Defined Contribution Quarterly 4Q 2024: ERISA 50: Past, Present & Future

In The News

Defined Contribution Industry

Key Developments

- The Employee Retirement Income Security Act (ERISA) turned 50. ERISA revolutionized the retirement industry by establishing laws and regulations intended to protect participants and beneficiaries of private employers’ benefit plans.

- The IRS issued a private letter ruling allowing a company to offer employees the flexibility to choose into which benefit plan employer nonelective contributions should be deposited. The employees may allocate such contributions between several non-taxable benefit plans, such as an Employee HSA, an Educational Assistance Program, a Retiree HRA or a 401(k) plan. While this ruling only applies to the company that received it, the door may be open to more flexibility for recipients.

- JPMorgan has announced the launch of a target-date fund series, the SmartRetirement Lifetime Income TDF, with an embedded guaranteed income annuity, provided by insurers.

- T. Rowe Price launched a new dynamic TDF product, the Personalized Retirement Manager, that transitions participants into a managed account solution at a selected age and uses the same underlying funds as the TDF.

- Milliman, Inc. introduced a student loan certification solution through Candidly. It is intended to help plan sponsors provide student loan matching contributions for qualified student loan payments.

SECURE 2.0 Corner

- The IRS published final guidelines for eligibility and withdrawals for required minimum distributions (RMDs) of inherited retirement assets. These guidelines may help beneficiaries determine the timeframe in which RMDs must be taken.

- The IRS issued FAQs to offer interim guidance on Student Loan Matching Payments for defined contribution plans, including details about eligibility, limitations of contributions, and how payments should be certified.

Regulatory, Legislative & Litigation

Regulatory

The DOL’s Retirement Security Rule is not in effect due to litigation challenges. District courts in both the Eastern and Northern Districts of Texas have stayed the rule nationally. The DOL has filed appeals to attempt to overturn the stay orders. Additionally, legislation has been introduced in the House to overturn the rule.

Legislative

- A bill was introduced in the Senate that would allow Collective Investment Trusts (CITs), to be utilized in 403(b) plans. A similar bill has already been passed in the House.

- A bill was introduced in both the House and the Senate with the intention of lowering the required minimum age for eligibility in employer-sponsored retirement plans from age 21 to 18.

- A bill was passed in the House that requires fiduciaries to generally only consider pecuniary factors when making investment selections for retirement plans (which is targeted at environmental, social and governance (ESG) investing). This bill is now in the Senate.

Litigation

Litigation filed this period continues to focus on recordkeeping fees, investment management fees and investment performance. There were additional cases filed alleging improper use of forfeited contributions.

Settlements reported during the covered period ranged from $330,000 to $7.9 million. Three settlements included non-monetary terms, with two requiring plan fiduciaries to conduct a request for proposal for recordkeeping services within three or five years.

A number of dismissals took place at the district court level, including a grant of summary judgment and trial decision. Another court granted a motion to dismiss claims of misusing plan proceeds.

A circuit court affirmed that an arbitration clause was unenforceable against plaintiffs.

The Supreme Court has agreed to review an appellate court decision concerning what facts plaintiffs must allege to support a claim that a plan engaged in a prohibited transaction when engaging a service provider.

ERISA 50: Past

“The farther back you can look, the farther forward you are likely to see.”

- Winston Churchill

Commemorating 50 Years of ERISA

On Labor Day in 1974, President Gerald Ford enacted the Employee Retirement Income Security Act (ERISA), a landmark piece of legislation designed to safeguard the retirement and health benefits of American workers. In September 2024, the retirement and health benefits industry reflected on the origins of this pivotal law, marking 50 years of progress in securing the financial futures of millions.

Why Was ERISA Passed?

