The Case for Private Real Estate Credit

The Opportunity

We believe the cyclical and structural changes in capital markets are creating a supply and demand imbalance for real estate credit, presenting an opportunity for private lenders to fill the gap. The debt maturity wall and the retrenchment of banks and traditional lenders from the commercial real estate lending market is expected to sustain refinancing demand over the next several years. The impact of higher interest rates during the last market cycle is now generally priced into real estate valuations, with cap rates at their highest levels in nearly a decade1. These dynamics enable private lenders to originate loans at today’s reset values, providing investors an opportunity to participate in the emerging real estate recovery with the potential for downside protection. Assuming real estate valuations have bottomed, we believe there is further opportunity for equity appreciation, which would lower the implied loan to value of existing loan positions.

As real estate owners and developers seek financing for recapitalizations and acquisitions, lenders with flexible capital and certainty of execution have the ability to generate attractive risk-adjusted returns and exert influence over terms and structure with borrowers. Heightened market volatility underscores the significance of reliable execution, proven expertise and strong borrower relationships. Lenders with differentiated access to opportunities from which to be selective and the ability to underwrite complexity will be well-positioned to manage risk during a period of uncertainty. We expect real estate credit to remain competitive across various interest rate environments, supported by favorable supply-demand dynamics and floating rate leverage.

The trends across private real estate credit have parallels to the growth of private corporate credit over the last fifteen years. Private financing initially gained traction as banks pulled back, driven largely by new regulations following the global financial crisis. Private credit stepped in to provide capital to smaller borrowers, who were excluded from the larger loan focused syndicated market. Over time, private credit has also come to be the preferred option for many larger borrowers due to the flexibility, customization, and certainty of execution it offers, compared to more standardized solutions offered in the public markets. We believe private real estate credit is on a similar trajectory, but earlier in its evolution, offering an attractive opportunity for investors to get in on the ground floor of an important part of the expanding private credit market.

Source: 1. NCREIF composite index as of March 31, 2025. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation. Targets are subject to change and are current as of the date of this presentation. Targets are objectives and do not provide any assurance as to future results. The information herein is presented as of the date indicated, which may have changed and may be subject to further change.

Portfolio Allocations

Private real estate credit is a complement to traditional fixed income, corporate credit and real estate equity with several key benefits:

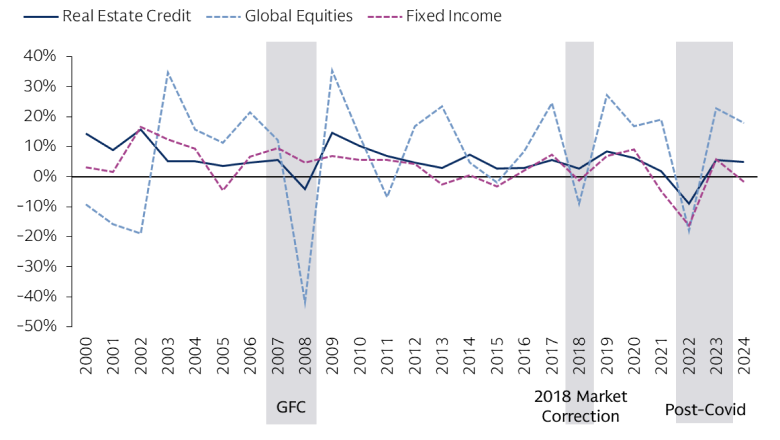

Income

Private real estate credit seeks to generate durable income through market cycles, underpinned by contractual obligations in the form of cash pay from borrowers. Senior real estate loans are typically secured by a mortgage on the property which provides an equity cushion if collateral values decline. We observed during the global financial crisis that although some credit losses were incurred, income returns were marginally impacted. Being in the senior credit position of a real estate capital structure seeks to mitigate risk through downturns while maintaining a steady stream of income through regular interest payments. Additionally, the floating-rate structure of financing can serve as a natural hedge, helping to enhance returns across varying interest rate environments.

Source: Giliberto-Levy Commercial Mortgage Index. Information as of December 31, 2024. Real Estate Credit is represented by the Giliberto-Levy Commercial Mortgage Index (G-L 1), Global Equities are represented by the MSCI ACWI Gross Total Return Index (USD); Fixed Income is represented by the BBG Barclays Global Aggregate Total Return Index (USD). The G-L Commercial Mortgage Performance Index or G-L 1 tracks investment results for fixed-rate senior mortgages made by lenders such as life insurance companies, GSEs, pension funds and investment managers and held on their balance sheets. G-L 1 has been produced continuously since 1993, with a return inception date of January 1, 1972. Past performance does not guarantee future results, which may vary.

