Spring Into Higher Yields

Dovish predictions around Fed cuts to start the year were quickly followed by stronger than expected macro data and higher first quarter municipal supply numbers, which has led to an adjustment of investors expectations and a subsequent market sell-off in recent weeks. The result is a refreshing spring shower of historically attractive muni yields. But approaching summer technicals may just create the perfect storm for a movement lower in yields.

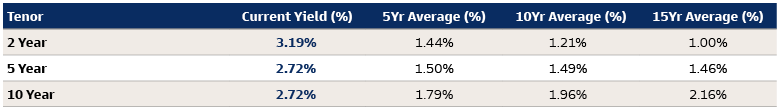

Higher and Higher

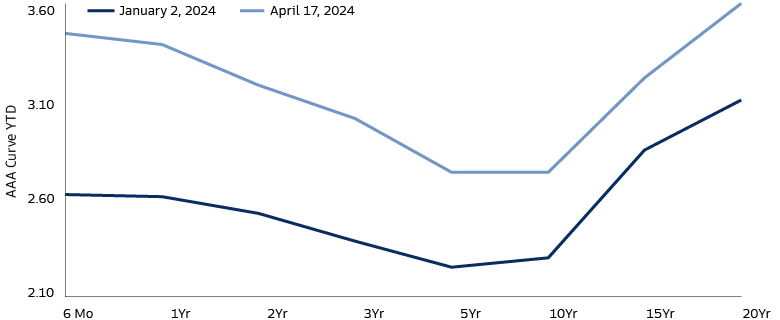

While Opening Day has just recently passed, the current rate cycle may be approaching its final innings, and thus the case for getting invested in the near-term is strong. High levels of new issue supply have remained persistent; total supply in the muni market is up 25% year-over-year. When combined with broader selling in late-March and early-April to service tax liabilities, the yield environment has become substantially more attractive since the end of 2023. The 10yr AAA has shifted roughly 45bps higher since the beginning of January, providing an improved entry point for investors.

Source: Goldman Sachs Asset Management, Bloomberg. As of April 17, 2024.

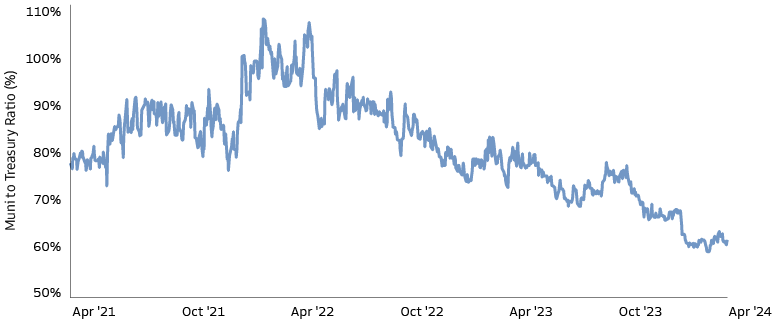

Get While the Getting’s Good

Such an entry point from an absolute yield perspective may be fleeting in nature, and while municipals are currently rich relative to treasuries, there are very few imminent catalysts to alleviate conditions. The volume of munis maturing in the summer months of 2024 is likely to exceed the 10-year average. This seasonal imbalance of supply and demand may very well grind both yields and ratios tighter right ahead of the first expected fed rate cuts. In addition, if higher taxes are on the horizon, it would increase the value of tax exemption, which may also bolster demand for munis, and potentially establish a new normal in terms of ratios, fundamentally changing what is considered ‘cheap.’

Source: Goldman Sachs Asset Management, Bloomberg.

Cautiously Optimistic

Rate markets remain volatile, so a few risk factors are presently top of mind. As the year has progressed, markets have priced in fewer and fewer rate cuts. While six cuts were expected in the beginning of January, sticky inflation and strong economic data have pushed back this timeline with the second full cut now not priced in until the Fed’s meeting next January. Should elevated inflation continue to be stubborn, the Fed will be in no rush to cut barring an economic downturn, meaning rates are apt to stay ‘higher-for-longer’. Lastly, within municipals, higher supply volumes may cause ratios to move higher; however, that scenario is not our base case.

Source: Goldman Sachs Asset Management, Bloomberg.

With seasonal factors providing elevated yields for investors, now is an attractive time to step into fixed income and extend duration on existing portfolios ahead of shifting supply and demand dynamics and the potential of a cutting Fed.