Pensions had existed for over a century before the passage of ERISA, but in the decade leading up to its enactment, concerns grew over the lack of rules and regulations that protected retirement and health benefits from corporate mismanagement. A pivotal moment came with the bankruptcy of the Studebaker Corporation, which left thousands of workers without their promised pensions. This incident, highlighted by NBC’s broadcast of "Pensions: The Broken Promise," brought widespread attention to the vulnerabilities of the unregulated pension system and spurred a national conversation.

Strengthening worker protections became a key priority for the Nixon administration. However, following President Nixon's resignation in 1974 due to the Watergate scandal, newly appointed President Gerald Ford sought to reassure the public that Congress could still effectively govern. ERISA, a bipartisan bill introduced years earlier by Senator Jacob Javits, was poised for passage and became one of the first major legislative acts under President Ford's administration.

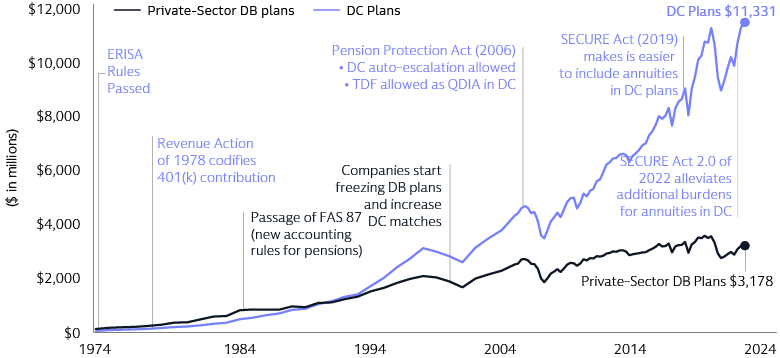

Impact on 401(k) Growth

The primary goal of ERISA was to expand and restore trust in the private pension system, primarily through mechanisms like the creation of the Pension Benefit Guaranty Corporation (PBGC). Originally, however, ERISA had little to do with the growth of 401(k) plans. In fact, it initially placed restrictions on existing deferred profit-sharing plans, or cash or deferred arrangements (CODA), which had been in existence since as early as 1953 and served as a precursor to the modern 401(k). It was not until the Revenue Act of 1978 that this feature was reintroduced and formally codified in section 401(k) of the Internal Revenue Code.

Source: Investment Company Institute and Goldman Sachs Asset Management. Data as of Q2 2024, latest available.

ERISA 50: Present

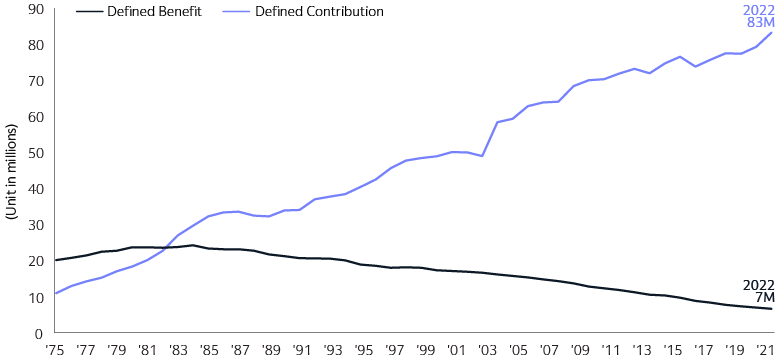

As the industry commemorates this landmark legislation, it is essential to acknowledge the shift from DB plans (what ERISA sought to restore) to DC plans, which became the predominant private employer-based retirement program. While ERISA wasn’t the sole catalyst for the transition from DB to DC plans, it played a part along with other changes such as the Revenue Act of 1978, the passage of new accounting rules related to DB plans in 1985, and the Pension Protection Act of 2006, to name a few. Below are key statistics that illustrate this progression in the private sector retirement landscape.

