Women and Investing: Insights from Advisors

The increasing role of women in the global economy is clear. Headline examples, such as Taylor Swift's record-breaking Eras tour,1 or the leadership of Time's CEO of the Year Lisa Su at Advanced Micro Devices, highlight significant achievements.2 However, a broader shift is underway, and women’s income globally is expected to reach about $29.3 trillion annually by 2026, a 26% increase from 2020.3 This shift prompts us to consider how the financial advisory and asset management industries might evolve. Last year, we explored the SHEconomy and the increasing role of women as a financial force. This year, we dive deeper into Womenomics by focusing on women and investing from the perspective of financial advisors. Specifically, we examine asset allocation trends, the client experience, and the changing wealth management landscape.

Our surveyed advisors also highlight the key priorities of High-Net-Worth investors, including those particularly important for women, who face additional financial challenges such as the wage gap, the family-care gap, and the retirement gap. Our survey revealed that both male and female advisors recognize the importance of empowering female investors and the benefits of having more female advisors in the industry. As women are set to earn more, inherit more, and invest more, the financial services industry is evolving to better serve female investors and meet their differentiated needs, in our view. This evolution creates exceptional opportunities for the asset management industry and advisors who can build trust and confidence with women investors.

Methodology

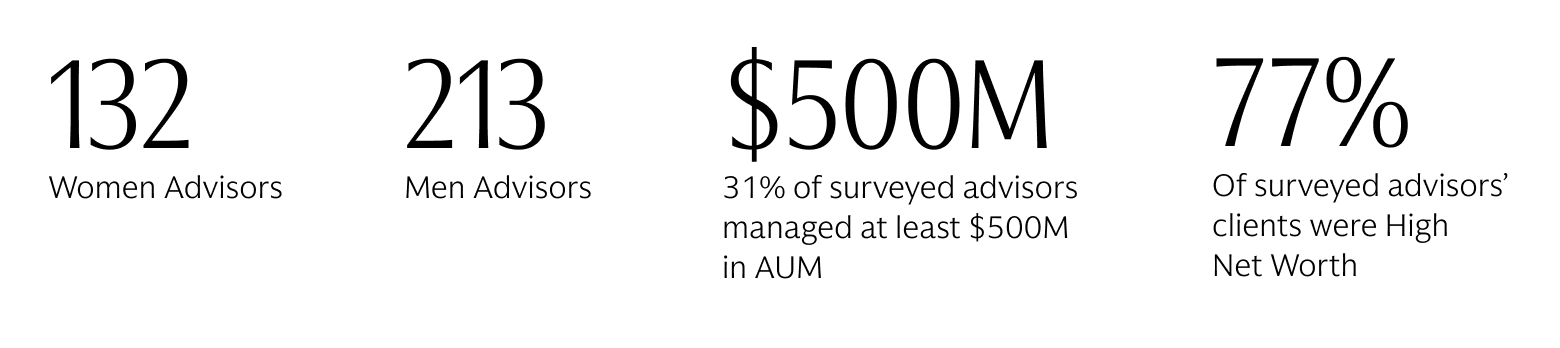

Observations in this report are based on a survey of 345 financial advisors across the US with Assets Under Management (AUM) ranging from $100 million-$1 billion+, conducted by Goldman Sachs Asset Management and 8Acre Perspective in October 2024.4 Each advisor managed at least $100 million in AUM, with at least 10% of their clients having $5 million in AUM. Respondents to our survey consisted of advisors with active books of businesses with wirehouses, regional broker dealers, independent broker dealers, registered investment advisors, and banks.

Demographic Representation Matters

Our surveyed advisors, both men and women, overwhelmingly agree that having more female financial advisors in the industry would empower more female investors. Advisors also believe that more women advisors help with client acquisition and retention, as some female clients prefer working with female advisors. Despite women making up over half of the US population and owning approximately 39% of all US businesses,5 Cerulli reports that only 18% of advisors are women.6 In line with the advisors we surveyed, we also would like to see more women consider careers in the financial services industry that can then have a multiplier effect by 1) attracting more female advisors and 2) attracting more female clients to the industry. We found that 85% of surveyed advisors believed that more female financial advisors in the financial industry would empower more female investors.

