Environmental Transition: Capturing Opportunity and Driving Real World Impact

Decarbonization: Where Is the Real-world Impact?

The most immediate and tangible impact on reducing carbon emissions can be achieved by helping high emitters that are restructuring their business models and repositioning themselves for a greener economy – companies often referred to as “carbon improvers” – to transition faster and more efficiently.

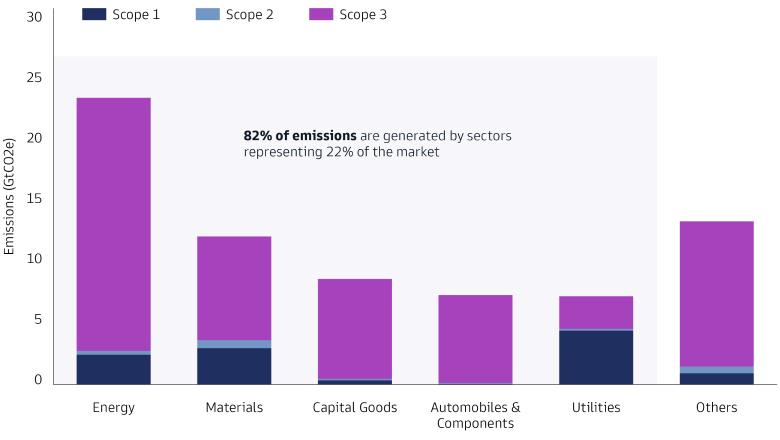

Carbon emissions are concentrated in a handful of sectors: over 80% of scope 1, 2 and 3 emissions are generated by sectors representing less than a quarter of the market.1 These sectors represent about 40% of global gross domestic product, and their products are indispensable to our way of life.2 In order to be on the path to net zero,3 companies within these sectors must make radical changes to their business models, because reducing their environmental footprint will lead to an immediate and tangible impact in the real world.

Source: MSCI, Goldman Sachs Asset Management, as of Sept-23. Global GDP is calculated as: sum of revenue (in million USD) grouped by GICS Industry Group for MSCI ACWI IMI.

*The Global Industry Classification Standard (GICS) is an industry taxonomy developed in 1999 by MSCI and Standard & Poor's (S&P) for use by the global financial community. The GICS structure consists of 11 sectors, 25 industry groups, 74 industries and 163 sub-industries.

Why Should Investors Care?

We believe that certain transitioning companies are undervalued relative to their economic potential, which creates an investment opportunity. There are many businesses that are currently perceived as transition laggards, predominantly due to the market’s heavy penalization of perceived transition risk based on sector-level views. Such underappreciation creates mispricing and alpha potential. In the context of the environmental transition, many of these companies will still be relevant in the future green economy and may even be critical in enabling sustainability commitments. We have already seen select examples in certain industries where a company’s transition can create value. It is our role as active managers to identify these companies, select, monitor, and catalyze their transition progress over the long term.

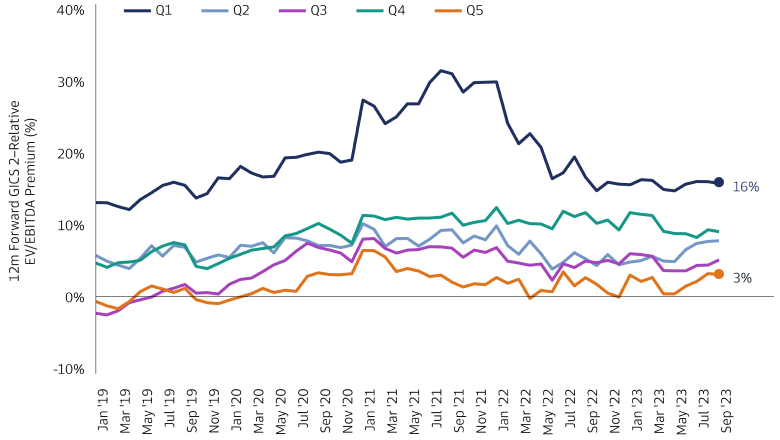

There is already compelling evidence that the market is more willing to place a premium valuation on companies that are making greater transition progress than their peers in areas such as climate-linked compensation incentives, emissions performance, and capital allocation alignment.4