Private Sector DB and DC Coverage

- $13 Trillion of ERISA-Covered Retirement Assets (DB and DC Assets)

- 141M participants covered

Shift from DB Plans to DC Plans

- 1989:

- 63% of employees covered by DB plans

- 36% of employees covered by DC plans

- 2024:

- 15% of private workers have access to DB plans

- 70% of private workers have access to DC plans (50% participation rate)

Growth of DC plans

- From 207,478 in 1975 to 754,862 in 2022

Participants Covered by DC Plans

- From 11,507,000 in 1975 to 121,311,000 in 2022

DC Plan Asset Growth1

- From $75B in 1975 to $8.1T in 2022

Median Retirement Savings

- $25,360 in 1989 to $87,000 in 2022

1. DC plan asset growth and median retirement savings adjusted for inflation.

Source: Employee Benefits Security Administration, Congressional Research Service, US Department of Labor, Bureau of Labor Statistics, and Goldman Sachs Asset Management. As of October 2024. Chart source: Employee Benefits Security Administration Private Pension Plan Bulletin Historical Tables and Graphs (1975 – 2022). As of September 2024, latest available.

ERISA 50: Future Improvements Needed

The focus of future developments should be aimed at enhancements needed to ensure the retirement system works for all. Three key areas of focus are:

- Mitigating the disparity of retirement savings

- Closing the coverage gap that impacts millions of small businesses, non-employee businesses and gig and contract workers

- Supporting the inclusion of retirement income solutions

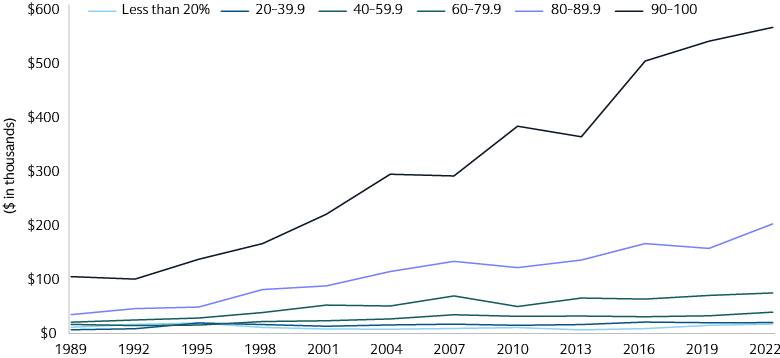

Mitigating the Disparity of Retirement Savings

The top income groups have experienced the most significant growth in retirement savings over the past 30+ years. However, for lower-income individuals, saving for retirement presents greater challenges. These challenges include balancing competing financial priorities and retaining retirement savings during times of financial hardship. This disparity highlights the need for targeted solutions to support retirement security for workers across all income levels.

Source: Survey of Consumer Finances, Federal Reserve, and Goldman Sachs Asset Management. As of October 2024. Retirement savings chart data as of November 2022, latest available.

Closing the Coverage Gap That Impacts Millions of Small Businesses, Non-Employee Businesses and Gig and Contract Workers

Small businesses are the backbone of the U.S. economy, employing over 61 million workers, or 46% of the labor force, and contributing to two-thirds of job growth over the past 25 years2. However, significant gaps remain in retirement plan coverage for these businesses and their workers. Key facts to consider:

- Out of 6 million small business employers, only 53% of those with 100 or fewer employees offer retirement plans to their workers.

- There are 26.5 million non-employee businesses, such as sole proprietorships, that often lack access to retirement plans.

- Approximately 41 million workers hold gig or freelance roles, most of which do not offer retirement benefits.

These gaps underscore the need for targeted efforts to expand retirement plan access across small businesses and non-traditional work arrangements.

Source: US Census Bureau County Business Patterns as of 2022, latest available.

Supporting the Inclusion of Retirement Income Solutions

Today, the vast majority of 401(k) plans do not offer guaranteed income solutions. With fewer retirement savers covered by pensions, many individuals will be responsible for managing their 401(k) investments to generate consistent and sustainable income needing to last for an uncertain duration. Nobel Prize-winning economist William Sharpe once described this as the “nastiest, hardest problem in finance.” Key areas of focus to address this issue include:

- Developing investment solutions, insurance solutions, or a combination of both to provide reliable retirement income.

