Investing in Financial Inclusion: Driving Growth and Building Wealth

Overdraft fees in the US that can spiral into hundreds of dollars in a few hours. Small businesses in Europe’s poorest regions that struggle to find the financing they need to grow. Millions of people in emerging economies who have no access to financial services because they live in areas without banks or even a digital network.

These are just a few of the obstacles low-income people and those in less developed regions can face when they try to use the financial system. As the sustainable transformation of the global economy gathers pace, policy makers and investors increasingly recognize that removing these barriers is an essential step in building a more inclusive economy.1 The growing awareness of the importance of financial inclusion, combined with the slow adjustment of traditional lenders, has spurred companies around the world to come up with new solutions, and this surge of innovation is changing the game for sustainable investors.

The World Bank defines financial inclusion as individuals and businesses having access to useful, affordable financial products and services – transactions, payments, savings, credit and insurance – that meet their needs and are delivered in a responsible and sustainable way.2 This access can help people handle their everyday financial needs more safely and affordably, improve their resilience in emergencies and allow them to make investments that create wealth for the future. The central role of financial inclusion in poverty reduction and equitable growth is highlighted by the United Nations, which cites it as a key factor in achieving seven of the Sustainable Development Goals (SDGs), including those that address hunger, health and gender equality.3

Many of the solutions aiming to promote financial inclusion deploy new technology to improve the delivery and reduce the cost of financial services, such as a US digital bank offering overdraft protection to its clients. In some African countries with few banks and no fixed broadband networks, companies are developing mobile broadband and mobile phone-based financial services. European banks are using a new financial product – social bonds, which first appeared in 2015 – to raise funds earmarked for lending to small businesses in deprived areas and low-income individuals.

The market for investing in financial inclusion has now matured to the point where companies like these that are making a real difference for their customers also offer the prospect of attractive financial performance for investors. By using an impact-focused approach in asset classes such as private equity, social bonds and listed equities, investors can discover the wide array of opportunities available across developed and emerging markets.

Unaffordable Finance in Developed Markets

In developed markets, the challenge in promoting financial inclusion is to expand access to affordable products and services that allow people to build wealth. Without access to the mainstream financial system, many people who need to make transactions or borrow money are forced to use alternatives such as check-cashing operations, rent-to-own services and loans from pawn shops. These providers tend to have looser standards than traditional lenders – no FICO credit score required in the US, for example.4 They cluster in low-income neighborhoods, making them more accessible. Their products, however, are expensive and offer no opportunities to build wealth.

The scale of this problem – even in wealthy countries – can be seen in the US, where 5.9 million households were “unbanked” in 2021, meaning no one in the household had a checking or savings account at a bank or credit union. Another 18.7 million US households were “underbanked.” This means they had a bank account, but still resorted to products or services such as payday and pawn shops loans that are “disproportionately” used by those without access to banks.5

The concept of financial inclusion encompasses much more than bank accounts, however. The pain and stress of exclusion is felt in many ways. Those overdraft fees collected by the big US banks amount to more than $11 billion each year, and 84% of that is paid by people with average balances below $350.6 Overall, 64% of American consumers live paycheck to paycheck; even for those earning more than $100,000 a year, the number is 48%.7

Private Equity: Driving Fintech Solutions

Financial technology (fintech) companies in developed markets are leading the way in devising solutions to make financial services more affordable and tailor them to the needs of lower-income consumers. Smartphone penetration and modern software capabilities, in particular cloud computing, the proliferation of application programming interfaces, and artificial intelligence have coalesced to create a generational opportunity to transform and increase access to financial services.

We believe fintech will be one of the biggest investment opportunities in financial inclusion over the next decade. The private equity market can provide exposure to this rapidly evolving theme through investments in new digital brands aimed at underserved consumers and software providers with embedded financial products that facilitate wealth-building, for example by improving the user experience with government benefits providers. We think private markets are well suited to finance the development of these innovative companies that may require significant capital investment and time to realize their potential.

One example is a privately owned US fintech company that partners with regional banks to provide low-cost banking services through its platform. It brings down the cost of entry to basic banking by providing checking and savings accounts with no monthly fees or minimum balance requirements. Its commitment to expanding access to affordable finance also includes fee-free overdraft and a credit card with no annual, interest or late fees.8 This company and others like it have shown that there are real businesses to be built by serving the underserved.

