Municipal Quarterly Review 4Q 2025

Finishing the Quarter on a Positive Note

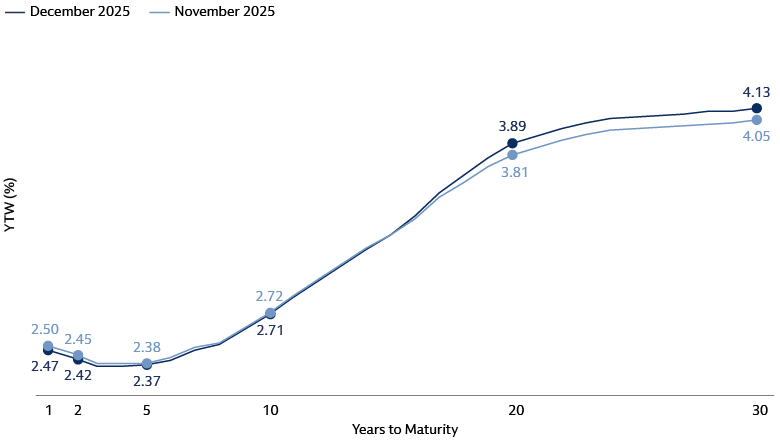

Yield Curve: Unchanged

Municipal yields were range-bound on average across the yield curve, driven predominately by technicals, while Treasury yields saw more volatility due to rate cut expectations. The Fed delivered their third and final cut for 2025, bringing the Fed funds rate to 3.50-3.75%. Forward guidance from the Fed indicated more caution around future cuts, pending data and the perceived balance of risks. Municipal yields were flat on average across the yield curve, driven by technicals and not impacted by the movement of Treasury yields. Munis outperformed treasuries as reinvestment and positive flows helped offset the strong pre-holiday issuance.

Valuations: Richer

Muni yields were up 1bp on average across the curve for December versus US Treasury yields which went higher by +11 bps on average. For the fourth quarter, muni yields were lower by 1 bp versus US Treasury yields which were lower by 1 bp on average. Muni/UST ratios richened –2% on average across the curve in December. For the fourth quarter, ratios cheapened by an average of +5% across the one- to five-year part of the curve and richened an average of -5% across 10- to 30-year notes. Ratios ended 2025 at 64%/65%/85% respectively for 5/10/30 years.

Source: Goldman Sachs Asset Management. Bloomberg. As of December 31, 2025.

Source: Goldman Sachs Asset Management. Bloomberg. As of December 31, 2025.

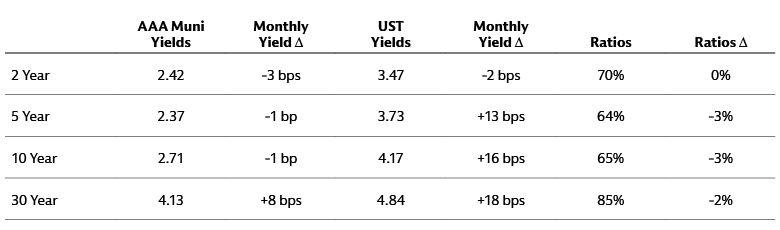

Muni Index Performance: Positive IG, Negative HY

The Bloomberg Municipal Aggregate Index returned +0.09% in December and +1.56% for Q4, while the Bloomberg Muni High Yield Index returned -0.24% and +1.15%, respectively. The IG and HY muni indices returned +4.25% and +2.46% respectively in 2025.

Source: Goldman Sachs Asset Management. Bloomberg. As of December 31, 2025.

Credit Research Spotlight

Municipal credit quality remained strong through 2025, with Moody's reporting upgrades outpaced downgrades by 1.9x in par amount, and defaults tracked well below 2024 levels.

The New York Metropolitan Transportation Authority (MTA) improved its credit quality over the year, with continued state support and the success of congestion pricing leading to multiple upgrades. MTA ended the year by approving a 2026 budget that includes reduced out-year budget gaps.

Muni Musings: Read more about the Key Themes for Munis in 2026 here.

