Infrastructure in 2025: Megatrends and Mid-Market Opportunities

Geopolitical tensions, tariffs, and AI-driven market volatility have already been featured in 2025. And if the past few weeks is any indicator, further disruption is likely to unfold as the year progresses. In our view, the current dynamic environment underscores the strategic importance of infrastructure investments in providing stability and resilience to an investor’s portfolio through economic cycles. Infrastructure has continuously delivered investors defensive performance throughout market cycles, and we anticipate this to remain true throughout the current market uncertainty. Today’s environment also strengthens our conviction that mid-market infrastructure offers some of the most compelling opportunities within the broader market, including areas tied to US power demand, data center development, and circular economy business models.

We summarize key themes that may shape the landscape in the coming quarters, presenting potential for differentiated and attractive risk-adjusted returns in the mid-market infrastructure space.

Megatrends and Mid-Market Opportunities

Trump 2.0 and The Energy Transition

The inauguration of President Trump on January 20, 2025 was accompanied by the US re-withdrawing from the Paris Agreement.1 A new executive order entitled ‘Unleashing American Energy’ was also announced to encourage traditional energy exploration and production and curb incentives and subsidies related to electric vehicle adaption. Regardless of the US administration’s policy priorities, we expect the underlying commercial drivers of sustainable investment opportunities—including sustainable-focused sectors in the mid-market space—to remain resilient. As we stated in our 2025 Asset Management Outlook, a multidimensional approach is required to support the energy transition while maintaining grid stability.2 Wind, solar, nuclear and gas will all be part of the power equation.

In our view, a full repeal of the Inflation Reduction Act (IRA) is unlikely. Executive orders have so far been muted on tax credits tied to the IRA. Changes to the tax code would require an act of Congress. There is also bi-partisan support for credits tied to areas such as solar and battery storage, which over the last decade have been tied to major economic development initiatives, particularly in Republican states. We are mindful that certain areas, such as offshore wind or funding of new green technologies, may experience some disruption. Meanwhile, we note that during the first Trump administration, installed wind and solar capacity in the US grew significantly, from 104GW to 167GW. This 60% increase resulted in a significant decrease in renewable technology cost, supporting the independent economic viability of these energy transition sources for the future.3

Broadly, we see the current environment creating interesting opportunities for infrastructure investors to capitalize on the energy transition space. The market disruption driven by the new administration as well as the pull back from market participants who invested heavily in recent years at stretched valuations create attractive tailwinds for buyers looking to deploy.

US Power Demand and AI Growth

We believe it is important to contextualize the significant shift and opportunity that we are seeing for power markets. In the US, power demand is expected to grow annually at a 2.4% CAGR through the end of the decade, after over a decade of zero demand growth.4 Digitalization and rapid adoption of AI across industries is driving an accelerated need for computing power and storage. Data center demand growth is expected to grow from 3% of total power demand in the US to 8% by the end of the decade, with AI representing about 20% of overall data center power demand by 2030.5 Based on installed power capacity across the grid, we expect a supply/demand imbalance in areas tied to data center development and manufacturing/industrial production. In addition, many “hyperscalers” such as Microsoft, Google and others have net zero goals in place and are targeting renewable energy power sources to meet those goals. Recessionary concerns aside, we remain bullish on the investment fundamentals tied to US renewables and all sources of power generation to meet these future demands.

Investing in Data Centers

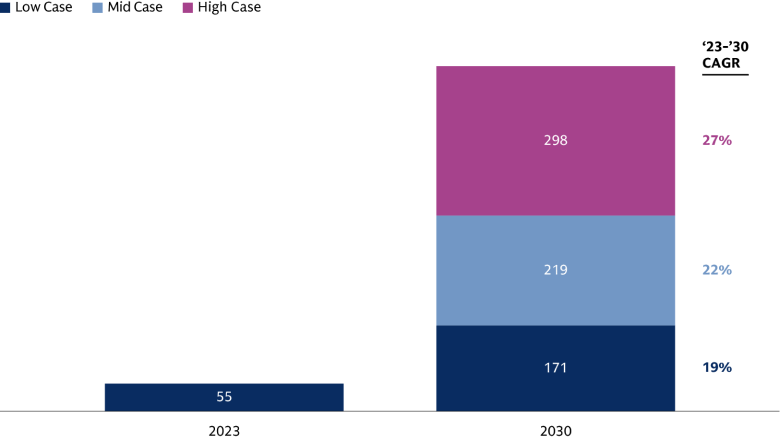

Announcements such as the Stargate project (a joint venture between Softbank, Oracle, and OpenAI)6 and capital expenditure plans from Meta and Microsoft have solidified the importance of AI and signal a growing need for greater data center capacity. Simultaneously, developments around DeepSeek have led to greater scrutiny on AI-related infrastructure. As investors seek to ensure longevity and resilience regarding data center investments, we expect a sharper focus on where capital is being deployed.

