Road to Renewal: Investing in a New Era for Europe

Fiscal Firepower Amid Global Tariff Turbulence

Germany’s fiscal breakthrough and plans for higher European-wide defense spending, combined with ECB rate cuts, have provided tailwinds for European assets in recent months. Although US tariffs are a near-term headwind for Europe and beyond, the prospect of increased fiscal firepower has led to renewed optimism on the Euro area’s medium-to-long term economic growth prospects. The spending shift also opens the potential for new investment opportunities across sectors.

Source: €800 Billion is from European Commission. As of March 19, 2025. €500 Billion is from Bundestag, Goldman Sachs Global Investment Research. As of March 18, 2025. 3% is from Goldman Sachs Global Investment Research. As of March 10, 2025.

Defense spending in the Euro area is projected to rise sharply, from 1.9% of GDP in 2024 to 2.8% by 2027. Analysis suggests it could eventually reach 3% based on Europe's military requirements. In Germany, defense spending has already increased from 1.5% before 2022 to 2.1% in 2024 and will now be mostly exempt from debt restrictions. A potential ceasefire in Ukraine, along with plans to help the country's recovery, reconstruction and modernization efforts, could result in additional growth upside in the years ahead.

The feasibility and full implementation of Europe’s fiscal plans is uncertain, however, given the varying economic situations of member states like France, Italy and Spain, which have limited fiscal space. The NextGenerationEU/Recovery Fund (NGEU)—Europe’s pandemic program that launched in 2020—came after a lengthy negotiation and approval process and, as of August 2024, just over 40% of its funds had been disbursed to EU member states.1

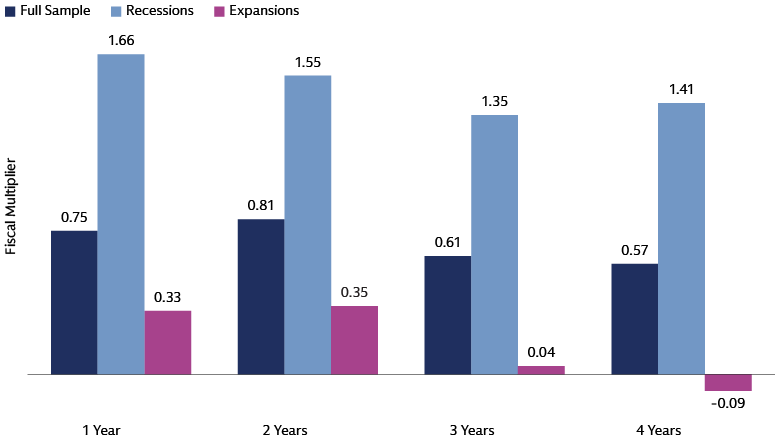

Even if the implementation of higher defense spending is gradual and complex, we believe it represents a potentially significant medium-term boost for European growth. Studies of fiscal multipliers in advanced and developing countries suggest every €1 spent on defense could generate 60-70 cents of GDP, potentially boosting EU GDP by 2-3 percentage points over the next 4 years, or about 0.5-0.7% per year, depending on how the money is spent.2 Investment in equipment and infrastructure usually has a longer-lasting impact than increasing personnel, and the effect also depends on how much is imported versus domestically produced.

Source: Federal Reserve Bank of Boston, University of Wisconsin, and Goldman Sachs Asset Management. As of March 21, 2025. Based on military spending for 129 countries in the period 1988-2013. Viacheslav Sheremirov & Sandra Spirovska (2022). Fiscal multiplier is calculated as the ratio of the change in national income to the change in government spending in advanced and developing countries: Evidence from military spending. Federal Reserve Bank of Boston & University of Wisconsin. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved.

In the near-term, US tariff uncertainty will likely weigh on Euro area growth for the rest of 2025, and impact global demand for capital goods, as well as European business investment and hiring decisions. Uncertainty remains elevated, and how EU-US trade relations evolve from here will impact Europe’s macroeconomic outlook, alongside global growth, financial conditions, and developments in FX markets.

Tariffs aside, Europe faces additional challenges. The global economy is splitting along geopolitical lines, and Europe's dependencies on the US and China for raw materials, security, and digital technology are becoming vulnerabilities. Energy prices, which are 2-3x times higher than in the US and China, and a lack of investment in innovative technologies and infrastructure are also hurting Europe's industrial competitiveness.

