Unlocking Tax Efficiency: Managing Your Portfolio with After-Tax Returns in Mind

Specific Asset Class Considerations Drive Final Results

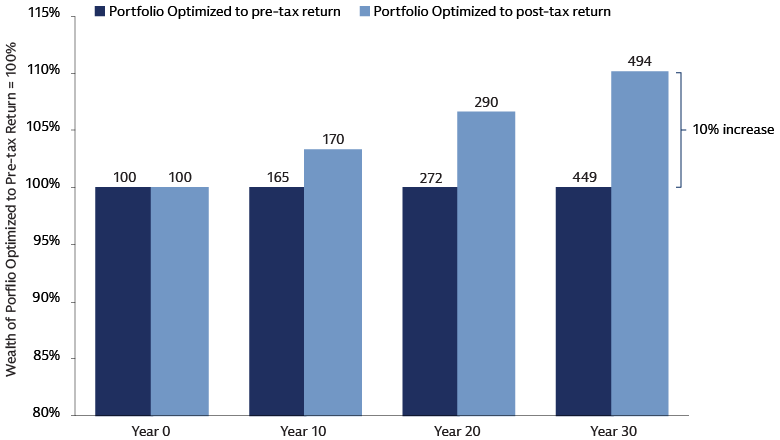

For investors seeking to create and safeguard long-term wealth, it’s important to consider after-tax returns. We believe understanding how different asset classes are taxed is key to maximizing those returns. Our research indicates that a tax-aware investment strategy can boost after-tax returns by about 0.35% each year, when compared to a portfolio constructed without tax considerations in mind. This seemingly small difference can add up to more than a 10% increase in your retirement over three decades. Importantly, investors themselves are subject to different tax treatments—at a federal and local level—with tax brackets based on income, filing status, and state of residence. It’s a complex, multi-layered system, underscoring the need for a personalized approach to investment planning that takes into consideration an investor’s total portfolio.

Source: Goldman Sachs Asset Management. As of December 31, 2024. Illustration of post-tax wealth growth over 30 years for portfolios optimized to pre- and post-tax (high-tax bracket without stepping-up cost basis) returns, assuming an investor with high federal tax rates (i.e., income tax of 37%, long-term capital gain tax of 20%, net investment income tax of 3.8%), no state/local tax, and no stepping-up cost basis after investment horizon.

How We Build Tax-Aware Portfolios

Insights on our Methodology

To capture a fuller picture of potential tax implications at a total portfolio level, we start by adjusting our tax-exempt capital market assumptions for taxes with a 10-year investment horizon in mind to create taxable capital markets assumptions (see appendix for marginal tax rate assumptions.)

For fixed income, we adjust the returns using ordinary income rates on coupons while attributing credit losses as an offset to capital gains.

For equities, we adjust returns in three steps:

- We apply taxation on dividends based on the composition of qualifying and ordinary dividends.

- We reinvest after-tax dividends and update the cost basis.

- We annualize total returns after taxation, assuming capital gains are realized at the end of our investment horizon. Alternatively, no capital gains are realized if we assume charitable gifting or step-up in cost basis upon death.

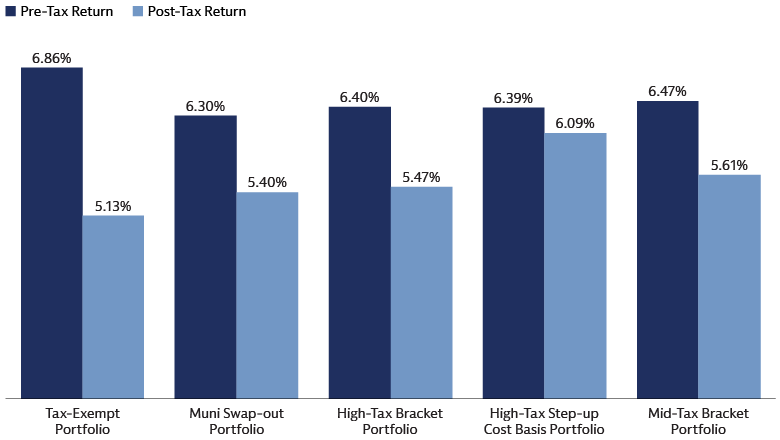

Using these taxable capital markets assumptions, we then construct four tax-aware portfolios. For each tax-aware portfolio, we compare the resulting allocations as well as expected pre- and post-tax expected returns in absolute and relative terms to the portfolio design to be optimized for pre-tax returns.

- Tax-Exempt Portfolio: A portfolio built using our tax-exempt capital market assumptions.

- Muni Swap-Out Portfolio: A portfolio built using our tax-exempt capital market assumptions and replacing traditional fixed income with municipal bonds

- High Tax Bracket Portfolio: A portfolio built for a high-income tax bracket investor using our after-tax capital market assumptions.

- High Tax Step-up Cost Basis Portfolio: A portfolio built for a high-income tax bracket investor with step-up in cost basis using our after-tax capital market assumptions.

- Mid-Tax Bracket Portfolio: A portfolio built for a middle-income tax bracket investor using our after-tax capital market assumptions.

Source: Goldman Sachs Asset Management. As of December 31, 2024. Post-tax returns for the Tax-Exempt, Muni Swap-out, and High-Tax Bracket portfolios are assumed to be taxed at high-tax bracket without stepping-up cost basis; The High-Tax Setup-up Cost Basis is assumed to be taxed at high-tax bracket with stepping-up cost basis; The Mid-Tax Bracket is assumed to be taxed at mid-tax bracket without stepping-up cost basis.

