Tax-Loss Harvesting: Can the Parts Be More Than the Whole?

Tax-loss harvesting is a strategy used by many types of investors across the financial services industry. The idea is simple. First you realize a capital loss in an asset by selling it for less than you paid. The next step is usually to buy a replacement asset to maintain the exposure. You then use the realized loss to offset a capital gain from selling another asset. Finally, you defer the tax on the capital gain, allowing you to keep more money invested to grow and compound.

While the idea is simple, the execution is more complicated. The effectiveness of a tax-loss harvesting strategy is highly dependent on its implementation, and one major variable is whether the investor harvests losses at the level of individual securities or of the market.

When loss harvesting is done at the market level, we’ve observed that investors generally use a broad market instrument such as an index ETF. While this can be effective when the whole market is trading at a loss, harvesting losses would be much more difficult during strong bull markets.

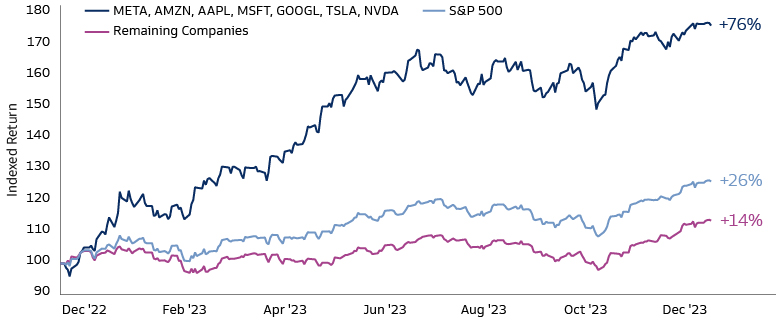

If investors owned component pieces of the market, however, they may be able to take advantage of stock dispersion and volatility. A prime example of this occurred last year. The S&P 500 finished the year up by 26.3%, but that increase was mostly driven by just seven stocks that gained 76% for the year. The remaining companies collectively were up 14%, and 170 of those ended the year with a negative return. For a tax-loss harvesting strategy, owning individual securities may offer the investor opportunities to potentially take advantage of stock dispersion as shown in Exhibit A.

Source: Global Investment Research. As of January 8, 2024.

A Year-Round Strategy, Not a Year-End Trade

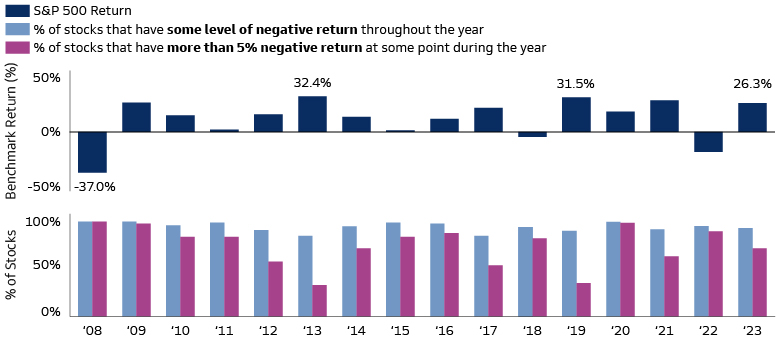

Loss harvesting with individual securities may also provide investors with more opportunities to take advantage of stock moves at different points throughout the year. Many investors wait until the end of the calendar year to consider loss harvesting. The challenge with this approach is that the market often finishes the year with a positive return. The S&P 500, for example, has followed this pattern in 13 of the past 16 years. If investors wait until the end of each year, they may find no losses to harvest.

However, based on historical data, some percentage of individual stocks will be trading at a loss at some point in any given year, offering opportunities to realize losses as shown in Exhibit B. That’s why tax-loss harvesting is most effective as a year-round strategy.

Source: Goldman Sachs Asset Management. As of December 31, 2023.

The Potential Tax Advantages of Direct Indexing

While tax-loss harvesting is a commonly utilized investment strategy, the tax benefits it provides depend on execution. Tax-loss harvesting within a Direct Indexing separately managed account is designed to offer a diversified market return and use refined instruments to maximize loss-harvesting opportunities at both the market and individual security level, helping investors keep more of what they earn.

Direct Indexing provides opportunities for other tax management strategies as well. The ownership of individual stocks enables curated selection of positions for charitable gifts to maximize tax benefits. Investors can also transition from existing portfolios to a Direct Indexing strategy in a tax-efficient manner and choose how closely their portfolio reflects the broad market, seeking to achieve their tax-management goals. With Direct Indexing, we believe investors are able to benefit from tailored solutions that meet their unique goals and objectives.