Source: Goldman Sachs Global Investment Research, “Climate Transition Tool 2.0: Bridging gaps, enhancing sectoral scope, highlighting performance links,” as of Sept 2023. Trimmed mean 12m-fwd GICS2 sector-relative EV/EBITDA premiums, ex-Financials, of companies in the respective Quintile (Q1 is best) on Performance Ranking (as shown above), MSCI ACWI, Jan 2019 to Sep 2023. Our Performance Rank is sector-relative to GS Sustain Environmental & Social sector peers in the MSCI ACWI.

So far, the climate investing market has largely focused on decarbonization “enablers” – companies providing green solutions such as renewables – while excluding heavily polluting sectors. The space of decarbonization “improvers” has been largely overlooked. Yet companies with credible decarbonization plans present potentially attractive investment opportunities. These companies are typically open to the economic opportunities decarbonization can create. They are ready to direct capital expenditure toward new technologies that facilitate this process, and they stand to benefit from regulatory and policy incentives in this area.

Companies that act on their decarbonization commitments and meet their targets are likely to improve their competitive position. Some will enjoy a first-mover advantage in new offerings to their existing customer base, while others will benefit from opening new markets. The potential for cost reduction and efficiency gains from decarbonization is significant, translating into improved future margins. These factors are often not yet recognized by the market. Companies in heavily emitting sectors tend to be indiscriminately penalized by investors and stock valuations are largely not reflective of transitioning companies’ potential role in the economy in 10 years’ time.

Where to Look for Investment Opportunities?

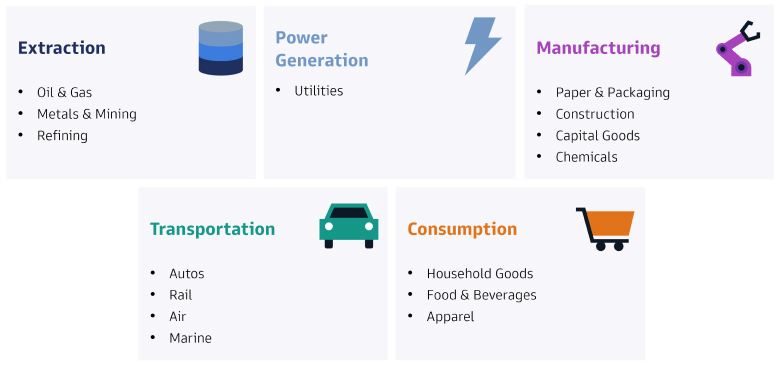

In our view, a climate-transition investment strategy should not be limited to the energy sector. It should encompass all areas of the economy where emission reductions would have the greatest impact. A company’s entire environmental footprint should be considered, and reductions should be sought in water use and waste in addition to carbon emissions.

Not all companies in these sectors are transforming their models at the same pace or with the same efficiency. Some are emerging as leaders, and some are falling behind. It is crucial to be able to identify true improvers, considering various areas ripe for transformation and their value chains.

The top 10% of the heaviest-emitters – about 1,100 companies – provides a meaningful universe from which to select potentially attractive investment opportunities. Rather than looking through the lens of traditional sector classifications, we have grouped these opportunities into five key areas driven by similar underlying factors and industry dynamics:

Source: Goldman Sachs Asset Management. For Illustrative Purposes Only.

How to Access Transition Companies?

The starting point of any decarbonization strategy is an assessment of the portfolio’s carbon emissions. Investors can utilize a bottom-up sector-specific approach to define a suitable pathway. However, carbon emissions data are reported with a lag and are backward-looking. In our view, portfolio companies’ alignment with net zero provides a more appropriate, forward-looking metric. The market is coalescing around certain frameworks for the quantitative part of the assessment. Among them is The Net Zero Investment Framework, a core publication of the Paris Aligned Investment Initiative. The initiative was established in May 2019 as a member led forum to support investors to align their portfolios and investment activities to the goals of the Paris Agreement.