Source: IDC; McKinsey Data Center Demand Model; broker research; public company filings; GS Alternatives estimates.

We are cautious on the long-term outlook of data center capacity serving AI training demand. As DeepSeek dynamics partly highlighted, there continues to be technological risk. Significant graphics processing unit (GPU) efficiencies are expected over time as well as potential rationalization of such capacity. We remain focused on identifying markets with strong underlying demand drivers and connectivity where the capacity need is expected to be more resilient.

We continue to see an important need for data center capacity closer to demand hubs due to latency needs, increasing “cloudification” and AI adoption by enterprises and consumers. This applies to markets catching up in digitalization. If there is a path to building effective AI models with less compute needs—as DeepSeek developments demonstrate— we see such inference demand materializing even quicker, making the data and compute needs for enterprises increase at a faster pace.

To date, the majority of institutional capital has been focused on development-oriented data center investments which offer attractive development yields. Investors will need new pools of liquidity in the market to keep delivering on their growth ambitions and keep capturing yields at compelling levels. We see a growing need for recycling capital through the sale of stabilized data centers to yield focused investors. These assets (particularly in Tier I/II markets) offer compelling core/core+ investment characteristics, with long term streams of predictable cash flows from high quality investment grade tenants. In 2025, we expect this segment of the market to be an attractive investment thematic that will play an important role in institutional investors’ yield-seeking portfolios.

While data center development remains an area of significant market interest, we see this segment of the market as generally expensive, with multiples reaching upwards of 30x EV/EBITDA for certain assets, requiring prudent evaluation and a strategic platform expansion approach to reduce entry point multiples over the life of a fund’s investment.

Circular Economy: Overlooked and Underappreciated?

While renewable energy generation is a key component of any decarbonization strategy, the critical importance of a more circular economy is often overlooked. Currently, only 7% of used materials are cycled back into our economy after use, contributing to pollution, climate change, and biodiversity loss.7 Further, ~120mm T/yr of landfill disposal capacity is expected to close by 2030, necessitating circular solutions.8 A circular economy is one in which consumption of ecological resources is equal to or less than what the planet can regenerate. Estimates suggest the circular economy must contribute up to 45% of global carbon emission reductions to meet some of the world's net zero targets.9 We see exciting investment opportunities among companies with circular business models in areas such as water treatment and efficiency, waste management through beneficial reuse and recycling, and modular building solutions.

Chronic underinvestment in critical infrastructure serving people’s most basic needs is fueling a need for private capital and resulting in a large addressable market.

Circular economy investments can also exhibit attractive infrastructure characteristics given high barriers to entry, contracted business models, and resiliency through economic cycles including the global financial crisis (GFC) and COVID-19 crisis. In the US, decreasing landfill capacity and ever-increasing tip fees in parts of the country have created unique growth opportunities for incumbent players to provide innovative solutions. Our view is informed by prior and current investments related to cooking oil, wastewater, and organics recycling. We believe a mid-market, value-add investor mindset is particularly well-suited to these sectors and can support companies in their next phase of growth. A strong moat can be achieved through increased scale, facilities network effects, and long-term customer relationships and contracts, as well as reliability, safety, and track record. These aspects can enhance the resilience of circular business models beyond the traditional downside protections that contracts or regulations can provide. In our view, circularity is going to become more prevalent across industries and in our daily lives. This will enable economies to be more sustainable, efficient, and deliver productivity gains that should be value accretive to investors and communities.

European Infrastructure in Focus

Europe remains a thriving hub for infrastructure investment opportunities. The continent continues to attract global investor interest due to broad based political support for large investments in infrastructure to revitalize the economy and boost productivity.

One of the key drivers of infrastructure investment in Europe is the region’s drive towards green energy and sustainability, which remains critical to its economic competitiveness. In an environment of lower growth and increasing geopolitical challenges, we see infrastructure as a strong investment opportunity. While some of Europe’s larger economies are experiencing slower growth, others – particularly in Southern Europe, such as Spain – are expanding at a faster pace than the US.10 The US administration's recent pause on clean energy funding presents both challenges and opportunities for the European Union (EU). While it may reduce competition in the clean tech space, it also underscores the need for the EU to strengthen its own policies to attract such investments. At the same time, constrained public budgets and higher capital costs are driving both governments and corporates to seek external investment to fund critical infrastructure – creating a significant opportunity for private capital.