Social Bonds: Supporting Small Business

Just as individuals and households suffer when they are cut off from the financial system, small businesses also feel the pain. One of the biggest issues they face is securing the financing they need to expand. In the euro area, for example, 24% of small and medium-sized enterprises (SMEs) reported severe difficulties in accessing finance in the first half of 2023 as borrowing costs rose and banks tightened SME lending standards.9

The struggles of small businesses to access finance can have knock-on effects for the communities they serve because of their central role in driving inclusive growth. In the European Union, 25 million SMEs, accounting for 99% of all businesses, create 85% of all new jobs.10 Micro-enterprises, which play a vital role in job creation in European regions with high unemployment, are even less likely to seek bank loans than larger companies because of higher rejection rates, stringent collateral requirements, high interest rates and bureaucratic hurdles.11

Some European banks are responding by using social bonds to raise funds for lending to promote the financial inclusion of SMEs.12 For example, a Spanish lender uses the proceeds from social bond sales to finance loans to self-employed workers, micro- and small businesses in parts of the country that are facing severe economic challenges. The bank also uses social bonds to provide loans to low-income individuals, helping recipients achieve goals such as access to decent and affordable housing, meeting basic family needs and gaining access to healthcare.13

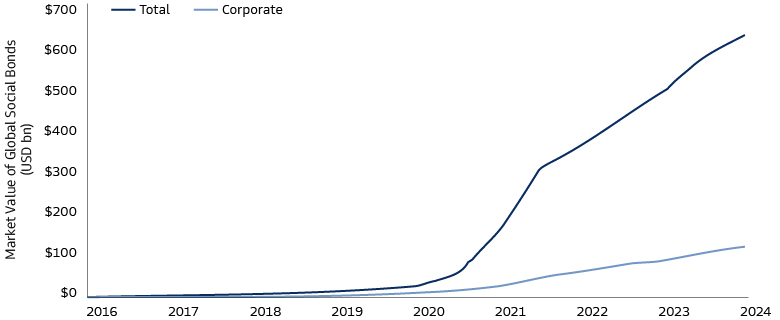

The social bond market has expanded to more than $630 billion in less than a decade, supported by strong investor demand.14 For issuers, tapping into this demand can provide a cost-effective way to raise funds to drive projects aimed at financial inclusion and other objectives.15 For investors, social bonds offer a way to advance their sustainability goals without sacrificing liquidity or returns. A key feature of social bonds is that their legal documentation spells out how their proceeds will be used, with the goal of financing only projects with clear social benefits. Issuers are also expected to report annually on the progress of projects financed with social bonds and the impact achieved.

Source: Goldman Sachs Asset Management, Bloomberg. As of December 31, 2023.

Connecting People With Finance in Emerging Markets

In emerging markets, the obstacles to financial inclusion are more extensive than in developed countries. Of the 1.4 billion adults worldwide who remained unbanked in 2021, nearly all of them lived in developing economies. As a result, just 57% of adults in developing economies made or received digital payments, compared with 95% in in high-income economies.16

Improving financial inclusion in these regions will depend on expanding ownership of transaction accounts, which allow people to receive salaries and remittances safely and securely. This is more than a convenience: these accounts open the door to more efficient saving, cheaper borrowing, obtaining insurance and investing in life-enhancing services such as health and education.

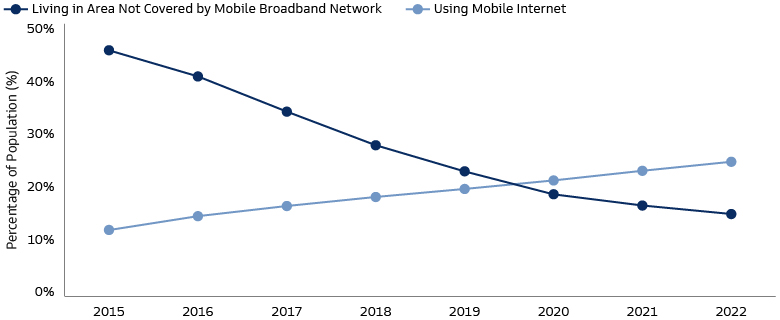

Where banks are scarce, the adoption of mobile financial services can be one of the most efficient solutions, allowing countries to leapfrog the traditional financial infrastructure of the developed world. In many cases, however, the first step is to increase digital connectivity. An estimated 2.9 billion people were still offline in 2021, with 1.7 billion in the Asia-Pacific region – mostly in China and India – and about 740 million in Africa.17 Huge disparities are also found between urban and rural areas.

Impact Equity: Building the Network

Investment strategies focused on achieving impact and returns in listed equities are helping address the connectivity gap and enhance financial inclusion around the world. To make a positive impact, companies need to offer unique, innovative products and services. Technology is at the core of this effort, as it is in developed economies, but the tasks in emerging markets often focus on building the infrastructure needed for mobile financial services to thrive.

