Technology in 2025: The Cycle Rolls On

Our outlook for tech equity in 2025 remains robust following strong market performance over the last couple of years. AI momentum has been a key driver. We have also seen the tech sector remain resilient in a lower growth, inflationary environment. As AI and the broader tech cycle advance, new frontrunners emerge. Identifying the right companies will be critical to long-term investment success. In this article, we build on our Broader Equity Horizons Outlook and highlight areas of tech—including hyperscalers, software and application-specific integrated circuit (ASIC) semiconductor companies—that may present investment opportunities in the year ahead.

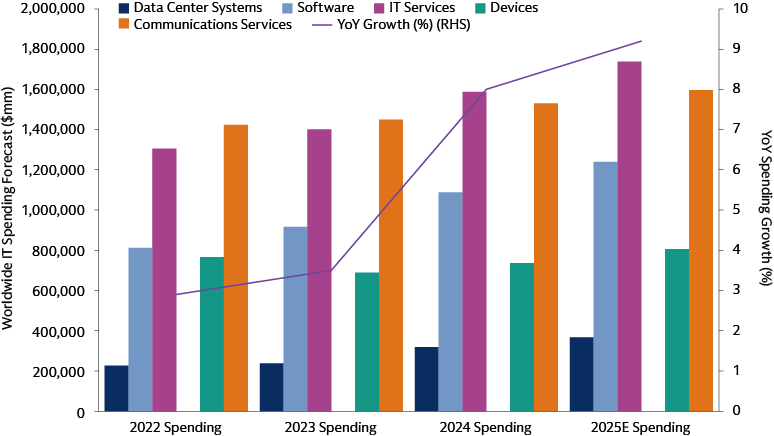

Tech Spend Trend Remains Intact

At the start of 2024 we predicted that overall tech spending would remain healthy in a lower growth environment.1 While AI-related spending was a strong tailwind, we also saw strong demand in cybersecurity, enterprise software, and semiconductors. As a result, valuations have been supported by strong fundamentals. We expect this trend to accelerate in areas such as data center systems, software, and IT services.

Source: Gartner. As of April 17, 2024 and October 23, 2024. For illustrative purposes only. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation.

We believe that the quest for the new frontier models will continue and hyperscalers will maintain their high level of capital expenditures (capex) in this space, as evidenced by the recent announcements on Q4 2024 earnings calls.

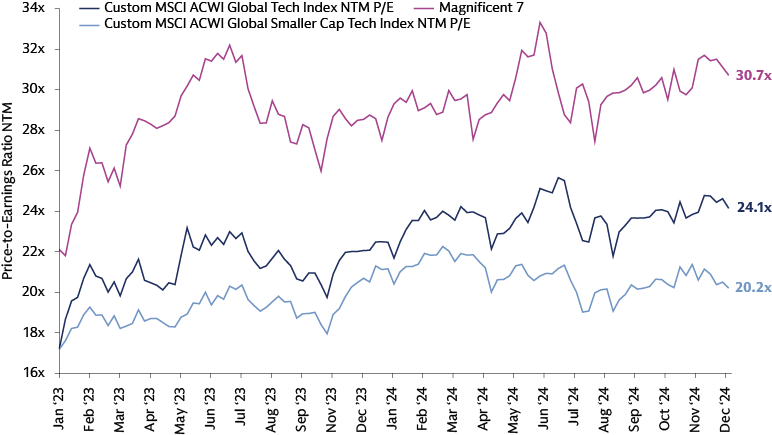

We hoped that AI-related market performance would broaden out beyond the Magnificent 7 in 2024. It has taken longer but now we believe the market is ripe for it. Key beneficiaries from the excitement around Generative AI (GenAI) have, until recently, been concentrated in a narrow group of stocks.2 We see several reasons why the investment landscape is likely to drive new opportunities for innovative companies further down the market cap spectrum. We believe software and IT services companies are increasingly attractive from a valuation perspective relative to mega-caps winners levered to AI. We are actively seeking the next set of beneficiaries and see interesting potential opportunities among innovative companies tied to data and security, as well as applications. We also believe smaller cap tech companies are particularly well positioned to benefit from lower borrowing costs, which may enhance their growth potential and profitability. As rates decline, these companies can access cheaper capital for innovation and expansion, making them more competitive in the market.