Tailored Advice for Female Clients

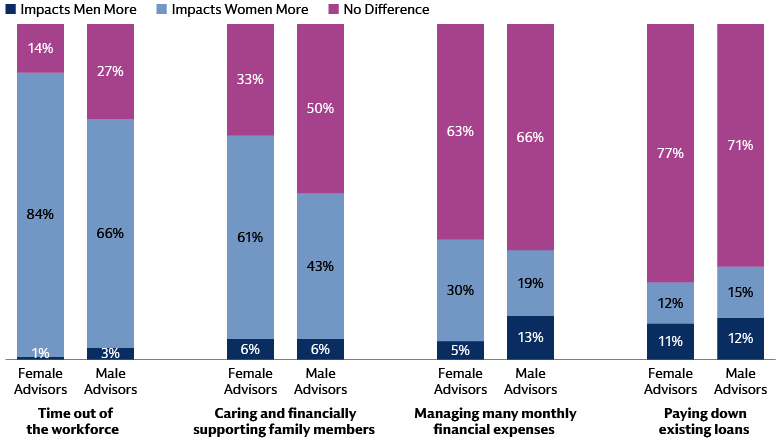

Our survey revealed that most female advisors see their gender as an advantage when serving women clients, while most male advisors believe having female advisors is beneficial for serving women clients. Female advisors were more attuned to the unique priorities of their female clients, such as long-term care planning for children and the elderly, financial education for children, philanthropy, generational wealth transfer, and career considerations. Meanwhile, more male advisors stated that there was little to no difference between the priorities of male and female clients. These financial goals are often shaped by experiences in both the workforce and family life. For instance, taking time out of the workforce to care for or financially support family members was a significant financial impact noted by both male and female respondents. Female advisors' understanding of these experiences can enhance the quality of their services and relationships with female clients. While not all women seek to work exclusively with female advisors, those who do may appreciate the shared experiences and perspectives on managing families, careers, and caregiving responsibilities.

Investment Strategy: Similarities Across Gender, Differences by Channel

Public Markets

When it comes to investing, there were no significant differences between male and female advisors. However, the type of firm across advisors did seem to have an impact. More Independent Broker Dealers (IBDs) and wirehouses have 70/30 allocations to equities and fixed income, whereas Registered Investment Advisors (RIAs) were more likely to provide for greater customization across clientele rather than standard allocations, 37% of RIAs are without a standard asset allocation as opposed to 20% and 26% for wirehouses and IBDs, respectively. These findings also come at a time where the asset management industry is seeing greater demand for personalization across client portfolios, all while the number of registered RIAs reached an all-time high of 15,441 in December 2023.7

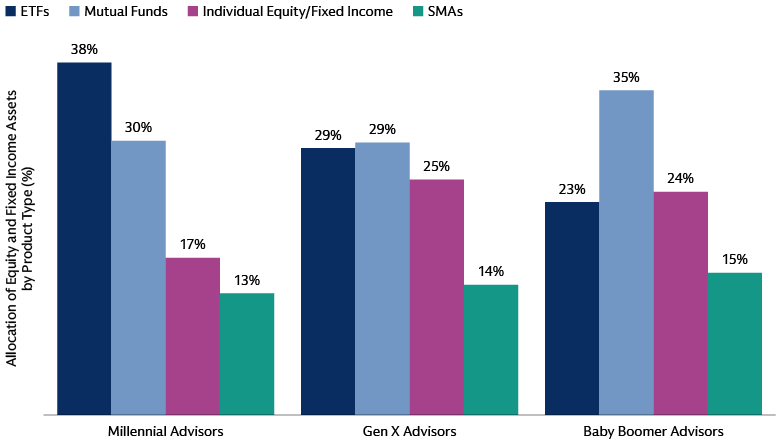

Moving forward, there is no denying that investor preference for lower fees, greater trading flexibility and tax efficiency will continue to power ETF growth, especially active ETFs. 2024 was a banner year for ETFs. According to Investment News, US ETF assets totaled ~$11 trillion with inflows of over $1.2 trillion and a record 700+ ETF fund launches. Although mutual funds still outnumber ETFs and continue to demonstrate great staying power within the asset management industry, there has also been and will continue to be a long-term secular shift from mutual funds to ETFs given their flexibility and a demographic shift toward ETFs. Our survey findings show that ETFs make up the largest share of millennial clients’ product types at 38%, whereas mutual funds continue to dominate across Gen X and Baby Boomer clients. From a portfolio construction perspective, we think there is ample room for both ETFs/mutual funds and active/passive allocations to exist in well-diversified portfolios.8