The EU Commission is simplifying sustainability reporting. The EU Green Deal was followed up by the ‘Clean Industrial Deal’ in February. This plan focuses on decarbonization of traditional, energy-intensive sectors and on fostering the growth of innovative clean technologies. The European Commission is expected to publish a Circular Economy Act in 2026 to reduce waste, improve domestic recycling and address resource shortages.11 We view biomethane platform build-outs and distributed generation projects in Europe as examples of investment prospects in this space that combine a number of energy policy objectives around affordability, sustainability and security of supply.

Europe's extensive but aging infrastructure in transport and utilities demands renewal. Investments in modernizing rail networks, fiber, electricity grid upgrades, renewables and water and waste systems are also critical to maintaining Europe’s competitiveness, meeting urbanization trends, and advancing towards green targets. Europe is also a leader in digital infrastructure, with significant investment flowing into data centers, 5G networks, and broadband connectivity to meet rising digitalization demands. Governments and investors are aligning to close gaps in underserved areas. We believe Europe's stable financial and legal systems, coupled with a strong focus on public-private partnerships, provide an attractive risk-reward balance for investors. In 2025, we anticipate Europe will offer promising potential infrastructure opportunities in the green and digital economy, supported by increasing government investments designed to catalyze even more private capital.

Mid-Market Manager Dynamics

In recent years, infrastructure fundraising has largely centered in the large-cap space. Over 50% of the cumulative capital raised in 2023 went into funds that ultimately raised over $9 billion. This is leading to greater deployment challenges between large-cap managers who have been forced to transact in competitive opportunities, often at auction, to invest their mega-funds.12

In addition to wider market consolidation, this dynamic has placed upward pressure on entry EV/EBITDA multiples for the large-cap segment, and in turn, has created more tailwinds for mid-market infrastructure than ever before.13 The mid-market (which we define as companies with enterprise values of between $400 million and $2 billion) has become far less crowded, enabling managers to take advantage of attractive entry points and dynamic investing opportunities. However, success in the mid-market does not come without a rigorous investment approach. In this space, managers must earn the right to win. We believe those with strong reputations, long-standing market relationships, and clear partnership mindsets – both at the buy and on the sell – are well-positioned.

We anticipate manager selection to be the most critical component to capitalizing on the trends the infrastructure mid-market has to offer in 2025. Mid-market assets are generally smaller in size versus large-cap counterparts, providing ample opportunity to generate value and outsized returns. Managers with a deep ownership mindset and an extensive network to attract top-tier management teams and boards to portfolio companies will develop and grow mid-market assets into the resilient and defensive businesses expected by today’s infrastructure investors. These managers will be rewarded with exit optionality, including the same large-cap funds still looking to deploy their capital in assets that have successfully been through the mid-market lifecycle. Conversely, managers who are less focused on disciplined value creation may find the coming years challenging and will leave some of the mid-market infrastructure opportunity untapped.

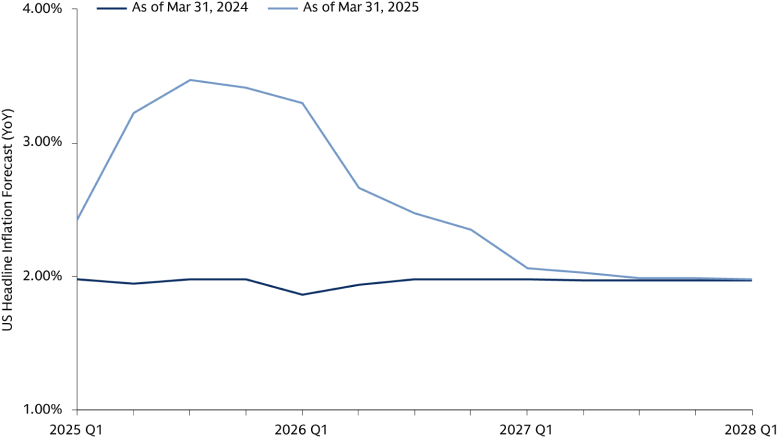

Strategies for Persistent Inflation

Despite encouraging inflation data at the conclusion of last year, with 2024’s Consumer Price Index (CPI) ending at 3.25%, a significant drop from its peak of 6.64%, there remains a material probability that inflation stays persistently above target as we move further into 2025.14 And now, given the significant increases in tariffs and increasing concerns on the sustainability of long-term government finances, we expect investors’ focus on inflation and interest rates to only grow throughout the year.

Source: GS Investment Research. Measured on forecasted % change YoY of headline PCE price index. April 2025.

At all times, but particularly in today’s environment, inflation is a continued risk that infrastructure owners should be thinking critically about and must navigate to show the resiliency of their assets. We believe managers must focus on infrastructure opportunities characterized by robust risk management frameworks, disciplined currency and interest rate hedging approaches, and conservative financing structures. With these underlying elements in place, the risk of persistent inflation (and broader macroeconomic uncertainty) can turn into opportunity. We’ve seen this at work in the recent period. We’ve witnessed well-placed portfolio companies with contracts explicitly linked to inflation enhance their market positions even in a time of market stress.

