Defined Contribution Quarterly

In The News

Defined Contribution Industry

Key Developments

- Former US Representative Lori Chavez-DeRemer was confirmed as the new Secretary of Labor and Keith Sonderling, former acting administrator of the Wage and Hour Division and Commissioner of the Equal Opportunity Commission was confirmed as the Deputy Secretary of Labor. Additionally, Daniel Aronowitz was nominated to become the Assistant Secretary of Labor for the Employee Benefits Security Administration.

- A unanimous decision by the Supreme Court in Cunningham v. Cornell held that to state a claim under the prohibited transaction rules of ERISA (Employee Retirement Income Security Act), a plaintiff need only plausibly allege the elements of the prohibited transaction, without addressing potential exemptions.

- As reported in data released this quarter, the average retirement plan balance, as well as contribution rate rose to all-time high levels during 2024. Additionally, the number of “401(k) millionaires” increased 27% during 2024. However, hardship withdrawals from 401(k) plans also reached a record high at 4.8% of account holders, up from 3.6% in 2023.1

Industry News

Private Markets:

- State Street Global Advisors and Apollo announced launch of new target-date series that includes both public and private market investments.

- Vanguard, Wellington and Blackstone announced partnership to develop multi-asset strategies that will combine public and private market exposure.

- SEI launched an alternative investment product marketplace, SEI Access. This platform is intended to be broadly available and to offer access to a range of alternative investment products.

Retirement Income:

- Apollo Global Management, Inc., Athene., and Motive Capital Management acquired Advantage Retirement Solutions, LLC (ARS), a financial advisory firm focusing on retirement income solutions.

In-Plan Emergency Savings Account:

- T. Rowe Price announced that it has launched an in-plan emergency savings account product for retirement plan participants. This launch is in conjunction with the SECURE 2.0 provision that allows for such an account inside a defined contribution retirement plan.

Increasing Access:

- State retirement plans reach $2B in assets in 2024; Georgia is latest state to announce a proposal for a new State-Sponsored IRA program

- Pooled employer plans (PEPs) reach $10B in assets in 2024; Equitable is latest entrant into the PEP market

Regulatory, Legislative & Litigation

SECURE 2.0 Corner

- The Internal Revenue Service (IRS), along with the Department of the Treasury, published proposed rules regarding Roth catch-up provisions for highly compensated employees, increased catch-up contributions for plan participants aged 60-63, and the requirement for newly established plans to implement automatic enrollment and auto-escalation of contributions.

- Catch-Up Provisions:

- Starting January 1, 2026, employees who are at least 50 years old and earned more than $145,000 (indexed for inflation) in wages in the prior year will be required to make any catch-up contributions as after-tax Roth contributions.

- For those participants who reach the ages of 60-63 in any plan year after January 1, 2025, there is an optional increased catch-up contribution limit which is the greater of (i) $10,000, or (ii) 150% of the regular catch-up amount for that year, indexed for inflation.

- Mandatory Automatic Enrollment features:

- Beginning with plan year 2025, most plans established after December 29, 2022 are required to include automatic enrollment and automatic escalation features, subject to opt-out provisions. Plans in scope for this requirement would be required to enroll participants at a rate of at least 3% of pay and increase this contribution by 1% annually until contributions reach at least 10%, but not more than 15%, of pay.

Regulatory

- The Voluntary Fiduciary Correction Program (VFCP) updates became effective, including the addition of a self-correction mechanism aimed at allowing plan sponsors to correct issues such as delinquent contributions or loan repayments if lost earnings total $1,000 or less.

- The “America First Investment Policy” was issued by President Trump, which directed the Department of Labor to update “fiduciary standards under ERISA for investments in public market securities of foreign adversary companies.” The memo adds that the DOL has the goal of restoring “the highest fiduciary standards as required by ERISA, [by] seeking to ensure that foreign adversary companies are ineligible for pension plan contributions.”

Legislative

- The “Retirement Fairness for Charities and Educational Institutions Act” was reintroduced to Congress to amend securities regulations in order to allow 403(b) plans to utilize Collective Investment Trusts (CITs) in their investment lineups.

- The “Financial Freedom Act” was reintroduced to Congress with the goal of prohibiting the Secretary of Labor from limiting the range and types of investments available to retirement plan participants.

- The “Women’s Retirement Protection Act of 2025” was introduced to congress with the intention of addressing the gap between men and women in retirement. This bill seeks to require spousal consent prior to withdrawal of retirement funds and to fund organizations with a mission of increasing women’s knowledge of retirement planning concepts.

Litigation

- New cases this quarter continue to focus on the alleged improper use of forfeitures, selection of stable value funds and target-date funds, and investment and recordkeeping fees and performance. Settlements this quarter ranged in amounts from $600,000 to $8.75 million. Dismissals this period focused on allegations relating to recordkeeping fees and performance, with several concerning target date funds. Additionally, two forfeiture cases were dismissed.

Quarterly Snapshot

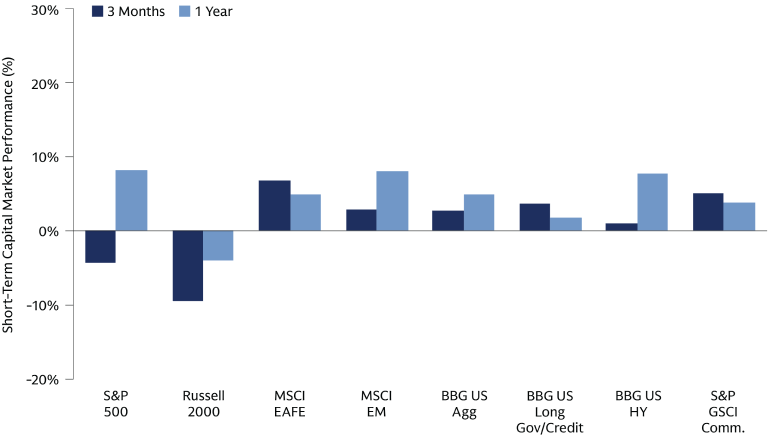

Target date fund (TDF) flows in Q1 were reported to be mostly in line with the prior quarter. Plan participants continued to seek more stable investments as we see inflows in bonds compared to larger outflows from equity. Year-to-date asset class performance has been largely positive across equity and fixed income, with the only exception being short-term US equities. Active managed outperformance has been most pronounced in emerging market equity and small cap growth.

Source: Strategic Insight, Simfund. As of March 31, 2025. For open-end mutual funds only. For illustrative purposes only.

Source: Strategic Insight, Simfund. As of March 31, 2025. For open-end mutual funds only. For illustrative purposes only.

Source: Morningstar and MSCI. As of March 31, 2025. Past performance does not predict future returns and does not guarantee future results, which may vary. For illustrative purposes only.

Source: Morningstar. As of March 31, 2025. Net of fees. Please refer to the disclosures for benchmarks. Past performance does not predict future returns and does not guarantee future results, which may vary. For illustrative purposes only.

1 Fidelity. As of Q4 2024. Retirement Savers Achieve Positive Momentum Through 2024