Playing the Long Game: Unlocking Value in a Steepening Municipal Yield Curve

Navigating the Muni Yield Curve in 2025

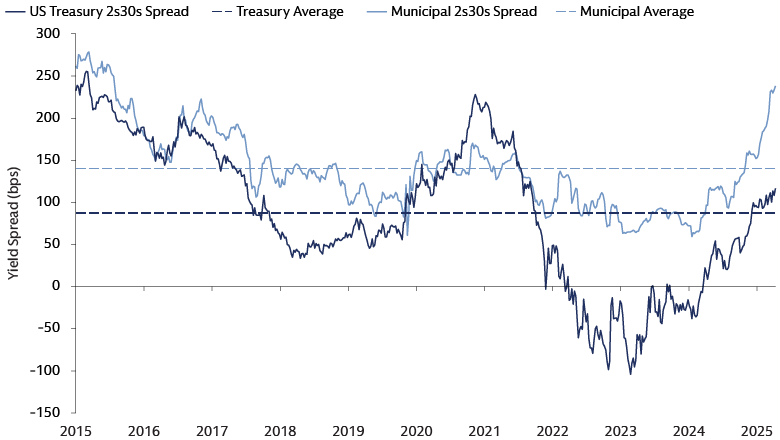

Heavy supply has weighed on the municipal market this year, particularly at the back end of the curve. Supply is up more than ~15% year-over-year, with the back end seeing a roughly 22% year-over-year increase, and a 50% increase relative to the five-year average.1 This heavier supply has affected the municipal bond market in different ways across the yield curve.

The front end for instance has rallied significantly over the past few months, partially influenced by strong demand as well as shifting expectations on potential Federal Reserve rate cuts over the coming months. Attractive absolute yields relative to history are also bolstering demand.

The belly of the curve, meanwhile, began its rally in early June as tariff concerns eased and municipal bond market participants grew less concerned about potential changes to its tax-exempt status post-tax bill discussions. The result encouraged investors to extend further out the curve, helping to absorb the increase in supply.

By contrast, while demand for longer maturity bonds has been positive, it has not been enough to take down the large increase in new issue supply. The result has been a significant steepening of the municipal yield curve. For example, 30-year AAA-rated municipal bond yields have risen more than 70 basis points (bps) this year while 2-year AAA-rated municipal bonds have seen yields move lower by 50 bps. The belly of the curve has been relatively range bound, as expressed by a 4 bp increase in 10-year AAAs.

This has caused Muni-to-Treasury ratios in the 30-year part of the curve to move higher by about 12 ratios year to date, and they currently now sit at approximately 96%. In our view, this underperformance has made municipals particularly attractive. For example, the performance of the long end of the yield curve has caused municipal bonds in general to lag their taxable fixed income counterparts year-to-date: the Bloomberg Municipal Bond Index returned -0.20% through July, while the Bloomberg US Aggregate Bond Index returned 3.75% - nearly a 400-bp excess return advantage.

Source: Goldman Sachs Asset Management, Bloomberg. July 31, 2025. The “2s30s” spread is difference between the two-year yield and 30-year yield.

Strong Credit Fundamentals

Municipal credits have mostly proven resilient on a fundamental basis despite recent spread widening. Over the past few years, rainy day fund balances have reached historically high levels,2 providing a strong financial foundation. Additionally, municipal credit has been on a solid footing across many different sectors in the market. While some recent isolated missteps, such as the Brightline High-Speed Rail project in Florida, have caused some underperformance in the high yield space, we believe these are idiosyncratic events, and that the credit environment remains attractive.

Source: Goldman Sachs Asset Management, Bloomberg. July 31, 2025

Outlook Moving Forward: Yields, Spreads, and Technical Landscape

We believe market conditions today present an attractive entry point for investors considering municipal bonds, with several factors pointing to a positive outlook:

- Attractive Yields: The current yield environment presents a compelling entry point for investors. High-yield municipal bonds provide tax-equivalent yields close to 10%, while investment-grade municipal bonds offer tax-equivalent yields closer to 7%. Longer-term, investment grade maturities offer over 8% on a tax-equivalent basis.3 Yields may be primed to move lower with the Fed signaling a restart to its easing campaign, potentially signaling better value in longer maturities.

- Resilient Credit Spreads: High yield spreads, currently around 200 bps, have widened modestly by about 15 bps, lagging other market sectors. However, this widening is largely attributed to technical factors within the municipal market rather than a deterioration in credit fundamentals. Given the diverse high yield municipal opportunity set, we believe careful credit selection will be key. Furthermore, income should continue to be the main driver of returns over the near term, and we expect credit spreads to remain range bound. Therefore, high yield exposure could be additive to overall portfolios for the year.

- Supportive Technicals: Investor demand has been largely positive, with ~$24 billion flowing into municipal funds YTD. However, the front end and belly of the curve make up approximately 80% of these inflows. Long-term and high-yield muni funds experienced net outflows during the second quarter as investors stepped away from the underperforming segments of the curve. This has led to elevated long-term yields and a steeper municipal yield curve, which has created a compelling tactical buying opportunity, as investors are now better compensated for extending duration.

Many foundational elements of the municipal bond market are in place for those considering them. Investors now can capitalize on the asset class’s compelling yields, robust credit fundamentals, and favorable technical shifts. We anticipate an improving technical environment in the second half of the year – particularly if some of the heavy 1H25 supply was a result of pulling forward of supply due to policy concerns in D.C. – which could set the table for attractive returns in longer maturities.

1Source: Goldman Sachs Asset Management. The Bond Buyer, Barclays.

2Source: Goldman Sachs Asset Management, Bloomberg.

3Source: Goldman Sachs Asset Management, Bloomberg.