Unlocking Innovation with Small Caps

Slower economic growth, higher rates, and narrow market breadth have been key impediments to the current equity rally. Even so, markets continue to assign premiums to a handful of firms that are durably growing their sales and net income, have defensive operations, and utilize superior technology.

While the prevailing economic backdrop may be a limiting factor, we believe that sectors and businesses that are innovating still have considerable long-term upside. In our view, much of this innovation can be found in the small-cap equity universe. Small caps are poised to benefit from structural shifts prioritizing supply chain resiliency, increased spending on domestic infrastructure, and smart consumption preferences. Many are also currently trading at deep discounts to their large-cap peers.

Reasons to Consider an Allocation to Small Caps

The world has experienced a range of unexpected disruptions in recent years, including the pandemic, the war in Ukraine, and the surge in inflation. The impacts of these shocks may outlast the events themselves as economic participants adapt to a new reality. For consumers, this may mean a preference for experiences over goods. For businesses, supply chain resiliency may become the new gold standard for inventory efficiency. In our view, small-cap equities are well placed to exploit structural transitions in themes linked to reshoring, energy independence, and instant consumer gratification due to the domestic nature of their supply chains and simplicity of operations.

The small-cap equity universe is rich in pure-play companies relative to large-cap counterparts. After years of acquisitions and consolidations, large-cap companies are overwhelmingly represented by global multinational firms with complex operations, varied revenue streams, and an array of products spanning different market segments. While diverse revenue streams may strengthen balance sheets, less profitable business segments may dilute secular-driven revenues flowing through to the bottom line. Small-cap companies, by contrast, tend to have more focused business activities and revenue-generating engines, enabling investors to access these themes more directly.

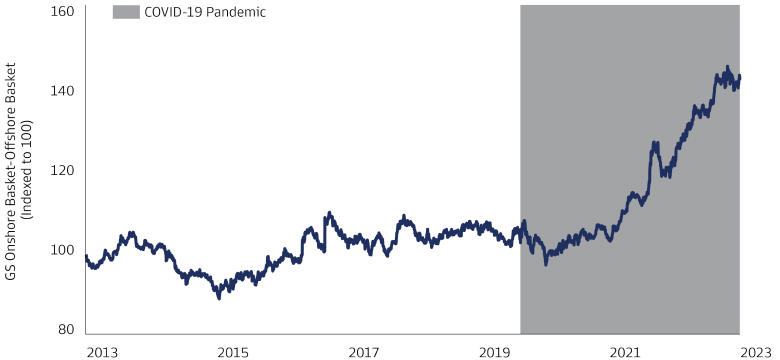

Reshoring is one sticky theme that is likely to benefit large parts of the US economy while also disrupting industrial and manufacturing sectors. The growth of “factory 2.0” will have an important place in US production following peak globalization in our view, leading the next generation of industrialization to be less reliant on legacy technology, capital, and labor. We believe automation and electrification will play major roles in unlocking upside return potential. Small-cap companies typically benefit from a clean slate when channeling innovation and therefore can minimize build-out inefficiencies that are often part of the DNA of large conglomerates. What’s more, US small caps tend to have greater domestic exposure relative to their large-cap peers, which often have more of a global focus. This means small caps’ earnings usually have a stronger link to the performance of the US economy.

Source: Goldman Sachs Global Investment Research and Goldman Sachs Asset Management. As of July 20, 2023. Chart shows total returns of the GS US Onshore & Onshoring Beneficiaries basket relative to the GS US Offshore basket. The GS US Onshore & Onshoring Beneficiaries basket is composed of US-listed equities that rely on domestic supply chains, have a high manufacturing footprint in the country, or that have announced initiatives to move operations to the United States. The GS US Offshore basket is composed of US-listed equities that rely on international supply chains, or have a high international manufacturing footprint. Shading begins March 11, 2020, when the World Health Organization declared a COVID-19 pandemic. Past performance does not predict future returns and does not guarantee future results, which may vary.

The Importance of an Active Approach

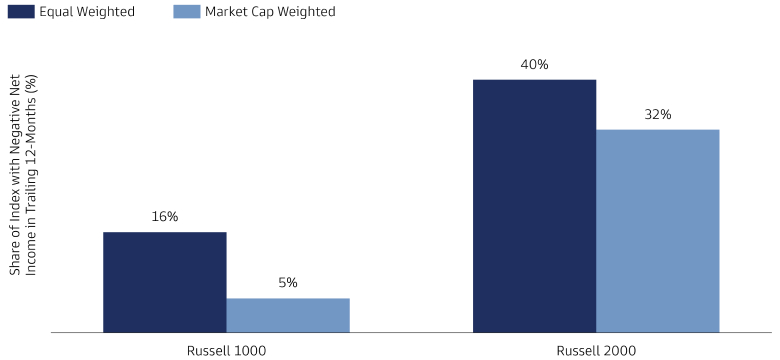

The small-cap universe is highly diverse, with as many potential losers as winners. We believe it’s important to adopt an active approach when investing in the asset class, in part due to the fact that 40% of companies in the Russell 2000 did not turn a profit over the past 12 months, as Exhibit 2 shows. While no company is completely immune to higher interest rates, cost pressures, and tighter financial conditions, owning small-cap companies that generate precise cash flows from emerging technological and industrial shifts may prove rewarding on a risk-adjusted basis. In a world in which equity multiples are challenged by interest rates and stock-specific dispersion has increased, we believe selectively seeking companies on the right side of disruption may pay dividends in today’s alpha-driven market.

Source: Bloomberg and Goldman Sachs Asset Management. As of July 20, 2023. Chart shows the share of companies in each index that have negative net income in the trailing 12-month period, weighted on a company count basis and market cap basis.

While economic conditions remain fluid, the current emphasis on deglobalization, operational efficiency, and innovation mean smaller companies can be highly competitive in a world with lower beta-driven returns and higher interest rates. We believe outperforming the broad market will increasingly require a bottom-up approach, which has historically been most rewarded in the small-cap space.