Corporate Pension Monthly

10-K Season: Unwrapping the Numbers

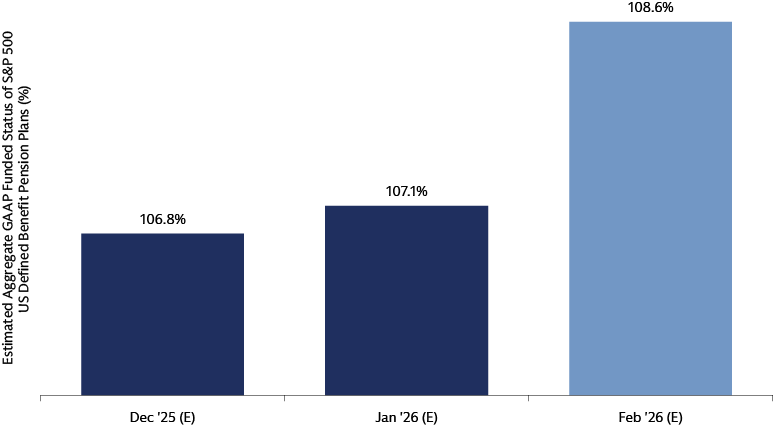

In February, our estimate of the aggregate corporate defined benefit (DB) funded status was 108.6%, further increasing from our estimate of 107.1% at the end of January. While interest rates were lower month-over-month and raised our estimated value of pension plan liabilities, the international equity market rallied more and pushed our funded status estimate higher.

Chart source: MSCI, Bloomberg, and Goldman Sachs Asset Management. Generally Accepted Accounting Principles (GAAP) funded status based on US plans (when specified) of S&P 500 companies (i.e., 229 companies with pension data per GS Asset Management research). Past performance does not predict future returns and does not guarantee future results, which may vary. The funded status figures are estimated and unaudited as of February 28, 2026, and subject to potentially significant revisions over time. Actual returns may vary significantly.

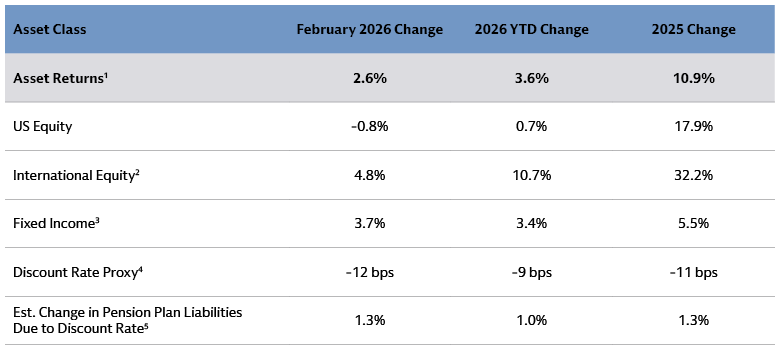

Source: MSCI, Bloomberg, and Goldman Sachs Asset Management. As of February 28, 2026.

Recent Matters of Note

Early Takeaways from FY 2025 Form 10-K Filings

As most companies in the S&P 500 universe filed their FY 2025 annual reports in February, we used these data to analyze key trends in the corporate pension universe. While filings are still rolling in, we highlight some early observations below and will expand further in our soon to be released “First Take” report:

- Funded levels rose again in 2025: On the back of another year of strong asset performance, most pension plans in our “First Take” sample posted a year-over-year funded level increase of around 1 – 4pp. The system remains overfunded in aggregate, the fourth consecutive year it has enjoyed that position.

- Asset allocations remained generally stable: Many plans kept target and actual asset allocations roughly the same from the prior year. When we did observe adjustments, they went in both directions with some plans continuing to take de-risking actions while others went the other way and re-risked.

- EROA assumptions to stay fairly steady for 2026: The average expected return on asset (EROA) assumption hovered around 7% for 2025. Disclosures around the assumption to be used in 2026 would indicate the average this year should be generally the same or perhaps slightly higher.

FASB Takes Action on Accounting for Market-Based Cash Balance Plans

The Financial Accounting Standards Board (FASB) recently added a project to its agenda, based on a recommendation from the Emerging Issues Task Force (EITF), to address the discount rate to be used in measuring the projected benefit obligation for market-based cash balance plans.

The FASB proposal will value market-based cash balance plan liabilities by setting the discount rate equal to the assumed crediting rate. This would fix the current mismatch of valuing the liabilities based on one rate (Aa corporate bond yields) even though the benefits are fixed to the value of a notional account and are not impacted by these rates.

The FASB directed its staff to draft a proposed accounting standards update, which will be subject to a 60-day comment period.

Source: News releases as of February 2026. Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or its securities. For illustrative purposes only. Please see additional disclosures at the end of this document. There is no guarantee that objectives will be met.

1 Asset return: Average asset-weighted return of S&P 500 companies’ US plans (when specified). US Equity uses S&P 500 Index.

2 Mix of MSCI EAFE and MSCI ACWI ex-US.

3 Mix of Corporates (Bloomberg US Aggregate Bond), High Yield (Bloomberg US High Yield), Treasuries (Bloomberg 20+ Year Treasuries), and Long Credit (Bloomberg Long US Credit).

4 Discount rate proxy measured by 50% Moody’s AA Corporate Bond and 50% US Long Duration Corporate Bond.

5 Estimated Change in Plan Liabilities based on increase in estimated discount rate and duration of 12. For 2025, uses average change in discount rate change for December year-end filers.