According to the framework, a net zero investment strategy should focus on achieving two objectives:

- Decarbonizing investment portfolios in a way that is consistent with achieving carbon neutrality by 2050; and

- Increasing investment in the range of climate change solutions needed to meet that goal.

The framework provides methodologies and actions investors can use to align their portfolios with net zero and to maximize their contribution to the decarbonization of the real economy. It puts forward metrics to assess investments and measure alignment, and requires investors to set clear, science-based targets at the portfolio and asset-class levels. It also sets out implementation actions to achieve portfolio alignment, meet targets and enable a broader transition toward net zero through portfolio construction, engagement, and policy advocacy.5

In March 2021, the Institutional Investors Group on Climate Change (IIGCC), a European body for investor partnership on climate change, together with other similar bodies, came out with an Implementation Guide for the Net Zero Investment Framework. The Implementation Guide is based on several key principles, most prominently that “the primary objective is achieving emissions reductions in the real economy.”6 For listed equities as an asset class, the guide stipulates the following approach:

- Identify assets in material sectors for assessment and alignment action.

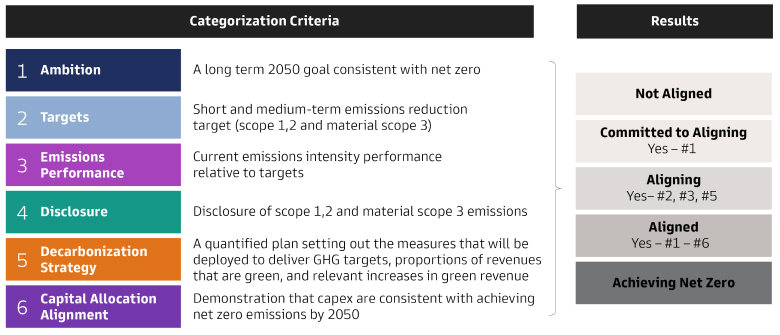

- Assess assets against four criteria: achieving net zero, aligned, aligning, not aligned / transitioning.

- Assess assets’ revenues from climate solutions (European Union taxonomy revenue or capex)

- Prioritization for engagement based on emissions intensity/exposure.

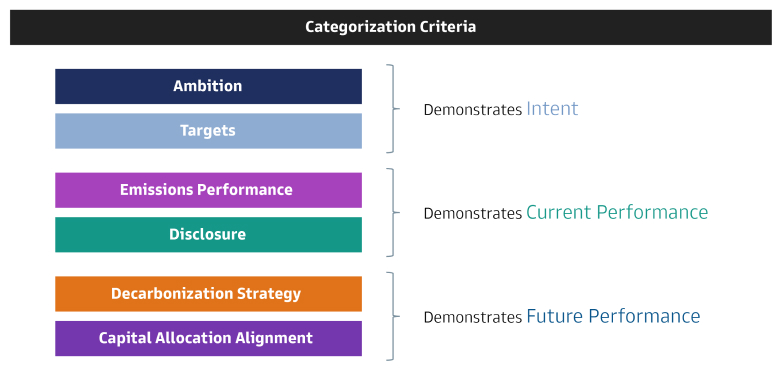

To assess high-impact companies, the guide recommends using the following alignment metrics:

Source: Institutional Investors Group on Climate Change, “Net Zero Investment Framework Implementation Guide”. As of March 2021

Based on these recommendations and alignment metrics, an investor can determine portfolio companies’ transition status. Companies can then be categorized as follows:

Source: Institutional Investors Group on Climate Change, “Net Zero Investment Framework Implementation Guide”. Goldman Sachs Asset Management. For Illustrative Purposes Only. As of March 2021.

We believe it is critical to supplement this quantitative analysis with qualitative review by experienced research analysts. This is particularly important in instances where confidence in management and execution capabilities could be a significant discounting factor or when data-quality and availability issues arise, notably in the oil and gas and fossil-fuel sectors.

Stock Example 1:

Alignment Category: Not Aligned

Theme: Extraction

Evaluation of the company based on the alignment metrics and strategy:

Background: Oil and gas operations account for around 15% of total energy-related emissions globally. Oil and gas producers have an opportunity to address this problem bytackling methane emissions, eliminating all non-emergency flaring, electrifying upstream facilities with low-emissions electricity, using carbon capture, utilization, and storage technologies, and expanding the use of hydrogen.