Diversification

Private real estate credit has income-oriented and defensive characteristics that offer investors an opportunity for diversification and downside protection.

The primary role of private real estate credit in a portfolio is to provide investors with a steady source of yield, serving as a complement to traditional fixed income, corporate credit and real estate equity. Over the last 25 years, returns from private real estate credit exhibited a low correlation to these asset classes:

Source: Quarterly Returns from Q1 2000 through December 31, 2024. Private Real Estate Credit – Giliberto-Levy Commercial Mortgage Index (G-L 1), High Yield – Barclays Global High Yield Index, Senior Loans – Morningstar LSTA Leverage Loan 100 Index, Private Real Estate Equity – NCREIF Property Index, Public Real Estate Equity , Public Real Estate – FTSE NAREIT All Equity total return index, CMBS – Bloomberg US CMBS Investment Grade Index, Investment Grade Bonds – Barclays Global Aggregate Bond Index, Direct Lending – Cambridge Direct Lending Index.

Private real estate credit offers diversification benefits to a variety of asset classes:

To Fixed Income: Relative to public high-yield and investment grade bonds, investors in private real estate credit can expect a lower observed volatility profile, supported by an appraisal-based valuation process, with lower sensitivity to broader market movements. Private real estate credit may also help mitigate a fixed income portfolio’s interest rate sensitivity, as the majority of loans are floating-rate, leading yields to increase if interest rates rise, and structured with interest rate floors creating a buffer if interest rates fall. This contrasts with high yield investments, a core public credit holding, which are fixed-rate. Although interest rates are off peak levels, we believe that levels are unlikely to revert to pre-COVID levels, offering an attractive base rate that should support returns going forward. Being in a control position in the capital structure as opposed to investing via a club of lenders or as a participant enables active risk management throughout the hold period.

To Private Corporate Credit: Private real estate credit offers diversifying underlying sources of risk from the corporate market and, therefore, from the broader macro and corporate M&A cycle. Real estate and private credit have diverged cyclically since COVID. Assuming real estate has bottomed, as previously discussed, investors in today’s market can deploy capital at a reset basis – an opportunity that is not available to private credit investors. Real estate is the beneficiary of trends that house the U.S. economy, such as digitization (data centers), evolving supply chains (industrial) and demographics (multifamily, student housing), which transcend macroeconomic cycles. In addition real estate loans are secured by tangible assets with the ability to lay claim on the property in the event of a default or foreclosure. To the extent a lender needs to foreclose on a property, there are various ways to preserve principal in the investment and/or explore liquidity options for the underlying asset. Private real estate credit is supported by cash-paying loans—offering investors consistent yield and reliable cash flow. While many private corporate credit strategies are also cash pay, there has been an increased prevalence of payment-in-kind interest which has not presented in the real estate lending markets.

To Real Estate Equity: Loans secured by real estate assets may offer similar inflation protections as real estate equity, insofar as underlying collateral values can increase with rising prices. Owning property generates total returns through appreciation and income over a medium to long-term time horizon, whereas real estate credit provides current income from a defensive position with an equity cushion, insulating some risk if property values fall. Senior mortgages are the first to be paid and last to incur losses in the capital structure in the event of a default.

Attractive After-Tax Distributions*

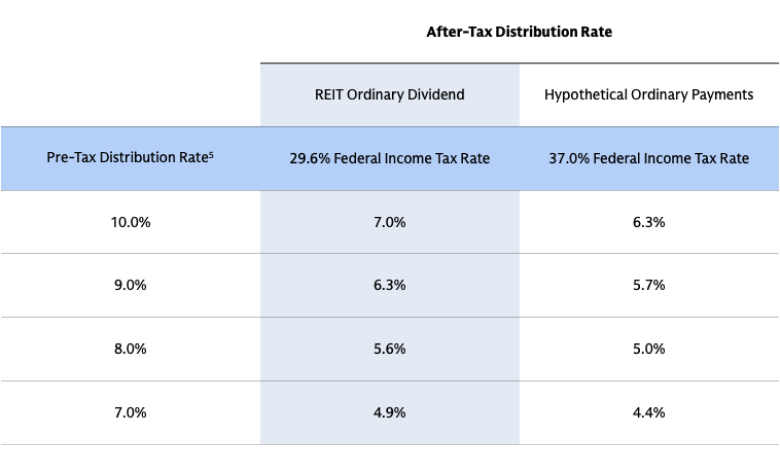

Private real estate credit ownership through REIT structures can provide potential attractive after-tax distributions for U.S. taxable individual investors. Non-U.S. investors and U.S. tax-exempt investors are subject to additional tax considerations not discussed herein.

