Municipal Bonds: Set To Shine?

What’s Happened This Year?

The municipal market has delivered positive returns year-to-date, managing through the weight of elevated new issue supply and shifting expectations around the speed and magnitude of Fed easing. The Bloomberg Municipal Bond Index has returned 1.7% YTD as of November 22, 2024.

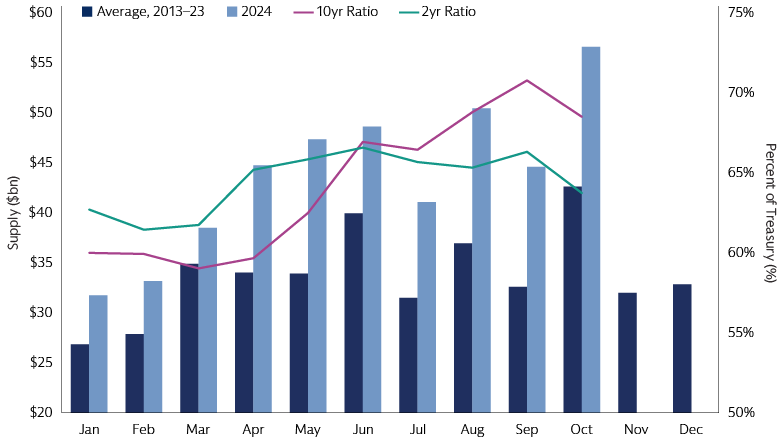

Year-to-date issuance is around 37% higher than at the same time last year.1 Factors responsible for the increase in supply include borrowing for Build America Bond extraordinary redemptions, the front-loading of issuance ahead of the Presidential election, and the need for issuers to catch up after muted issuance during the pandemic.

Source: Goldman Sachs Asset Management, Bloomberg, JP Morgan Municipal Research. As of October 30, 2024.

The good news is that despite this increased new issue supply, there has been steady demand for municipal bonds from mutual funds, ETFs and managed accounts. Year-to-date inflows into the asset class currently sit at $41 billion, bucking the trend of two consecutive years of outflows in 2022 and 2023.2

What’s Likely To Happen From Here?

Looking ahead to the remainder of this year and heading into 2025, we believe municipal bonds are poised to find a supportive backdrop from a technical perspective.

We expect the net supply picture to turn more favorable for investors into year-end, with net supply projections of -$6 billion in November and -$14 billion in December.3

From a yield perspective, investment-grade munis currently yield 3.6%. For investors in the top federal tax bracket, that places the taxable equivalent yield on investment-grade munis at 6.1% – nearly 1.3 percentage points higher than those of comparable taxable bonds.4

We believe these compelling after-tax yields should continue to lead to strong investor demand into the asset class across mutual funds, ETFs and separately managed accounts.

With these factors in mind, we believe this may be an opportune time for long-term investors to capitalize on attractive after-tax income and supportive technicals within the municipal market.

Investment ideas

In our view, fixed income investors could benefit by considering the following approaches.

- Getting Invested. We believe investors should consider moving off the sidelines and explore actively managed municipal bond strategies. These strategies, with their flexible approach to duration management and credit selection, are currently providing compelling after-tax yield and total return opportunities.5

- Considering Adding Credit. In our view, municipal bond strategies that incorporate medium to lower-grade credit exposure are currently offering attractive absolute and tax-equivalent income opportunities.6 Year-to-date, high-yield municipal credit has outperformed investment-grade municipals. With strong credit fundamentals, adding exposure to medium- to lower-grade municipals remains a powerful addition to increase return potential in portfolios.

- Exploring A Range of Options. There are many ways to add exposure to the municipal bond market. For investors seeking customization, separate accounts can be a powerful option to maximize tax-efficiency. Diversified mutual fund and ETF strategies that take an active approach to duration and have the flexibility to add credit present an attractive option for investors as well.

Reach out to your Goldman Sachs representative to learn more about how our decades of experience equips our dedicated Municipals Fixed Income team to make informed investment decisions in the complex municipal bond market.

1Source: Goldman Sachs Asset Management, The Bond Buyer, Barclays. As of October 31, 2024

2Source: Goldman Sachs Asset Management, Refinitiv. As of October 31, 2024.

3Source: Bank of America Merril Lynch. As of October 31, 2024.

4Source: Goldman Sachs Asset Management and Bloomberg. As of November 22, 2024.

5Source: Goldman Sachs Asset Management and Morningstar. As of October 31, 2024.

6Source: Goldman Sachs Asset Management and Morningstar. As of October 31, 2024.