Private Markets

In addition to public markets exposure, we see alternatives and private markets as a growing area of focus for both financial advisors and the evolving High-Net-Worth client base. What was most notable was a higher allocation to alternatives among millennial clients compared to GenX and Baby Boomers. We believe that as private markets continue to evolve, they will attract a broader base of investors seeking to complement traditional market exposures. Investors can potentially enhance returns relative to traditional portfolios by expanding beyond the public markets. For example, the correlations between stocks and hedge funds has decreased considerably while that between stocks and bonds has increased to the highest level in over a decade.9 Although there are many factors to consider for constructing a well-diversified portfolio, correlations may often be a useful guide for monitoring the sensitivity of a portfolio to movements of any single asset class or strategy. Alternatives have also helped reduce market risk or reduced the effect of severe equity drawdowns in portfolios and provided a source of differentiated returns amidst rising rates.10 This reflects the opportunity for further portfolio diversification through alternatives which are becoming increasingly democratized, enabling accessibility for a wider range of investors. According to McKinsey, the projected growth in the alternatives business is from $1.4T to $2.0T of AUM by 2026.11

An Evolving Wealth Landscape

As the wealth management landscape evolves demographically— and in terms of investment strategies, product types, and digital platforms—we believe women will play a pivotal role in the future of asset management. We expect to see an increase in women as primary earners, and they may be the greatest beneficiaries of the great wealth transfer. According to Bloomberg, women stand to inherit $34 trillion by 2030 from both spouses (as women tend to outlive their male counterparts) and parents (as the baby boomer generation passes on their wealth).12 As a result, the financial services industry stands to benefit from better serving female investors and accommodating their specific needs. As women's financial impact grows, the industry must address the unique challenges that women face, including the wage gap, family care gap, and retirement gap. For High-Net-Worth Investors in particular, three major priorities are crucial: preserving wealth, enhancing wealth, and bestowing wealth. Given potential for higher volatility and return dispersion across asset classes versus the prior decade, we believe High-Net-Worth investors can take advantage of differentiated investment solutions available to them in the years ahead.

Preserve, Enhance, and Bestow

High-Net-Worth investors aim to preserve, enhance, and bestow their wealth without capturing losses from market movements or tax burdens. Given their higher earnings, they may benefit significantly from strategies that limit their tax burden, before seeking to outperform the market through active strategies. Enhancing portfolio tax efficiency is crucial, and strategies like tax-loss harvesting or investing in municipal bonds can increase after-tax income without sacrificing potential returns from equities and fixed income. Customization is increasingly important for High-Net-Worth clients, who may have varying preferences for asset classes or market conditions. Meanwhile, many single-stock positions purchased by High-Net-Worth investors years ago at lower costs may trigger a large capital gain upon an outright market sale. Certain nontraditional tax-aware strategies, such as exchange funds, can provide tax-efficient diversification benefits to holders of concentrated equity securities.13 Aside from exchange funds, we believe a broader allocation to alternatives such as private equity, private credit, infrastructure and real estate can provide differentiated sources of returns and diversification for High-Net-Worth investors. Many High-Net-Worth investors also focus on building and leaving a solid legacy that reflects their journey, values, and priorities. When aiming to securely pass on assets to the next generation, a well-thought-out plan for generational wealth transfer is key.