In our view, Europe’s long-term path largely depends on the successful implementation of fiscal ambitions and the political will to increase cooperation within the union. Germany’s fiscal shift and the region’s defense strategy at the EU level could be the first steps toward a closer union. If this is the case, it could open opportunities across multiple sectors of the economy. A key long-term benefit of defense spending will most likely come from the innovation it can spur. Increased defense spending in the US, particularly through DARPA,3 has led to groundbreaking innovations like the internet, GPS, advanced robotics, and cybersecurity systems, which have significantly impacted both military and civilian life. Germany, with its biotechnology expertise demonstrated by developing one of the first COVID-19 vaccines, has the innovative capacity to drive similar advancements. We take a closer look at some areas of potential opportunity below.

Finding Opportunities from Fiscal Reindustrialization

Looking Beyond the “Front-Liners” in Industrials

Beyond well-known aerospace and defense companies, we believe many other businesses stand to benefit from increased defense spending. From analyzing supply chains, earnings calls and granular revenue data, we have identified a larger set of European companies outside the traditional defense sector that have a higher-than-average connection to defense spending. Importantly, not all these companies have moved in lockstep with the aerospace and defense sector over the past year, suggesting the market hasn't fully recognized their potential to benefit from the theme.

In our view, detailed bottom-up analysis is required to find the best opportunities. For instance, we believe a software company specializing in 3D platforms for industrial projects is well-positioned to profit from a rise in aerospace and defense. As military manufacturing expands, industrial automation, especially "digital twins" and 3D modeling, becomes critical for cost-effectiveness and efficiency. In our view, this company's expertise in collaborative platforms, system engineering, and meeting cybersecurity requirements makes it valuable to the defense sector. While the business doesn't directly report defense revenue and hasn't historically correlated with the A&D sector, we believe it's a prime beneficiary. We have also seen hints of this potential in management's comments during recent earnings calls.

Fiscal Reindustrialization Signals Rising Power Demand

Europe’s fiscal reindustrialization, in addition to growing demand for data centers, is likely to significantly boost power demand. This dynamic is similar to the US market which, in our view, is reaching a power demand inflection point. In Germany, electricity consumption is expected to accelerate to 3-3.5% by 2031, compared to zero growth since 1990.4 The European grid system, being the oldest in the world with 40% of the power distribution grid over 40 years old, needs an upgrade. The relevant investments over the next decade could exceed half a trillion euros, implying a capex acceleration of nearly three times compared to the past decade. We see this potentially benefiting companies across the energy value chain, from power generation and transmission (upgrades to the electrical grid through medium-voltage equipment for example), to energy management and storage.

Momentum Building for Construction and Materials

Germany's infrastructure spending is set to rise due to fiscal rule changes and a €500 billion fund. While major projects like rail and LNG-port upgrades will take time, smaller renovation and repair projects should start by late 2025. Around 20% of the fund will go to regional authorities, focusing on areas with the greatest need. Initially, we expect cement, concrete, and aggregates companies to benefit most, with the broader construction sector potentially benefiting from improvements in GDP at a later stage. Germany’s construction sector has ample capacity due to past order declines.5 Staff shortages and slow approvals remain challenges.

Unpacking Other Areas of Potential Opportunity

Higher fiscal spending has the potential to boost various other sectors, including packaging with increased demand for boxes and crates reflecting increased shipments and logistics. We believe companies providing chemicals (e.g., adhesives, plastics, polymers) and products required for renovation and refurbishment (e.g., paints, glass, resins, and fillers) also stand to benefit. Heavy industrial supply chains, including steel, aluminum, copper, and industrial chemicals, could also see increased demand, with industrial gases playing a key role in most industrial production processes.

Financials, and banks in particular, are gearing to capitalize on increased corporate activity and business expansion. Unlike the US, European corporates have traditionally been financed by banks, rather than capital markets. In the near term, banks are likely to be the main beneficiaries of the business expansion, with loans needed to finance large construction and infrastructure projects. In the longer term, if there is meaningful progress towards a European savings and investments union and ultimately a capital one, some diversified banks and asset managers will benefit from greater disintermediation. From a European investment grade credit perspective, we favor financials and expect net interest margins to continue supporting earnings. Capital ratios also remain close to recent highs and non-performing loan ratios remain low, which is supportive of higher overall asset quality.

To identify such valuable underappreciated opportunities, we believe it is crucial for managers to leverage deep expertise and knowledge on the interconnection among different business models across industries, complemented by data-driven insights on such hidden linkages through the use of technology.