Our Observations

A Holistic Approach Matters

A holistic, portfolio-level approach designed to significantly enhances after-tax returns without substantially increasing portfolio risk. For instance, as the exhibit below illustrates, high-tax-bracket individuals can potentially increase their annual expected return by approximately 0.35%, translating to over a 10% increase in retirement savings over 30 years. For investors focused on wealth transfer rather than retirement savings, the benefit may be higher.

Source: Goldman Sachs Asset Management. As of December 31, 2024. Post-tax returns for the Tax-Exempt, Muni Swap-out, and High-Tax Bracket portfolios are assumed to be taxed at high-tax bracket without stepping-up cost basis; The High-Tax Setup-up Cost Basis is assumed to be taxed at high-tax bracket with stepping-up cost basis; The Mid-Tax Bracket is assumed to be taxed at mid-tax bracket without stepping-up cost basis.

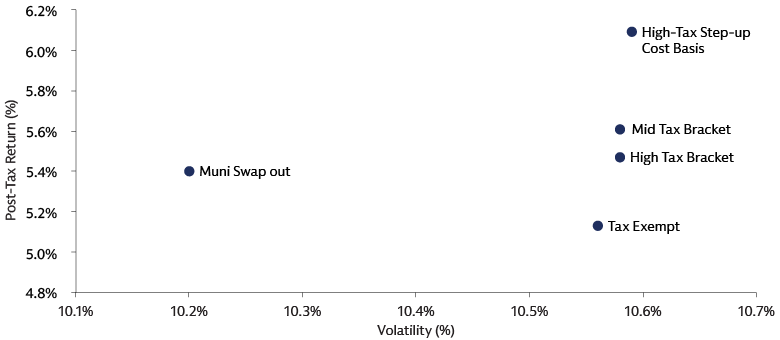

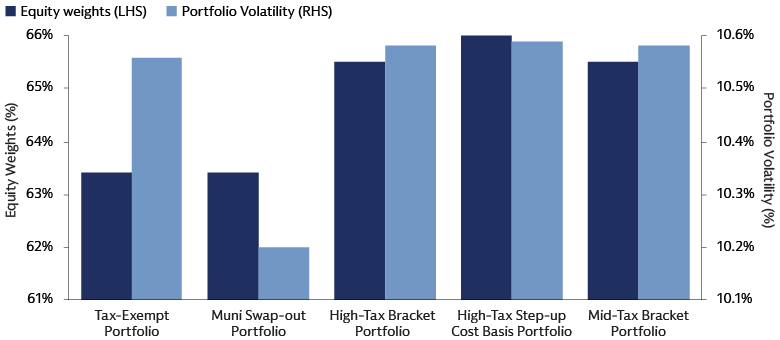

Potential Return Enhancement Without Materially Increasing Overall Risk

For high-income earners, substituting taxable fixed income with triple tax-exempt municipal bonds can substantially boost after-tax returns. We observe that investors’ allocations to taxable fixed income often include corporate bonds. Although corporate bonds have relatively low risk, their correlation with equities means that replacing taxable fixed income with Munis allows for a slight increase in equity allocation without significantly increasing the portfolio's overall risk or beta (exhibit below). Equities generally offer higher expected returns than bonds, and their gains are taxed more favorably than traditional fixed income, creating substantial value.

Source: Goldman Sachs Asset Management. As of December 31, 2024.

Growth Stocks Display Tax Efficiency

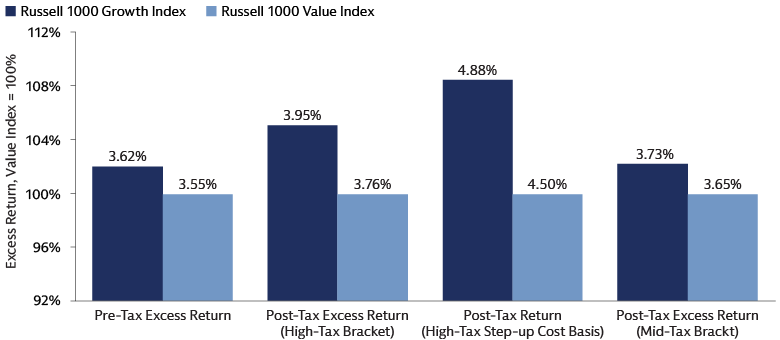

The ratio of dividends to capital gains within an asset class is an important consideration, especially given that high earners face higher tax rates on dividends. As shown in the exhibit below, growth-oriented stocks tend to be more tax-efficient for high-income earners due to the deferral of capital gains. Small-cap stocks also benefit from this effect, albeit to a lesser extent, as a larger portion of their returns typically comes from capital gains.

Source: Goldman Sachs Asset Management. As of December 31, 2024. Pre-tax risk-free rate is assumed to be 3.90%, post-tax risk-free rate is assumed to be 2.31% at high-tax bracket (with and without stepping-up cost basis) and 2.65% at mid-tax bracket.

Customization is Key

For lower-income investors, portfolio allocations should differ. As tax rates decrease, incorporating modest amounts of taxable fixed income, such as Treasury exposure, can enhance diversification. Simultaneously, the after-tax appeal of low-dividend-paying stocks diminishes. Customizing the final allocation to align with individual client circumstances is, therefore, paramount.

Seeking to Maximizing Your Clients’ After-Tax Returns

Our analysis demonstrates the importance of tax awareness at the portfolio level and the potential benefits of rethinking asset allocation based on our after-tax capital market assumptions. Further out, we plan to expand on this study and address implications for different product types and strategy selection such as actively managed mutual funds, ETFs or tax loss harvesting strategies, and alternatives. We look forward to sharing more of our insights.