Defined Contribution Trends 2025

401(k) Plans: A Force in Retirement Security

The 401(k) industry has been a force in democratizing retirement saving and investing, raising the standard of living in retirement for millions of Americans. However, millions still don’t have access to a retirement plan, many save less than an optimal amount, competing costs are increasing, and demographic shifts continue to change what it means to prepare for retirement. Historically, there has been limited innovation successfully addressing these challenges.

We believe this is about to change!

DC Plans: A Force to Build a More Effective and Comprehensive Retirement System

As the industry focuses on building a more effective and comprehensive retirement system – one that supports working and retirement phases of life – there are five major trends that may change the shape of the industry over the next decade and may even gain traction in 2025.

Competing Priorities and Shifting Social Norms Impact Affordability of Retirement

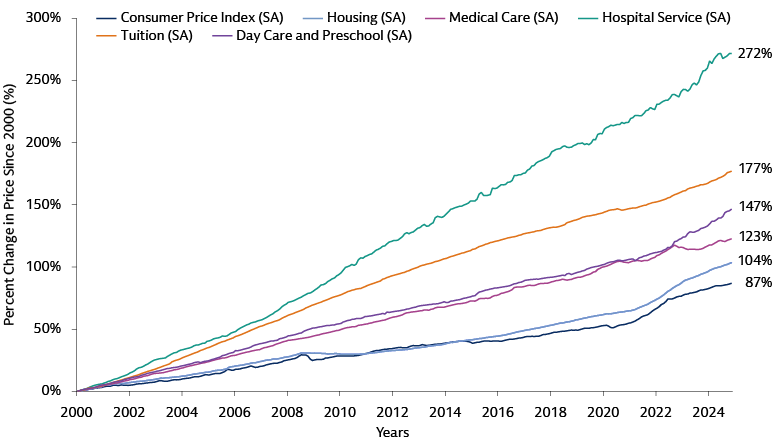

- Rising Costs of Basic Needs: As costs of child and elder care, education, healthcare, housing and essentials rise, it is difficult for many to plan and save for retirement, particularly at mid- to lower- income levels. This trend can put pressure on savings.

Source: U.S. Bureau of Labor Statistics. Data represents seasonally adjusted inflation statistics as of November 2024, latest available. For illustrative purposes only.

- Changing Societal Norms: The median age for marriage, having children, home buying, and expected retirement date continues to rise, causing these events to overlap in many cases.

- Impact on Retirement Affordability: Saving consistently for retirement continues to be difficult to prioritize for many, particularly those in mid to low-income households. Solutions that may improve savings habits and help participants navigate financial priorities are important ways to overcome these headwinds.

Legislative and Regulatory Tailwinds

- New Tax Policy: The extension of the 2017 tax cuts and potential new tax policy including tariffs and Social Security changes may affect retirement savings. For instance, it remains to be seen whether “Rothification” could be part of the discussions and potentially affect the tax advantages of retirement plans.

- Guidance on New Asset Classes: It is unclear whether there may be possible future guidance on certain asset classes and investment strategies such as ESG investments, private assets, crypto assets, and retirement income solutions (both guaranteed and non-guaranteed options) that could impact application in retirement accounts.

- SECURE 2.0 Implementation: Ongoing adoption of features such as emergency savings, student loan match, and auto-portability, for example, aim to enhance participation, support short-term needs and alleviate saving challenges.

- SECURE 3.0?: Industry observers have identified potential areas of focus for possible future legislation including in the area of default investment options, CIT availability in 403(b) plans, a Federal IRA program, and guidance on guaranteed income solutions.

Consolidation, Collaboration and Integration Reshaping the Industry

- Consolidation: Recordkeepers, advisory aggregators (RIAs that acquire other advisory practices to offer business tools and infrastructure at scale) and pooled employer plans (a retirement plan that allows unrelated businesses to participate in one plan managed by a pooled plan provider) are important consolidation trends driving increased scale, operational efficiency and comprehensive financial services platforms.

- Collaboration: The industry has increasingly embraced partnerships and collaboration to deliver comprehensive, participant-focused solutions. These partnerships are reshaping how financial services address the evolving needs of retirement plan participants.

- Integration: Retirement and wealth management integration is driving new business models and revenue streams which aim to close the advice gap by delivering scalable, personalized advice to all participants.

Innovation on the Horizon

Innovation in the areas of new business models, expanded use of CITs, and technological advancements are changing the retirement landscape and can provide new avenues for early adoption. Key areas of innovation include:

- Personalization

- Education and Advice

- AI Integration

- Private Assets & Alternative Investments

- Stable Value Innovation

- Retirement Income Solutions

Growth of Professional Fiduciary Services

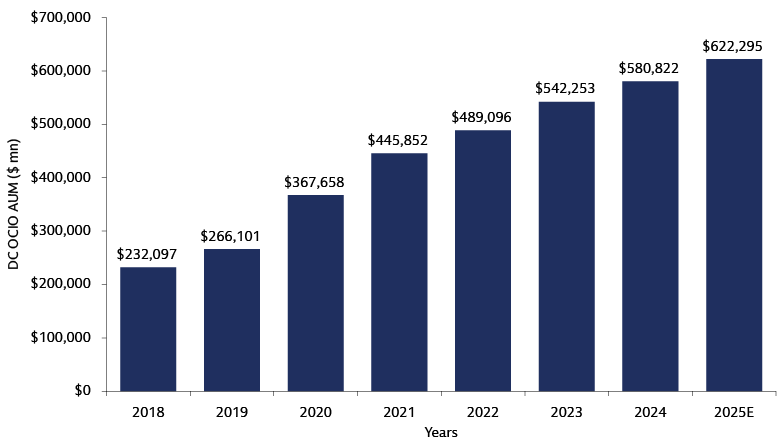

- OCIO Services and PEPs: Growing interest in professional fiduciaries is resulting in the growth of OCIO services and the growth of pooled employer plans (PEPs). PEPs may be particularly attractive to small to mid-market plans, but we continue to see growth of Outsourced Chief Investment Officer (OCIO) services in plans of all sizes.

Source: Cerulli Associates, U.S. Outsourced Chief Investment Officer 2024. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation.