Where are the Opportunities in Fixed Income?

In our Fixed Income Outlook 2Q 2024 we aim to navigate investment portfolios toward resilience and capitalize on new opportunities by filtering out the noise.

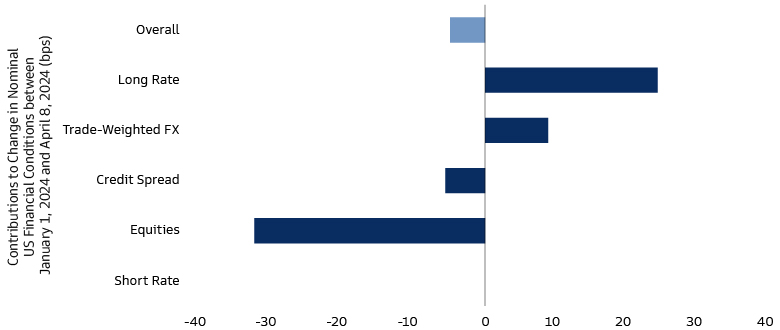

Interest Rates

We have adopted a cautious directional stance on rates, which we will maintain until we see stronger evidence of disinflation or if market policy expectations seem overly hawkish. We see more cross-market opportunities arising from divergent economic and policy paths, with potential outperformance in rates from the UK, Euro area, Sweden, and Canada due to faster disinflation and swifter monetary easing. By contrast, we are underweight on intermediate Japanese government bonds, expecting underperformance as Japan's inflation may prompt further moderate rate hikes by the BoJ. Additionally, positioning for a yield curve steepening could be beneficial, with rate cuts potentially lowering short-end yields and resilient growth, high debt issuance, and a re-evaluation of the neutral rate keeping long-end yields elevated.

Source: Goldman Sachs Global Investment Research. As of April 8, 2024

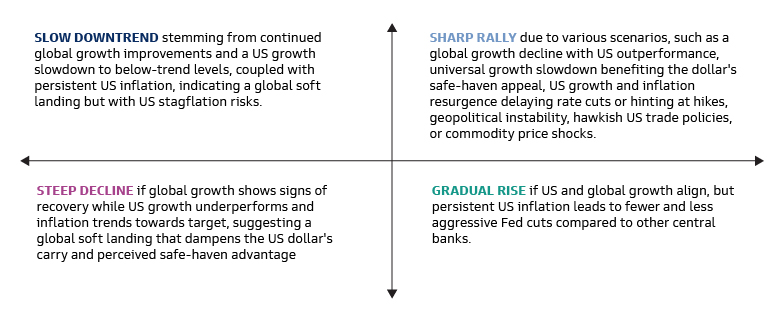

Currencies

Entering the second quarter, our steadfast view is to favor the US dollar, due to its carry advantage and robust US economic data. However, given high uncertainty and various potential paths, we prefer to express our exposures through currency options. Across EM, we are underweight currencies from economies undergoing monetary easing and prefer high-carry currencies like the Mexican peso, which benefits from a high real yield, a hawkish central bank, and the prospect of inflows as its economy is well positioned for reshoring trade trends. Central Eastern European currencies, such as the Polish zloty, are also favored due to their strong balance of payments and foreign direct investment, reflecting closer EU alignment, while we are underweight the euro in anticipation of ECB easing.

Source: Goldman Sachs Asset Management. For illustrative purposes only.

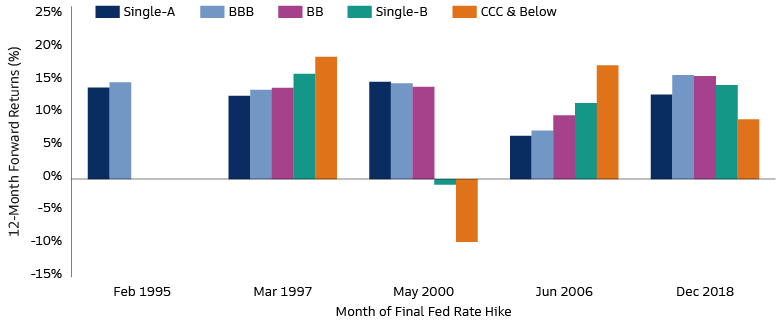

Fixed Income Spread Sectors

With benchmark index spreads nearing decade lows, active alpha pursuit through fundamental security selection is key. For example, within the US investment grade credit market, bonds from well-capitalized and diversified banks offers an appealing risk premium. The BBB-rated segment also holds potential for income and total returns. In high yield, select CCC-rated bonds stand out for their spread premium. Agency MBS are favoured considering stable demand and prepayment rates, with higher coupon securities benefiting from reduced rate volatility and a steepening yield curve. In securitized credit, CLOs and CMBS offer income opportunities; we have a preference for CMBS backed by prime office properties in desirable locations or linked to industrial properties benefiting from e-commerce trends. Disinflation, lower funding costs, and robust global growth suggest carry-driven total returns in emerging market (EM) bonds, with alpha potential in distressed credits but astute security selection is needed to navigate potential challenges.

Source: Goldman Sachs Asset Management, ICE BofA. * Weakness in CCC-bonds in the early 2000s reflects a confluence of cyclical headwinds, including the aftermath of the tech bubble, the impact of 9/11, and the fallout from accounting scandals.