Optimism on ROI among “hyperscalers”

Despite significant amounts of capex already being spent on the AI infrastructure buildout, big tech’s AI spending continued to accelerate rapidly, which demonstrates a strong focus on expanding AI infrastructure. As of May 2024, Amazon, Meta, Google, and Microsoft were expected to invest an estimated $188 billion in 2024 to obtain the necessary hardware for the buildout of next-gen data centers capable of training GenAI.3 These hyperscalers’ AI capex is expected to exceed $250 billion in 2025.4 The spending by these companies with large balance sheets and disciplined management teams provides optimism that hyperscalers are confident in the return on investment they will see from these huge investments.

Through numerous interactions with management teams, we know firsthand how disciplined these companies are with their capital. A chief financial officer at one of these enterprises was clear that they would obtain more graphics processing units (GPUs) if they could—despite the substantial cost. The escalating cost of GPUs is driven by the race among frontier model providers to build the most capable framework, and we don't expect that race to slow down any time soon. From an ROI perspective, while the hyperscalers are beginning to see incremental revenues from GenAI, meaningful progress may be a year or two down the road, and this is what the market is grappling with.

The market may be missing AI benefits to software

Following a difficult 1Q 2024 earnings period and reports of slower than expected AI adoption, software companies sold-off.5 We believe this was primarily due to investors’ fears that customers of software companies would be spending more on AI and less on enterprise software. Questions around the ability of GenAI to integrate enterprise software capabilities subsided later in the year with the recognition that GenAI was still early in its evolution and due to spending on software remaining healthy.

As opposed to being at risk of disruption by frontier models,6 we believe many of the biggest software companies are more valuable in the context of frontier model development as they have vast amounts of proprietary customer data. We believe there are many potentially exciting GenAI integration initiatives in the works among the largest software companies. We may also see partnerships develop between enterprise software companies that have valuable datasets and frontier model providers, creating clear advantages for the providers that can train their frontier models on high-quality data that is organized, accurate, and secure.

We believe that AI features (like agents and copilots) will drive incremental revenue and won’t cannibalize core software products and offerings. Additionally, with more widespread adoption of AI, data management is playing an increasingly critical role. Data management refers to the entire lifecycle of data—everything from the source of the data to its end use case, including collection, storage, cleaning, and protection. To maximize the value of data, it must be stored, leveraged, and protected appropriately. We believe companies across the tech ecosystem that can help other companies derive insights from their data may be set to benefit.

As AI models become more sophisticated and complex, we believe the reliance on vast and accurate data sets is among the highest priorities. A company’s limit within the context of gen-AI capabilities is determined by the accuracy and validity of its data and ability to manage that data throughout its lifecycle.

Throughout 2025, we believe that companies will begin to differentiate themselves as AI technologies mature and opportunity expands beyond the initial enablers.