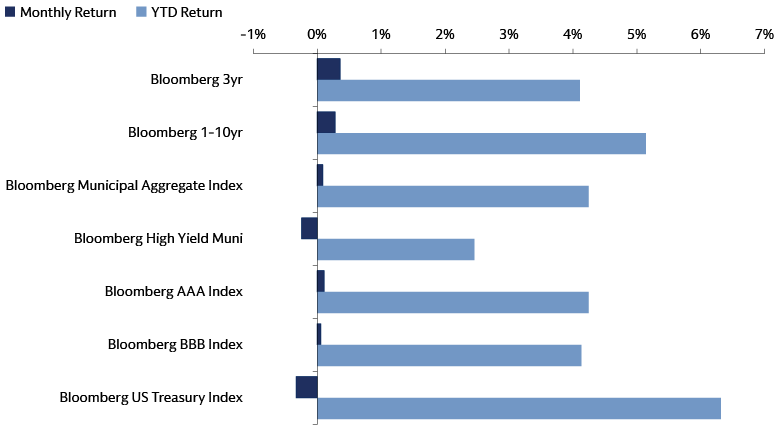

Supply: Elevated

December new issue supply amounted to $40 billion ($38 billion tax-exempt and $2 billion taxable). This was a decrease of 3% from November, and 28% higher versus December 2024. For the fourth quarter, supply was $142 billion, 9% below previous quarter, but 16% higher than 24Q4.

2025 full-year municipal issuance totaled $580 billion ($547 billion tax-exempt and $33 billion taxable). This is up 14% versus 2024 and a record year for total new issuance.

Source: Goldman Sachs Asset Management. The Bond Buyer, Barclays. As of December 31, 2025

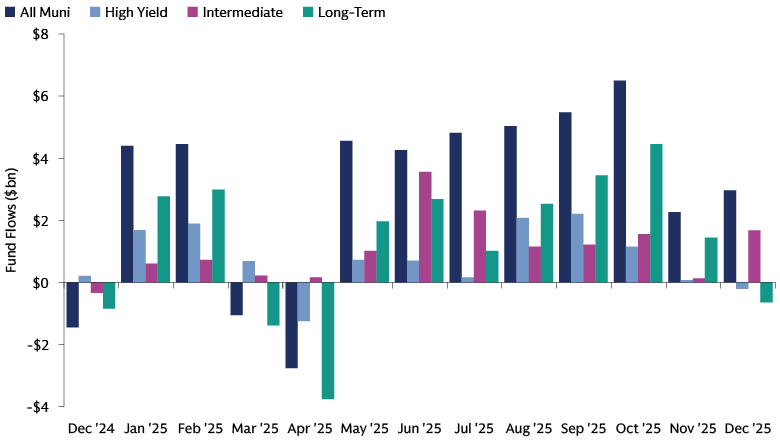

Demand: Positive

Municipals saw positive inflows through December with an average of $540 million each week. There was strong investment grade muni inflows, while high yield saw outflows over the month. Inflows were trending towards short-term and intermediate-term munis, with outflows at the long-term portion of the yield curve.

Muni fund flows totaled $3 billion for December. 2025 fund flows totaled $51 billion ($17 billion mutual funds and $34 billion ETFs). Investment grade quality munis saw strong flows at the intermediate and long-end of the curve.

Source: Goldman Sachs Asset Management. Refinitiv. As of December 31, 2025

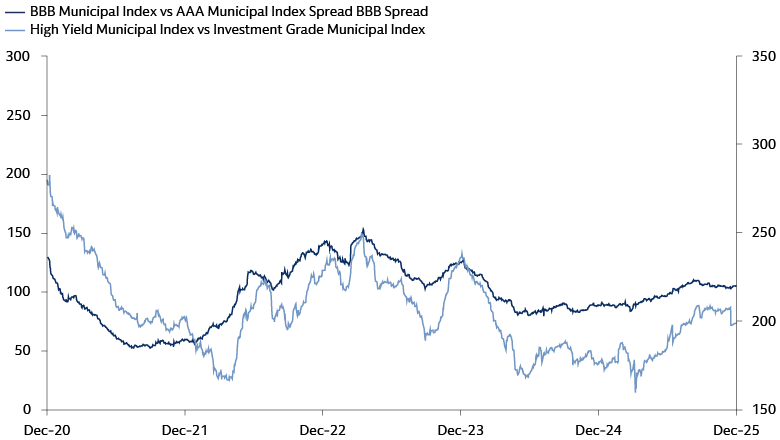

Spreads: Risk On

BBB spreads remained flat over the month, ending at 105 bps, while high yield muni spreads tightened 7 bps to close the year at 199 bps. For the fourth quarter, BBB and high yield spreads tightened by 1 bp and 3 bps, respectively.

Within the high yield portion of the muni market, the shorter maturities outperformed, while the longest maturities underperformed during December. All high yield maturities outperformed in the fourth quarter. For December and the fourth quarter, transportation and tobacco sectors underperformed while water and sewer sectors performed positively.

Source: Goldman Sachs Asset Management, Bloomberg. As of December 31, 2025