- Offering advice services or products that help retirees manage their income effectively.

- Considering whether guaranteed income solutions should be optional or if savers could be defaulted into such options within their 401(k) plans.

- Exploring in-plan versus out-of-plan options for guaranteed income solutions.

Given that one of ERISA’s primary objectives is to protect retirement assets, future legislation may be aimed at supporting the income phase of retirement. Lawmakers, regulators, and industry stakeholders will likely consider how best to balance asset protection with the growing need for guaranteed income solutions in retirement plans.

ERISA 50: Future

With a deeper understanding of the foundational goals of ERISA, we can better predict how retirement plans may continue to evolve to protect and safeguard retirement assets. Here are five changes we expect to see to improve retirement savings in America.

1) Expansion of 401(k) Market

SECURE 2.0 has set the stage for broader adoption of DC plans

- Tax Credits for Small Employer Plans: Offering 100% coverage of administrative costs (up to $5,000) for the first three years to incentivize small businesses to establish retirement plans.

- The Federal Savers Match: This initiative increases savings incentives for lower-income individuals, providing additional support for those with joint incomes below $71,000.

- Mandatory Automatic Enrollment: New retirement plans are now required to automatically enroll participants, helping workers begin saving for retirement without the need for proactive enrollment, which has been shown can significantly boost participation rates.

- Automatic Portability Between 401(k) Plans: This feature allows retirement assets to move seamlessly between employer-sponsored plans, reducing the risk of cash-outs and preserving long-term retirement savings.

2) Development and Growth of Pooled Employer Plan Market

- Pooled Employer Plans (PEPs) are designed specifically to benefit small businesses, allowing them to join together to offer retirement benefits at reduced cost and with simplified administration.

3) Growth of Personalized Solutions

- Not all retirement savers have the same life experiences or journey to retirement. As a result, more personalized solutions are entering the market from personalized investment portfolios to personalized advice platforms to personalized communications to participants.

4) Expansion of Employer-Based Education and Advice

- Employer-based plans allow sponsors to provide financial education and advice to plan participants through a scalable and hybrid (digital and human-based) advice platform.

5) Integration of Insurance-Based Solutions to Support Retirement Phase

- Insurance solutions are generally the only products that can provide guaranteed, longevity protecting income solutions in DC plans. Integrated solutions may create a better participant experience and allow these solutions to be broadly utilized by plan participants resulting in reduced costs and expanded access.

