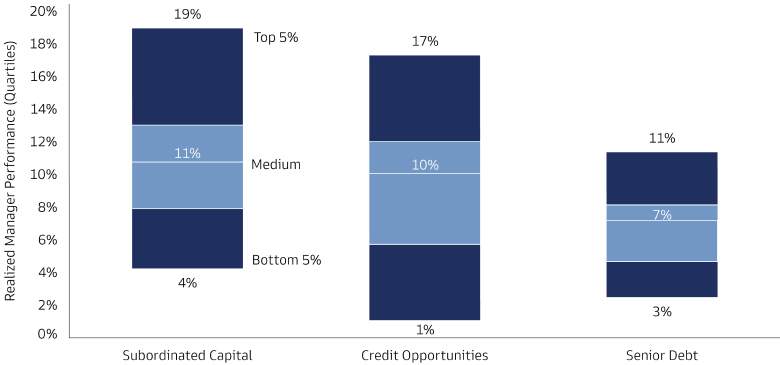

The realized performance of individual private credit managers can vary considerably from expectations for the broader asset class.

The chart on the right shows the breadth of performance across managers with different styles. Although median performance is similar, there are wide ranges across strategy types.

We believe managers with experience through market cycles are better positioned to manage the strategy’s benefits. Therefore, selecting the right manager is key.

Source: Goldman Sachs Asset Management/SAS. Cambridge Associates as of December 2022. Net of Fee Returns. For each strategy, the realized manager performance (IRR) includes funds of vintage years 2000-2018. Past performance does not guarantee future results, which may vary.

1 Source: PitchBook LCD. As of March 2023. This financial promotion is provided by Goldman Sachs Bank Europe SE. Past performance does not guarantee future results, which may vary.