Today’s environment should serve as a reminder that a prudent focus on market leading, resilient infrastructure businesses with durable capital structures is always paramount but becomes increasingly more critical when the macroeconomic outlook is unclear.

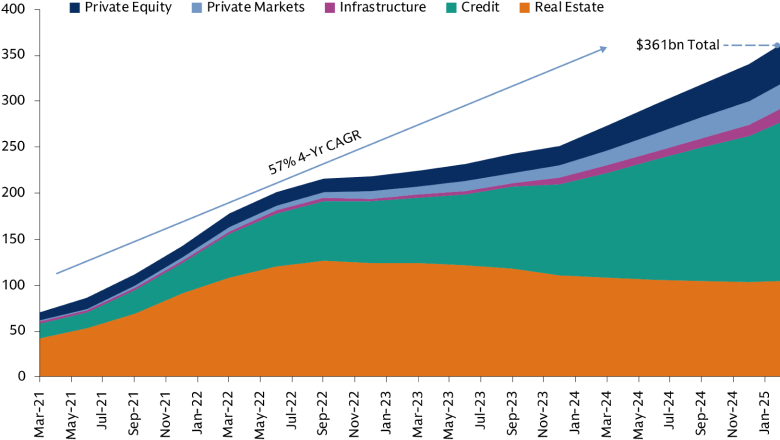

Catching the “Wealth Wave”

Rising demand for private infrastructure from the private wealth channel is a major topic of discussion among market participants. As a new entrant to the wealth channel, infrastructure is potentially on course to catch one of the biggest waves of capital disruption the asset class has ever seen. To put the “wealth wave” in context, retail and wealth fundraising via evergreen products in alternatives has grown to ~$361 billion at a rapid 57% 4-Year Compound Annual Growth Rate (CAGR).15 Infrastructure has grown within that cohort at a 99% CAGR.

We think wealth adoption of infrastructure will continue to expand rapidly in 2025, particularly as megatrends such as digital infrastructure and energy transition continue to appeal to individual investors’ portfolios and personal goals. By contrast, a dilemma persists in infrastructure capital raising on the institutional side. 2023 and 2024 presented the most challenging fundraising environments infrastructure has seen, with less than $100 billion raised each of these years, compared to an average of ~$140 billion raised annually over the preceding five years.16 Capital remains trapped in the system, with sale processes proving increasingly difficult, and institutional clients focused on distributions and liquidity. “DPI is the new IRR” was the mantra of 2024. Transaction volumes are down over 50% since 2017, with exit sale success rates still moderately low compared with years past. The dilemma persists. Could wealth be what unlocks transaction volumes in 2025? We think there is a strong case to be made here.

Source: Bloomberg, Company filings, Goldman Sachs Global Investment Research. As of February 28, 2025.

Looking Ahead

As we navigate through 2025, the dynamic landscape of sweeping tariff policies, economic shifts and major megatrends underscores the strategic importance of infrastructure investments. Infrastructure can provide stability and resilience through economic cycles, and today’s environment reinforces our conviction that mid-market infrastructure offers some of the most compelling opportunities within the broader market. By focusing on key themes such as the energy transition, AI-driven power demand, data center investments, and the circular economy, we believe there is significant potential to generate attractive risk-adjusted returns.

1 Source: The White House (.gov). As of January 20, 2025.

2 Source: The White House (.gov). As of January 20, 2025.

3 Source: U.S. Energy Information Administration (EIA). As of 2025.

4 Source: Goldman Sachs Global Investment Research. As of April 2024.

5 Source: Goldman Sachs Global Investment Research. As of May 2024.

6 Source: Goldman Sachs Global Investment Research. As of January 2025.

7 Source: UNDP Climate Promise. What is circular economy and why does it matter?

8 Source: United States Environmental Protection Agency.

9 Source: World Economic Forum. “7 surprising facts to know about the circular economy for COP26”

10 Source: AP News. Foreign workers help Spain’s economic growth outpace the US and the rest of Europe. February 2025.

11 Source: Publyon, “ EU Circular Economy Act: How will it shape the future of the EU and your business. As of Jan 3, 2025.

12 Source: Preqin. Data as of October 30, 2024.

13 Source: Goldman Sachs Asset Management. The Case for Mid-Market Infrastructure. September 2024.

14 Source: GS Investment Research. US Monthly Inflation Monitor: January 2025.

15 Source: Bloomberg, Company filings, Goldman Sachs Global Investment Research. As of Feb 28, 2025.

16 Source: Preqin Pro. Data as of March 2025.