An Alpha Rich Environment

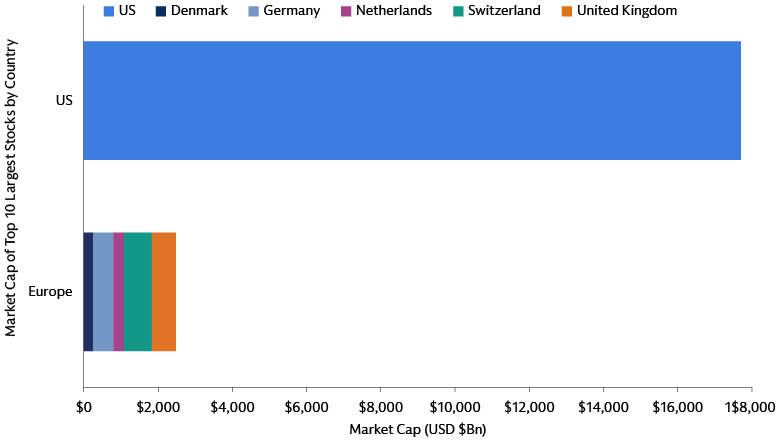

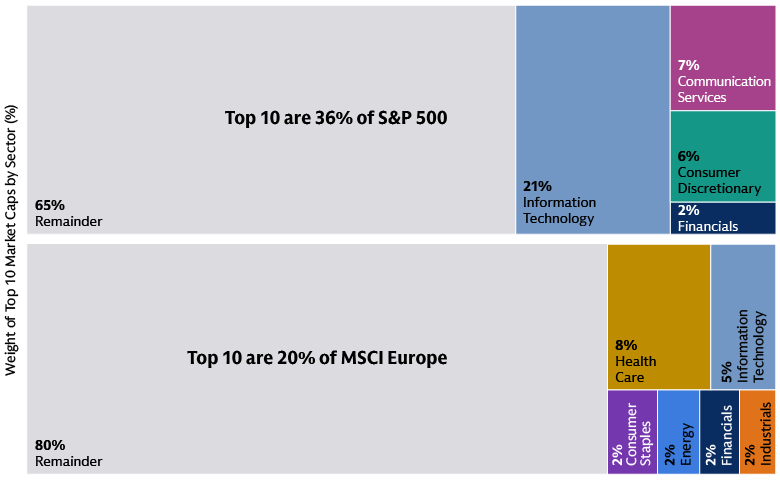

Europe’s equity market is broad and diverse, with lower market concentration compared to the US. It has a more diversified composition at both the country and sector levels. For instance, technology dominates the US large-cap equity market, accounting for approximately 30%, whereas in Europe, the two largest sectors—financials and industrials—each account for 20%.

Source: Goldman Sachs Asset Management, MSCI, Bloomberg. As of March 25, 2025. Diversification does not protect an investor from market risk and does not ensure a profit.

Source: Goldman Sachs Asset Management, MSCI, Bloomberg. As of March 25, 2025. Diversification does not protect an investor from market risk and does not ensure a profit.

We also observe that information in Europe is less abundant, more dispersed, and diffuses more slowly versus the US. This is due to fewer news reports, lower research analyst coverage, and more limited sources of information that investors rely on. For instance, in the US, each stock has a market cap weighted average of 41 analysts covering it, while in Europe, each stock has about 25 analysts, and in emerging markets, it's around 27. The number of analysts covering each stock can vary widely across countries and is not related to the number of stocks in each country. Additionally, each stock in the US gets an average of 36 news articles, compared to just 14 in Europe, with coverage spread across many sectors rather than concentrated in a few.

These dynamics create market inefficiencies, meaning not all available information is immediately reflected in stock prices. Active investors can exploit these inefficiencies by conducting independent fundamental research and analysis to identify undervalued or overvalued stocks. Lower analyst coverage also means less competition among investors to find and act on valuable information, providing active investors with opportunities to generate alpha (excess returns above the market average) by uncovering insights that others might miss.

Momentum-based factors have historically delivered stronger performance on a sustained basis in Europe compared to other regions, which suggests that the value of information releases tends to persist more in the European context. For example, information on earnings releases in Europe tends to spread more slowly, resulting in higher and more persistent performance for certain stocks in the days following announcements than in the US. This indicates that European equity markets follow a less efficient price finding mechanism versus the US, making Europe a comparably richer space to systematically source alpha.