REIT distributions are taxed at different rates depending on whether they are characterized as ordinary dividend, capital gains dividend or return of capital (“ROC”) distribution.

U.S. taxable individual investors benefit from a 20% tax rate reduction on ordinary REIT dividend. The legislation commonly known as the "One Big Beautiful Bill Act" recently made permanent both the 20% deduction and the maximum individual tax rate of 37%.

The 20% tax rate deduction reduces the federal income tax rate for ordinary REIT dividend payments from 37% to 29.6% for U.S. taxable individual investors in the highest tax bracket resulting in payments that may produce attractive after-tax distributions compared to a hypothetical investment generating distributions classified as ordinary income, not subject to the 20% deduction and not classified as a ROC. 1, 2, 3, 4, 6

* See Endnotes for additional information. Note: Goldman Sachs does not provide accounting, tax or legal advice. The information provided above does not constitute tax advice. Every investor’s tax position is different. Investors should always consult with a tax professional prior to making any investment decisions. An investment in a REIT could generate unrelated business taxable income (“UBTI”) if the REIT engages in certain types of securitization transactions that give rise to excess inclusion income. No assurances can be given that a REIT will structure its securitization transactions to avoid the allocation of excess inclusion income to investors. We will notify investors if a portion of a dividend paid by the REIT is attributable to excess inclusion income.

Bonus Benefit: The Benefits of Origination

Direct origination enables lenders to receive borrower-paid economics, such as upfront fees, which may be passed on to investors, creating incremental yield potential.

The origination model also allows private lenders to set loan terms, engage directly with borrowers, and actively manage portfolios. This enables direct lenders to retain more control throughout the life of the loan than broadly syndicated loan alternatives.

Directly originated loans may be structured with features such as cash coupons, undrawn fees, interest rate floors, extension or exit fees, lender protections, and/or extension tests based on cash flow, loan-to-value (LTV), or other performance hurdles.

Manager Selection Considerations

In today's increasingly fragmented market, achieving success in alternative lending demands specialized expertise, strong borrower relationships, and a disciplined, equity-minded investment approach to effectively navigate the varying growth prospects across diverse sectors and regions.

Investors should seek a platform that demonstrates resilience across market cycles, maintains a strong track record of low default rates, and leverages access to a broad funnel of opportunities—each of which instills confidence in its ability to manage risk and allocate capital during periods of uncertainty.

As real estate owners, developers, and operators increasingly seek holistic financing solutions, lenders with flexible capital are well-positioned to generate attractive risk-adjusted returns and influence deal terms and structures. Borrowers are prioritizing relationships with trusted lenders with a longstanding reputation as dependable real estate credit providers—enabling them to win business in an increasingly competitive market.

Efficiency in differentiated sourcing and underwriting capabilities are paramount: requiring a broad, integrated network and platform to strategically align opportunities with predefined portfolio objectives and ensuring a risk-conscious investment strategy. Moreover, proactive loan asset management, coupled with close lender-borrower collaboration, is critical for early detection of potential challenges and safeguarding principal, providing enhanced resilience amidst market volatility.

By selecting managers in private real estate credit with these skillsets, investors have the opportunity to generate durable yield, mitigate risk and complement other income-oriented strategies in their portfolios.

1 Ordinary REIT dividends will not qualify for reduced capital gain rates (e.g., 20%) that generally apply to qualified dividends by non-REIT “C” corporations.

2 Certain individual tax provisions such as the 20% tax rate deduction to individual tax rates on the ordinary income portion of taxable distributions from a REIT and a reduction of the highest U.S. federal tax rate from 39.6% to 37% that were originally set to expire on December 31, 2025 under the Tax Cuts and Jobs Act of 2017 have been made permanent by the “One Big Beautiful Bill Act”.

3 Investors could be subject to state income tax in their state of residence which would lower the after-tax distribution received by the investor.

4 Investors may also be subject to net investment income taxes of 3.8% and/or state income tax in their state of residence, which would lower the after-tax distribution rate received by the investor.

5 Represents net taxable income distributed to investors.

6 An investor should consider his or her current and anticipated investment horizon and income tax bracket when making an investment decision. The illustration above does not reflect these factors.