Quarterly Snapshot

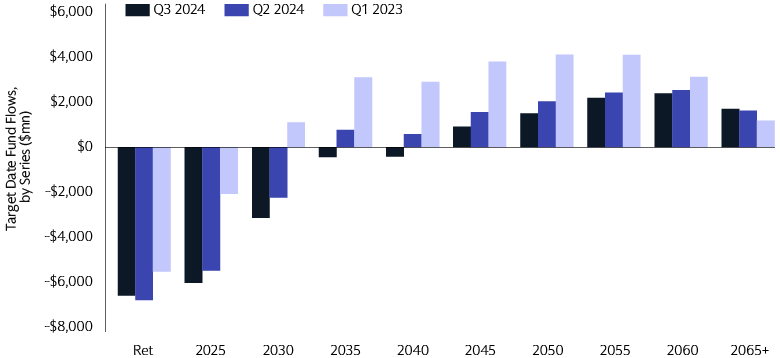

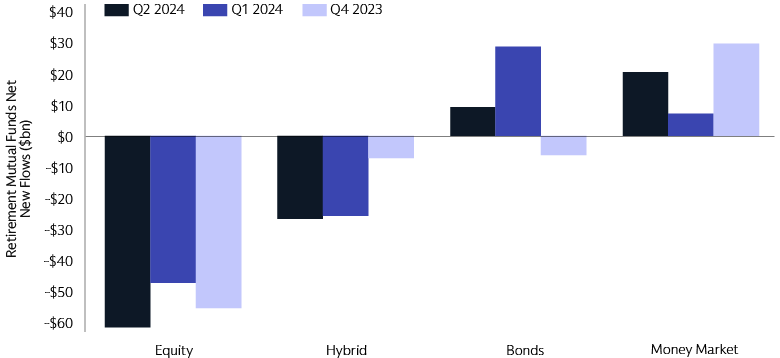

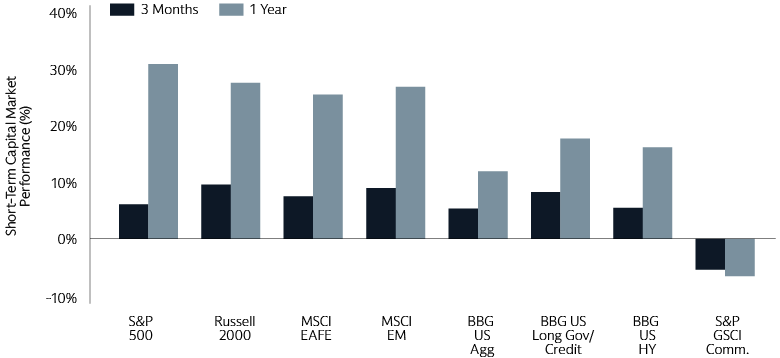

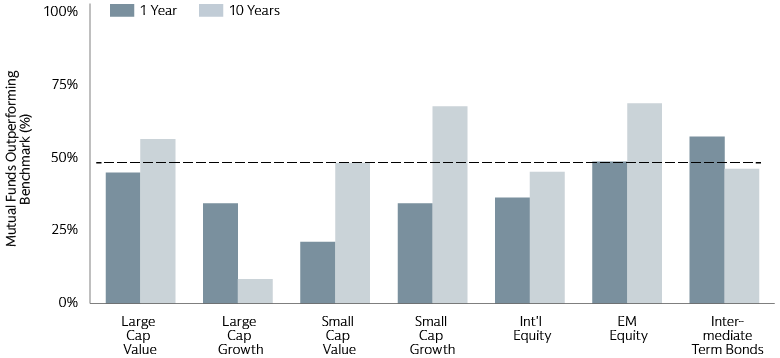

Target date fund (TDF) flows in Q3 were reported to be either lower than or in line with the prior quarter. Plan participants continue to seek more stable investments as we see inflows in bonds compared to larger outflows from equity. Year-to-date asset class performance has been largely positive across equity and fixed income, with the only exception being commodities. Active managed outperformance has been most pronounced in emerging market equity and intermediate term bonds.

Source: Strategic Insight, Simfund. As of September 30, 2024. For open-end mutual funds only. For illustrative purposes only.

Source: ICI “The U.S. Retirement Market, Second Quarter 2024.” As of Q2 2024 (latest available). For illustrative purposes only.

Source: Morningstar. As of September 30, 2024. For illustrative purposes only.

Source: Morningstar. As of September 30, 2024. Net of fees. Asset class categories based on Morningstar’s Style Box. Please refer to the disclosures for benchmarks. For illustrative purposes only.

Indices referenced in each category: Large Cap Value (Russell 1000 Value Index), Large Cap Growth (Russell 1000 Growth Index), Small Cap Value (Russell 2000 Value Index), Small Cap Growth (Russell 2000 Growth Index), International Equity (MSCI EAFE Index), EM Equity (MSCI Emerging Markets Index), Intermediate Bonds (Bloomberg US Aggregate Bond Index). EM = Emerging Markets. Please refer to the disclosures for additional definitions.

Past performance does not guarantee future results, which may vary.

2 Small Business & Entrepreneurship Council, Bureau of Labor Statistics, US Small Business Administration Office of Advocacy, US Census Bureau, and Goldman Sachs Asset Management. As of October 2024.