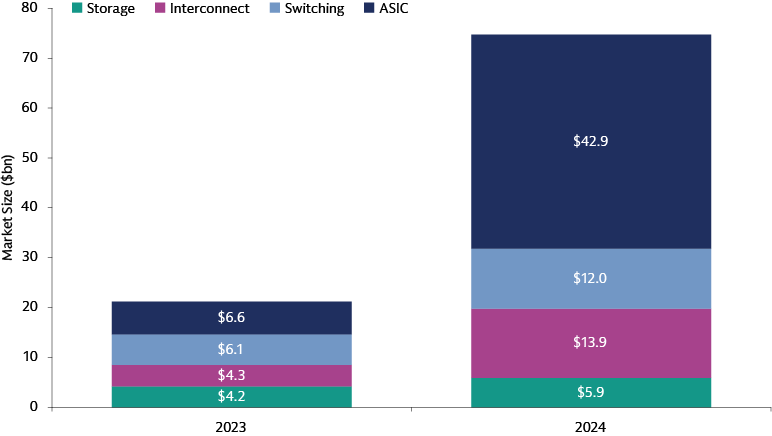

ASIC semiconductors: scale and growth ahead

While NVIDIA’s GPUs have enjoyed near total market share in the GenAI training market due to their unparalleled processing power and software ecosystem, we believe other semiconductor manufacturers are also poised to benefit.7 Most notably, the hyperscalers have developed their own ASICs (application-specific integrated circuits) which, while not as versatile, are effective at running repeatable tasks in high volumes.

ASICs are purpose-built for specific workloads and can perform that task much more efficiently and at significantly lower cost than a powerful NVIDIA GPU. While the upfront cost to build ASIC infrastructure is high, the cost to run GenAI workloads on these chips will likely be lower than once the upfront investment is made. The hyperscalers are also uniquely positioned to spend on the software needed to support ASIC infrastructure for both training and inference. We are focused on identifying the potential beneficiaries in the semiconductor industry that may gain from this transition.

We saw the most relevant ASIC companies report 3Q 2024 earnings and orders that were above consensus expectations. Hyperscalers are increasingly focused on ASIC infrastructure to support growing AI demand, and we believe orders will accelerate in 2025.

Source: Marvell. As of April 11, 2024. For illustrative purposes only. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation.

Where do valuations stand?

We expect a broader opportunity set in 2025 due to drivers across technology identified above. Looking at the valuations of the Magnificent 7, MSCI ACWI Global Tech, and MSCI ACWI Global Smaller-Cap Tech we see attractive opportunities further down the market-cap spectrum and beyond the Magnificent 7 for underpriced growth. While valuations may be high based on historical data, they are supported by strong fundamentals and tech spending. We believe we are still in the early innings of a durable tech cycle.

Source: Goldman Sachs Asset Management, MSCI. As of December 31, 2024. For illustrative purposes only.

Staying Active as the Cycle Rolls On

We expect the investment landscape to broaden beyond mega caps in 2025, driving new potential opportunities for innovating smaller-cap tech companies. We believe our large, global team of experienced investors positions us well to identify attractive names we consider to be underrepresented in benchmarks. Our diverse group of tech investors are focused on identifying underappreciated names across regions with strong earnings growth and top-tier management teams.

We believe hyperscalers’ capital spending will result in positive ROI given the general capital discipline of these companies and the strong competitive moat. We expect software companies to benefit from partnering with frontier model providers and capitalizing on their vast data sets. We are also excited about the ability of ASIC companies to scale and grow as companies seek application-specific affordable solutions. Additionally, we believe we are likely to see continued innovation and volatility in the AI theme overall as governments and companies commit huge resources to the technology, making it increasingly important to re-underwrite where are conviction is to ensure we are positioned in the right companies. In the environment of broadening market performance, we believe it will be crucial to stay active to find next areas of growth and identify potential beneficiaries of the accelerating trends.

1 Goldman Sachs Asset Management. Tech Outlook 2024: AI, Improving Fundamentals, And Attractive Valuations. As of January 29, 2024.

2 Bloomberg, Datastream, Goldman Sachs Global Investment Research. As of January 10, 2025.

3 MSCI, Wind, Bloomberg, FactSet, Goldman Sachs Global Investment Research. As of May 24, 2024.

4 Bloomberg. As of December 9, 2024. Microsoft capital expenditure numbers include capital leases.

5 FactSet. As of April 30, 2024.

6 Frontier model, a dual-use foundation model, is an AI model that is trained on broad data; generally uses self-supervision; contains at least tens of billions of parameters; is applicable across a wide range of contexts.