Metals and mining are currently responsible for up to 7% of global greenhouse gas emissions. Mining companies could use technology to reduce their costs and make progress on decarbonization by electrifying mining equipment and shifting to renewable energy sources such as hydrogen and biomass. Currently, only 0.5 percent of mining equipment is fully electric.7

Investment opportunity: A global mining company that set a target of a 15% reduction in scope 1 and 2 carbon emissions by 2025 and 50% by 2030 from the 2018 baseline, with the goal of reaching carbon neutrality by 2050. The company can gain significant operational efficiencies by using micro-grid construction and solar cell deployment, which can provide continuous onsite energy delivery, tackling intermittency issues often associated with Renewables. The company’s processing plant consumes large amounts of energy to melt mined materials, and it is a heavy emitter of greenhouse gases. Processing efficiencies obtained via renewable power and electrification could deliver a marked cost reduction and meet 50% of the company’s emission-reduction targets. There is also a technological opportunity for achieving carbon neutrality thanks to the use of hydrogen and biomass. Alternative fuels also present business diversification via green aluminium smelting.

Stock Example 2:

Alignment Category: Not Aligned

Theme: Manufacturing

Evaluation of the company based on the alignment metrics and strategy:

Background: The European Commission estimates that the EU buildings account for 40% of the bloc’s energy consumption and 35% of its CO2 emissions.8 The EU Energy Performance of Buildings Directive aims to make public and residential buildings more climate friendly by improving insulation and energy efficiency. Each member state will adopt its own national trajectory to reduce the average primary energy use of residential buildings, by 16% by 2030 and 20-22% by 2035. For non-residential buildings, countries will need to renovate the 16% worst-performing buildings by 2030 and the 26% worst-performing buildings by 2033. As Europe is embarking on a construction and building renovation wave, companies that produce green building materials stand to benefit from increased demand and government incentives.

Steel is one of the most important engineering and construction materials and will remain a core pillar of the greener economy of the future. Steel plays a key role in converting solar energy into electricity and hot water. It is used as a base for solar thermal panels and in pumps, tanks and heat exchangers. About 90% of all wind turbine towers are tubular steel towers; every part of a wind turbine depends on iron and steel.

Investment opportunity: A US steel and metal producer is facing a challenge of high input and maintenance costs of legacy steel furnace technology that is highly emissions-intensive. Switching the technology to produce steel exclusively from electric arc furnaces could significantly reduce the cost base and potentially position the company as the lowest-emitting steel producer globally. These furnaces are expected to have the highest future growth rate, with the potential to significantly reduce carbon emissions. The management has committed to a 50% intensity reduction (scopes 1 and2) across its EAF steel mills by 2030 compared with 2018, while increasing the use of renewable electrical energy for EAF steel mills by 30%. The goal is to have all EAF steel operations carbon neutral by 2050.9 Furthermore, steel production involves significant waste, mostly from blast furnace output (dust) and smelting material sourcing. As we view environmental transition in totality – focusing on waste and water in addition to emissions – the steel industry is of particular interest. Recycled ferrous scrap is used as the primary material input for EAFs. Other new technologies can be utilized that allow capture and recycling of dust, such asmagnesium capture. Additionally, the company’s emissions intensity and cost of facilities are heavily dependent upon fossil-fuel power, which can be mitigated by switching to source 100% energy from non-fossil fuel sources.

Furthermore, partnering with companies to improve sustainability practices and disclosures is absolutely key to such a strategy’s credibility and its successful implementation. Investors should make use of a range of tools to provide feedback and promote best practice at portfolio companies. Active portfolio stewardship is critical to the process, leveraging investors’ role as active owners to support progress on climate transition by way of proxy voting, alongside seeking to engage with all portfolio companies on their transition thesis and monitor company specific transition-related key performance indicators. We carefully consider climate-related shareholder proposals and take decisions on voting issues case by case. Escalation and consideration of sell discipline in the context of company transition progress are also key, as investors continuously evaluate management’s ability to deliver on the transition thesis.