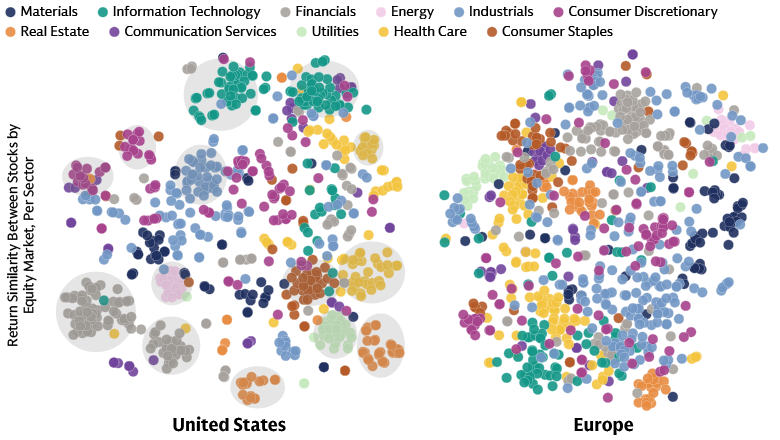

Analyzing the correlations of excess returns of companies within sectors, we find that the return relationships between European stocks can be less obvious than the relationships between US stocks. In the US, stocks within sectors tend to be clustered together in terms of return profile, suggesting a higher degree of similarity in performance. Meanwhile, in Europe, stocks within sectors are more dispersed, meaning there is less similarity in returns between stocks within sectors.

Return similarity between stocks by equity market, per sector. Source: Goldman Sachs Asset Management As of February 28, 2025. For illustrative purposes only. The plots are meant to visually represent the return similarity between stocks in each universe, calculated based on the pairwise correlation of stock returns from January 2021 until December 2024.

Another aspect contributing to greater opportunities for active investors in Europe is the more differentiated excess returns between European stocks, even within specific sectors. In contrast, US stocks within specific sectors tend to have more similar return profiles. These factors have benefited active investment approaches in the European equity market. Over the past decade, 74% of European investment managers achieved positive excess returns (averaging 1.05% annually) compared to 44% in the US, where the average manager underperformed the market by -0.35% annually.6

Additional structural characteristics of the European market can also benefit global investors seeking to broaden their regional equity horizons. European equities have the advantage of a much lower valuation starting point compared to the US,7 including after adjusting for US’s higher proportion of tech stocks. Historically, European companies have also shown a strong commitment to distributing dividends and buying back shares, resulting in higher income and capital appreciation potential relative to US stocks. With European companies holding significant cash reserves, we expect the payout ratio for shareholder-friendly activities like dividends and buybacks to rise further. The sectoral composition in Europe is also less geared towards ‘growth’ stocks compared to the US, providing differentiated and potentially more resilient exposures during economic slowdowns.

Technical factors also present a potential tailwind, with global investor allocations having room to expand after more than a decade of persistent inflows to the US. We believe we are in the early stages of global investors seeking to rebuild or establish allocations to European equities, with only 14% of the outflows observed since Russia’s invasion of Ukraine in February 2022 returning so far. We also see room for European investors—who hold around $9 trillion in US equities—to rebalance their allocation to be more domestically focused. Even a 5% reduction in US equity holdings would yield an inflow of $450 billion into Europe, indicating significant potential for inflows to build on the $35 billion seen year-to-date.8

Looking Ahead

The recent tariff developments and the broader geopolitical landscape add another layer of complexity to the investment environment. However, the green shoots of recovery in Europe, coupled with the ambitious fiscal and defense spending plans, present significant opportunities for investors in areas across sectors: from aerospace and defense to electric grid operators and suppliers of key construction materials. The diverse and fragmented nature of the European market, along with the slower rate of information diffusion, creates a rich environment for active investing. By capitalizing on these inefficiencies and dispersion, investors can potentially generate higher alpha and navigate the challenges of 2025 and beyond.

1 European Central Bank. As of December 2, 2024.

2 Based on military spending for 129 countries in the period 1988-2013. Viacheslav Sheremirov & Sandra Spirovska (2022). Fiscal multipliers in advanced and developing countries: Evidence from military spending. Federal Reserve Bank of Boston & University of Wisconsin.

3 DARPA, or the Defense Advanced Research Projects Agency, is a research and development agency of the United States Department of Defense. It is responsible for the development of emerging technologies for use by the military.

4 Goldman Sachs Global Investment Research. As of March 31, 2025.

5 Goldman Sachs Global Investment Research. As of March 19, 2025.

6 Annualized returns, based on past trailing 10Y. And the figures are the average across all managers in each category respectively.

7 Goldman Sachs Global Investment Research. As of April 8, 2025.

8 Bank of America, The Bull Case For Europe Continues. As of May 7, 2025