One company, for example, is developing telecommunications infrastructure in sub-Saharan African countries from Madagascar to Senegal. It owns and operates more than 14,000 telecom towers and enables mobile network coverage for over 144 million people, especially in rural areas. This has made the company a key player in the roll-out of mobile service in Africa and an important enabler of digital inclusion.18

Another company is building on this infrastructure, providing affordable mobile services to 151 million customers in 14 African markets, including data customers and users of its mobile money business.19 Its target is to ensure that around 90% of the population in its markets have access to mobile network services by 2030. The company has also set financial inclusion targets, including boosting the number of women using its mobile money product.20

Source: GSMA, Goldman Sachs Asset Management. Data as of December 31, 2022.21

Impact and Returns

The tech-driven revolution in financial services has transformed the market for investors seeking to promote financial inclusion and sustainable growth. In developed markets, fintech companies that make vital services affordable are expanding fast, demonstrating the viability of a business model based on bringing underserved groups into the financial system. In emerging markets, companies are successfully deploying technology to bring millions into the internet age and connect them to the financial grid through mobile services. And traditional financial firms are using innovative products like social bonds to raise funds earmarked for lending to low-income borrowers and small businesses. For investors, these companies show how far financial inclusion investment has come in recent years. Once viewed as concessionary investing, the market has progressed to the point where the dual goals of sustainable investing – social impact and returns – are increasingly aligned.

1 The World Bank, for example, notes that ensuring universal and affordable access to financial services is a “key enabler” in the drive to reduce extreme poverty and increase shared prosperity. See “Financial Inclusion,” The World Bank website. As of February 6, 2023.

2 Ibid.

3 “Annual Report to the Secretary-General,” United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development. As of September 2018. The 17 SDGs, adopted in 2015, are the core of the UN’s 15-year action plan for protecting the environment, ending poverty and reducing inequality.

4 A FICO score is a brand of credit score used to predict the likelihood that a borrower will repay a loan on time. FICO stands for the Fair Isaac Corporation, a pioneer in developing a method for calculating a credit score based on the information collected by credit reporting agencies. See “What Is a FICO Score,” Consumer Financial Protection Bureau. As of September 4, 2020.

5 “FDIC National Survey of Unbanked and Underbanked Households,” FDIC. As of July 24, 2023. The products and services in question are: money orders, check cashing or international remittances (nonbank transactions); rent-to-own services or payday, pawn shop, tax refund anticipation or auto title loans (nonbank credit). The Federal Reserve has released more recent data on unbanked individuals, showing that 6% of US adults were “unbanked” in 2022, meaning neither they nor their spouse or partner had a checking, savings or money market account. See “Economic Well-Being of U.S. Households in 2022,” Board of Governors of the Federal Reserve System. As of May 2023.

6 “Overdraft Fees: Banks Must Stop Gouging Consumers During the COVID-19 Crisis,” Center for Responsible Lending. As of June 2020.

7 “48 Percent of Americans With Annual Incomes Over $100,000 Live Paycheck to Paycheck, 9 Percentage Points Higher Than First Reported in June 2021,” LendingClub press release. As of March 3, 2022. Data as of January 2022.

8 Company-reported information on its website. As of February 20, 2024.

9 “The European Small Business Finance Outlook 2023,” European Investment Fund Research and Market Analysis. As of December 2023.

10 “Access to Finance,” European Commission website. As of February 21, 2024. Globally, micro, small and medium-sized enterprises (MSMEs) account for 90% of businesses, more than 60% of employment and half of gross domestic product. See “Supporting small businesses to achieve inclusive growth for all,” UN Department of Economic and Social Affairs. As of June 27, 2023.

11 “The European Small Business Finance Outlook 2023,” European Investment Fund Research and Market Analysis. As of December 2023.

12 Social bonds are fixed income securities with a social element. Their financial characteristics such as structure, risk and return are similar to those of conventional bonds. The main difference is that the legal documentation of social bonds spells out how their proceeds will be used, with the goal of financing only projects with clear social benefits such as building affordable housing, creating jobs and expanding access to education and healthcare. Most social bonds are also intended to make a positive impact on a specific population, such as the unemployed, undereducated and people living below the poverty line.

13 Company-reported information. As of December 2023.

14 Goldman Sachs Asset Management, Bloomberg. As of January 31, 2024. Spain’s Instituto de Crédito Oficial (ICO), a state-owned investment bank, issued the first formal social bond in early 2015.

15 Evidence of investor demand can be found in the order books of many social bond issues. For example, CADES – a French state agency and the largest issuer in the social bond market – sold a €5 billion social bond in early 2023. The order book for this issue totaled more than €31 billion, then a record level of interest in a bond issued by the agency. See “The Newsletter,” Number 46. CADES. As of February 2023. CADES (an acronym for Caisse d’amortissement de la dette sociale) was established by government order to redeem French social debt.

16 “The Global Findex Database 2021,” World Bank Group. As of June 2022.

17 “Global Connectivity Report 2022,” International Telecommunication Union. As of June 2022.

18 Company-reported information on its website. As of February 22, 2024.

19 Company-reported information. As of December 31, 2023.

20 Company-reported information. As of 2022.

21 “The State of Mobile Internet Connectivity Report 2023,” GSMA website. As of February 23, 2024. GSMA is the Global System for Mobile Association, an industry group representing the interests of mobile network operators.