Finding the Right Match

From a client acquisition perspective, both male and female advisors find client referrals to be the most effective method. Referrals build trust and expand an advisor’s reach in forming new relationships. Referrals from centers of influence, such as CPAs and attorneys, are also valuable. Additionally, many women find events and conferences effective for networking and acquiring clients. Advisors can use events to strengthen client relationships by showing appreciation and connecting with potential prospects through client introductions. Successful gatherings include networking events where prospective clients can bond with existing clients and learn why they chose their financial advisor. Informational workshops and seminars are also meaningful, featuring engaging keynote speakers on topics important to clients. For example, workshops that empower female investors, sessions on the macroeconomy and markets, or seminars on timely themes like artificial intelligence (AI) can add value. Educational, memorable, and fun gatherings keep clients engaged and prospects excited to partner with advisors.

While diversification is a pillar of prudent portfolio construction, we also see the benefits of diversification in the asset management industry. Women represent 49.7% of the population and approximately 39% of business owners in the US, but the financial services industry continues to be dominated by men.14 Just 18% of financial advisors were women, while only 12 of the Barron’s top 100 financial advisors were women.15 We believe that diversifying with female financial advisors can have a multiplier effect to attract more female advisors to the industry and empower more female investors to grow their finances with the help of an advisor. In a recent study, McKinsey predicts that over the next decade, approximately 110,000 advisors, or 42% of total industry assets, are expected to retire. There is an urgent need for the industry to therefore attract and retain new talent as retirements outpace recruiting. We believe women are a key source of talent that make up a minority of financial advisors but can help meet the demand for talent and the growing female investor base.

One untapped source for next generation talent is on-campus recruiting. From an undergraduate recruiting perspective, women undergraduates are less likely to consider a career in investment management, less likely to understand the jobs available and less confident that they can land a job. However, women were more likely to consider investment management as a career if they had family members in the industry (1.6x) or were exposed to a high-profile female investor (2.4x).16 Women were also twice as confident that they could secure an investment management job if they had friends in the industry or knew a high-profile female investor.

Charting the Path Forward

Women are a powerful financial force and an important client base for financial advisors, with strong earnings potential and increasing inheritance. A growing number of women will seek financial guidance and advice, activating structural changes within the traditionally male-dominated investor base. We see a growing commitment among advisors to help women achieve their financial goals and advisors unanimously agree on the need for more female financial advisors. The wealth management industry is at the precipice of change. We see an evolving business and we expect continued evolution around customization, product-type, and client service as the industry adapts to change.

1 Investopedia. Taylor Swift’s $2 Billion ‘Eras Tour’ Broke Records and Boosted Economies Worldwide. December 9, 2024.

2 Time Magazine. 2024 CEO of the Year. December 10, 2024.

3 Frost & Sullivan. Sheconomy: 9 Mega Trends Leading the Way in Businesses. June 29, 2022.

4 All charts in this report are based on survey results and sourced to Goldman Sachs Asset Management. As of October 2024.

5 National Women’s Business Council. 2023 Impact of Women-Owned Businesses Report. December 2023.

6 Cerulli Associates. US Advisor Metrics. August 2024.

7 Securities Exchange Commission. Investment Adviser Statistics. May 14, 2024.

8 Goldman Sachs Asset Management. How Active ETFs Can Help Investors Fine-Tune Portfolio Construction. Adapting to Uncertainty, Asset Management Perspectives. 1Q 2025.

9 Bloomberg and Goldman Sachs Asset Management. As of January 31, 2025.

10 Bloomberg and Goldman Sachs Asset Management. As of January 31, 2025. In months where the S&P 500 is down -3% or more, hedge funds outperform by 5.1% on average. Past performance does not predict future returns nor guarantee future results, which may vary.

11 Cerulli Associates. Alternatives Providers Increasingly Strike Partnerships to Gather Retail Assets. August 1, 2024.

12 Bloomberg. Massive Wealth Transfer Will Give Women $34 Trillion By 2030. December 9, 2024.

13 Exchange funds are a private investment vehicle that allows investors with large stock positions to pool their stocks into a single fund, diversifying their holdings without triggering a taxable event.

14 Wells Fargo. The Impact of Women-Owned Businesses. January 2025.

15 Cerulli Associates. US Advisor Metrics. 2024.

16 Carr, Ellen and Katrina Dudley. Undiversified: The Big Gender Short In Investment Management. 2021.